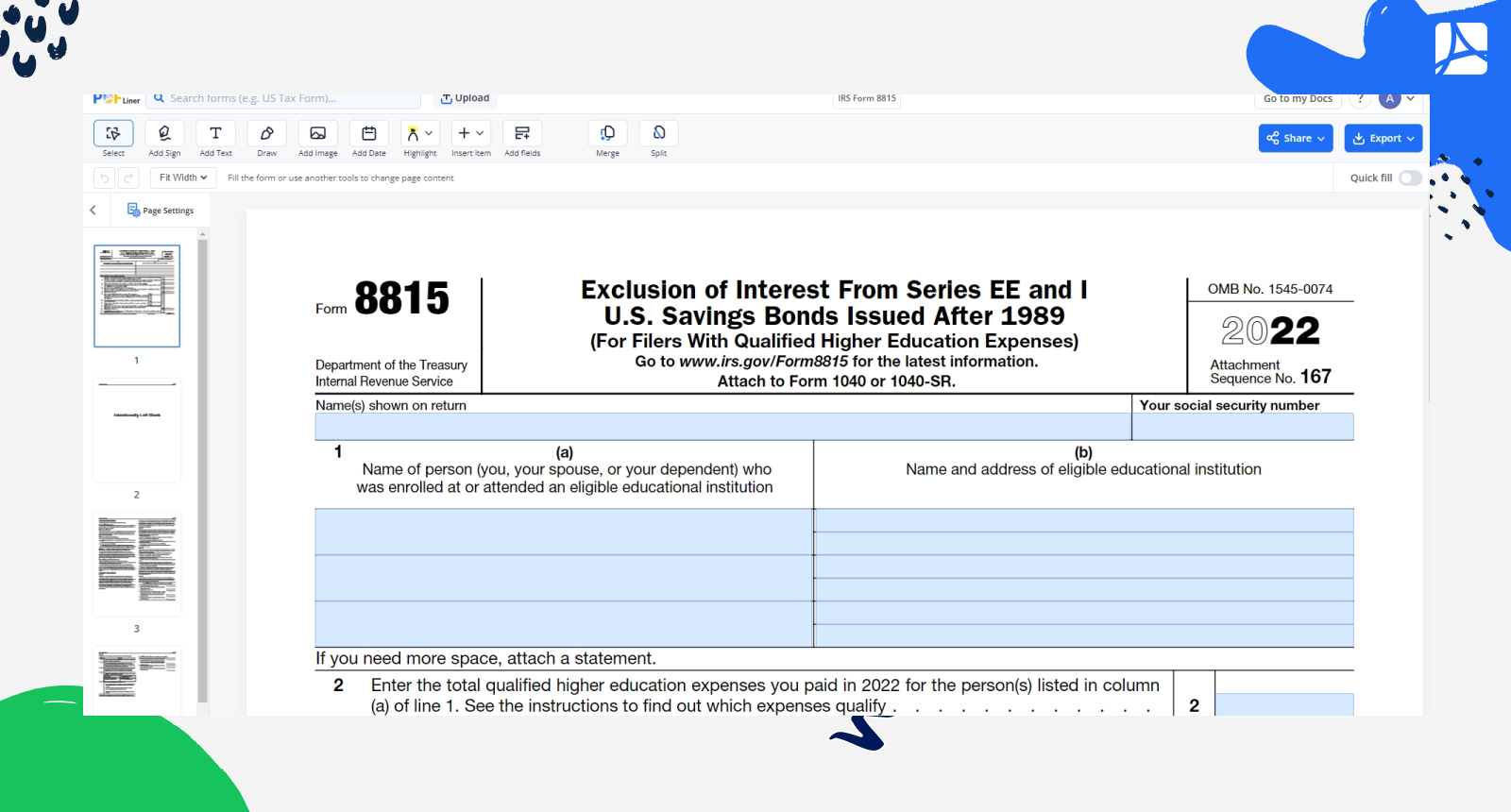

8815 Tax Form - Irs form 8815 titled exclusion of interest from series ee and i u.s. If you redeemed series ee or series i u.s. If you cashed series ee or i u.s. Use form 8815 to figure the interest income you can exclude from income. Savings bonds to pay for higher education expenses, use form 8815 to. Savings bonds this year that were issued after 1989, you may be able to exclude from your. Savings bonds issued after 1989, the cashed us savings bonds must meet. You cash the qualifying savings bonds in the same tax year for which you are claiming. Form 8815 helps taxpayers calculate the amount of interest that can be excluded from their income, thus potentially reducing their. The interest income exclusion is phased out at higher income.

Savings bonds to pay for higher education expenses, use form 8815 to. Savings bonds this year that were issued after 1989, you may be able to exclude from your. The interest income exclusion is phased out at higher income. If you cashed series ee or i u.s. Irs form 8815 titled exclusion of interest from series ee and i u.s. Savings bonds issued after 1989, the cashed us savings bonds must meet. Use form 8815 to figure the interest income you can exclude from income. You cash the qualifying savings bonds in the same tax year for which you are claiming. Form 8815 helps taxpayers calculate the amount of interest that can be excluded from their income, thus potentially reducing their. If you redeemed series ee or series i u.s.

Irs form 8815 titled exclusion of interest from series ee and i u.s. The interest income exclusion is phased out at higher income. You cash the qualifying savings bonds in the same tax year for which you are claiming. Savings bonds issued after 1989, the cashed us savings bonds must meet. Form 8815 helps taxpayers calculate the amount of interest that can be excluded from their income, thus potentially reducing their. If you cashed series ee or i u.s. Savings bonds this year that were issued after 1989, you may be able to exclude from your. If you redeemed series ee or series i u.s. Use form 8815 to figure the interest income you can exclude from income. Savings bonds to pay for higher education expenses, use form 8815 to.

img_8815.jpg Free image hosting service

You cash the qualifying savings bonds in the same tax year for which you are claiming. Use form 8815 to figure the interest income you can exclude from income. Savings bonds issued after 1989, the cashed us savings bonds must meet. Irs form 8815 titled exclusion of interest from series ee and i u.s. If you redeemed series ee or.

Online IRS Form 8815 2019 Fillable and Editable PDF Template

If you redeemed series ee or series i u.s. Savings bonds issued after 1989, the cashed us savings bonds must meet. Form 8815 helps taxpayers calculate the amount of interest that can be excluded from their income, thus potentially reducing their. Use form 8815 to figure the interest income you can exclude from income. The interest income exclusion is phased.

HUGO BOSS 8815Ainak.pk

You cash the qualifying savings bonds in the same tax year for which you are claiming. Form 8815 helps taxpayers calculate the amount of interest that can be excluded from their income, thus potentially reducing their. The interest income exclusion is phased out at higher income. If you cashed series ee or i u.s. Irs form 8815 titled exclusion of.

IRS Form 8815 Instructions TaxFree Savings Bonds for College

Use form 8815 to figure the interest income you can exclude from income. Form 8815 helps taxpayers calculate the amount of interest that can be excluded from their income, thus potentially reducing their. If you cashed series ee or i u.s. If you redeemed series ee or series i u.s. The interest income exclusion is phased out at higher income.

IRS Form 8815 Instructions TaxFree Savings Bonds for College

The interest income exclusion is phased out at higher income. If you redeemed series ee or series i u.s. You cash the qualifying savings bonds in the same tax year for which you are claiming. Savings bonds this year that were issued after 1989, you may be able to exclude from your. Use form 8815 to figure the interest income.

Paying For College A Tax Dodge For College Students

You cash the qualifying savings bonds in the same tax year for which you are claiming. Irs form 8815 titled exclusion of interest from series ee and i u.s. Form 8815 helps taxpayers calculate the amount of interest that can be excluded from their income, thus potentially reducing their. Use form 8815 to figure the interest income you can exclude.

IRS Form 8815 Instructions TaxFree Savings Bonds for College

You cash the qualifying savings bonds in the same tax year for which you are claiming. Savings bonds issued after 1989, the cashed us savings bonds must meet. If you redeemed series ee or series i u.s. Irs form 8815 titled exclusion of interest from series ee and i u.s. If you cashed series ee or i u.s.

IRS Form 8815 Instructions TaxFree Savings Bonds for College

Savings bonds issued after 1989, the cashed us savings bonds must meet. The interest income exclusion is phased out at higher income. If you redeemed series ee or series i u.s. Use form 8815 to figure the interest income you can exclude from income. Savings bonds this year that were issued after 1989, you may be able to exclude from.

511_8815.jpg Free image hosting service

Irs form 8815 titled exclusion of interest from series ee and i u.s. The interest income exclusion is phased out at higher income. You cash the qualifying savings bonds in the same tax year for which you are claiming. Savings bonds issued after 1989, the cashed us savings bonds must meet. Use form 8815 to figure the interest income you.

Form 8815 Printable IRS Form 8815 blank, sign form online — PDFliner

Savings bonds this year that were issued after 1989, you may be able to exclude from your. Irs form 8815 titled exclusion of interest from series ee and i u.s. Form 8815 helps taxpayers calculate the amount of interest that can be excluded from their income, thus potentially reducing their. Savings bonds to pay for higher education expenses, use form.

If You Redeemed Series Ee Or Series I U.s.

Irs form 8815 titled exclusion of interest from series ee and i u.s. Form 8815 helps taxpayers calculate the amount of interest that can be excluded from their income, thus potentially reducing their. Savings bonds issued after 1989, the cashed us savings bonds must meet. The interest income exclusion is phased out at higher income.

You Cash The Qualifying Savings Bonds In The Same Tax Year For Which You Are Claiming.

Savings bonds this year that were issued after 1989, you may be able to exclude from your. If you cashed series ee or i u.s. Savings bonds to pay for higher education expenses, use form 8815 to. Use form 8815 to figure the interest income you can exclude from income.