Accrued Revenues Would Appear On The Balance Sheet As - Understand that accrued revenues are incomes that are earned but not received and hence are classified on the balance sheet. On your company income statements, list it as earned. Accrued revenues are amounts that a company has earned, but has not yet received payment for. Accrued revenue is recorded when you have earned revenues from a customer, but have not yet billed the customer (once the. You need to record accrued revenue on different financial documents. They are considered assets because they.

They are considered assets because they. You need to record accrued revenue on different financial documents. Understand that accrued revenues are incomes that are earned but not received and hence are classified on the balance sheet. On your company income statements, list it as earned. Accrued revenues are amounts that a company has earned, but has not yet received payment for. Accrued revenue is recorded when you have earned revenues from a customer, but have not yet billed the customer (once the.

Understand that accrued revenues are incomes that are earned but not received and hence are classified on the balance sheet. Accrued revenues are amounts that a company has earned, but has not yet received payment for. On your company income statements, list it as earned. They are considered assets because they. Accrued revenue is recorded when you have earned revenues from a customer, but have not yet billed the customer (once the. You need to record accrued revenue on different financial documents.

Is accrued revenue a debit? Leia aqui What type of account is accrued

Accrued revenues are amounts that a company has earned, but has not yet received payment for. Understand that accrued revenues are incomes that are earned but not received and hence are classified on the balance sheet. On your company income statements, list it as earned. Accrued revenue is recorded when you have earned revenues from a customer, but have not.

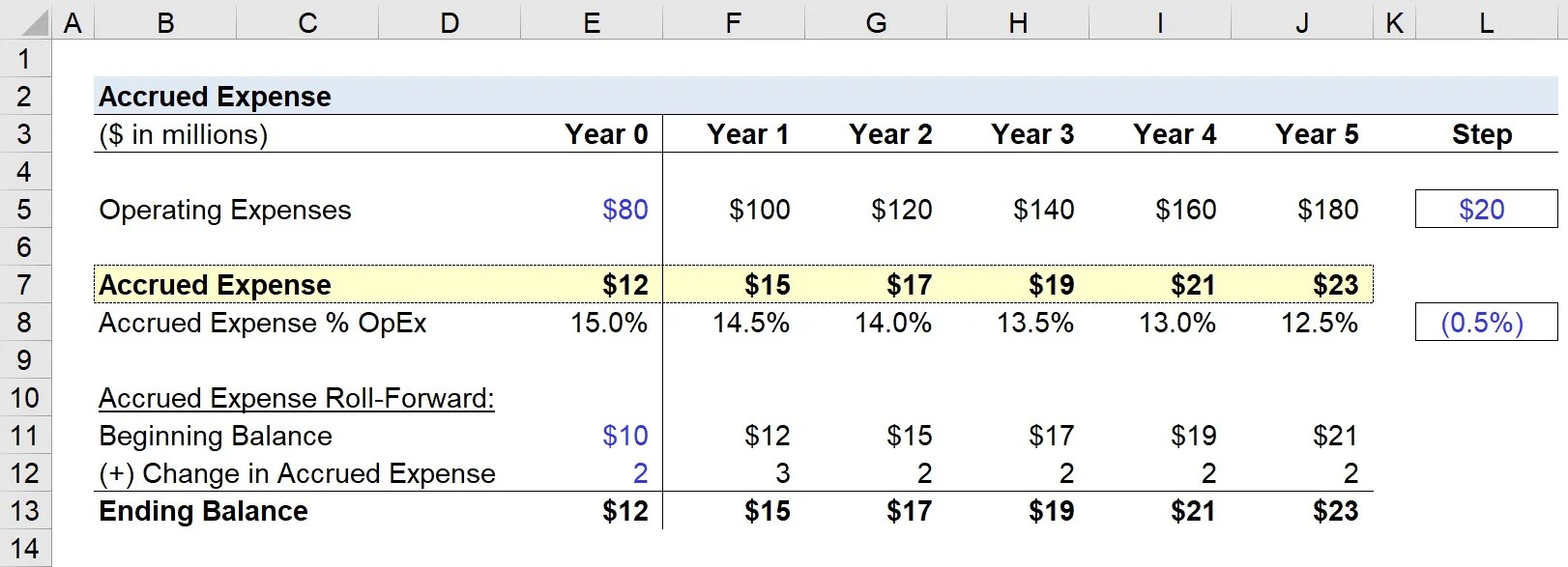

What Is Accrued Expenses On A Balance Sheet LiveWell

Accrued revenue is recorded when you have earned revenues from a customer, but have not yet billed the customer (once the. On your company income statements, list it as earned. Understand that accrued revenues are incomes that are earned but not received and hence are classified on the balance sheet. You need to record accrued revenue on different financial documents..

Deferred Revenue Understand Deferred Revenues in Accounting

Accrued revenue is recorded when you have earned revenues from a customer, but have not yet billed the customer (once the. You need to record accrued revenue on different financial documents. They are considered assets because they. On your company income statements, list it as earned. Understand that accrued revenues are incomes that are earned but not received and hence.

Outstanding Elaborate Format Of Balance Sheet As Per Schedule 3

They are considered assets because they. On your company income statements, list it as earned. You need to record accrued revenue on different financial documents. Accrued revenues are amounts that a company has earned, but has not yet received payment for. Accrued revenue is recorded when you have earned revenues from a customer, but have not yet billed the customer.

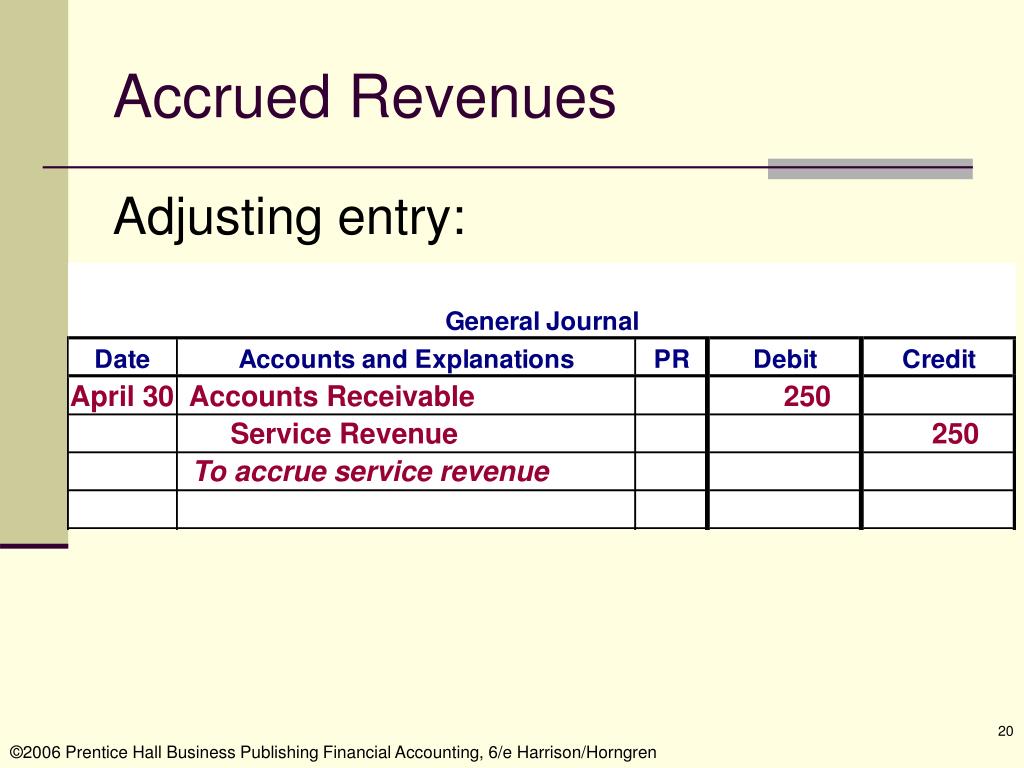

PPT Accrual Accounting and the Financial Statements Chapter 3

Understand that accrued revenues are incomes that are earned but not received and hence are classified on the balance sheet. Accrued revenue is recorded when you have earned revenues from a customer, but have not yet billed the customer (once the. You need to record accrued revenue on different financial documents. They are considered assets because they. On your company.

Accrued Expense Meaning, Accounting Treatment And More

You need to record accrued revenue on different financial documents. Accrued revenue is recorded when you have earned revenues from a customer, but have not yet billed the customer (once the. They are considered assets because they. On your company income statements, list it as earned. Understand that accrued revenues are incomes that are earned but not received and hence.

Retained Earnings What Are They, and How Do You Calculate Them?

Accrued revenues are amounts that a company has earned, but has not yet received payment for. On your company income statements, list it as earned. You need to record accrued revenue on different financial documents. They are considered assets because they. Understand that accrued revenues are incomes that are earned but not received and hence are classified on the balance.

Accrued revenue how to record it in 2023 QuickBooks

Understand that accrued revenues are incomes that are earned but not received and hence are classified on the balance sheet. Accrued revenues are amounts that a company has earned, but has not yet received payment for. They are considered assets because they. Accrued revenue is recorded when you have earned revenues from a customer, but have not yet billed the.

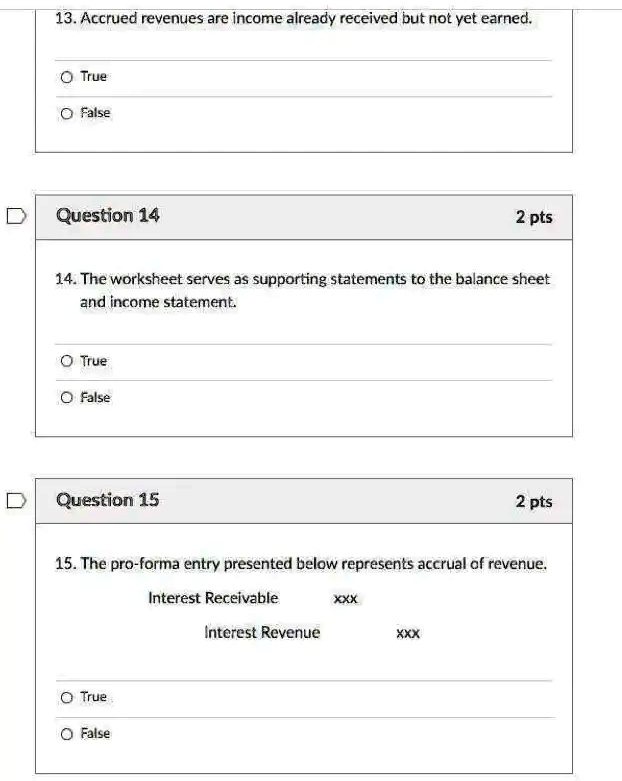

SOLVED 13. Accrued revenues are already received but not yet

Understand that accrued revenues are incomes that are earned but not received and hence are classified on the balance sheet. They are considered assets because they. Accrued revenues are amounts that a company has earned, but has not yet received payment for. You need to record accrued revenue on different financial documents. On your company income statements, list it as.

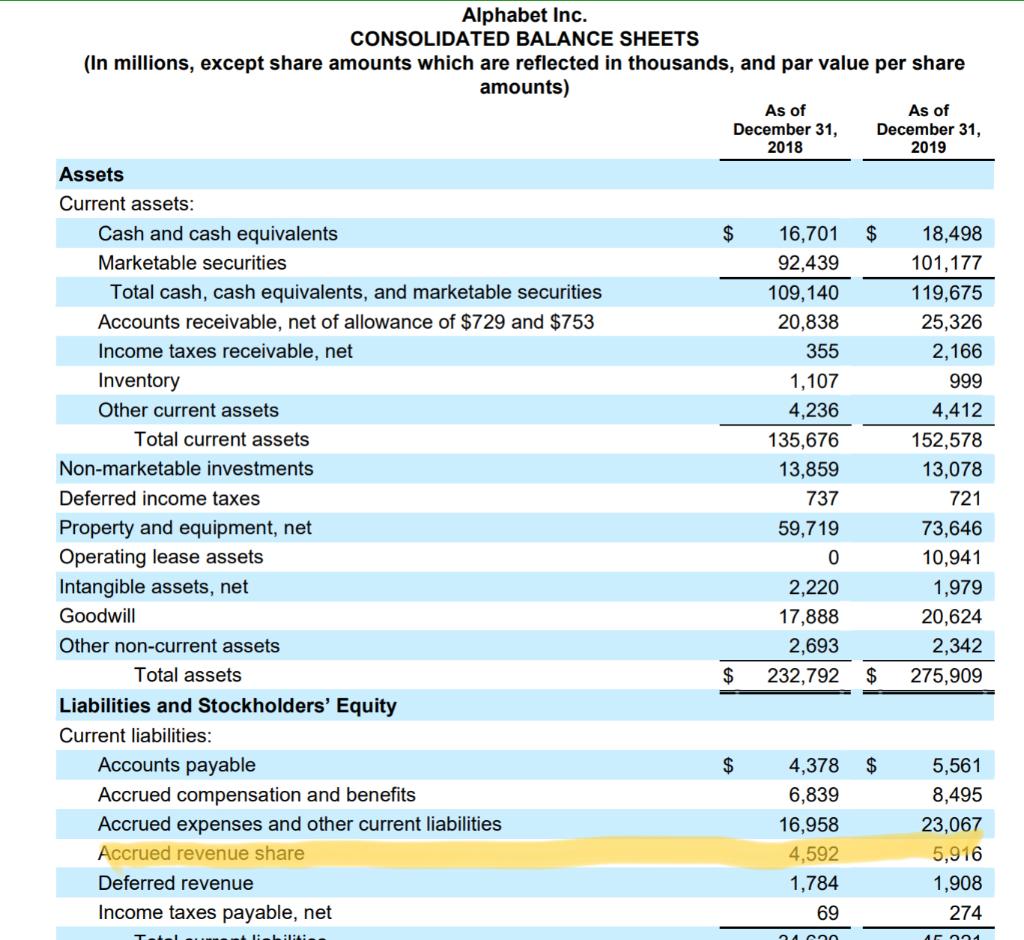

Solved Accrued revenue is an asset. But, on the balance

Understand that accrued revenues are incomes that are earned but not received and hence are classified on the balance sheet. You need to record accrued revenue on different financial documents. On your company income statements, list it as earned. They are considered assets because they. Accrued revenues are amounts that a company has earned, but has not yet received payment.

Accrued Revenues Are Amounts That A Company Has Earned, But Has Not Yet Received Payment For.

On your company income statements, list it as earned. Accrued revenue is recorded when you have earned revenues from a customer, but have not yet billed the customer (once the. They are considered assets because they. You need to record accrued revenue on different financial documents.

:max_bytes(150000):strip_icc()/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)