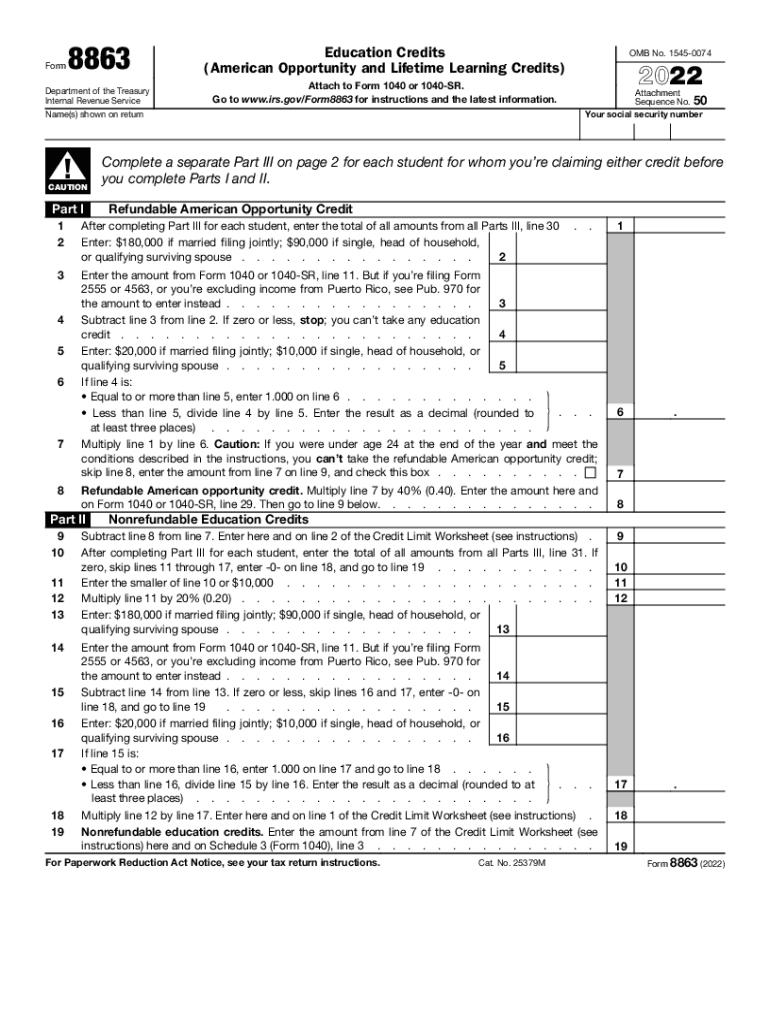

American Opportunity Credit Form - The american opportunity credit offers significant savings. Learn how to claim the american opportunity tax credit (aotc) or the lifetime learning credit (llc) for qualified education expenses on your tax. Use form 8863 to calculate and claim the american opportunity credit or the lifetime learning credit for qualified education. Complete part iii for each student for whom you’re claiming either the american opportunity credit or lifetime learning credit. How much can i claim with the american opportunity credit?

Complete part iii for each student for whom you’re claiming either the american opportunity credit or lifetime learning credit. The american opportunity credit offers significant savings. How much can i claim with the american opportunity credit? Learn how to claim the american opportunity tax credit (aotc) or the lifetime learning credit (llc) for qualified education expenses on your tax. Use form 8863 to calculate and claim the american opportunity credit or the lifetime learning credit for qualified education.

How much can i claim with the american opportunity credit? The american opportunity credit offers significant savings. Complete part iii for each student for whom you’re claiming either the american opportunity credit or lifetime learning credit. Learn how to claim the american opportunity tax credit (aotc) or the lifetime learning credit (llc) for qualified education expenses on your tax. Use form 8863 to calculate and claim the american opportunity credit or the lifetime learning credit for qualified education.

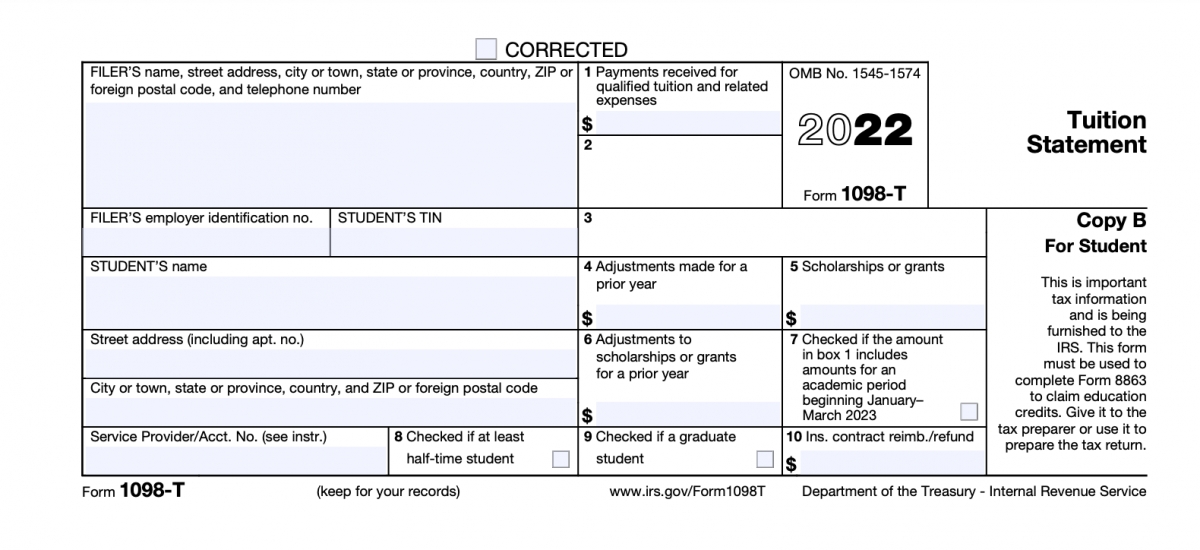

Education Tax Credits (1098T) Old Dominion University

Learn how to claim the american opportunity tax credit (aotc) or the lifetime learning credit (llc) for qualified education expenses on your tax. Use form 8863 to calculate and claim the american opportunity credit or the lifetime learning credit for qualified education. The american opportunity credit offers significant savings. How much can i claim with the american opportunity credit? Complete.

American Opportunity Tax Credit, Eligibility, Refundable, Calculator

How much can i claim with the american opportunity credit? Complete part iii for each student for whom you’re claiming either the american opportunity credit or lifetime learning credit. Use form 8863 to calculate and claim the american opportunity credit or the lifetime learning credit for qualified education. Learn how to claim the american opportunity tax credit (aotc) or the.

American Opportunity Credit 2024

Complete part iii for each student for whom you’re claiming either the american opportunity credit or lifetime learning credit. How much can i claim with the american opportunity credit? Use form 8863 to calculate and claim the american opportunity credit or the lifetime learning credit for qualified education. The american opportunity credit offers significant savings. Learn how to claim the.

American Opportunity Credit Complete with ease airSlate SignNow

The american opportunity credit offers significant savings. Learn how to claim the american opportunity tax credit (aotc) or the lifetime learning credit (llc) for qualified education expenses on your tax. Use form 8863 to calculate and claim the american opportunity credit or the lifetime learning credit for qualified education. Complete part iii for each student for whom you’re claiming either.

2022 Form IRS 8863 Fill Online, Printable, Fillable, Blank pdfFiller

Learn how to claim the american opportunity tax credit (aotc) or the lifetime learning credit (llc) for qualified education expenses on your tax. The american opportunity credit offers significant savings. Complete part iii for each student for whom you’re claiming either the american opportunity credit or lifetime learning credit. Use form 8863 to calculate and claim the american opportunity credit.

How to File Form 8863 for American Opportunity Tax Credit for 2022

Learn how to claim the american opportunity tax credit (aotc) or the lifetime learning credit (llc) for qualified education expenses on your tax. Complete part iii for each student for whom you’re claiming either the american opportunity credit or lifetime learning credit. How much can i claim with the american opportunity credit? Use form 8863 to calculate and claim the.

The Lifetime Learning Credit Key Factors

The american opportunity credit offers significant savings. Learn how to claim the american opportunity tax credit (aotc) or the lifetime learning credit (llc) for qualified education expenses on your tax. Use form 8863 to calculate and claim the american opportunity credit or the lifetime learning credit for qualified education. Complete part iii for each student for whom you’re claiming either.

Can you only claim the AOTC once? Leia aqui How many times can I claim

Complete part iii for each student for whom you’re claiming either the american opportunity credit or lifetime learning credit. The american opportunity credit offers significant savings. Learn how to claim the american opportunity tax credit (aotc) or the lifetime learning credit (llc) for qualified education expenses on your tax. How much can i claim with the american opportunity credit? Use.

Printable Form 8863

Learn how to claim the american opportunity tax credit (aotc) or the lifetime learning credit (llc) for qualified education expenses on your tax. Use form 8863 to calculate and claim the american opportunity credit or the lifetime learning credit for qualified education. How much can i claim with the american opportunity credit? Complete part iii for each student for whom.

American Opportunity Tax Credit Calculator Internal Revenue Code

How much can i claim with the american opportunity credit? The american opportunity credit offers significant savings. Complete part iii for each student for whom you’re claiming either the american opportunity credit or lifetime learning credit. Use form 8863 to calculate and claim the american opportunity credit or the lifetime learning credit for qualified education. Learn how to claim the.

How Much Can I Claim With The American Opportunity Credit?

Use form 8863 to calculate and claim the american opportunity credit or the lifetime learning credit for qualified education. The american opportunity credit offers significant savings. Learn how to claim the american opportunity tax credit (aotc) or the lifetime learning credit (llc) for qualified education expenses on your tax. Complete part iii for each student for whom you’re claiming either the american opportunity credit or lifetime learning credit.