Are Condominium Deposits Discharged In Bankruptcies - The hoa dues will be discharged up to the date that you file if you give up your home or condo in the bankruptcy. § 523 (a) (16) does not discharge an individual debtor from any debt for a fee or assessment that becomes due and. However, if you intend to keep. The rationale behind this is only debts one owes to another person or entity may be discharged in a bankruptcy, however money borrowed by one’s.

However, if you intend to keep. § 523 (a) (16) does not discharge an individual debtor from any debt for a fee or assessment that becomes due and. The hoa dues will be discharged up to the date that you file if you give up your home or condo in the bankruptcy. The rationale behind this is only debts one owes to another person or entity may be discharged in a bankruptcy, however money borrowed by one’s.

§ 523 (a) (16) does not discharge an individual debtor from any debt for a fee or assessment that becomes due and. However, if you intend to keep. The hoa dues will be discharged up to the date that you file if you give up your home or condo in the bankruptcy. The rationale behind this is only debts one owes to another person or entity may be discharged in a bankruptcy, however money borrowed by one’s.

Yavapai County Quitclaim Deed Condominium Form Arizona

§ 523 (a) (16) does not discharge an individual debtor from any debt for a fee or assessment that becomes due and. However, if you intend to keep. The rationale behind this is only debts one owes to another person or entity may be discharged in a bankruptcy, however money borrowed by one’s. The hoa dues will be discharged up.

Condominium abstract concept vector illustration Stock Vector Image

§ 523 (a) (16) does not discharge an individual debtor from any debt for a fee or assessment that becomes due and. The hoa dues will be discharged up to the date that you file if you give up your home or condo in the bankruptcy. However, if you intend to keep. The rationale behind this is only debts one.

How Bankruptcies Work In India Priceless Knowledge 2024 Hindi Hue

§ 523 (a) (16) does not discharge an individual debtor from any debt for a fee or assessment that becomes due and. However, if you intend to keep. The hoa dues will be discharged up to the date that you file if you give up your home or condo in the bankruptcy. The rationale behind this is only debts one.

Yes, You Can Remove Discharged Bankruptcies Early The TRUTH YouTube

However, if you intend to keep. § 523 (a) (16) does not discharge an individual debtor from any debt for a fee or assessment that becomes due and. The rationale behind this is only debts one owes to another person or entity may be discharged in a bankruptcy, however money borrowed by one’s. The hoa dues will be discharged up.

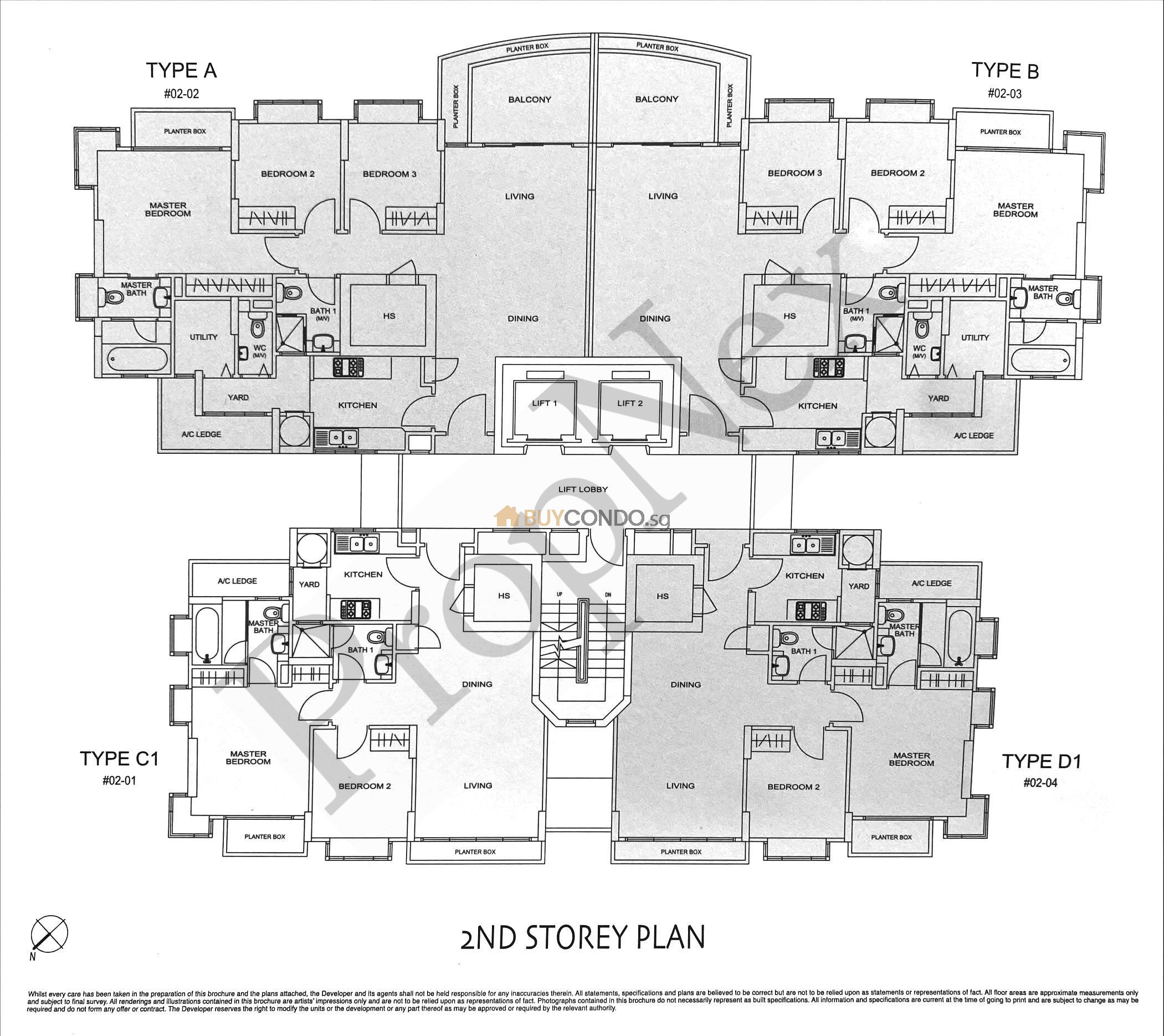

Papillon Condominium Floor Plan Buy Condo Singapore

§ 523 (a) (16) does not discharge an individual debtor from any debt for a fee or assessment that becomes due and. The rationale behind this is only debts one owes to another person or entity may be discharged in a bankruptcy, however money borrowed by one’s. The hoa dues will be discharged up to the date that you file.

Bankruptcy Dismissed vs. Discharged What’s The Difference?

The rationale behind this is only debts one owes to another person or entity may be discharged in a bankruptcy, however money borrowed by one’s. The hoa dues will be discharged up to the date that you file if you give up your home or condo in the bankruptcy. § 523 (a) (16) does not discharge an individual debtor from.

Webinar Condominium Terminations Unthinkable No Longer Becker

However, if you intend to keep. The rationale behind this is only debts one owes to another person or entity may be discharged in a bankruptcy, however money borrowed by one’s. § 523 (a) (16) does not discharge an individual debtor from any debt for a fee or assessment that becomes due and. The hoa dues will be discharged up.

What all goes away when you file bankruptcies? Leia aqui Do you lose

The rationale behind this is only debts one owes to another person or entity may be discharged in a bankruptcy, however money borrowed by one’s. § 523 (a) (16) does not discharge an individual debtor from any debt for a fee or assessment that becomes due and. The hoa dues will be discharged up to the date that you file.

US Corporate Bankruptcies Are On The Rise ZeroHedge

The rationale behind this is only debts one owes to another person or entity may be discharged in a bankruptcy, however money borrowed by one’s. The hoa dues will be discharged up to the date that you file if you give up your home or condo in the bankruptcy. § 523 (a) (16) does not discharge an individual debtor from.

CHART OF THE DAY 2Year Growth of Bankruptcies & Foreclosures Highest

The rationale behind this is only debts one owes to another person or entity may be discharged in a bankruptcy, however money borrowed by one’s. § 523 (a) (16) does not discharge an individual debtor from any debt for a fee or assessment that becomes due and. However, if you intend to keep. The hoa dues will be discharged up.

The Hoa Dues Will Be Discharged Up To The Date That You File If You Give Up Your Home Or Condo In The Bankruptcy.

However, if you intend to keep. The rationale behind this is only debts one owes to another person or entity may be discharged in a bankruptcy, however money borrowed by one’s. § 523 (a) (16) does not discharge an individual debtor from any debt for a fee or assessment that becomes due and.

:max_bytes(150000):strip_icc()/what-debt-cannot-be-discharged-when-filing-bankruptcy.asp_final-1787b61755b34e1799fdde71e9b8508f.png)