Can I Use My Hsa For My Parents Medical Expenses - But you can use the money that's left in your hsa to cover qualified medical expenses for yourself, your daughter, and your parents (parents are. Separately, your parents can only use their hsa to pay for your medical expenses if you are their dependent. Medical expenses for your dependents count as qualified medical expense, so go ahead and use your hsa for those. When you are no longer.

Separately, your parents can only use their hsa to pay for your medical expenses if you are their dependent. But you can use the money that's left in your hsa to cover qualified medical expenses for yourself, your daughter, and your parents (parents are. When you are no longer. Medical expenses for your dependents count as qualified medical expense, so go ahead and use your hsa for those.

Medical expenses for your dependents count as qualified medical expense, so go ahead and use your hsa for those. When you are no longer. But you can use the money that's left in your hsa to cover qualified medical expenses for yourself, your daughter, and your parents (parents are. Separately, your parents can only use their hsa to pay for your medical expenses if you are their dependent.

7 Purchases You May Not Know You Can Make With Your HSA Fund

But you can use the money that's left in your hsa to cover qualified medical expenses for yourself, your daughter, and your parents (parents are. Separately, your parents can only use their hsa to pay for your medical expenses if you are their dependent. Medical expenses for your dependents count as qualified medical expense, so go ahead and use your.

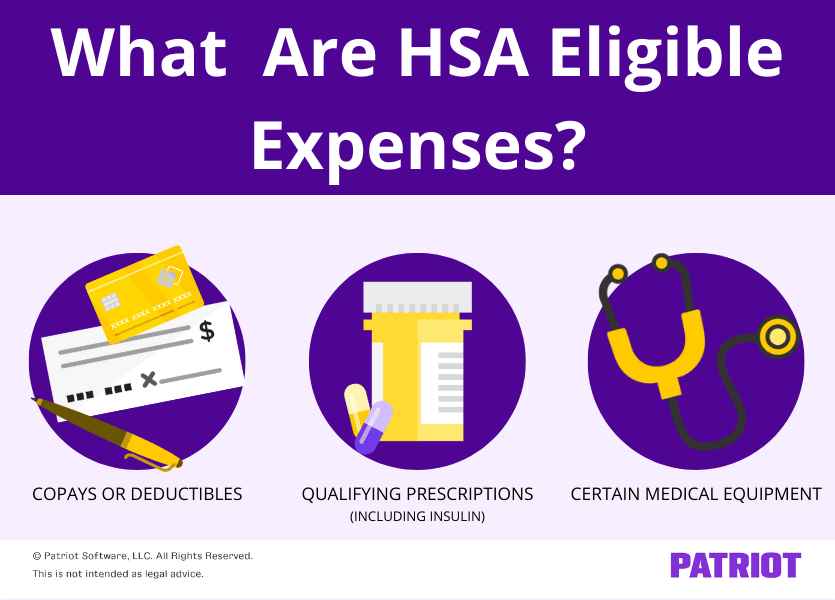

Hsa Eligible Expenses 2024 Irs Lory Silvia

Separately, your parents can only use their hsa to pay for your medical expenses if you are their dependent. Medical expenses for your dependents count as qualified medical expense, so go ahead and use your hsa for those. When you are no longer. But you can use the money that's left in your hsa to cover qualified medical expenses for.

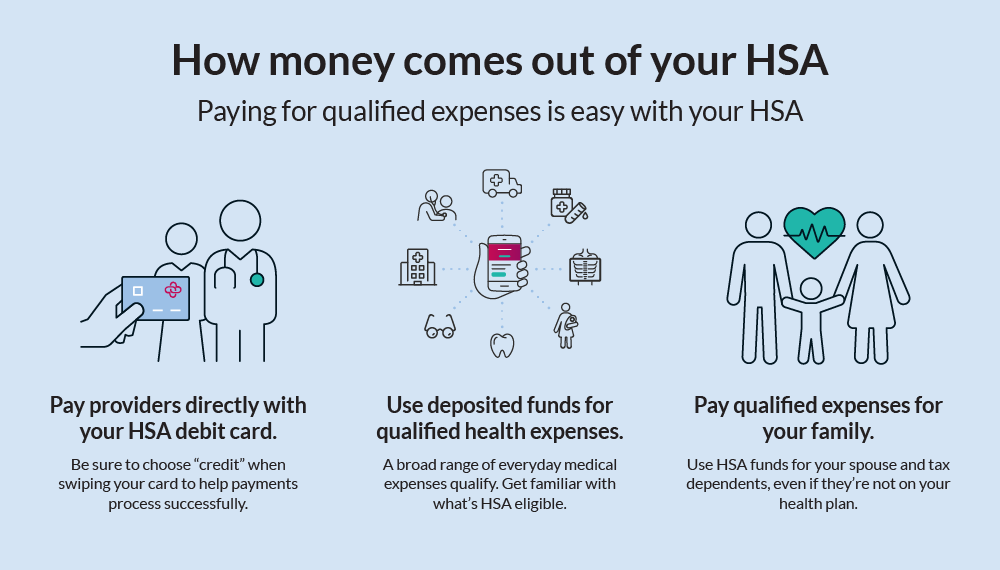

How much should I put into my HSA? Lively

Separately, your parents can only use their hsa to pay for your medical expenses if you are their dependent. But you can use the money that's left in your hsa to cover qualified medical expenses for yourself, your daughter, and your parents (parents are. Medical expenses for your dependents count as qualified medical expense, so go ahead and use your.

What Is an HSA? Rules and Benefits of an HSA finansdirekt24.se

When you are no longer. But you can use the money that's left in your hsa to cover qualified medical expenses for yourself, your daughter, and your parents (parents are. Separately, your parents can only use their hsa to pay for your medical expenses if you are their dependent. Medical expenses for your dependents count as qualified medical expense, so.

Can I Use Hsa For Dog Meds

But you can use the money that's left in your hsa to cover qualified medical expenses for yourself, your daughter, and your parents (parents are. Medical expenses for your dependents count as qualified medical expense, so go ahead and use your hsa for those. When you are no longer. Separately, your parents can only use their hsa to pay for.

What Is a Health Savings Account (HSA) Rules, Limits & How to Open

Medical expenses for your dependents count as qualified medical expense, so go ahead and use your hsa for those. But you can use the money that's left in your hsa to cover qualified medical expenses for yourself, your daughter, and your parents (parents are. Separately, your parents can only use their hsa to pay for your medical expenses if you.

How to submit FSA/HSA reimbursement claim for purchase that you already

Medical expenses for your dependents count as qualified medical expense, so go ahead and use your hsa for those. Separately, your parents can only use their hsa to pay for your medical expenses if you are their dependent. When you are no longer. But you can use the money that's left in your hsa to cover qualified medical expenses for.

Guide to HSA Withdrawal Rules Health Savings Accounts Lively

Medical expenses for your dependents count as qualified medical expense, so go ahead and use your hsa for those. But you can use the money that's left in your hsa to cover qualified medical expenses for yourself, your daughter, and your parents (parents are. Separately, your parents can only use their hsa to pay for your medical expenses if you.

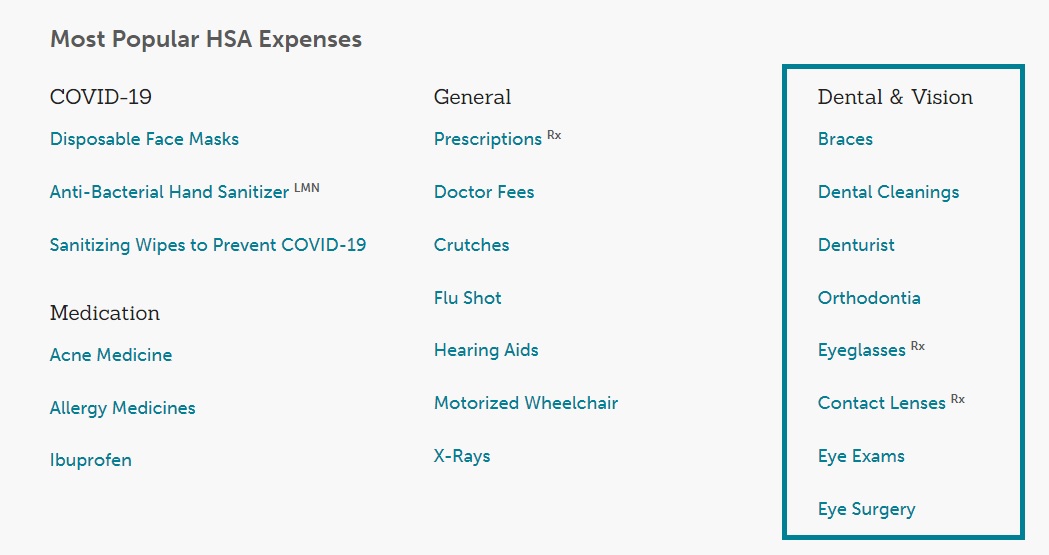

Can I use my HSA or FSA to pay for dental services?

Separately, your parents can only use their hsa to pay for your medical expenses if you are their dependent. Medical expenses for your dependents count as qualified medical expense, so go ahead and use your hsa for those. When you are no longer. But you can use the money that's left in your hsa to cover qualified medical expenses for.

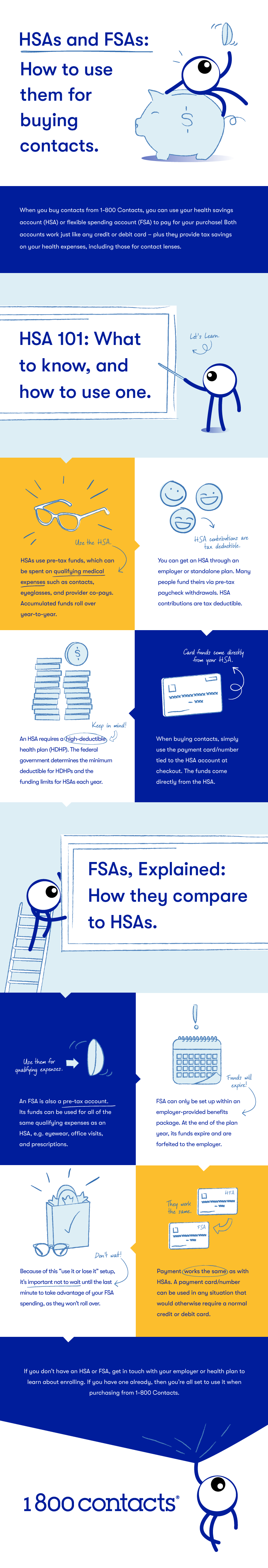

Can I Use My HSA or FSA to Buy Contacts? 1800 Contacts

Medical expenses for your dependents count as qualified medical expense, so go ahead and use your hsa for those. But you can use the money that's left in your hsa to cover qualified medical expenses for yourself, your daughter, and your parents (parents are. When you are no longer. Separately, your parents can only use their hsa to pay for.

But You Can Use The Money That's Left In Your Hsa To Cover Qualified Medical Expenses For Yourself, Your Daughter, And Your Parents (Parents Are.

Medical expenses for your dependents count as qualified medical expense, so go ahead and use your hsa for those. When you are no longer. Separately, your parents can only use their hsa to pay for your medical expenses if you are their dependent.