Can Tax Debt Be Discharged In Bankruptcy - Essentially, this rule requires that the irs. When determining whether they can discharge tax debt, bankruptcy filers must consider many factors. When conditions are in the best interest of both the. Bankruptcy court to discharge your tax debt. Some filers can discharge or wipe out tax debts in chapter 13 bankruptcy but most pay it through the chapter 13 repayment plan. Irs may keep payments, and time in bankruptcy extends time to collect remaining tax liabilities. You must meet three requirements for the u.s. Paying your tax debt in full is the best way to get rid of a federal tax lien.

Essentially, this rule requires that the irs. When conditions are in the best interest of both the. Paying your tax debt in full is the best way to get rid of a federal tax lien. Irs may keep payments, and time in bankruptcy extends time to collect remaining tax liabilities. You must meet three requirements for the u.s. Bankruptcy court to discharge your tax debt. Some filers can discharge or wipe out tax debts in chapter 13 bankruptcy but most pay it through the chapter 13 repayment plan. When determining whether they can discharge tax debt, bankruptcy filers must consider many factors.

You must meet three requirements for the u.s. Irs may keep payments, and time in bankruptcy extends time to collect remaining tax liabilities. When conditions are in the best interest of both the. Bankruptcy court to discharge your tax debt. Essentially, this rule requires that the irs. When determining whether they can discharge tax debt, bankruptcy filers must consider many factors. Paying your tax debt in full is the best way to get rid of a federal tax lien. Some filers can discharge or wipe out tax debts in chapter 13 bankruptcy but most pay it through the chapter 13 repayment plan.

Can Tax Debt be discharged in Bankruptcy YouTube

Irs may keep payments, and time in bankruptcy extends time to collect remaining tax liabilities. When determining whether they can discharge tax debt, bankruptcy filers must consider many factors. Some filers can discharge or wipe out tax debts in chapter 13 bankruptcy but most pay it through the chapter 13 repayment plan. Paying your tax debt in full is the.

Can Tax Debt Be Smart Tax Strategies Call Us (888) 8883649

When determining whether they can discharge tax debt, bankruptcy filers must consider many factors. Paying your tax debt in full is the best way to get rid of a federal tax lien. Irs may keep payments, and time in bankruptcy extends time to collect remaining tax liabilities. You must meet three requirements for the u.s. Bankruptcy court to discharge your.

Bankruptcy Explained Types And How It Works, 57 OFF

When determining whether they can discharge tax debt, bankruptcy filers must consider many factors. Irs may keep payments, and time in bankruptcy extends time to collect remaining tax liabilities. When conditions are in the best interest of both the. Some filers can discharge or wipe out tax debts in chapter 13 bankruptcy but most pay it through the chapter 13.

Can I Qualify for IRS Debt in Bankruptcy? OakTree Law

When conditions are in the best interest of both the. Paying your tax debt in full is the best way to get rid of a federal tax lien. Some filers can discharge or wipe out tax debts in chapter 13 bankruptcy but most pay it through the chapter 13 repayment plan. When determining whether they can discharge tax debt, bankruptcy.

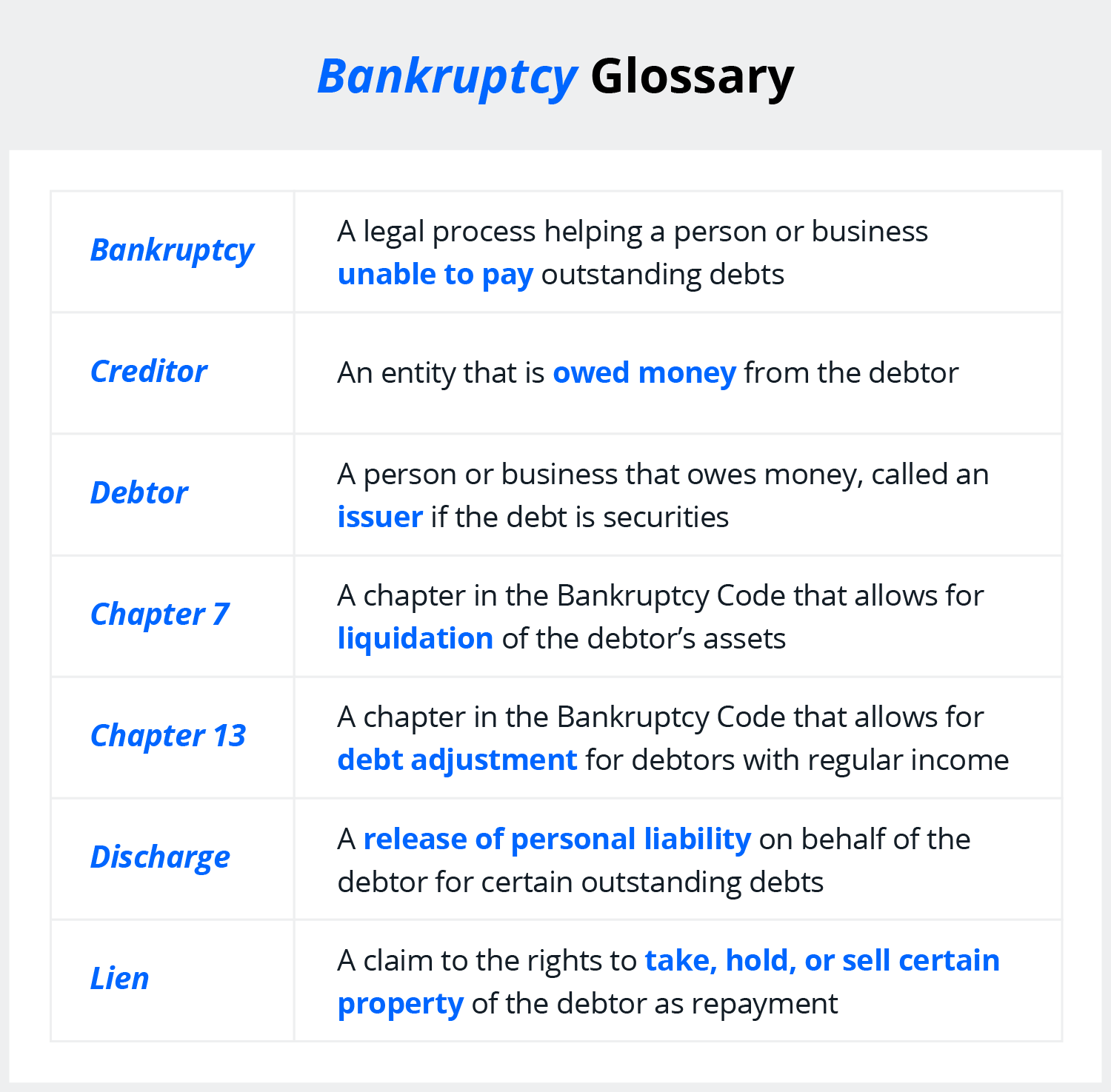

What Is a Bankruptcy Discharge?

Paying your tax debt in full is the best way to get rid of a federal tax lien. Irs may keep payments, and time in bankruptcy extends time to collect remaining tax liabilities. Bankruptcy court to discharge your tax debt. Essentially, this rule requires that the irs. Some filers can discharge or wipe out tax debts in chapter 13 bankruptcy.

Can Tax Debt Be Inherited Smart Tax Strategies Call Us (888) 8883649

Bankruptcy court to discharge your tax debt. Some filers can discharge or wipe out tax debts in chapter 13 bankruptcy but most pay it through the chapter 13 repayment plan. When conditions are in the best interest of both the. When determining whether they can discharge tax debt, bankruptcy filers must consider many factors. Irs may keep payments, and time.

What Debt Can’t Be Discharged When Filing for Bankruptcy? (2024)

Some filers can discharge or wipe out tax debts in chapter 13 bankruptcy but most pay it through the chapter 13 repayment plan. Bankruptcy court to discharge your tax debt. Paying your tax debt in full is the best way to get rid of a federal tax lien. When conditions are in the best interest of both the. Irs may.

What Debt Can't Be Discharged Through Bankruptcy? DebtStoppers

Some filers can discharge or wipe out tax debts in chapter 13 bankruptcy but most pay it through the chapter 13 repayment plan. Irs may keep payments, and time in bankruptcy extends time to collect remaining tax liabilities. You must meet three requirements for the u.s. When determining whether they can discharge tax debt, bankruptcy filers must consider many factors..

Chapter 13 Bankruptcy Can IRS Debt be Discharged? Internal Revenue

Bankruptcy court to discharge your tax debt. You must meet three requirements for the u.s. When conditions are in the best interest of both the. Irs may keep payments, and time in bankruptcy extends time to collect remaining tax liabilities. Essentially, this rule requires that the irs.

What Debt Can't Be Discharged Through Bankruptcy? DebtStoppers

When conditions are in the best interest of both the. You must meet three requirements for the u.s. Some filers can discharge or wipe out tax debts in chapter 13 bankruptcy but most pay it through the chapter 13 repayment plan. Bankruptcy court to discharge your tax debt. When determining whether they can discharge tax debt, bankruptcy filers must consider.

When Determining Whether They Can Discharge Tax Debt, Bankruptcy Filers Must Consider Many Factors.

Essentially, this rule requires that the irs. Irs may keep payments, and time in bankruptcy extends time to collect remaining tax liabilities. Bankruptcy court to discharge your tax debt. You must meet three requirements for the u.s.

Some Filers Can Discharge Or Wipe Out Tax Debts In Chapter 13 Bankruptcy But Most Pay It Through The Chapter 13 Repayment Plan.

When conditions are in the best interest of both the. Paying your tax debt in full is the best way to get rid of a federal tax lien.

:max_bytes(150000):strip_icc()/bankruptcy-discharge-what-is-it-and-when-does-it-happen-8eafb0f711c24a048d4854a82cdb5f70.png)

:max_bytes(150000):strip_icc()/what-debt-cannot-be-discharged-when-filing-bankruptcy.asp_final-1787b61755b34e1799fdde71e9b8508f.png)