Cftc Form 40 - Cftc form 40 allows the cftc to compile information to assess whether a trader’s activities could potentially impact the market and whether traders are complying with speculative. In addition, once an account reaches a reportable size, the commission may contact the trader directly and require that the trader file a more detailed identification report, a cftc form 40:. (see section 18.04 of the regulations under the. When to file—a reporting trader must file a form 40 on call by the commission or its designee. This page contains forms and other documents related to large traders who report futures and option positions at or above specific reporting levels.

In addition, once an account reaches a reportable size, the commission may contact the trader directly and require that the trader file a more detailed identification report, a cftc form 40:. This page contains forms and other documents related to large traders who report futures and option positions at or above specific reporting levels. Cftc form 40 allows the cftc to compile information to assess whether a trader’s activities could potentially impact the market and whether traders are complying with speculative. (see section 18.04 of the regulations under the. When to file—a reporting trader must file a form 40 on call by the commission or its designee.

Cftc form 40 allows the cftc to compile information to assess whether a trader’s activities could potentially impact the market and whether traders are complying with speculative. This page contains forms and other documents related to large traders who report futures and option positions at or above specific reporting levels. In addition, once an account reaches a reportable size, the commission may contact the trader directly and require that the trader file a more detailed identification report, a cftc form 40:. (see section 18.04 of the regulations under the. When to file—a reporting trader must file a form 40 on call by the commission or its designee.

CFTC Form 40 Large Trader Disclosure

In addition, once an account reaches a reportable size, the commission may contact the trader directly and require that the trader file a more detailed identification report, a cftc form 40:. Cftc form 40 allows the cftc to compile information to assess whether a trader’s activities could potentially impact the market and whether traders are complying with speculative. This page.

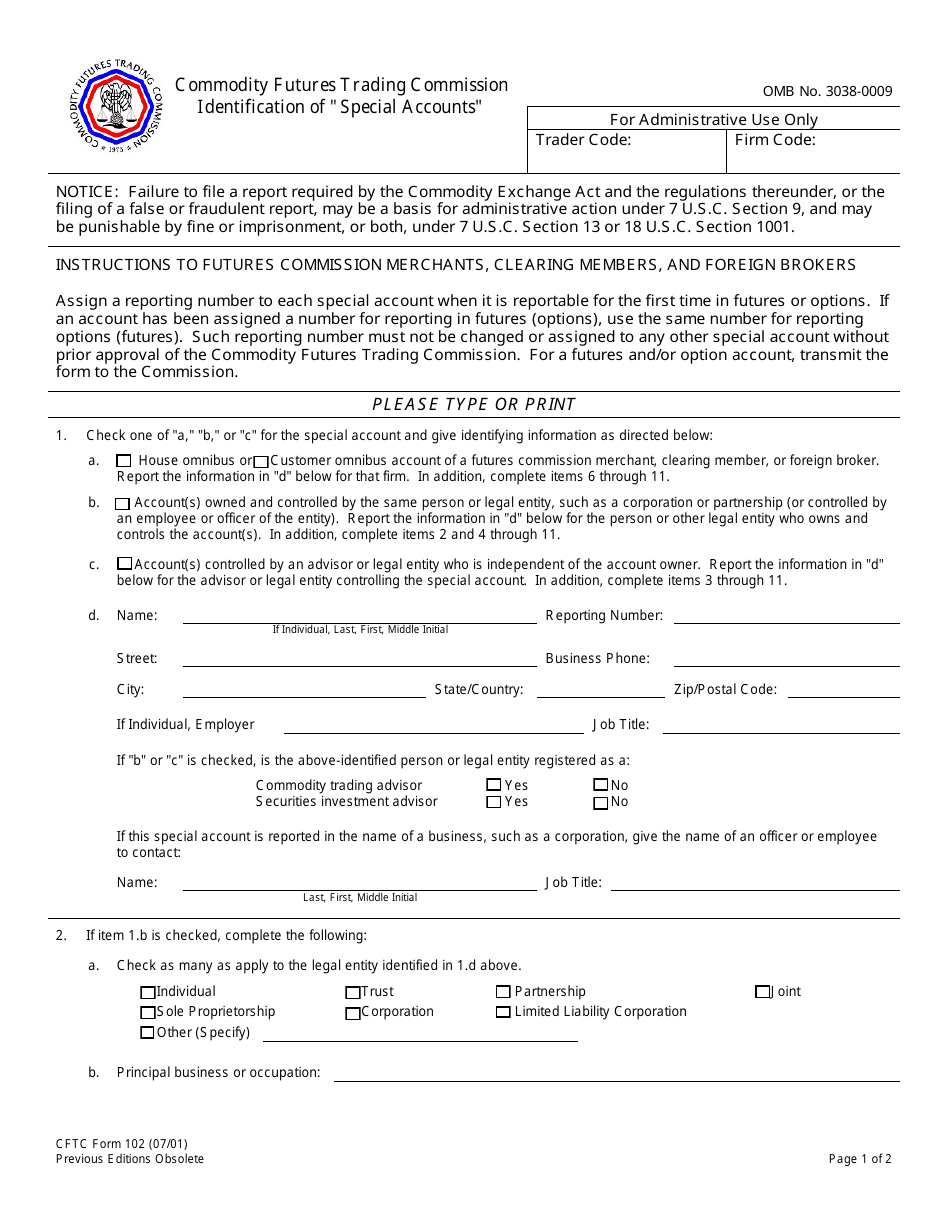

CFTC Form 102 Fill Out, Sign Online and Download Fillable PDF

Cftc form 40 allows the cftc to compile information to assess whether a trader’s activities could potentially impact the market and whether traders are complying with speculative. When to file—a reporting trader must file a form 40 on call by the commission or its designee. This page contains forms and other documents related to large traders who report futures and.

CFTC Form 40 Large Trader Disclosure tastytrade

(see section 18.04 of the regulations under the. In addition, once an account reaches a reportable size, the commission may contact the trader directly and require that the trader file a more detailed identification report, a cftc form 40:. Cftc form 40 allows the cftc to compile information to assess whether a trader’s activities could potentially impact the market and.

CFTC Form 40 Large Trader Disclosure tastytrade

This page contains forms and other documents related to large traders who report futures and option positions at or above specific reporting levels. In addition, once an account reaches a reportable size, the commission may contact the trader directly and require that the trader file a more detailed identification report, a cftc form 40:. (see section 18.04 of the regulations.

SEC, CFTC Adopt Form PF for Systemic Advisers

Cftc form 40 allows the cftc to compile information to assess whether a trader’s activities could potentially impact the market and whether traders are complying with speculative. When to file—a reporting trader must file a form 40 on call by the commission or its designee. In addition, once an account reaches a reportable size, the commission may contact the trader.

Fill Commodity Futures Trading Commission

This page contains forms and other documents related to large traders who report futures and option positions at or above specific reporting levels. Cftc form 40 allows the cftc to compile information to assess whether a trader’s activities could potentially impact the market and whether traders are complying with speculative. When to file—a reporting trader must file a form 40.

CFTC Enforcement Advisory on Penalties, Monitors and Admissions

In addition, once an account reaches a reportable size, the commission may contact the trader directly and require that the trader file a more detailed identification report, a cftc form 40:. (see section 18.04 of the regulations under the. This page contains forms and other documents related to large traders who report futures and option positions at or above specific.

Fill Free fillable CFTC Form 40 Statement of Reporting Trader PDF form

When to file—a reporting trader must file a form 40 on call by the commission or its designee. This page contains forms and other documents related to large traders who report futures and option positions at or above specific reporting levels. (see section 18.04 of the regulations under the. Cftc form 40 allows the cftc to compile information to assess.

Fill Free fillable CFTC Form 40 Statement of Reporting Trader PDF form

In addition, once an account reaches a reportable size, the commission may contact the trader directly and require that the trader file a more detailed identification report, a cftc form 40:. When to file—a reporting trader must file a form 40 on call by the commission or its designee. This page contains forms and other documents related to large traders.

CFTC Discloses 15 Million Payment to Crypto Whistleblowers

This page contains forms and other documents related to large traders who report futures and option positions at or above specific reporting levels. (see section 18.04 of the regulations under the. Cftc form 40 allows the cftc to compile information to assess whether a trader’s activities could potentially impact the market and whether traders are complying with speculative. In addition,.

(See Section 18.04 Of The Regulations Under The.

When to file—a reporting trader must file a form 40 on call by the commission or its designee. Cftc form 40 allows the cftc to compile information to assess whether a trader’s activities could potentially impact the market and whether traders are complying with speculative. This page contains forms and other documents related to large traders who report futures and option positions at or above specific reporting levels. In addition, once an account reaches a reportable size, the commission may contact the trader directly and require that the trader file a more detailed identification report, a cftc form 40:.