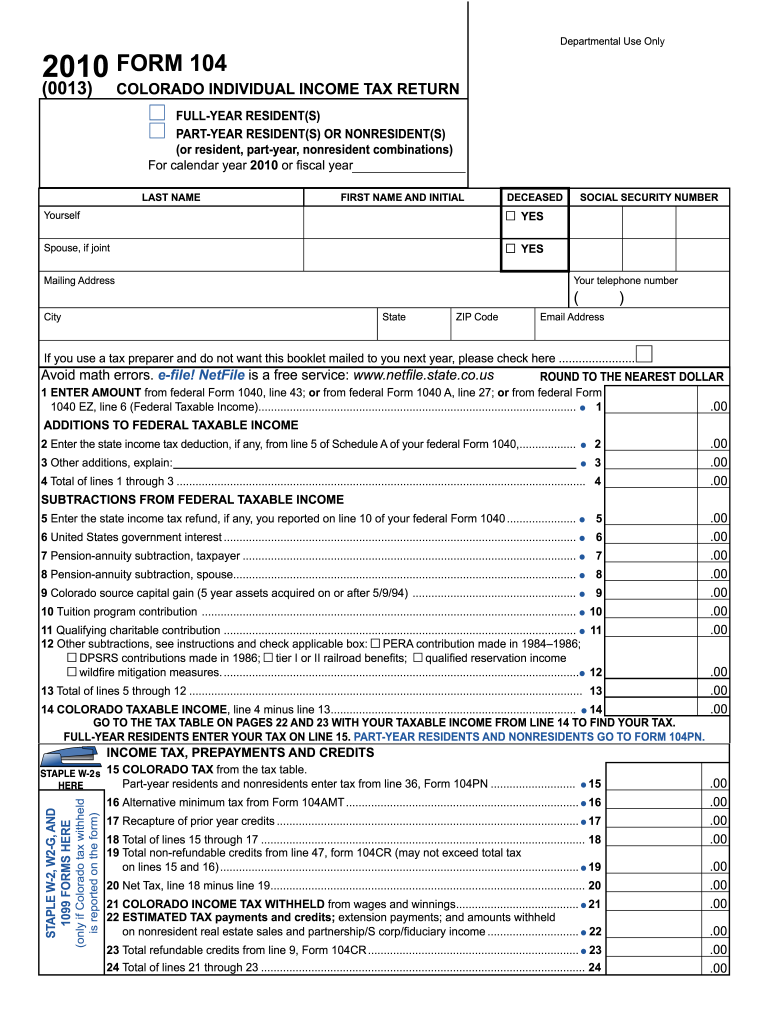

Colorado Tax Return Form - Colorado residents must file this return if they are required to file an income tax return with the irs, even if they do not have a colorado tax liability. You may file by mail with paper forms or efile. Generally, you must file a colorado individual income tax return if you are required to file a federal income tax return with the irs for the. Your browser appears to have cookies disabled. Form 104 is the general, and simplest, income tax return for individual residents of colorado. Cookies are required to use this site. File your individual income tax return, submit documentation electronically, or apply for a ptc rebate. Make sure you protect your personally identifiable information. The forms on this page are fillable and savable (except the instruction booklets).

You may file by mail with paper forms or efile. File your individual income tax return, submit documentation electronically, or apply for a ptc rebate. Form 104 is the general, and simplest, income tax return for individual residents of colorado. Your browser appears to have cookies disabled. Cookies are required to use this site. Make sure you protect your personally identifiable information. Colorado residents must file this return if they are required to file an income tax return with the irs, even if they do not have a colorado tax liability. Generally, you must file a colorado individual income tax return if you are required to file a federal income tax return with the irs for the. The forms on this page are fillable and savable (except the instruction booklets).

File your individual income tax return, submit documentation electronically, or apply for a ptc rebate. You may file by mail with paper forms or efile. Cookies are required to use this site. Colorado residents must file this return if they are required to file an income tax return with the irs, even if they do not have a colorado tax liability. Your browser appears to have cookies disabled. Form 104 is the general, and simplest, income tax return for individual residents of colorado. Generally, you must file a colorado individual income tax return if you are required to file a federal income tax return with the irs for the. Make sure you protect your personally identifiable information. The forms on this page are fillable and savable (except the instruction booklets).

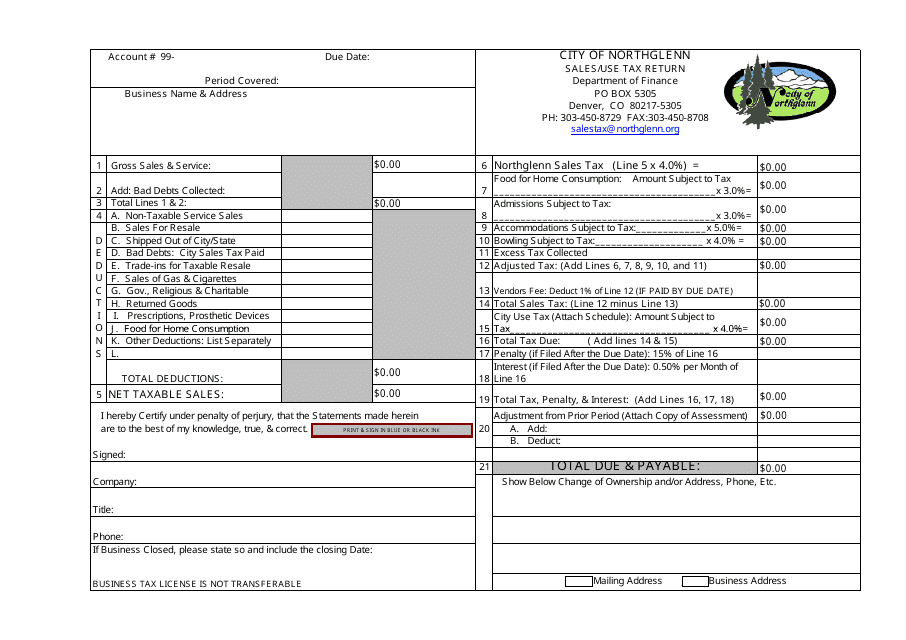

City of Northglenn, Colorado Sales/Use Tax Return Form Fill Out, Sign

The forms on this page are fillable and savable (except the instruction booklets). File your individual income tax return, submit documentation electronically, or apply for a ptc rebate. Cookies are required to use this site. Colorado residents must file this return if they are required to file an income tax return with the irs, even if they do not have.

American Tax Return Form 1040, US Individual Tax Return, Working Desk

Colorado residents must file this return if they are required to file an income tax return with the irs, even if they do not have a colorado tax liability. Make sure you protect your personally identifiable information. The forms on this page are fillable and savable (except the instruction booklets). Form 104 is the general, and simplest, income tax return.

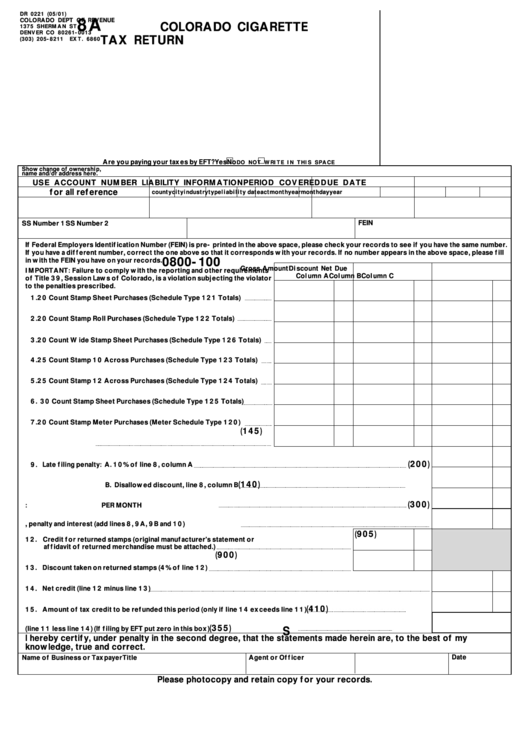

Form 8a Colorado Cigarette Tax Return printable pdf download

Generally, you must file a colorado individual income tax return if you are required to file a federal income tax return with the irs for the. Make sure you protect your personally identifiable information. Cookies are required to use this site. Your browser appears to have cookies disabled. Form 104 is the general, and simplest, income tax return for individual.

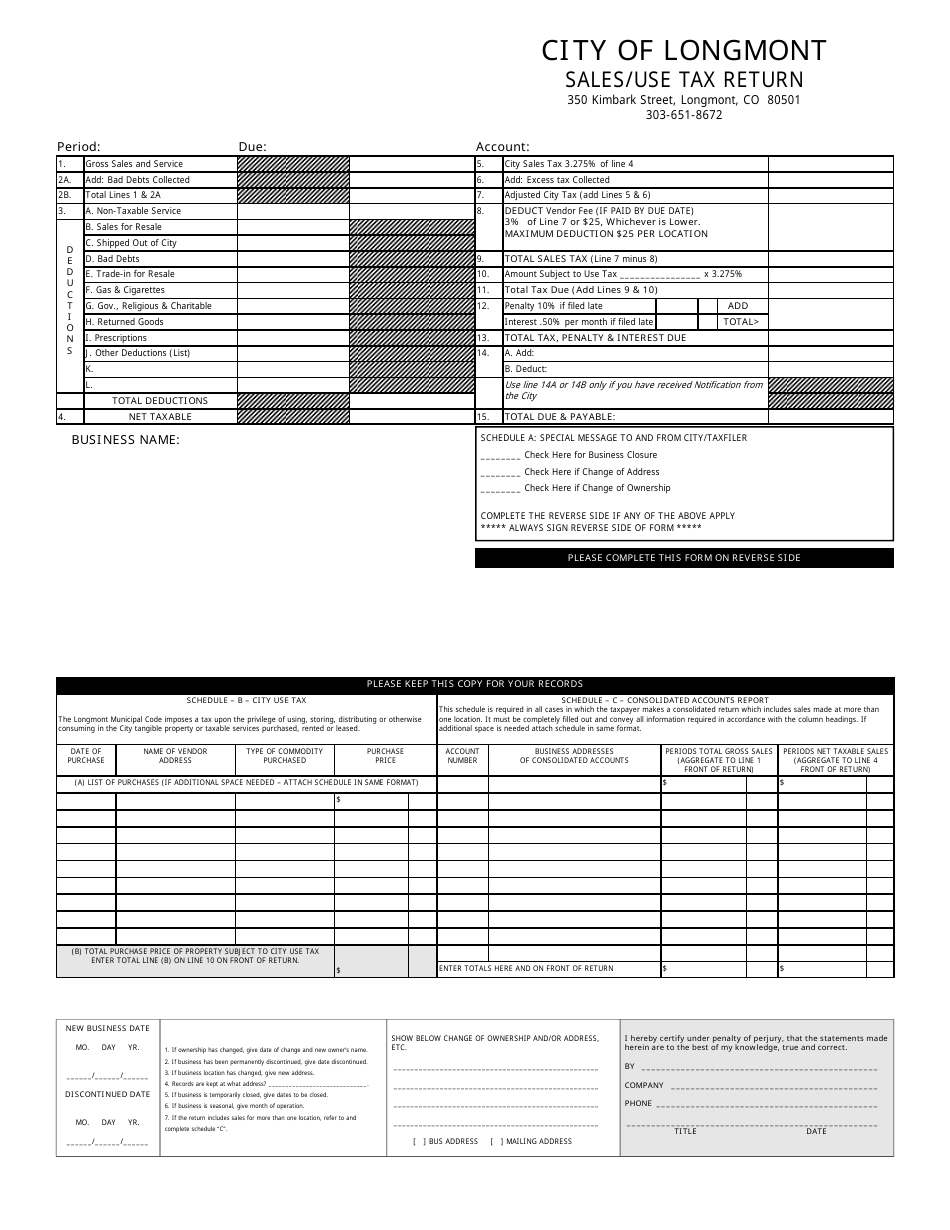

LONGMONT, Colorado Sales/Use Tax Return Form Fill Out, Sign Online

You may file by mail with paper forms or efile. Cookies are required to use this site. Form 104 is the general, and simplest, income tax return for individual residents of colorado. File your individual income tax return, submit documentation electronically, or apply for a ptc rebate. Make sure you protect your personally identifiable information.

If your Colorado tax return gets rejected this week don’t freak out. It

Form 104 is the general, and simplest, income tax return for individual residents of colorado. Colorado residents must file this return if they are required to file an income tax return with the irs, even if they do not have a colorado tax liability. Generally, you must file a colorado individual income tax return if you are required to file.

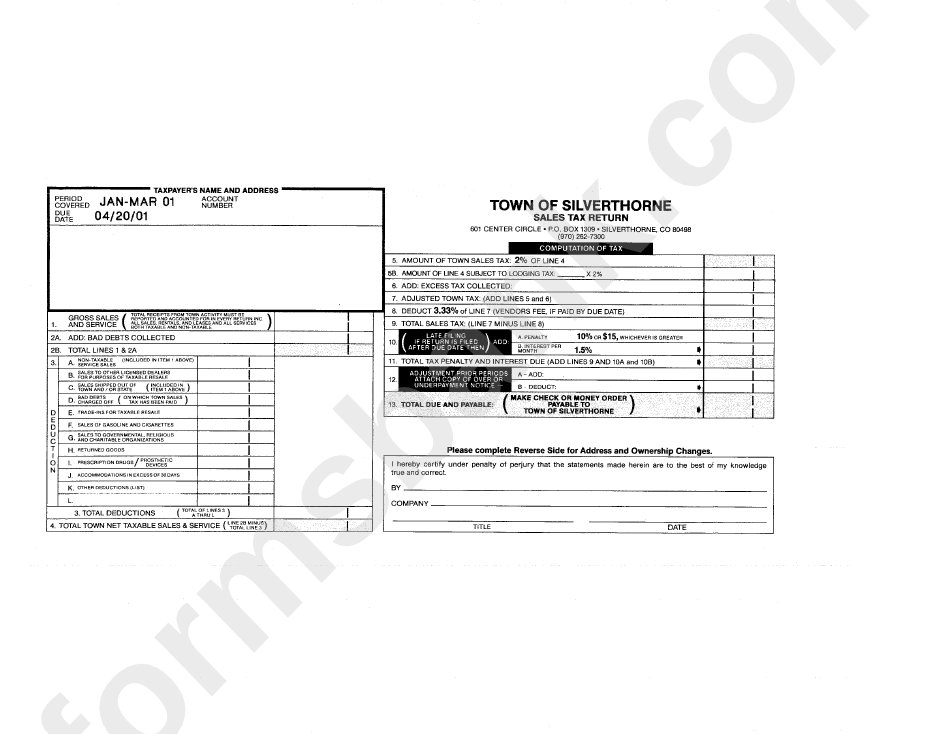

Sales Tax Return Form State Of Colorado printable pdf download

Make sure you protect your personally identifiable information. Generally, you must file a colorado individual income tax return if you are required to file a federal income tax return with the irs for the. Colorado residents must file this return if they are required to file an income tax return with the irs, even if they do not have a.

How to File the Colorado Retail Sales Tax Return (DR 0100) Paper Form

You may file by mail with paper forms or efile. Make sure you protect your personally identifiable information. Cookies are required to use this site. Your browser appears to have cookies disabled. Form 104 is the general, and simplest, income tax return for individual residents of colorado.

Colorado ends tax breaks for wealthy and big businesses, changes

The forms on this page are fillable and savable (except the instruction booklets). Your browser appears to have cookies disabled. Cookies are required to use this site. Colorado residents must file this return if they are required to file an income tax return with the irs, even if they do not have a colorado tax liability. You may file by.

2023 Colorado Estimated Tax Payment Form Printable Forms Free

File your individual income tax return, submit documentation electronically, or apply for a ptc rebate. Colorado residents must file this return if they are required to file an income tax return with the irs, even if they do not have a colorado tax liability. Generally, you must file a colorado individual income tax return if you are required to file.

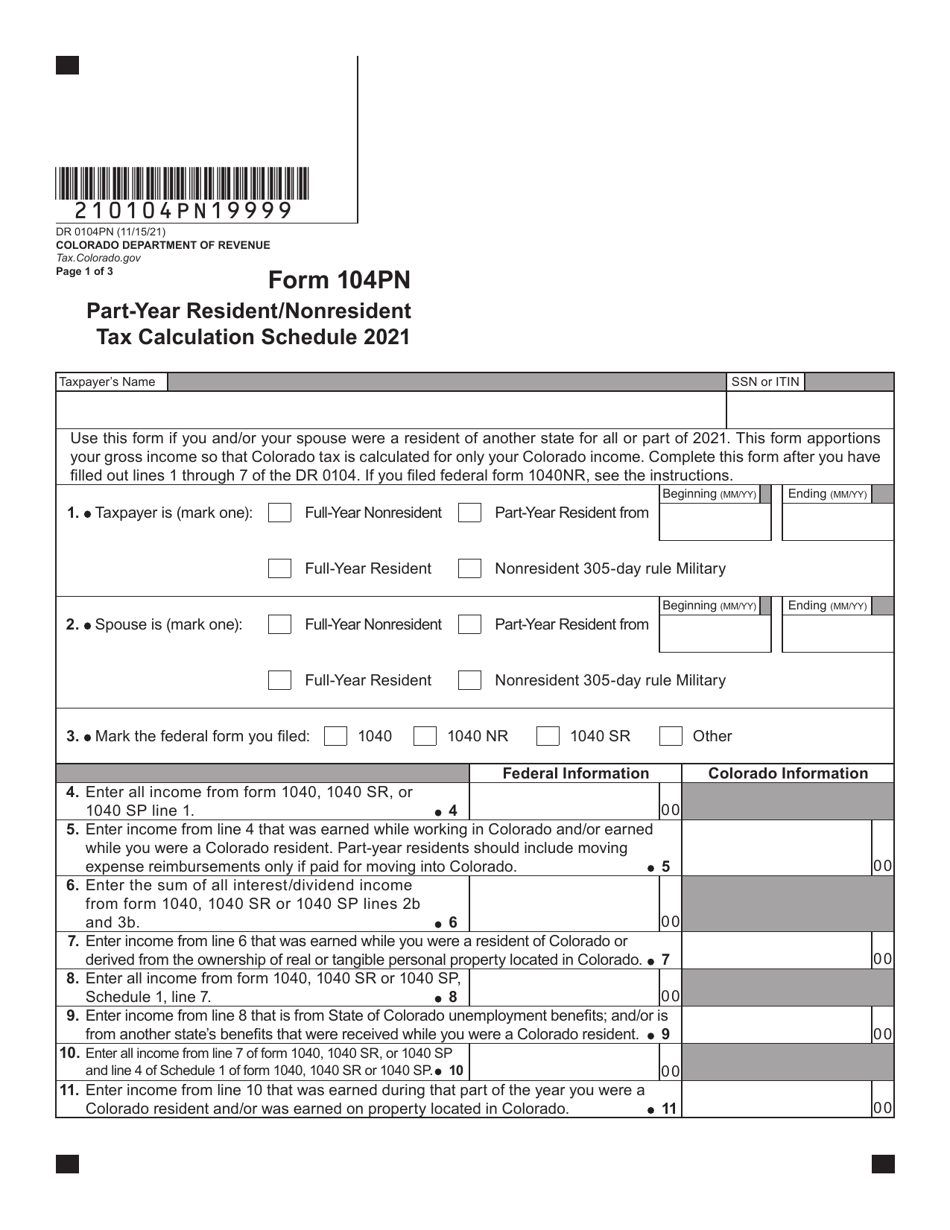

Form DR0104PN 2021 Fill Out, Sign Online and Download Fillable PDF

Cookies are required to use this site. Your browser appears to have cookies disabled. Form 104 is the general, and simplest, income tax return for individual residents of colorado. The forms on this page are fillable and savable (except the instruction booklets). You may file by mail with paper forms or efile.

Your Browser Appears To Have Cookies Disabled.

The forms on this page are fillable and savable (except the instruction booklets). Generally, you must file a colorado individual income tax return if you are required to file a federal income tax return with the irs for the. Make sure you protect your personally identifiable information. Colorado residents must file this return if they are required to file an income tax return with the irs, even if they do not have a colorado tax liability.

You May File By Mail With Paper Forms Or Efile.

Cookies are required to use this site. File your individual income tax return, submit documentation electronically, or apply for a ptc rebate. Form 104 is the general, and simplest, income tax return for individual residents of colorado.