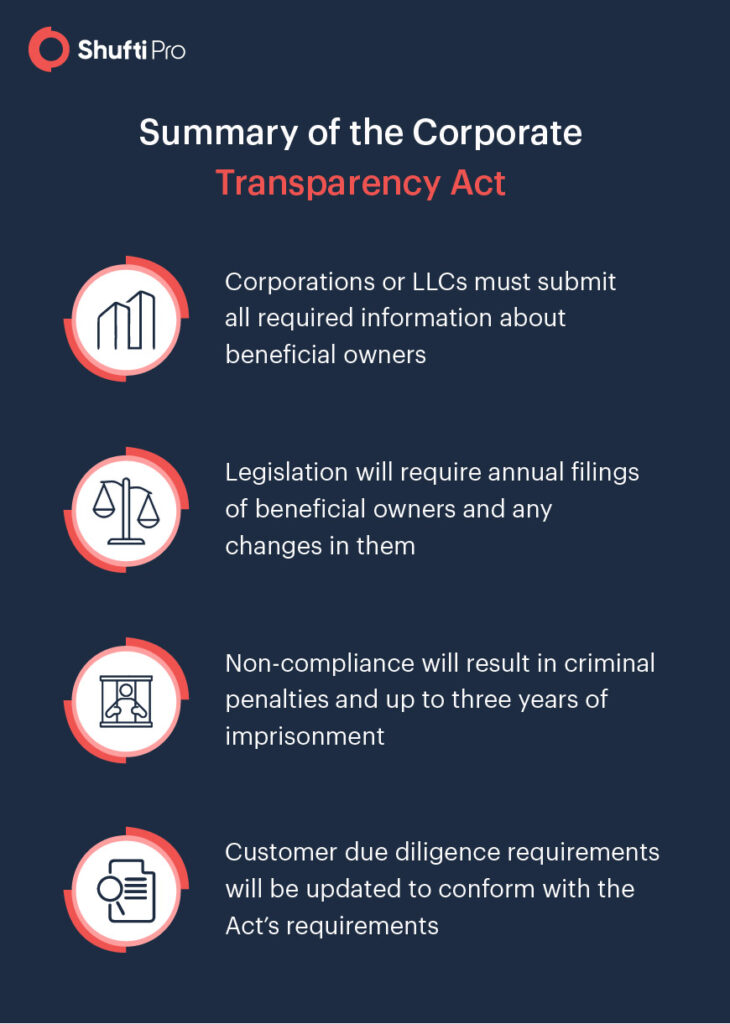

Corporate Transparency Act Form - And international financial systems, as well as people across the country, from illicit finance threats like terrorist financing, drug. The corporate transparency act (cta) specifies that a company may qualify for the large operating company exemption based on a federal income tax or information return filed “in” the. The bipartisan corporate transparency act, enacted in 2021 to curb illicit finance, requires many companies doing business in the united states to report information about the individuals. And foreign entities to report beneficial ownership information to the financial crimes enforcement network (fincen), a bureau of the. The corporate transparency act (cta) plays a vital role in protecting the u.s. The corporate transparency act requires certain types of u.s.

And international financial systems, as well as people across the country, from illicit finance threats like terrorist financing, drug. The corporate transparency act (cta) specifies that a company may qualify for the large operating company exemption based on a federal income tax or information return filed “in” the. The corporate transparency act (cta) plays a vital role in protecting the u.s. And foreign entities to report beneficial ownership information to the financial crimes enforcement network (fincen), a bureau of the. The corporate transparency act requires certain types of u.s. The bipartisan corporate transparency act, enacted in 2021 to curb illicit finance, requires many companies doing business in the united states to report information about the individuals.

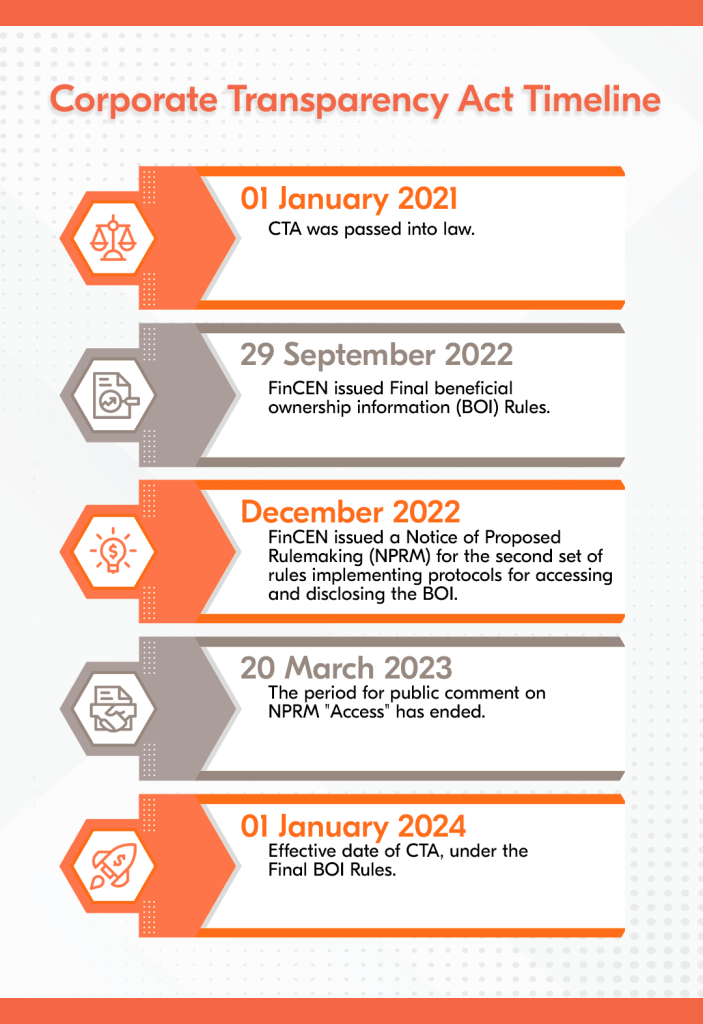

The corporate transparency act (cta) plays a vital role in protecting the u.s. The bipartisan corporate transparency act, enacted in 2021 to curb illicit finance, requires many companies doing business in the united states to report information about the individuals. The corporate transparency act (cta) specifies that a company may qualify for the large operating company exemption based on a federal income tax or information return filed “in” the. And foreign entities to report beneficial ownership information to the financial crimes enforcement network (fincen), a bureau of the. The corporate transparency act requires certain types of u.s. And international financial systems, as well as people across the country, from illicit finance threats like terrorist financing, drug.

Corporate Transparency Act 2024 Form 1 Alica Petronilla

The corporate transparency act (cta) specifies that a company may qualify for the large operating company exemption based on a federal income tax or information return filed “in” the. The corporate transparency act (cta) plays a vital role in protecting the u.s. The bipartisan corporate transparency act, enacted in 2021 to curb illicit finance, requires many companies doing business in.

Understanding the Corporate Transparency Act and Its Implications CCA

The corporate transparency act requires certain types of u.s. The corporate transparency act (cta) plays a vital role in protecting the u.s. The bipartisan corporate transparency act, enacted in 2021 to curb illicit finance, requires many companies doing business in the united states to report information about the individuals. And international financial systems, as well as people across the country,.

Corporate Transparency Act 2024 Form 1 Lilas Carmelle

The bipartisan corporate transparency act, enacted in 2021 to curb illicit finance, requires many companies doing business in the united states to report information about the individuals. And international financial systems, as well as people across the country, from illicit finance threats like terrorist financing, drug. The corporate transparency act requires certain types of u.s. And foreign entities to report.

Corporate Transparency Act 2024 Filing Form Mala Sorcha

The corporate transparency act requires certain types of u.s. The corporate transparency act (cta) specifies that a company may qualify for the large operating company exemption based on a federal income tax or information return filed “in” the. The bipartisan corporate transparency act, enacted in 2021 to curb illicit finance, requires many companies doing business in the united states to.

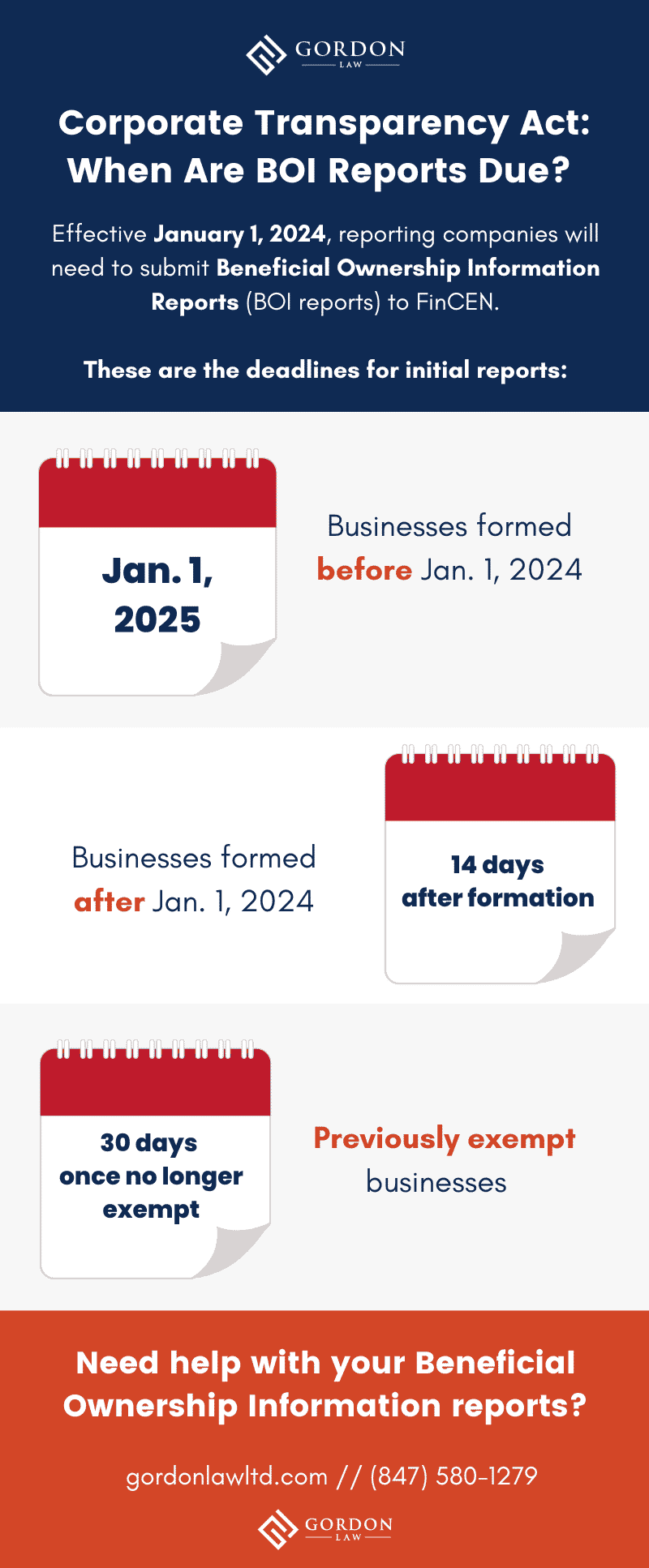

Corporate Transparency Act — Beneficial Ownership Information Reporting

The corporate transparency act (cta) specifies that a company may qualify for the large operating company exemption based on a federal income tax or information return filed “in” the. And foreign entities to report beneficial ownership information to the financial crimes enforcement network (fincen), a bureau of the. The corporate transparency act requires certain types of u.s. The bipartisan corporate.

An Overview of the US Corporate Transparency Act Bolder Group

And international financial systems, as well as people across the country, from illicit finance threats like terrorist financing, drug. The corporate transparency act (cta) specifies that a company may qualify for the large operating company exemption based on a federal income tax or information return filed “in” the. The bipartisan corporate transparency act, enacted in 2021 to curb illicit finance,.

Everything you need to know about the Corporate Transparency Act for

And international financial systems, as well as people across the country, from illicit finance threats like terrorist financing, drug. The corporate transparency act (cta) specifies that a company may qualify for the large operating company exemption based on a federal income tax or information return filed “in” the. The corporate transparency act requires certain types of u.s. And foreign entities.

Corporate Transparency Act 2024 Pdf Form Danya Chelsea

The bipartisan corporate transparency act, enacted in 2021 to curb illicit finance, requires many companies doing business in the united states to report information about the individuals. The corporate transparency act (cta) specifies that a company may qualify for the large operating company exemption based on a federal income tax or information return filed “in” the. And foreign entities to.

How to Prepare for the Implementation of the Corporate Transparency Act

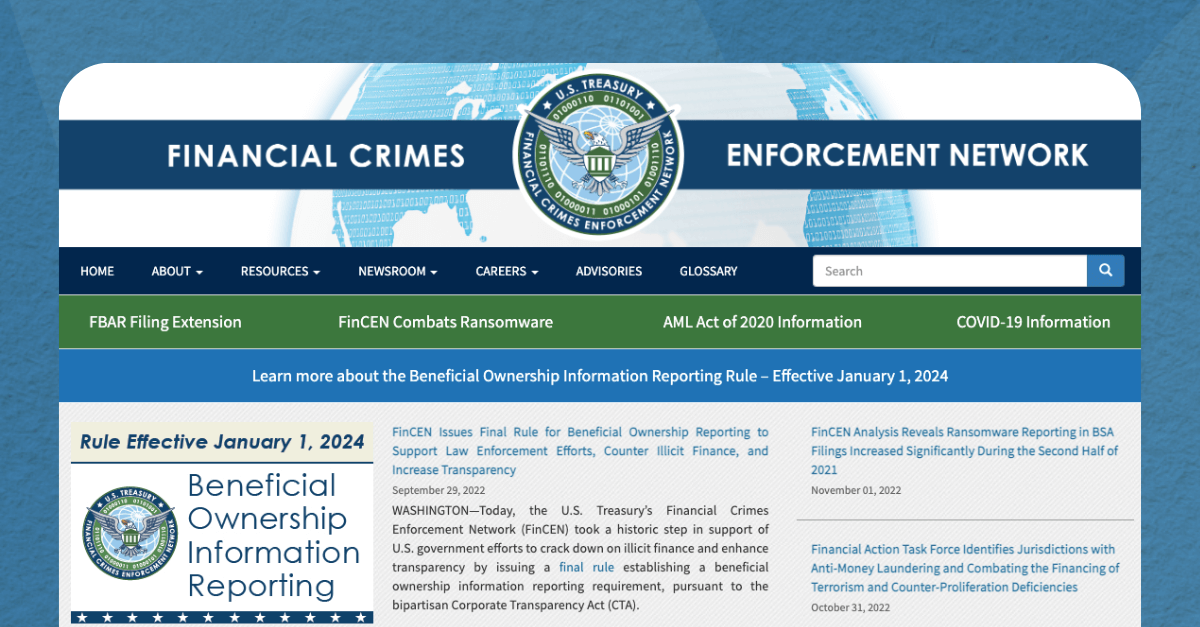

And foreign entities to report beneficial ownership information to the financial crimes enforcement network (fincen), a bureau of the. And international financial systems, as well as people across the country, from illicit finance threats like terrorist financing, drug. The corporate transparency act requires certain types of u.s. The corporate transparency act (cta) plays a vital role in protecting the u.s..

Corporate Transparency Act Understanding Reporting Requirements

The corporate transparency act requires certain types of u.s. And international financial systems, as well as people across the country, from illicit finance threats like terrorist financing, drug. And foreign entities to report beneficial ownership information to the financial crimes enforcement network (fincen), a bureau of the. The corporate transparency act (cta) specifies that a company may qualify for the.

The Corporate Transparency Act (Cta) Specifies That A Company May Qualify For The Large Operating Company Exemption Based On A Federal Income Tax Or Information Return Filed “In” The.

The bipartisan corporate transparency act, enacted in 2021 to curb illicit finance, requires many companies doing business in the united states to report information about the individuals. And international financial systems, as well as people across the country, from illicit finance threats like terrorist financing, drug. The corporate transparency act (cta) plays a vital role in protecting the u.s. And foreign entities to report beneficial ownership information to the financial crimes enforcement network (fincen), a bureau of the.