De4 Tax Form - You must file the state form employee’s withholding allowance certificate (de 4) (pdf) (edd.ca.gov/pdf_pub_ctr/de4.pdf) to determine. De 4 is a form for california personal income tax (pit) withholding purposes only. Filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in. It helps your employer calculate the amount of taxes to.

It helps your employer calculate the amount of taxes to. Filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in. De 4 is a form for california personal income tax (pit) withholding purposes only. You must file the state form employee’s withholding allowance certificate (de 4) (pdf) (edd.ca.gov/pdf_pub_ctr/de4.pdf) to determine.

It helps your employer calculate the amount of taxes to. Filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in. You must file the state form employee’s withholding allowance certificate (de 4) (pdf) (edd.ca.gov/pdf_pub_ctr/de4.pdf) to determine. De 4 is a form for california personal income tax (pit) withholding purposes only.

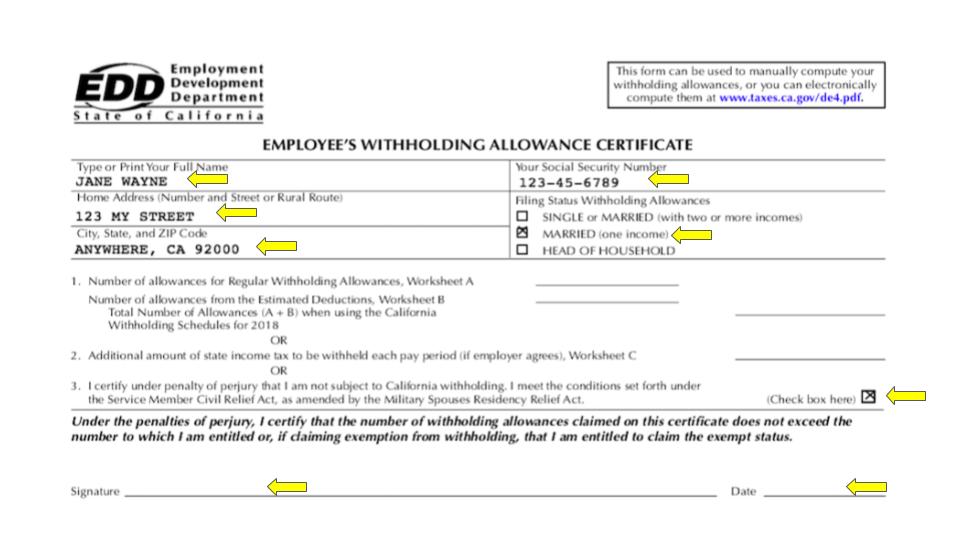

20212023 Form CA DE 4 Fill Online, Printable, Fillable, Blank pdfFiller

Filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in. You must file the state form employee’s withholding allowance certificate (de 4) (pdf) (edd.ca.gov/pdf_pub_ctr/de4.pdf) to determine. It helps your employer calculate the amount of taxes to. De 4 is a form for california personal income tax (pit).

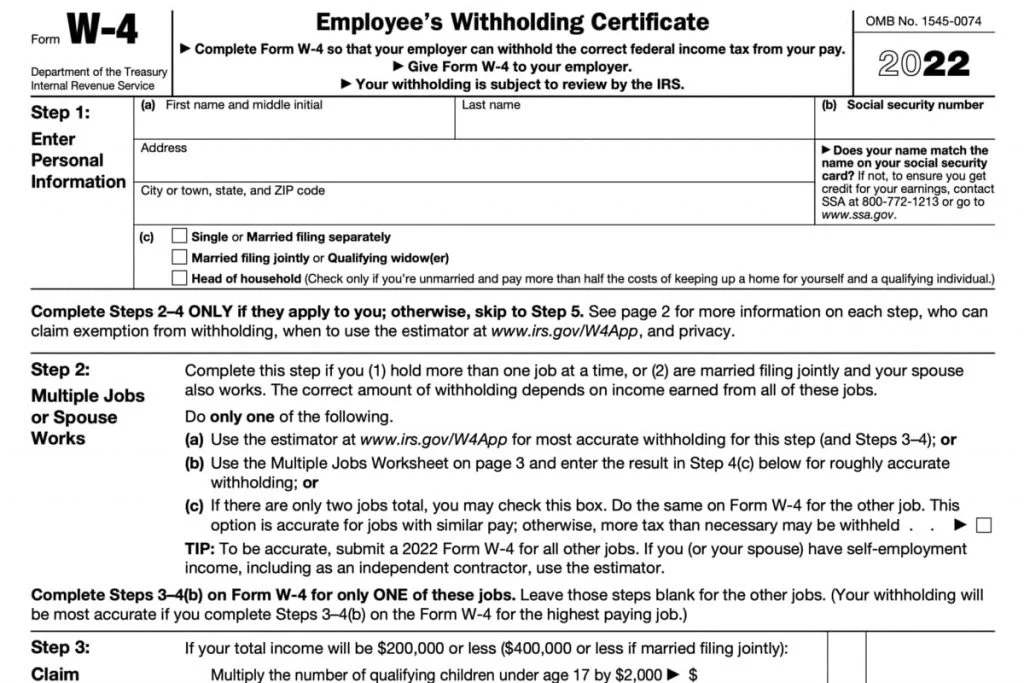

Form W4 (Employee's Withholding Certificate) template

De 4 is a form for california personal income tax (pit) withholding purposes only. You must file the state form employee’s withholding allowance certificate (de 4) (pdf) (edd.ca.gov/pdf_pub_ctr/de4.pdf) to determine. It helps your employer calculate the amount of taxes to. Filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages.

Fillable Online de4.pdf Clear Form EMPLOYEES WITHHOLDING ALLOWANCE

It helps your employer calculate the amount of taxes to. You must file the state form employee’s withholding allowance certificate (de 4) (pdf) (edd.ca.gov/pdf_pub_ctr/de4.pdf) to determine. Filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in. De 4 is a form for california personal income tax (pit).

De4 Printable Form Printable Forms Free Online

Filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in. You must file the state form employee’s withholding allowance certificate (de 4) (pdf) (edd.ca.gov/pdf_pub_ctr/de4.pdf) to determine. It helps your employer calculate the amount of taxes to. De 4 is a form for california personal income tax (pit).

Form DE4 Fill Out, Sign Online and Download Fillable PDF, California

It helps your employer calculate the amount of taxes to. Filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in. De 4 is a form for california personal income tax (pit) withholding purposes only. You must file the state form employee’s withholding allowance certificate (de 4) (pdf).

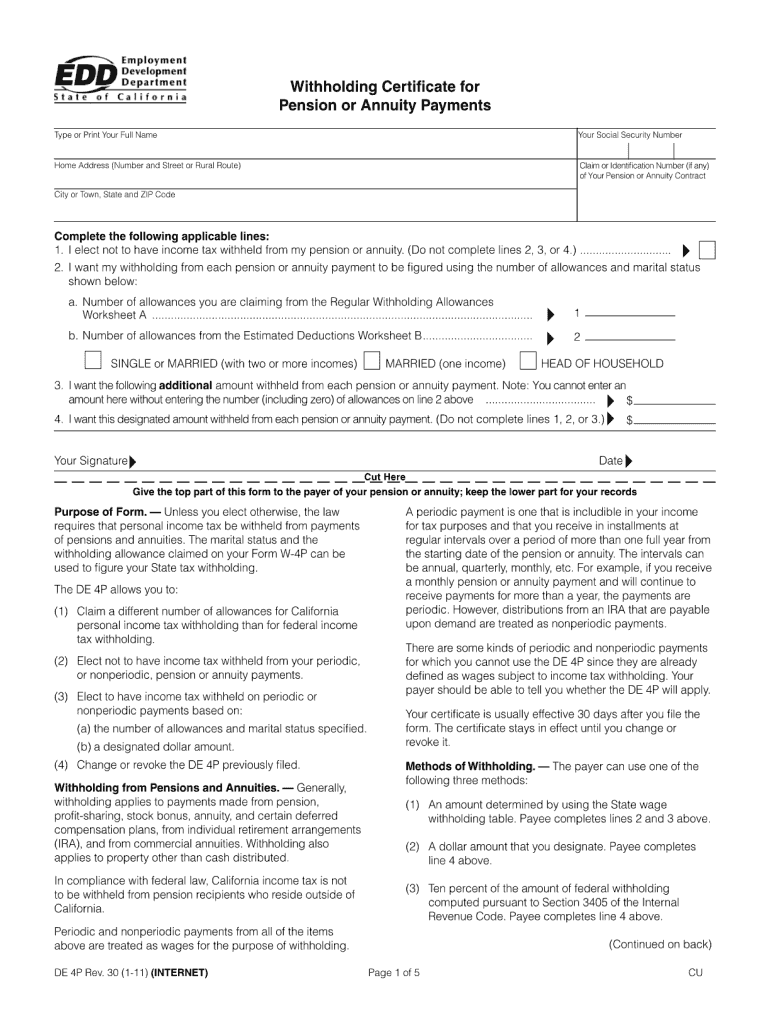

2011 Form CA EDD DE 4P Fill Online, Printable, Fillable, Blank pdfFiller

You must file the state form employee’s withholding allowance certificate (de 4) (pdf) (edd.ca.gov/pdf_pub_ctr/de4.pdf) to determine. It helps your employer calculate the amount of taxes to. Filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in. De 4 is a form for california personal income tax (pit).

de4 Withholding Tax Tax In The United States

De 4 is a form for california personal income tax (pit) withholding purposes only. Filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in. It helps your employer calculate the amount of taxes to. You must file the state form employee’s withholding allowance certificate (de 4) (pdf).

Form De4 PDF

You must file the state form employee’s withholding allowance certificate (de 4) (pdf) (edd.ca.gov/pdf_pub_ctr/de4.pdf) to determine. Filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in. De 4 is a form for california personal income tax (pit) withholding purposes only. It helps your employer calculate the amount.

How to Complete Forms W4 Attiyya S. Ingram, AFC

You must file the state form employee’s withholding allowance certificate (de 4) (pdf) (edd.ca.gov/pdf_pub_ctr/de4.pdf) to determine. De 4 is a form for california personal income tax (pit) withholding purposes only. It helps your employer calculate the amount of taxes to. Filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages.

W4 Form 2024 Irs Daffy Drucill

Filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in. You must file the state form employee’s withholding allowance certificate (de 4) (pdf) (edd.ca.gov/pdf_pub_ctr/de4.pdf) to determine. It helps your employer calculate the amount of taxes to. De 4 is a form for california personal income tax (pit).

De 4 Is A Form For California Personal Income Tax (Pit) Withholding Purposes Only.

You must file the state form employee’s withholding allowance certificate (de 4) (pdf) (edd.ca.gov/pdf_pub_ctr/de4.pdf) to determine. It helps your employer calculate the amount of taxes to. Filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in.