Discharge Of Indebtedness To The Extent Insolvent - If you had debt cancelled and are no longer obligated to repay the debt, you generally must include the amount of cancelled debt in your. Subparagraphs (c) and (d) of paragraph (1) shall not apply to a discharge to the extent the taxpayer is insolvent. The final hurdle is convincing the irs that you were insolvent at the time your debt was canceled. Normally, a taxpayer is not required to include forgiven. You must complete and file. The forgiven debt may be excluded as income under the insolvency exclusion. You were insolvent to the extent that your liabilities exceeded the fair market value (fmv) of your assets immediately before the discharge.

The final hurdle is convincing the irs that you were insolvent at the time your debt was canceled. You were insolvent to the extent that your liabilities exceeded the fair market value (fmv) of your assets immediately before the discharge. You must complete and file. The forgiven debt may be excluded as income under the insolvency exclusion. Normally, a taxpayer is not required to include forgiven. Subparagraphs (c) and (d) of paragraph (1) shall not apply to a discharge to the extent the taxpayer is insolvent. If you had debt cancelled and are no longer obligated to repay the debt, you generally must include the amount of cancelled debt in your.

The final hurdle is convincing the irs that you were insolvent at the time your debt was canceled. Normally, a taxpayer is not required to include forgiven. If you had debt cancelled and are no longer obligated to repay the debt, you generally must include the amount of cancelled debt in your. You must complete and file. Subparagraphs (c) and (d) of paragraph (1) shall not apply to a discharge to the extent the taxpayer is insolvent. You were insolvent to the extent that your liabilities exceeded the fair market value (fmv) of your assets immediately before the discharge. The forgiven debt may be excluded as income under the insolvency exclusion.

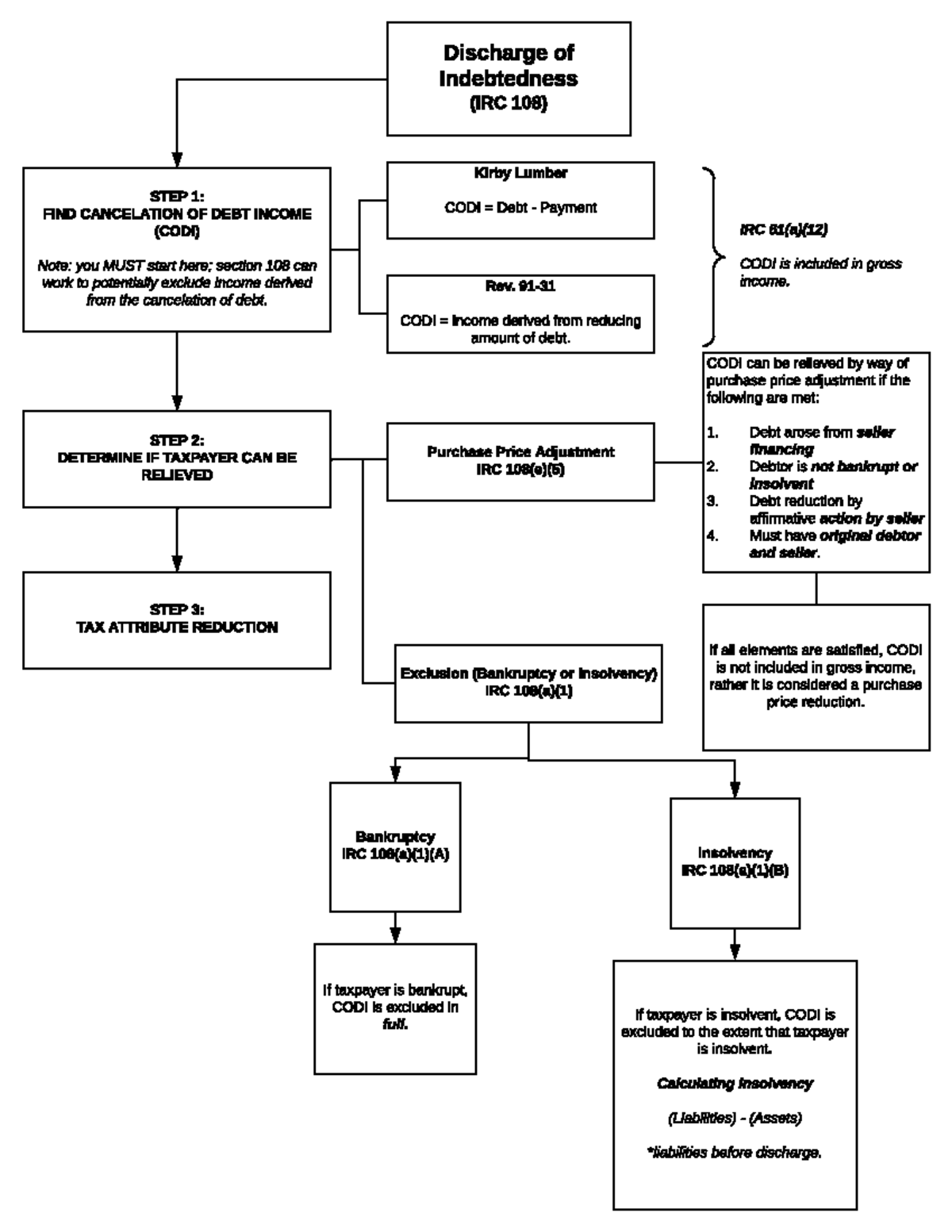

Discharge of Indebtedness Chart 1 Discharge of Indebtedness (IRC

You were insolvent to the extent that your liabilities exceeded the fair market value (fmv) of your assets immediately before the discharge. If you had debt cancelled and are no longer obligated to repay the debt, you generally must include the amount of cancelled debt in your. The final hurdle is convincing the irs that you were insolvent at the.

PPT Dr H Srinivas , IRPS PowerPoint Presentation, free download ID

Subparagraphs (c) and (d) of paragraph (1) shall not apply to a discharge to the extent the taxpayer is insolvent. If you had debt cancelled and are no longer obligated to repay the debt, you generally must include the amount of cancelled debt in your. You must complete and file. Normally, a taxpayer is not required to include forgiven. The.

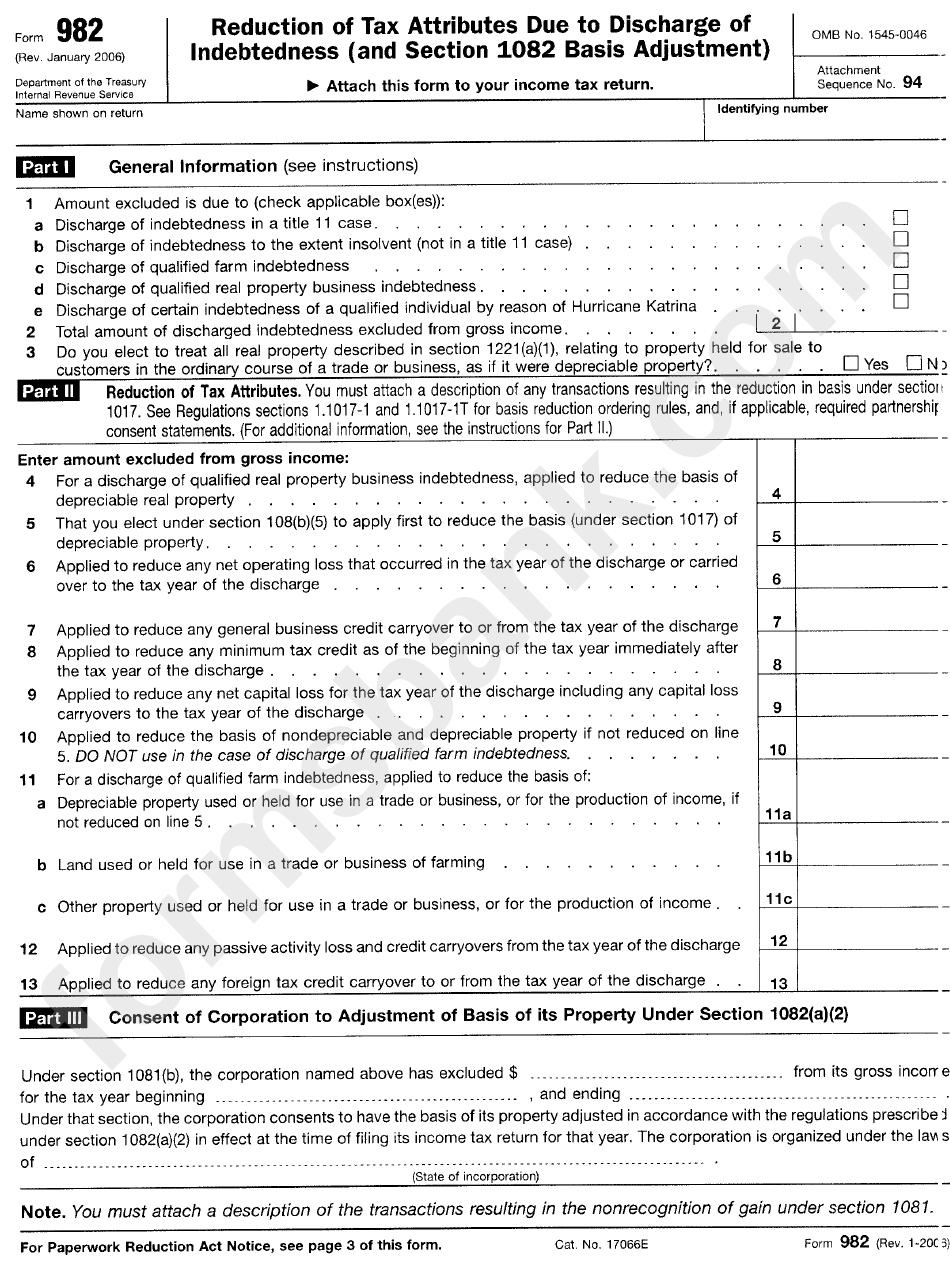

IRS Form 982 Instructions Discharge of Indebtedness

The forgiven debt may be excluded as income under the insolvency exclusion. Normally, a taxpayer is not required to include forgiven. You must complete and file. You were insolvent to the extent that your liabilities exceeded the fair market value (fmv) of your assets immediately before the discharge. Subparagraphs (c) and (d) of paragraph (1) shall not apply to a.

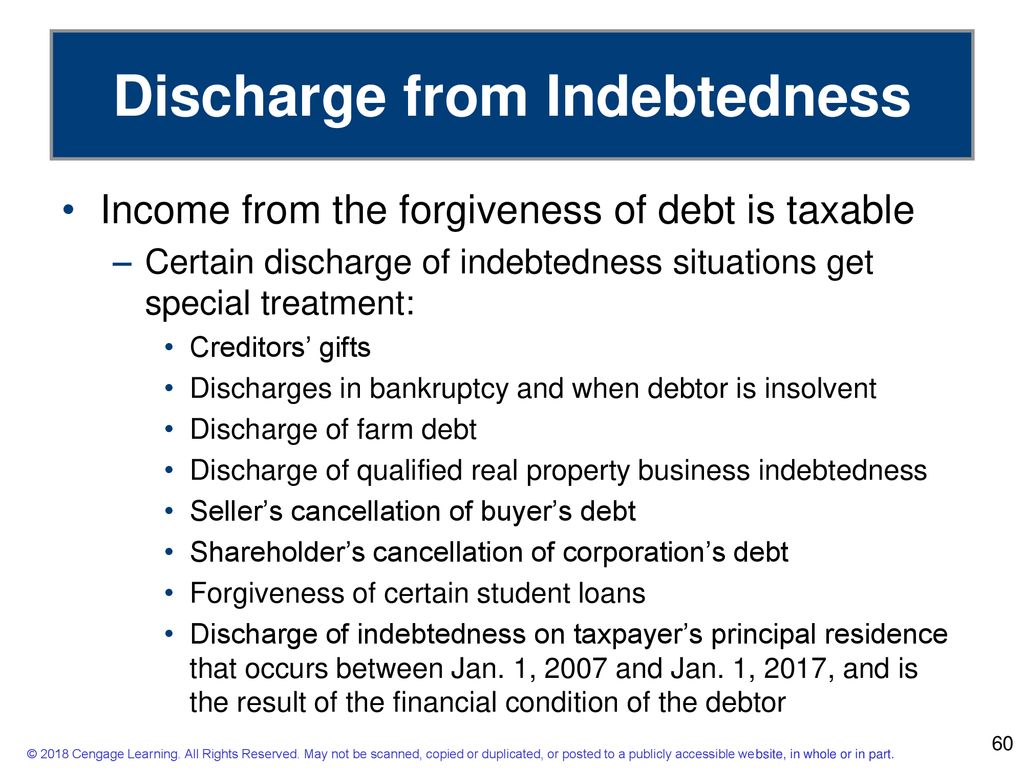

Gross Exclusions ppt download

You must complete and file. If you had debt cancelled and are no longer obligated to repay the debt, you generally must include the amount of cancelled debt in your. The forgiven debt may be excluded as income under the insolvency exclusion. Normally, a taxpayer is not required to include forgiven. The final hurdle is convincing the irs that you.

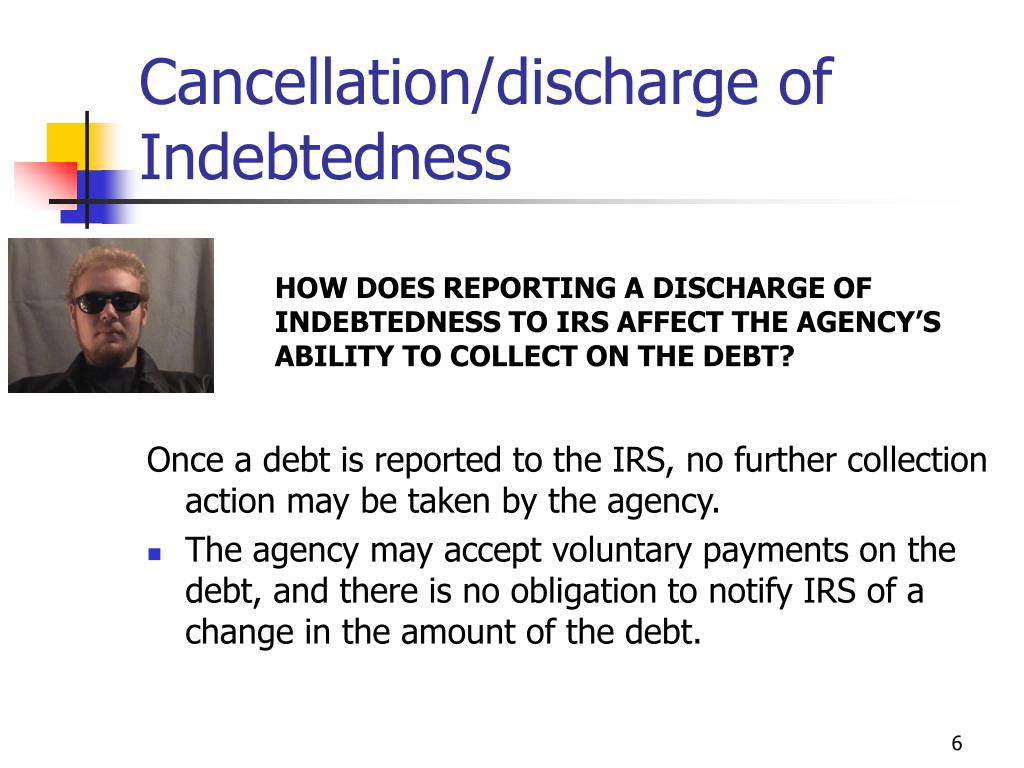

PPT Cancellation/discharge of Indebtedness PowerPoint Presentation

The forgiven debt may be excluded as income under the insolvency exclusion. Subparagraphs (c) and (d) of paragraph (1) shall not apply to a discharge to the extent the taxpayer is insolvent. Normally, a taxpayer is not required to include forgiven. If you had debt cancelled and are no longer obligated to repay the debt, you generally must include the.

Discharge of Indebtedness John A. Tatoian Law

You were insolvent to the extent that your liabilities exceeded the fair market value (fmv) of your assets immediately before the discharge. Subparagraphs (c) and (d) of paragraph (1) shall not apply to a discharge to the extent the taxpayer is insolvent. Normally, a taxpayer is not required to include forgiven. You must complete and file. The final hurdle is.

Irs Form 982 Insolvency Worksheet

If you had debt cancelled and are no longer obligated to repay the debt, you generally must include the amount of cancelled debt in your. You must complete and file. Subparagraphs (c) and (d) of paragraph (1) shall not apply to a discharge to the extent the taxpayer is insolvent. The forgiven debt may be excluded as income under the.

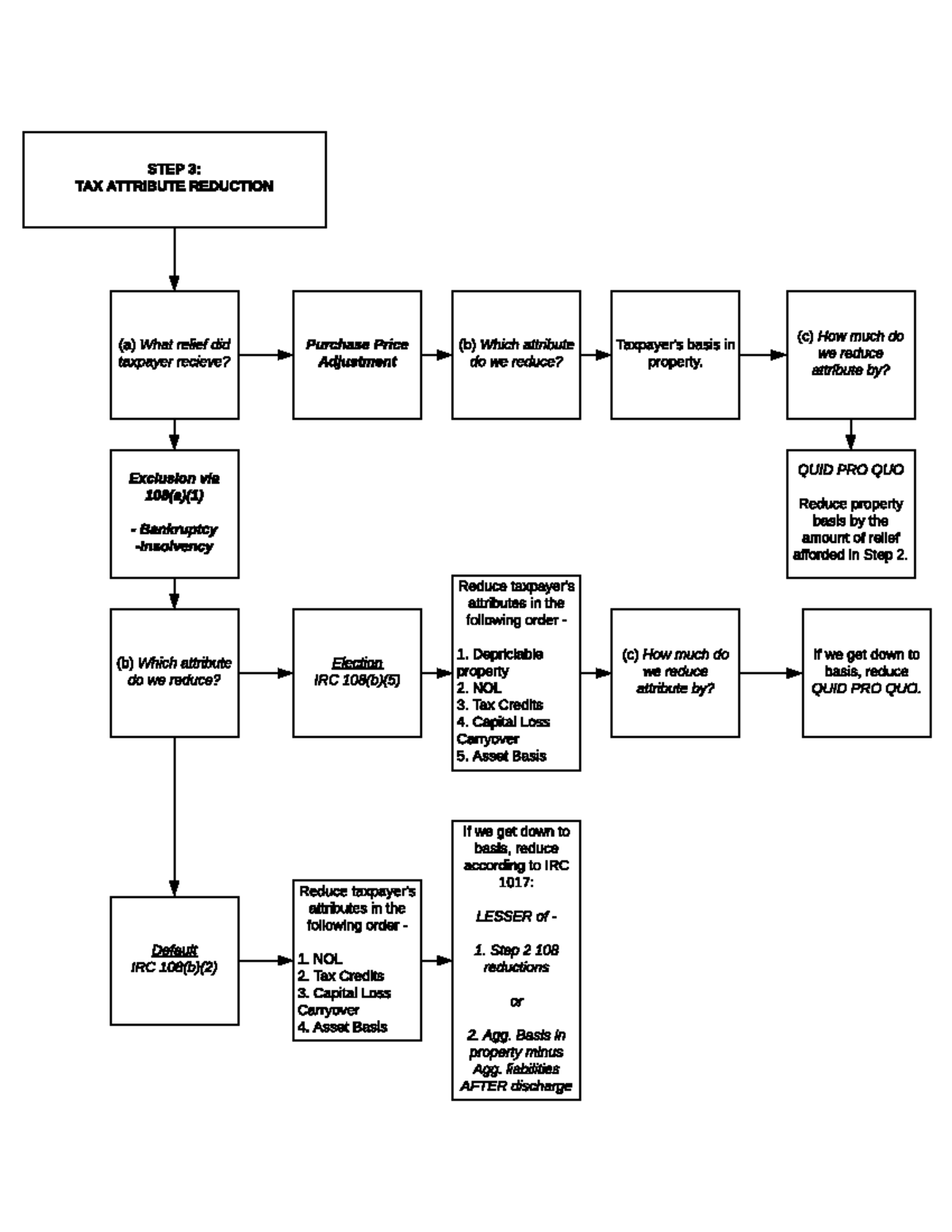

Discharge of Indebtedness Chart 2 STEP 3 TAX ATTRIBUTE REDUCTION

If you had debt cancelled and are no longer obligated to repay the debt, you generally must include the amount of cancelled debt in your. Normally, a taxpayer is not required to include forgiven. Subparagraphs (c) and (d) of paragraph (1) shall not apply to a discharge to the extent the taxpayer is insolvent. The forgiven debt may be excluded.

IRS Form 982 Instructions Discharge of Indebtedness

The forgiven debt may be excluded as income under the insolvency exclusion. Subparagraphs (c) and (d) of paragraph (1) shall not apply to a discharge to the extent the taxpayer is insolvent. The final hurdle is convincing the irs that you were insolvent at the time your debt was canceled. You must complete and file. Normally, a taxpayer is not.

Discharge of Indebtedness on Principal Residences and Business Real

The forgiven debt may be excluded as income under the insolvency exclusion. You must complete and file. Normally, a taxpayer is not required to include forgiven. Subparagraphs (c) and (d) of paragraph (1) shall not apply to a discharge to the extent the taxpayer is insolvent. The final hurdle is convincing the irs that you were insolvent at the time.

Normally, A Taxpayer Is Not Required To Include Forgiven.

The forgiven debt may be excluded as income under the insolvency exclusion. If you had debt cancelled and are no longer obligated to repay the debt, you generally must include the amount of cancelled debt in your. You were insolvent to the extent that your liabilities exceeded the fair market value (fmv) of your assets immediately before the discharge. The final hurdle is convincing the irs that you were insolvent at the time your debt was canceled.

You Must Complete And File.

Subparagraphs (c) and (d) of paragraph (1) shall not apply to a discharge to the extent the taxpayer is insolvent.