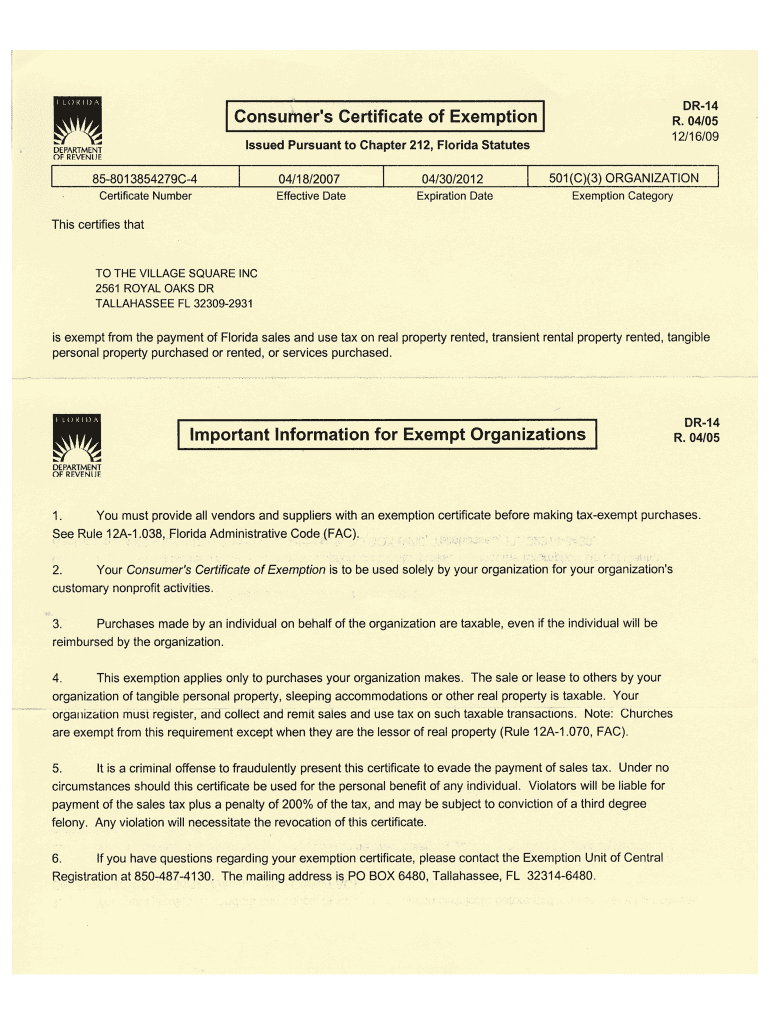

Dr 14 Tax Exemption Form - Is exempt from the payment of florida sales and use tax on real property rented, transient rental property rented, tangible personal property purchased or rented, or services purchased. This exemption applies only to purchases your organization makes. The sale or lease to others of tangible personal property, sleeping accommodations, or other real property is.

The sale or lease to others of tangible personal property, sleeping accommodations, or other real property is. Is exempt from the payment of florida sales and use tax on real property rented, transient rental property rented, tangible personal property purchased or rented, or services purchased. This exemption applies only to purchases your organization makes.

Is exempt from the payment of florida sales and use tax on real property rented, transient rental property rented, tangible personal property purchased or rented, or services purchased. The sale or lease to others of tangible personal property, sleeping accommodations, or other real property is. This exemption applies only to purchases your organization makes.

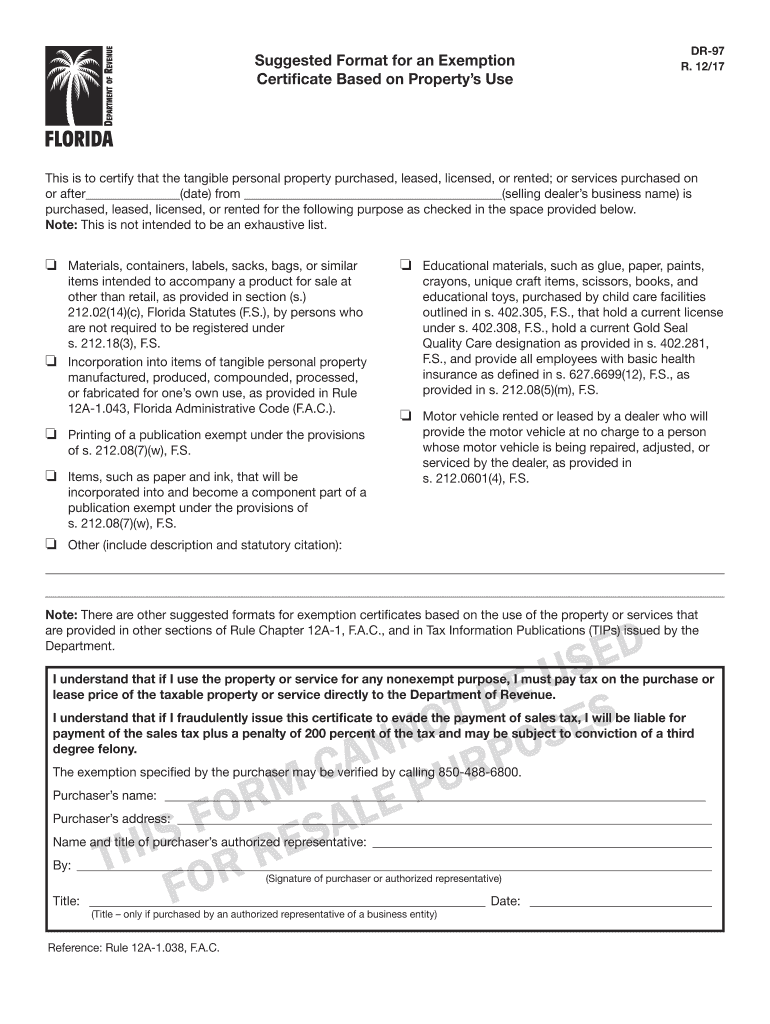

Fillable Form R 1310 Certificate Of Sales Tax Exemption Exclusion For

Is exempt from the payment of florida sales and use tax on real property rented, transient rental property rented, tangible personal property purchased or rented, or services purchased. This exemption applies only to purchases your organization makes. The sale or lease to others of tangible personal property, sleeping accommodations, or other real property is.

Dr 14 2009 form Fill out & sign online DocHub

Is exempt from the payment of florida sales and use tax on real property rented, transient rental property rented, tangible personal property purchased or rented, or services purchased. This exemption applies only to purchases your organization makes. The sale or lease to others of tangible personal property, sleeping accommodations, or other real property is.

Dr 14 form pdf Fill out & sign online DocHub

The sale or lease to others of tangible personal property, sleeping accommodations, or other real property is. Is exempt from the payment of florida sales and use tax on real property rented, transient rental property rented, tangible personal property purchased or rented, or services purchased. This exemption applies only to purchases your organization makes.

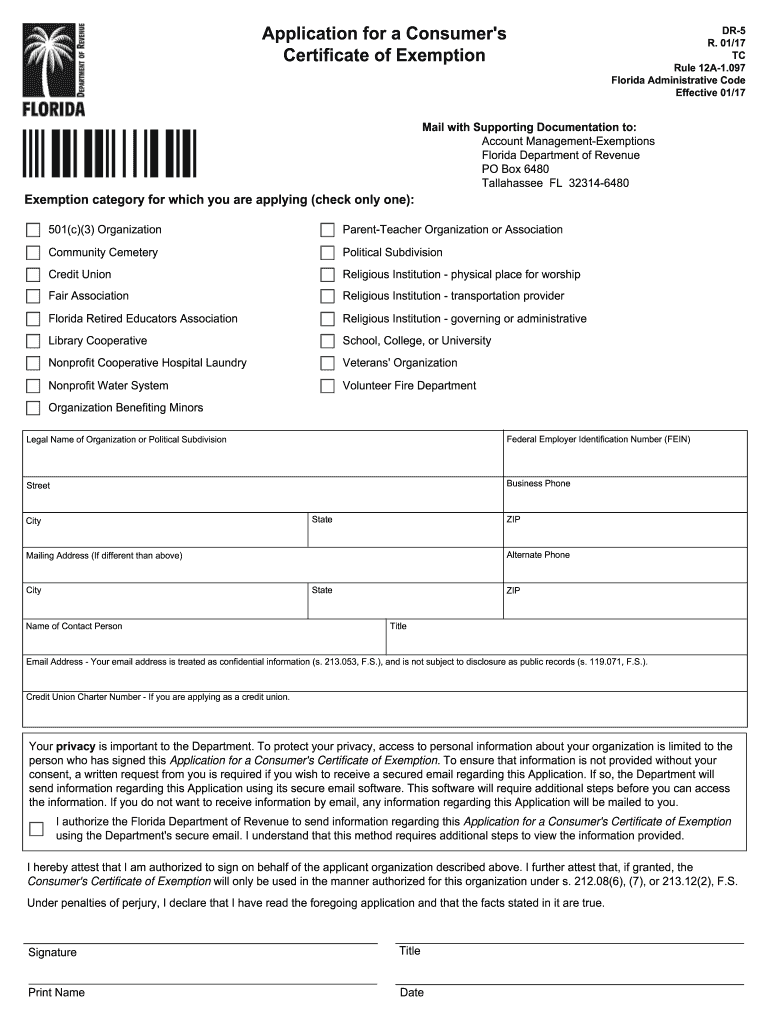

Exemption State of Florida 20172024 Form Fill Out and Sign Printable

Is exempt from the payment of florida sales and use tax on real property rented, transient rental property rented, tangible personal property purchased or rented, or services purchased. This exemption applies only to purchases your organization makes. The sale or lease to others of tangible personal property, sleeping accommodations, or other real property is.

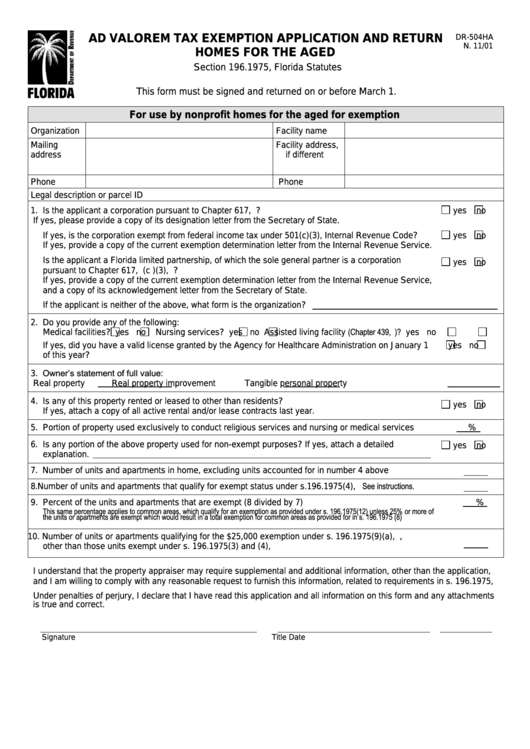

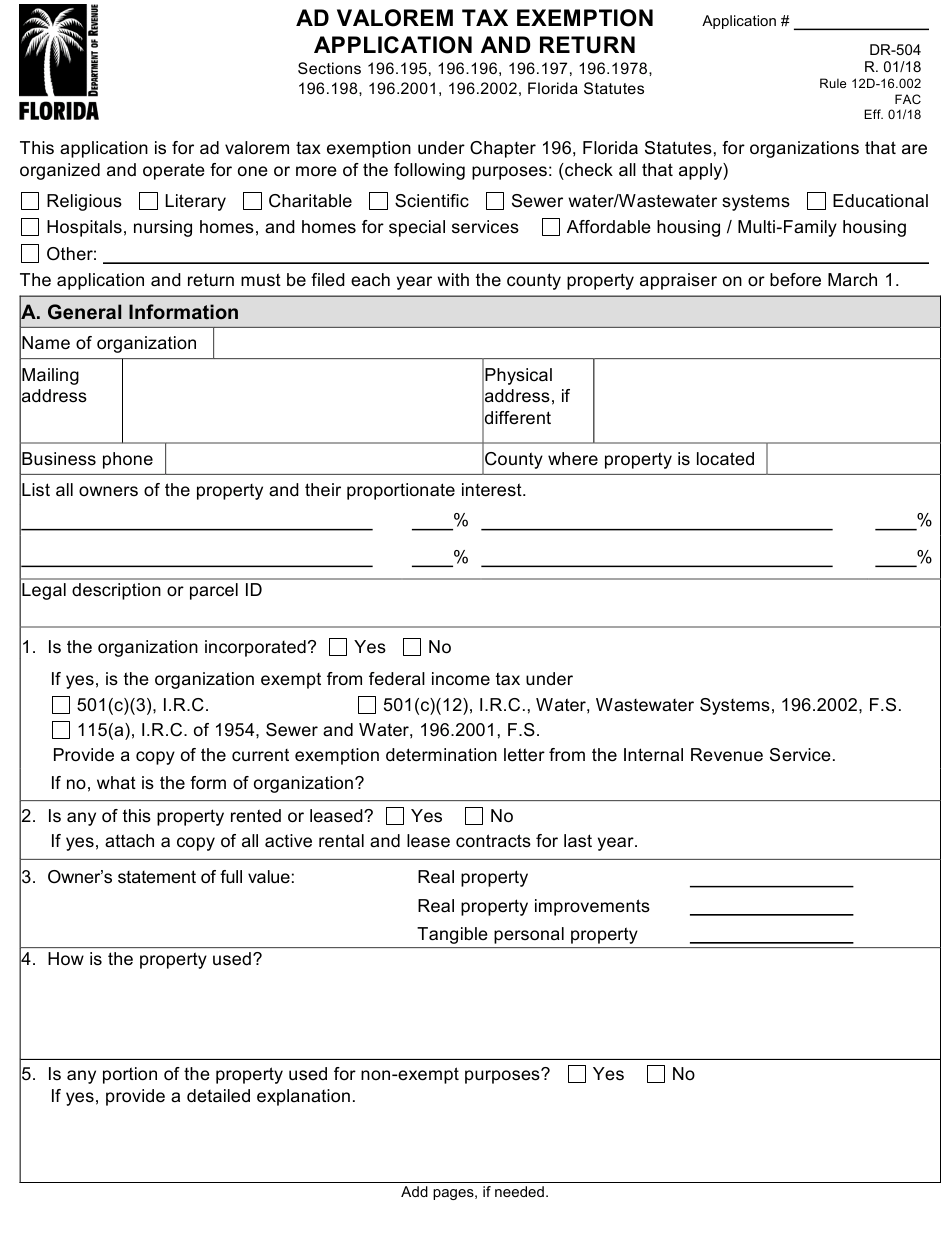

Form Dr504ha Ad Valorem Tax Exemption Application And Return Homes

Is exempt from the payment of florida sales and use tax on real property rented, transient rental property rented, tangible personal property purchased or rented, or services purchased. This exemption applies only to purchases your organization makes. The sale or lease to others of tangible personal property, sleeping accommodations, or other real property is.

Tax Free Week 2024 Florida Lina Shelby

The sale or lease to others of tangible personal property, sleeping accommodations, or other real property is. Is exempt from the payment of florida sales and use tax on real property rented, transient rental property rented, tangible personal property purchased or rented, or services purchased. This exemption applies only to purchases your organization makes.

Agriculture Tax Exempt Form Florida

This exemption applies only to purchases your organization makes. Is exempt from the payment of florida sales and use tax on real property rented, transient rental property rented, tangible personal property purchased or rented, or services purchased. The sale or lease to others of tangible personal property, sleeping accommodations, or other real property is.

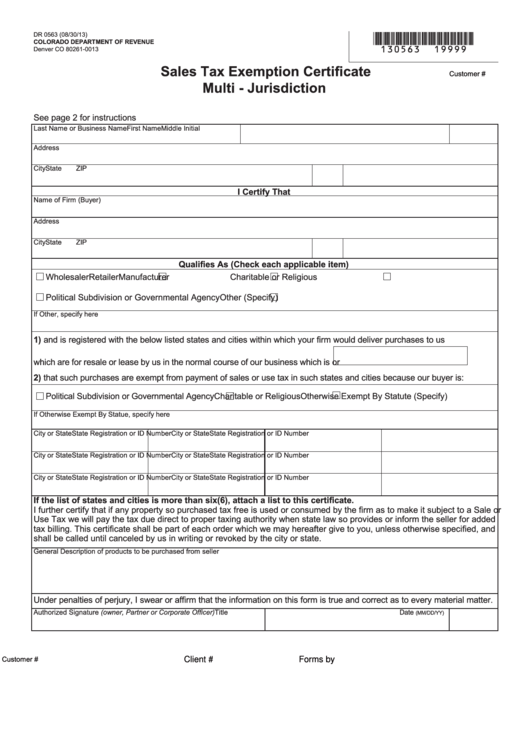

Sales Tax Exemption Certificate Multi Jurisdiction Form

Is exempt from the payment of florida sales and use tax on real property rented, transient rental property rented, tangible personal property purchased or rented, or services purchased. This exemption applies only to purchases your organization makes. The sale or lease to others of tangible personal property, sleeping accommodations, or other real property is.

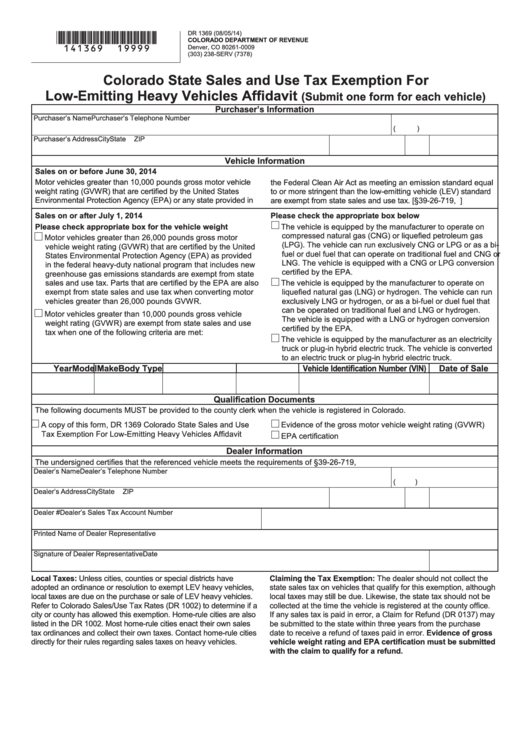

Form Dr 1369 Colorado State Sales And Use Tax Exemption For Low

The sale or lease to others of tangible personal property, sleeping accommodations, or other real property is. Is exempt from the payment of florida sales and use tax on real property rented, transient rental property rented, tangible personal property purchased or rented, or services purchased. This exemption applies only to purchases your organization makes.

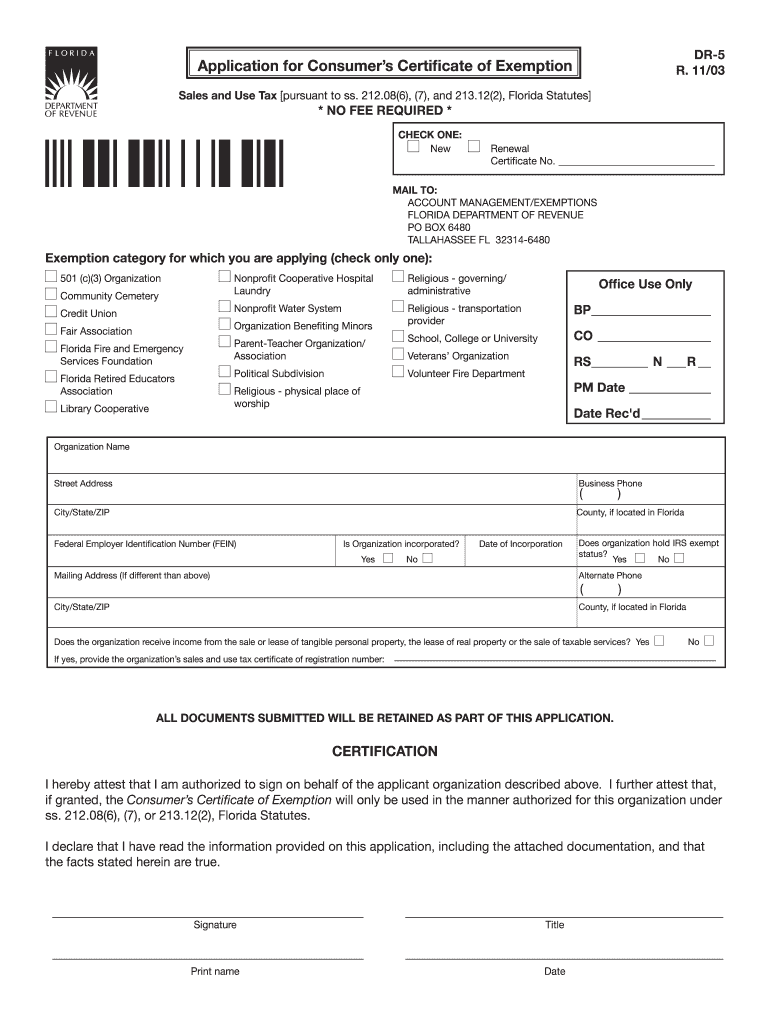

Florida Sales Tax Exemption Application Form

Is exempt from the payment of florida sales and use tax on real property rented, transient rental property rented, tangible personal property purchased or rented, or services purchased. This exemption applies only to purchases your organization makes. The sale or lease to others of tangible personal property, sleeping accommodations, or other real property is.

Is Exempt From The Payment Of Florida Sales And Use Tax On Real Property Rented, Transient Rental Property Rented, Tangible Personal Property Purchased Or Rented, Or Services Purchased.

This exemption applies only to purchases your organization makes. The sale or lease to others of tangible personal property, sleeping accommodations, or other real property is.