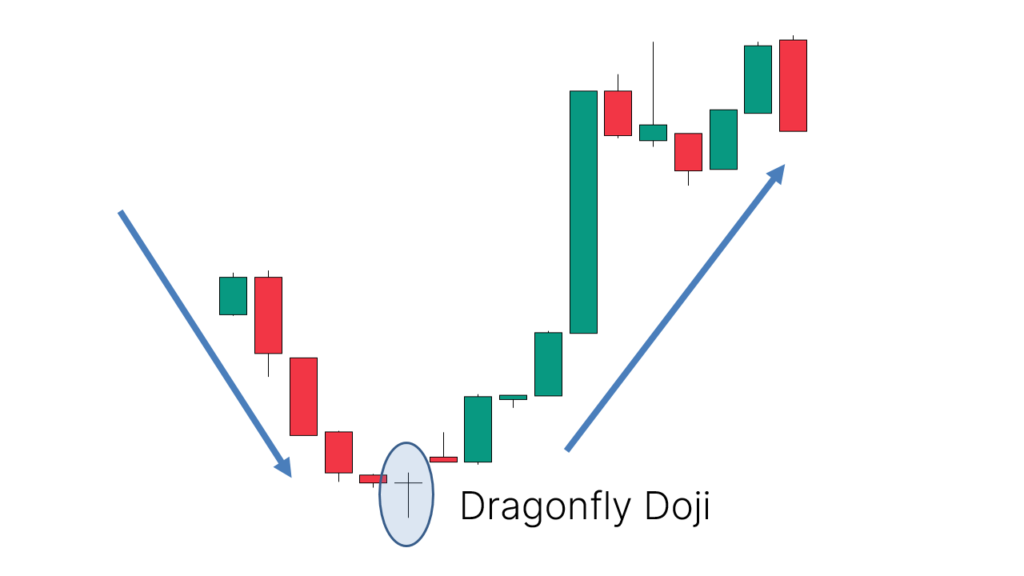

Dragonfly Doji Candlestick Pattern Meaning - The dragonfly doji is typically interpreted as a bullish reversal candlestick chart pattern that mainly occurs at the bottom of downtrends. A dragonfly doji candlestick is typically a bullish candlestick reversal pattern found at the bottom of downtrends. It occurs when the asset’s high, open,. Dragonfly doji is a candle pattern with no real body and a long downward shadow. They are also found at support levels. The dragonfly doji is a candlestick pattern that can. What is a dragonfly doji candlestick pattern? They look like a hammer candlestick but have much thinner real bodies. A dragonfly doji is a candlestick pattern described by the open, high, and close prices equal or very close to each other, while the low of the period is significantly lower than the. A dragonfly doji indicates a potential price reversal to the downside or upside, depending on previous price action.

What is a dragonfly doji candlestick pattern? Dragonfly doji is a candle pattern with no real body and a long downward shadow. A dragonfly doji candlestick is typically a bullish candlestick reversal pattern found at the bottom of downtrends. A dragonfly doji is a candlestick pattern described by the open, high, and close prices equal or very close to each other, while the low of the period is significantly lower than the. The dragonfly doji is typically interpreted as a bullish reversal candlestick chart pattern that mainly occurs at the bottom of downtrends. The dragonfly doji is a candlestick pattern that can. They look like a hammer candlestick but have much thinner real bodies. It occurs when the asset’s high, open,. A dragonfly doji indicates a potential price reversal to the downside or upside, depending on previous price action. A dragonfly doji is a type of candlestick pattern that can signal a potential reversal in price to the downside or upside, depending on past price action.

Dragonfly doji is a candle pattern with no real body and a long downward shadow. A dragonfly doji is a candlestick pattern described by the open, high, and close prices equal or very close to each other, while the low of the period is significantly lower than the. The dragonfly doji is typically interpreted as a bullish reversal candlestick chart pattern that mainly occurs at the bottom of downtrends. A dragonfly doji indicates a potential price reversal to the downside or upside, depending on previous price action. It occurs when the asset’s high, open,. They are also found at support levels. A dragonfly doji is a type of candlestick pattern that can signal a potential reversal in price to the downside or upside, depending on past price action. A dragonfly doji candlestick is typically a bullish candlestick reversal pattern found at the bottom of downtrends. What is a dragonfly doji candlestick pattern? They look like a hammer candlestick but have much thinner real bodies.

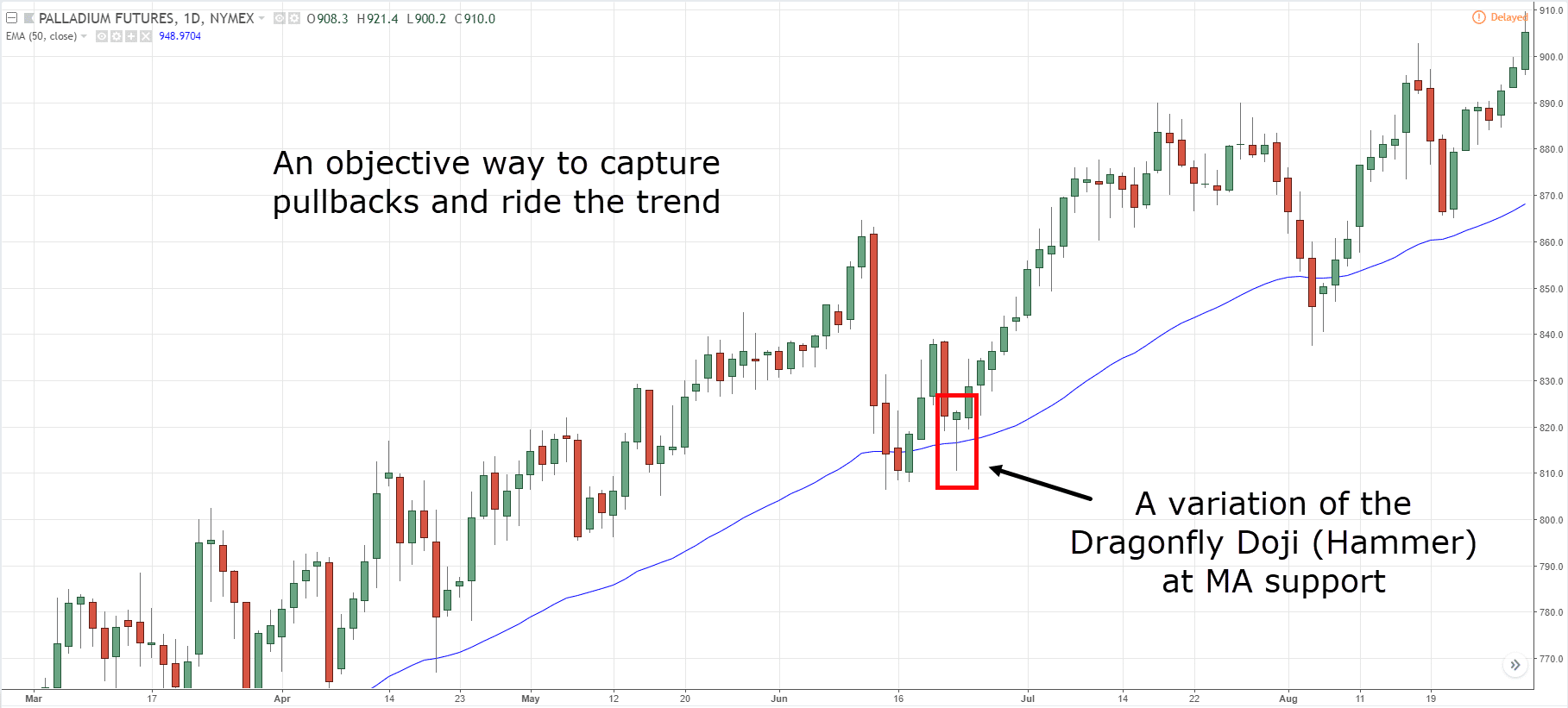

Dragonfly & Gravestone Doji Candlestick Easy Examples

What is a dragonfly doji candlestick pattern? The dragonfly doji is a candlestick pattern that can. A dragonfly doji is a type of candlestick pattern that can signal a potential reversal in price to the downside or upside, depending on past price action. They look like a hammer candlestick but have much thinner real bodies. The dragonfly doji is typically.

Dragonfly Doji Pattern Examples, Hints and Trading Strategies

A dragonfly doji is a type of candlestick pattern that can signal a potential reversal in price to the downside or upside, depending on past price action. They look like a hammer candlestick but have much thinner real bodies. A dragonfly doji indicates a potential price reversal to the downside or upside, depending on previous price action. A dragonfly doji.

Dragonfly Doji Candlestick Definition and Tactics

It occurs when the asset’s high, open,. Dragonfly doji is a candle pattern with no real body and a long downward shadow. A dragonfly doji candlestick is typically a bullish candlestick reversal pattern found at the bottom of downtrends. A dragonfly doji is a candlestick pattern described by the open, high, and close prices equal or very close to each.

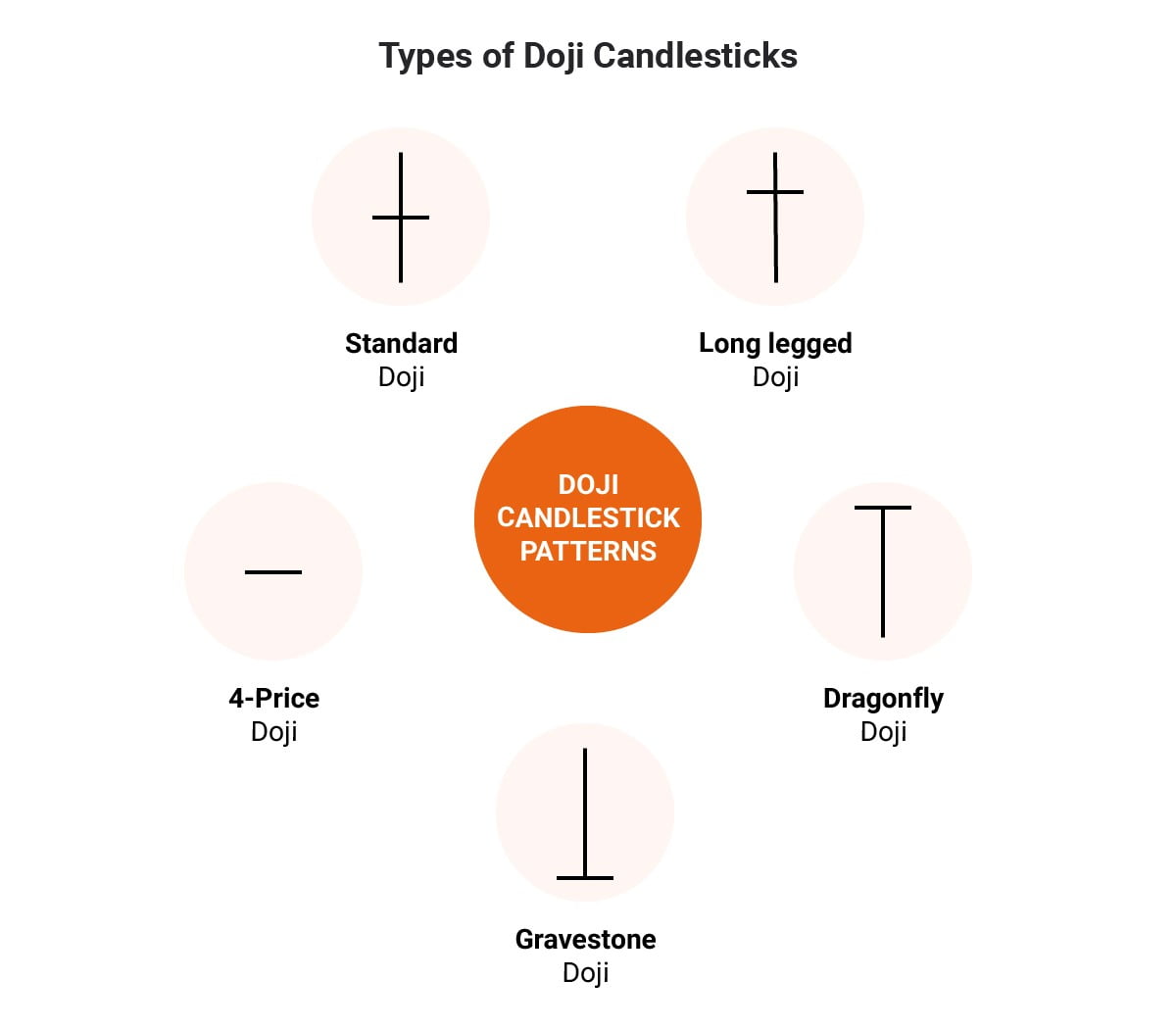

The Complete Guide to Doji Candlestick Pattern

It occurs when the asset’s high, open,. The dragonfly doji is a candlestick pattern that can. A dragonfly doji indicates a potential price reversal to the downside or upside, depending on previous price action. A dragonfly doji candlestick is typically a bullish candlestick reversal pattern found at the bottom of downtrends. A dragonfly doji is a type of candlestick pattern.

What Is a Doji Candle Pattern and What Does It Tell You?

What is a dragonfly doji candlestick pattern? It occurs when the asset’s high, open,. The dragonfly doji is a candlestick pattern that can. A dragonfly doji is a candlestick pattern described by the open, high, and close prices equal or very close to each other, while the low of the period is significantly lower than the. They look like a.

Dragonfly Doji How to Spot and Trade Candlestick Patterns Freedom

The dragonfly doji is a candlestick pattern that can. What is a dragonfly doji candlestick pattern? A dragonfly doji indicates a potential price reversal to the downside or upside, depending on previous price action. The dragonfly doji is typically interpreted as a bullish reversal candlestick chart pattern that mainly occurs at the bottom of downtrends. A dragonfly doji is a.

Dragonfly Doji Candlestick How To Use on Trading, Limitations

Dragonfly doji is a candle pattern with no real body and a long downward shadow. A dragonfly doji candlestick is typically a bullish candlestick reversal pattern found at the bottom of downtrends. The dragonfly doji is typically interpreted as a bullish reversal candlestick chart pattern that mainly occurs at the bottom of downtrends. They are also found at support levels..

Candlestick Patterns The Definitive Guide [UPDATED 2022]

A dragonfly doji is a type of candlestick pattern that can signal a potential reversal in price to the downside or upside, depending on past price action. It occurs when the asset’s high, open,. A dragonfly doji candlestick is typically a bullish candlestick reversal pattern found at the bottom of downtrends. What is a dragonfly doji candlestick pattern? They look.

Dragonfly Doji Candlestick Pattern Best Analysis

The dragonfly doji is typically interpreted as a bullish reversal candlestick chart pattern that mainly occurs at the bottom of downtrends. A dragonfly doji indicates a potential price reversal to the downside or upside, depending on previous price action. They look like a hammer candlestick but have much thinner real bodies. They are also found at support levels. A dragonfly.

A Dragonfly Doji Candlestick Pattern Definition, Interpretation, and

A dragonfly doji is a candlestick pattern described by the open, high, and close prices equal or very close to each other, while the low of the period is significantly lower than the. They are also found at support levels. A dragonfly doji is a type of candlestick pattern that can signal a potential reversal in price to the downside.

Dragonfly Doji Is A Candle Pattern With No Real Body And A Long Downward Shadow.

What is a dragonfly doji candlestick pattern? They are also found at support levels. A dragonfly doji is a candlestick pattern described by the open, high, and close prices equal or very close to each other, while the low of the period is significantly lower than the. The dragonfly doji is typically interpreted as a bullish reversal candlestick chart pattern that mainly occurs at the bottom of downtrends.

They Look Like A Hammer Candlestick But Have Much Thinner Real Bodies.

The dragonfly doji is a candlestick pattern that can. A dragonfly doji is a type of candlestick pattern that can signal a potential reversal in price to the downside or upside, depending on past price action. It occurs when the asset’s high, open,. A dragonfly doji candlestick is typically a bullish candlestick reversal pattern found at the bottom of downtrends.

:max_bytes(150000):strip_icc()/dotdash_Final_Dragonfly_Doji_Candlestick_Definition_and_Tactics_Nov_2020-01-eb0156a30e9745b687c8a65e93f54b07.jpg)

:max_bytes(150000):strip_icc()/DojiDefinition-efc3ba7213db4200a0a69f354369960b.png)

![Candlestick Patterns The Definitive Guide [UPDATED 2022]](https://www.alphaexcapital.com/wp-content/uploads/2020/04/Dragonfly-Doji-Candlestick-Patterns-Example-by-Alphaex-Capital-1030x1030.png)