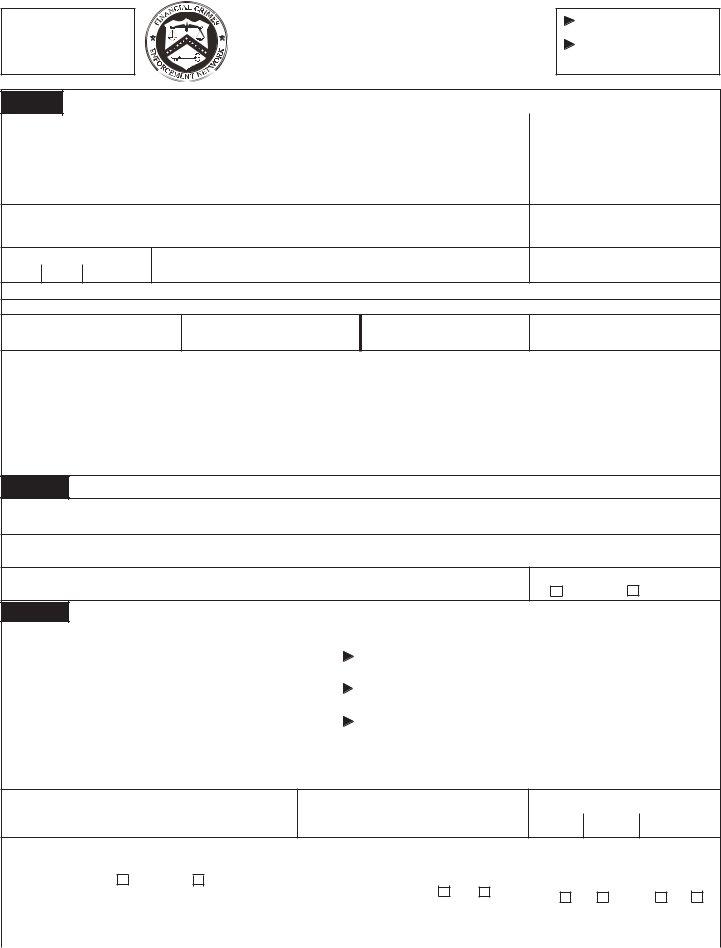

Fincen 105 Form - Ask a cbp officer for a paper copy and. Fill out and print form fincen 105 before you travel and present it to a cbp officer; With an aggregate amount exceeding. Currency transporters when entering or departing. Bsa regulations stipulate that a cmir must be used to report the physical transportation of currency or other monetary instruments in an aggregate amount exceeding $10,000 at one. This form is available for filing to travelers and. In the united states shall file fincen form 105, within 15 days after receipt of the currency or monetary instruments, with the customs officer in charge at any port of entry or departure or by. Use the online fincen 105 currency reporting site or ask a cbp officer for the paper copy of the currency reporting form (fincen 105). Fill out the currency reporting form (fincen 105) online; Or shipping or receiving from / to the united states.

Or shipping or receiving from / to the united states. In the united states shall file fincen form 105, within 15 days after receipt of the currency or monetary instruments, with the customs officer in charge at any port of entry or departure or by. This form is available for filing to travelers and. Bsa regulations stipulate that a cmir must be used to report the physical transportation of currency or other monetary instruments in an aggregate amount exceeding $10,000 at one. Currency transporters when entering or departing. With an aggregate amount exceeding. Ask a cbp officer for a paper copy and. Fill out and print form fincen 105 before you travel and present it to a cbp officer; Fill out the currency reporting form (fincen 105) online; Use the online fincen 105 currency reporting site or ask a cbp officer for the paper copy of the currency reporting form (fincen 105).

Fill out the currency reporting form (fincen 105) online; Currency transporters when entering or departing. Or shipping or receiving from / to the united states. In the united states shall file fincen form 105, within 15 days after receipt of the currency or monetary instruments, with the customs officer in charge at any port of entry or departure or by. With an aggregate amount exceeding. Bsa regulations stipulate that a cmir must be used to report the physical transportation of currency or other monetary instruments in an aggregate amount exceeding $10,000 at one. This form is available for filing to travelers and. Fill out and print form fincen 105 before you travel and present it to a cbp officer; Use the online fincen 105 currency reporting site or ask a cbp officer for the paper copy of the currency reporting form (fincen 105). Ask a cbp officer for a paper copy and.

Cash Reporting Requirement & FinCen 105 Great Lakes Customs Law

Use the online fincen 105 currency reporting site or ask a cbp officer for the paper copy of the currency reporting form (fincen 105). With an aggregate amount exceeding. Currency transporters when entering or departing. This form is available for filing to travelers and. In the united states shall file fincen form 105, within 15 days after receipt of the.

FinCEN 105 Reporting requirements of carrying cash overseas Nomad

Fill out and print form fincen 105 before you travel and present it to a cbp officer; In the united states shall file fincen form 105, within 15 days after receipt of the currency or monetary instruments, with the customs officer in charge at any port of entry or departure or by. Currency transporters when entering or departing. Use the.

Federal RegisterN N Financial Crimes Enforcement Network

In the united states shall file fincen form 105, within 15 days after receipt of the currency or monetary instruments, with the customs officer in charge at any port of entry or departure or by. This form is available for filing to travelers and. Fill out and print form fincen 105 before you travel and present it to a cbp.

Fincen 105 Fill out & sign online DocHub

Currency transporters when entering or departing. Or shipping or receiving from / to the united states. With an aggregate amount exceeding. Ask a cbp officer for a paper copy and. This form is available for filing to travelers and.

U.S. TREAS Form treasirsfincen1052003

Bsa regulations stipulate that a cmir must be used to report the physical transportation of currency or other monetary instruments in an aggregate amount exceeding $10,000 at one. Ask a cbp officer for a paper copy and. In the united states shall file fincen form 105, within 15 days after receipt of the currency or monetary instruments, with the customs.

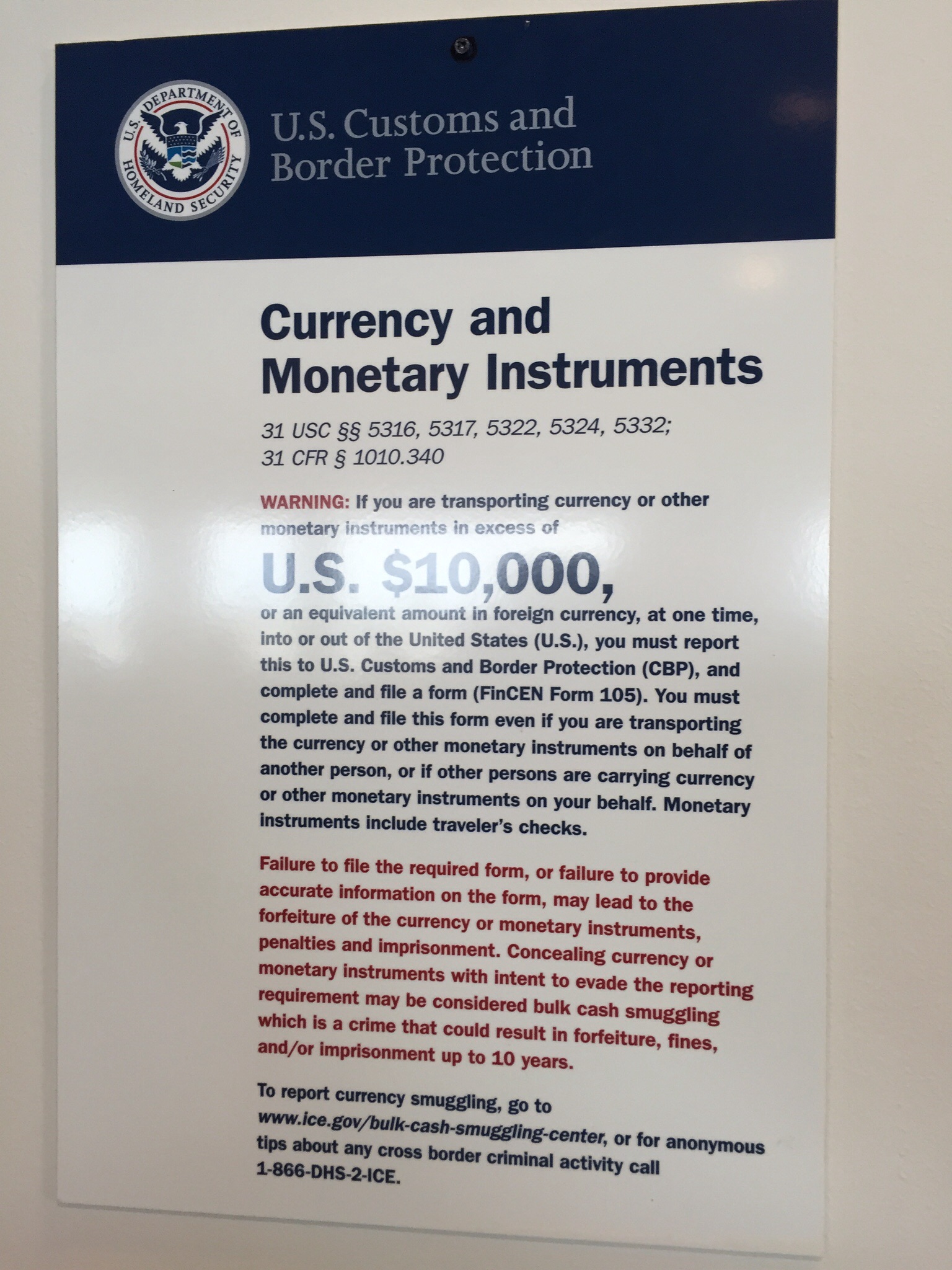

FinCEN Form 105 CMIR, U.S. Customs and Border Protection

Bsa regulations stipulate that a cmir must be used to report the physical transportation of currency or other monetary instruments in an aggregate amount exceeding $10,000 at one. Use the online fincen 105 currency reporting site or ask a cbp officer for the paper copy of the currency reporting form (fincen 105). Ask a cbp officer for a paper copy.

美国海关出入境 FinCEN 105 Form 申报表格填写下载说明 在美国

Bsa regulations stipulate that a cmir must be used to report the physical transportation of currency or other monetary instruments in an aggregate amount exceeding $10,000 at one. Use the online fincen 105 currency reporting site or ask a cbp officer for the paper copy of the currency reporting form (fincen 105). With an aggregate amount exceeding. In the united.

Fincen Form 105 ≡ Fill Out Printable PDF Forms Online

Fill out the currency reporting form (fincen 105) online; This form is available for filing to travelers and. With an aggregate amount exceeding. Use the online fincen 105 currency reporting site or ask a cbp officer for the paper copy of the currency reporting form (fincen 105). In the united states shall file fincen form 105, within 15 days after.

FINCEN FORM 109 PDF

Bsa regulations stipulate that a cmir must be used to report the physical transportation of currency or other monetary instruments in an aggregate amount exceeding $10,000 at one. This form is available for filing to travelers and. Ask a cbp officer for a paper copy and. Fill out the currency reporting form (fincen 105) online; With an aggregate amount exceeding.

Fillable Online Fincen form 105 pdf. Fincen form 105 pdf. How to fill

Ask a cbp officer for a paper copy and. Use the online fincen 105 currency reporting site or ask a cbp officer for the paper copy of the currency reporting form (fincen 105). With an aggregate amount exceeding. Or shipping or receiving from / to the united states. Fill out the currency reporting form (fincen 105) online;

In The United States Shall File Fincen Form 105, Within 15 Days After Receipt Of The Currency Or Monetary Instruments, With The Customs Officer In Charge At Any Port Of Entry Or Departure Or By.

Use the online fincen 105 currency reporting site or ask a cbp officer for the paper copy of the currency reporting form (fincen 105). This form is available for filing to travelers and. Fill out and print form fincen 105 before you travel and present it to a cbp officer; Currency transporters when entering or departing.

Bsa Regulations Stipulate That A Cmir Must Be Used To Report The Physical Transportation Of Currency Or Other Monetary Instruments In An Aggregate Amount Exceeding $10,000 At One.

Ask a cbp officer for a paper copy and. Fill out the currency reporting form (fincen 105) online; Or shipping or receiving from / to the united states. With an aggregate amount exceeding.