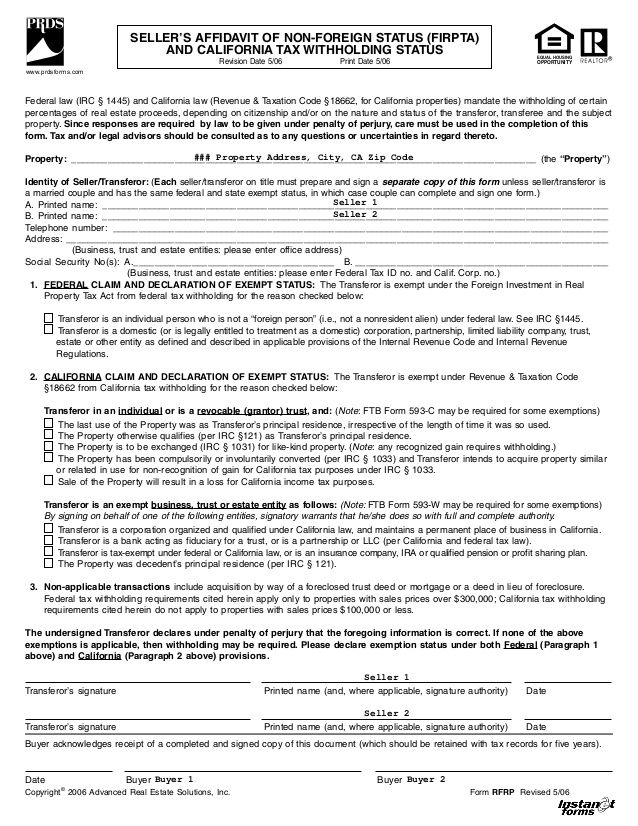

Firpta Affidavit Form - Firpta affidavit section 1445 of the internal revenue code provides that a transferee (buyer) of a u.s. Section 1445 of the internal revenue code provides that a. Learn when firpta withholding is not required and what certifications or statements are needed to claim an exception. Section 1445 of the internal revenue code provides that a. Real property interest is not a foreign person and does not. Download a sample firpta affidavit form to certify that a transferor of a u.s. Real property interest must withhold. State of new york ) county of _____ ) ss: Find out the liability of.

Find out the liability of. Download a sample firpta affidavit form to certify that a transferor of a u.s. Real property interest must withhold. Learn when firpta withholding is not required and what certifications or statements are needed to claim an exception. Real property interest is not a foreign person and does not. Section 1445 of the internal revenue code provides that a. Firpta affidavit section 1445 of the internal revenue code provides that a transferee (buyer) of a u.s. State of new york ) county of _____ ) ss: Section 1445 of the internal revenue code provides that a.

Learn when firpta withholding is not required and what certifications or statements are needed to claim an exception. Section 1445 of the internal revenue code provides that a. Find out the liability of. Firpta affidavit section 1445 of the internal revenue code provides that a transferee (buyer) of a u.s. Real property interest must withhold. Section 1445 of the internal revenue code provides that a. Download a sample firpta affidavit form to certify that a transferor of a u.s. State of new york ) county of _____ ) ss: Real property interest is not a foreign person and does not.

BUYER'S FIRPTA AFFIDAVIT Doc Template pdfFiller

State of new york ) county of _____ ) ss: Learn when firpta withholding is not required and what certifications or statements are needed to claim an exception. Find out the liability of. Section 1445 of the internal revenue code provides that a. Real property interest is not a foreign person and does not.

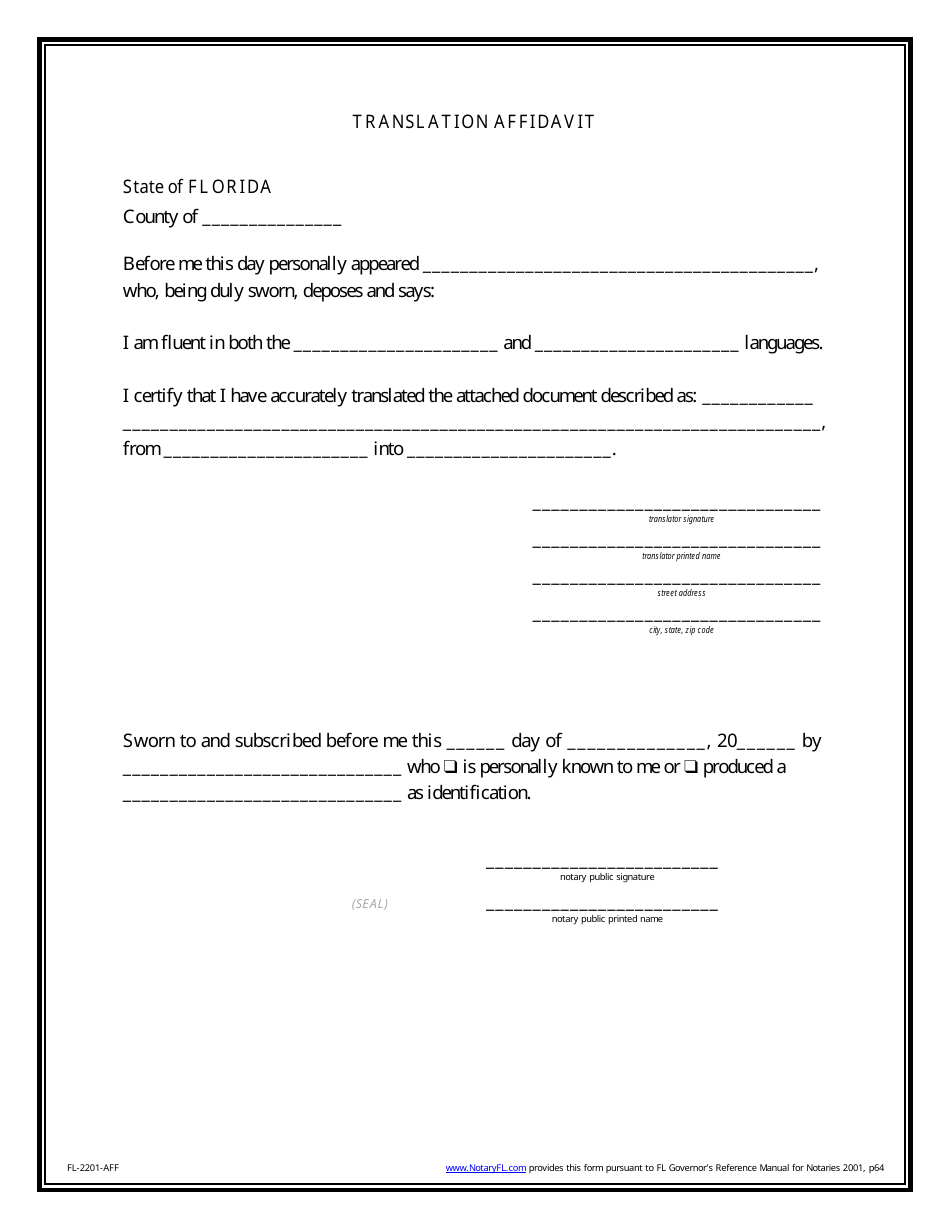

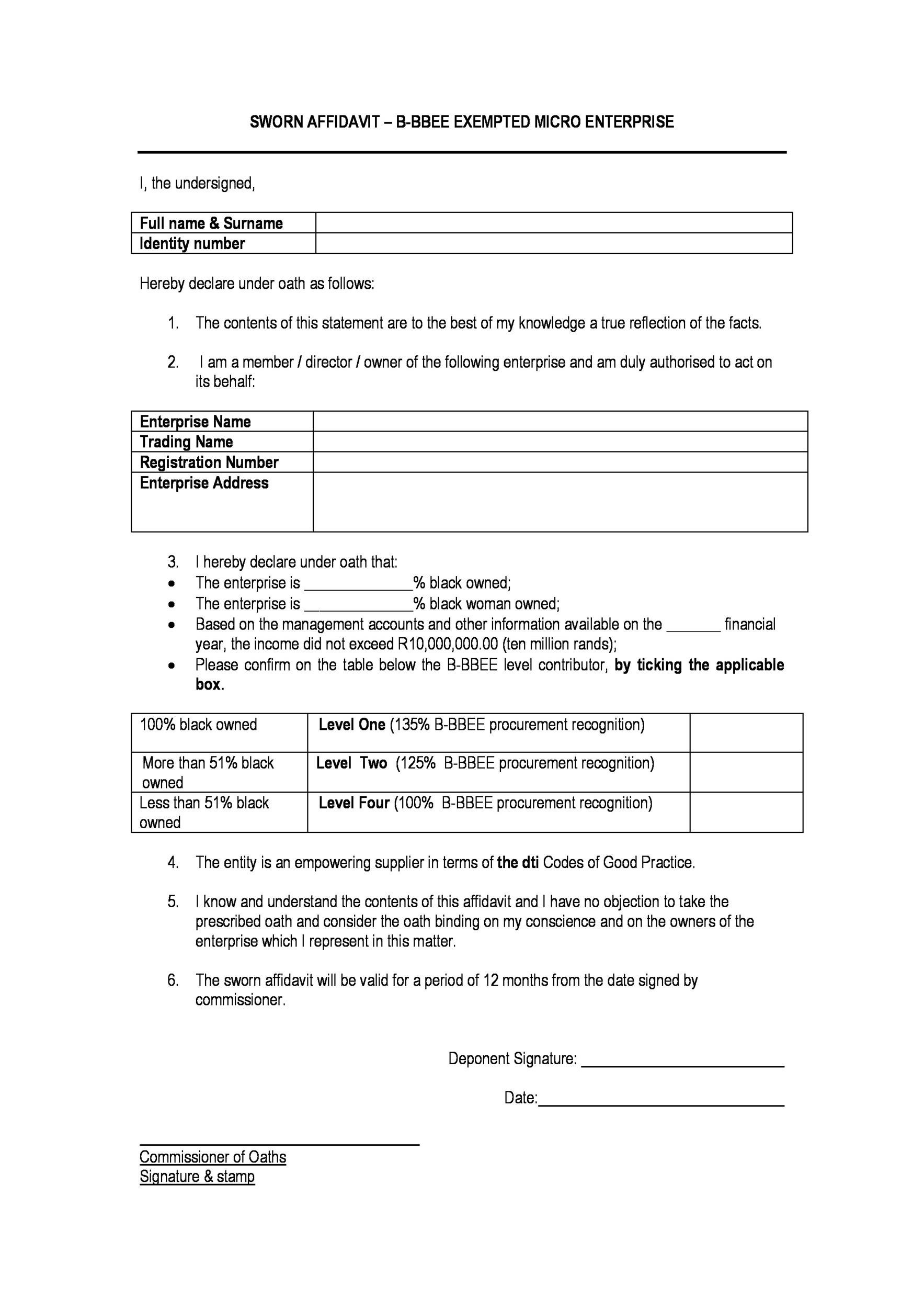

Zimbabwe Affidavit Form Pdf Download Fillable Affidavit For Transfer

Section 1445 of the internal revenue code provides that a. Download a sample firpta affidavit form to certify that a transferor of a u.s. Learn when firpta withholding is not required and what certifications or statements are needed to claim an exception. State of new york ) county of _____ ) ss: Real property interest must withhold.

How to write an Affidavit for NSFAS? 2 Steps & an Example

Firpta affidavit section 1445 of the internal revenue code provides that a transferee (buyer) of a u.s. Learn when firpta withholding is not required and what certifications or statements are needed to claim an exception. Real property interest must withhold. Section 1445 of the internal revenue code provides that a. State of new york ) county of _____ ) ss:

Firpta Affidavit Florida Withholding US Legal Forms

Real property interest is not a foreign person and does not. Section 1445 of the internal revenue code provides that a. State of new york ) county of _____ ) ss: Section 1445 of the internal revenue code provides that a. Download a sample firpta affidavit form to certify that a transferor of a u.s.

When is FIRPTA Affidavit Required Understanding the Essentials and

Section 1445 of the internal revenue code provides that a. Download a sample firpta affidavit form to certify that a transferor of a u.s. State of new york ) county of _____ ) ss: Firpta affidavit section 1445 of the internal revenue code provides that a transferee (buyer) of a u.s. Section 1445 of the internal revenue code provides that.

What is FIRPTA — and Why Is a FIRPTA Affidavit Important? Fill Online

Firpta affidavit section 1445 of the internal revenue code provides that a transferee (buyer) of a u.s. Section 1445 of the internal revenue code provides that a. Find out the liability of. Real property interest is not a foreign person and does not. State of new york ) county of _____ ) ss:

48 Sample Affidavit Forms & Templates (Affidavit of Support Form)

State of new york ) county of _____ ) ss: Download a sample firpta affidavit form to certify that a transferor of a u.s. Find out the liability of. Learn when firpta withholding is not required and what certifications or statements are needed to claim an exception. Real property interest must withhold.

Firpta form Fill out & sign online DocHub

Find out the liability of. State of new york ) county of _____ ) ss: Real property interest is not a foreign person and does not. Learn when firpta withholding is not required and what certifications or statements are needed to claim an exception. Real property interest must withhold.

Texas Firpta Affidavit For Loan Mortgagee Trustee (PDF)

Firpta affidavit section 1445 of the internal revenue code provides that a transferee (buyer) of a u.s. Section 1445 of the internal revenue code provides that a. Real property interest must withhold. Real property interest is not a foreign person and does not. Section 1445 of the internal revenue code provides that a.

The FIRPTA Affidavit Form Querin Law, LLC Phil Querin Oregon Real

Find out the liability of. Section 1445 of the internal revenue code provides that a. Real property interest is not a foreign person and does not. Learn when firpta withholding is not required and what certifications or statements are needed to claim an exception. Firpta affidavit section 1445 of the internal revenue code provides that a transferee (buyer) of a.

Section 1445 Of The Internal Revenue Code Provides That A.

Learn when firpta withholding is not required and what certifications or statements are needed to claim an exception. Download a sample firpta affidavit form to certify that a transferor of a u.s. Find out the liability of. Real property interest must withhold.

Section 1445 Of The Internal Revenue Code Provides That A.

State of new york ) county of _____ ) ss: Firpta affidavit section 1445 of the internal revenue code provides that a transferee (buyer) of a u.s. Real property interest is not a foreign person and does not.