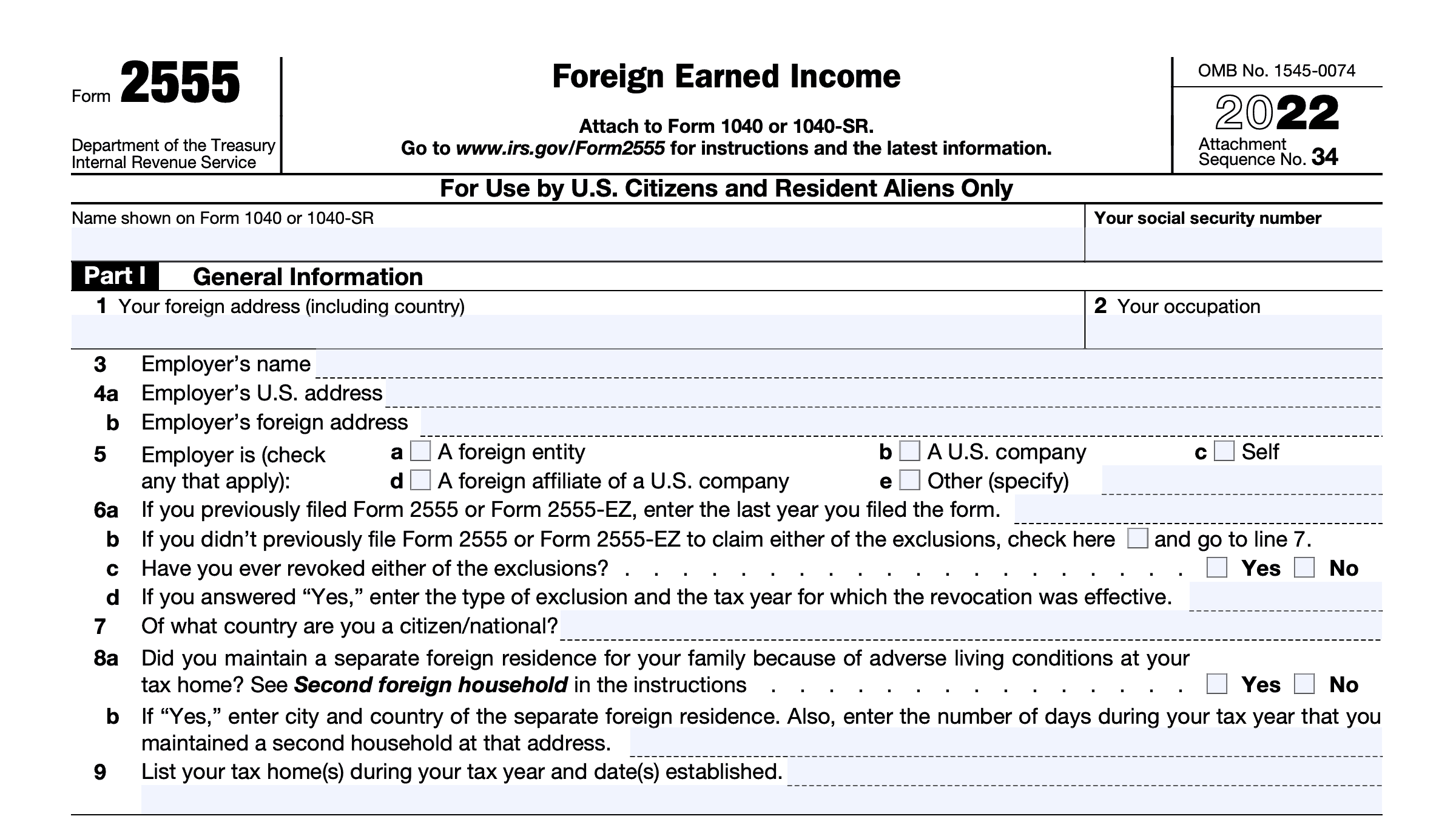

Foreign Earned Income Exclusion Form - What is the foreign earned income exclusion (form 2555)? The foreign earned income exclusion is claimed by filling out irs tax form 2555 and filing it along with your tax return. If you are living and working abroad, you may be entitled to exclude up to $126,500. You can use the irs’s interactive tax assistant tool to help determine whether income earned in a foreign country is eligible to. If you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction.

You can use the irs’s interactive tax assistant tool to help determine whether income earned in a foreign country is eligible to. If you are living and working abroad, you may be entitled to exclude up to $126,500. The foreign earned income exclusion is claimed by filling out irs tax form 2555 and filing it along with your tax return. What is the foreign earned income exclusion (form 2555)? If you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction.

You can use the irs’s interactive tax assistant tool to help determine whether income earned in a foreign country is eligible to. If you are living and working abroad, you may be entitled to exclude up to $126,500. If you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. The foreign earned income exclusion is claimed by filling out irs tax form 2555 and filing it along with your tax return. What is the foreign earned income exclusion (form 2555)?

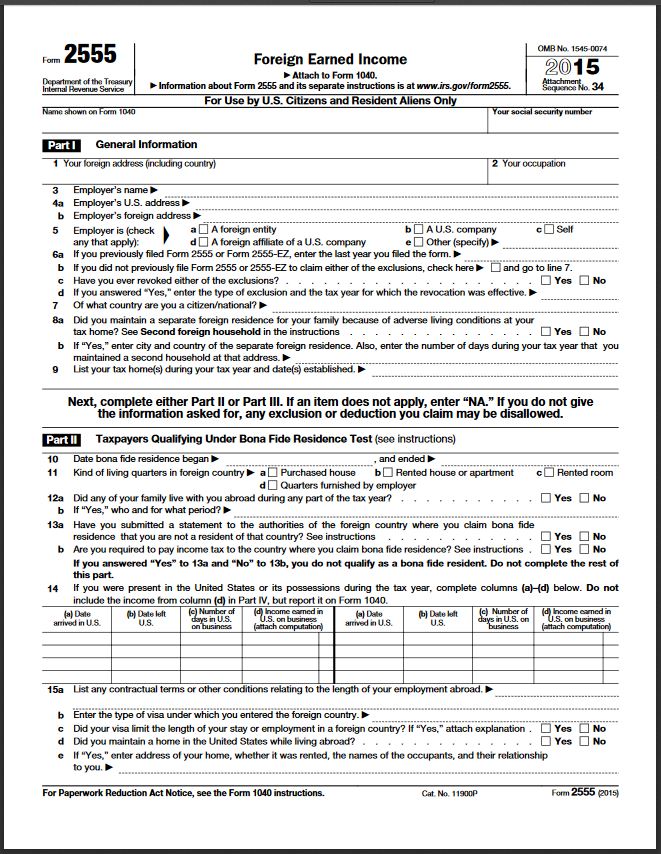

IRS Form 2555 Instructions

If you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. What is the foreign earned income exclusion (form 2555)? If you are living and working abroad, you may be entitled to exclude up to $126,500. The foreign earned income exclusion is claimed by filling out irs tax form 2555.

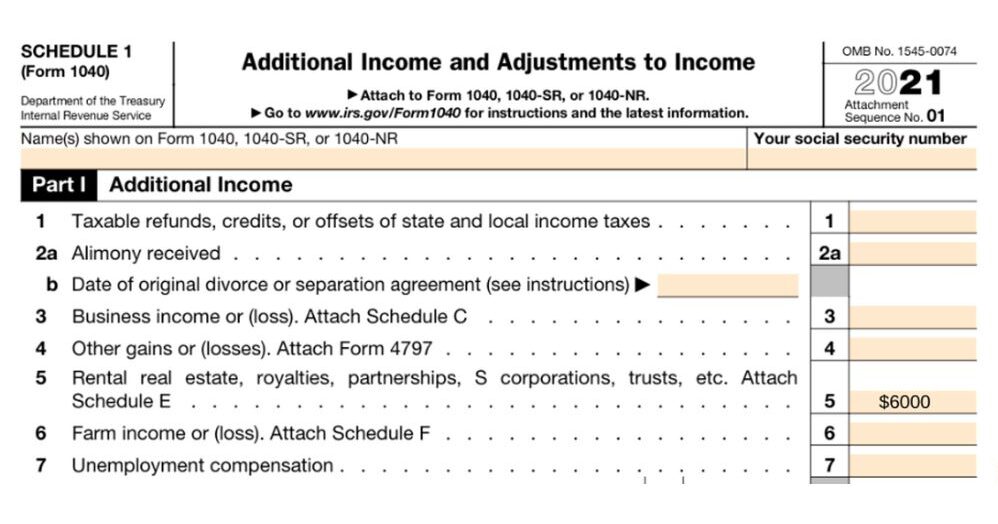

Earned Worksheet 2023

You can use the irs’s interactive tax assistant tool to help determine whether income earned in a foreign country is eligible to. If you are living and working abroad, you may be entitled to exclude up to $126,500. What is the foreign earned income exclusion (form 2555)? The foreign earned income exclusion is claimed by filling out irs tax form.

How to Complete Form 1040 With Foreign Earned Worksheets Library

What is the foreign earned income exclusion (form 2555)? The foreign earned income exclusion is claimed by filling out irs tax form 2555 and filing it along with your tax return. If you are living and working abroad, you may be entitled to exclude up to $126,500. You can use the irs’s interactive tax assistant tool to help determine whether.

What is Foreign Earned Exclusion? Caye International Bank

If you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. You can use the irs’s interactive tax assistant tool to help determine whether income earned in a foreign country is eligible to. The foreign earned income exclusion is claimed by filling out irs tax form 2555 and filing it.

Filing Form 2555 for the Foreign Earned Exclusion

What is the foreign earned income exclusion (form 2555)? If you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. The foreign earned income exclusion is claimed by filling out irs tax form 2555 and filing it along with your tax return. If you are living and working abroad, you.

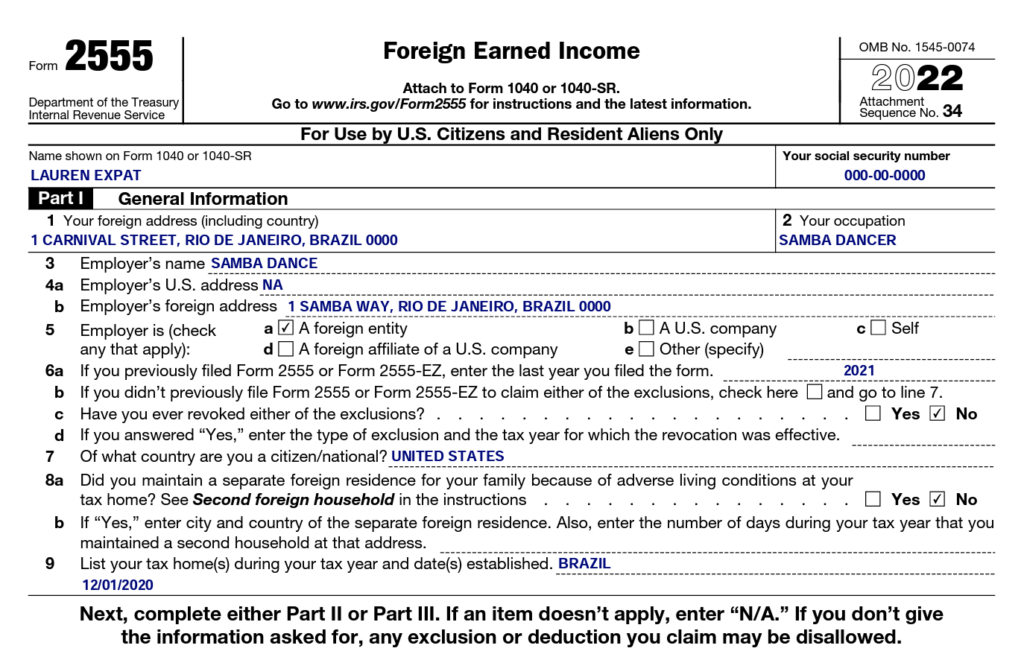

Foreign Earned Exclusion Form 2555 Verni Tax Law

You can use the irs’s interactive tax assistant tool to help determine whether income earned in a foreign country is eligible to. If you are living and working abroad, you may be entitled to exclude up to $126,500. What is the foreign earned income exclusion (form 2555)? The foreign earned income exclusion is claimed by filling out irs tax form.

Do I pay U.S. taxes on foreign Leia aqui How much foreign

You can use the irs’s interactive tax assistant tool to help determine whether income earned in a foreign country is eligible to. If you are living and working abroad, you may be entitled to exclude up to $126,500. If you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. What.

Foreign Earned Exclusion For 2024 Ediva

You can use the irs’s interactive tax assistant tool to help determine whether income earned in a foreign country is eligible to. The foreign earned income exclusion is claimed by filling out irs tax form 2555 and filing it along with your tax return. If you qualify, you can use form 2555 to figure your foreign earned income exclusion and.

Foreign Exclusion 2024 Kirby Merrily

If you are living and working abroad, you may be entitled to exclude up to $126,500. What is the foreign earned income exclusion (form 2555)? If you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. The foreign earned income exclusion is claimed by filling out irs tax form 2555.

Everything You Need To Know About The Foreign Earned Exclusion

What is the foreign earned income exclusion (form 2555)? If you are living and working abroad, you may be entitled to exclude up to $126,500. The foreign earned income exclusion is claimed by filling out irs tax form 2555 and filing it along with your tax return. If you qualify, you can use form 2555 to figure your foreign earned.

What Is The Foreign Earned Income Exclusion (Form 2555)?

The foreign earned income exclusion is claimed by filling out irs tax form 2555 and filing it along with your tax return. You can use the irs’s interactive tax assistant tool to help determine whether income earned in a foreign country is eligible to. If you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. If you are living and working abroad, you may be entitled to exclude up to $126,500.