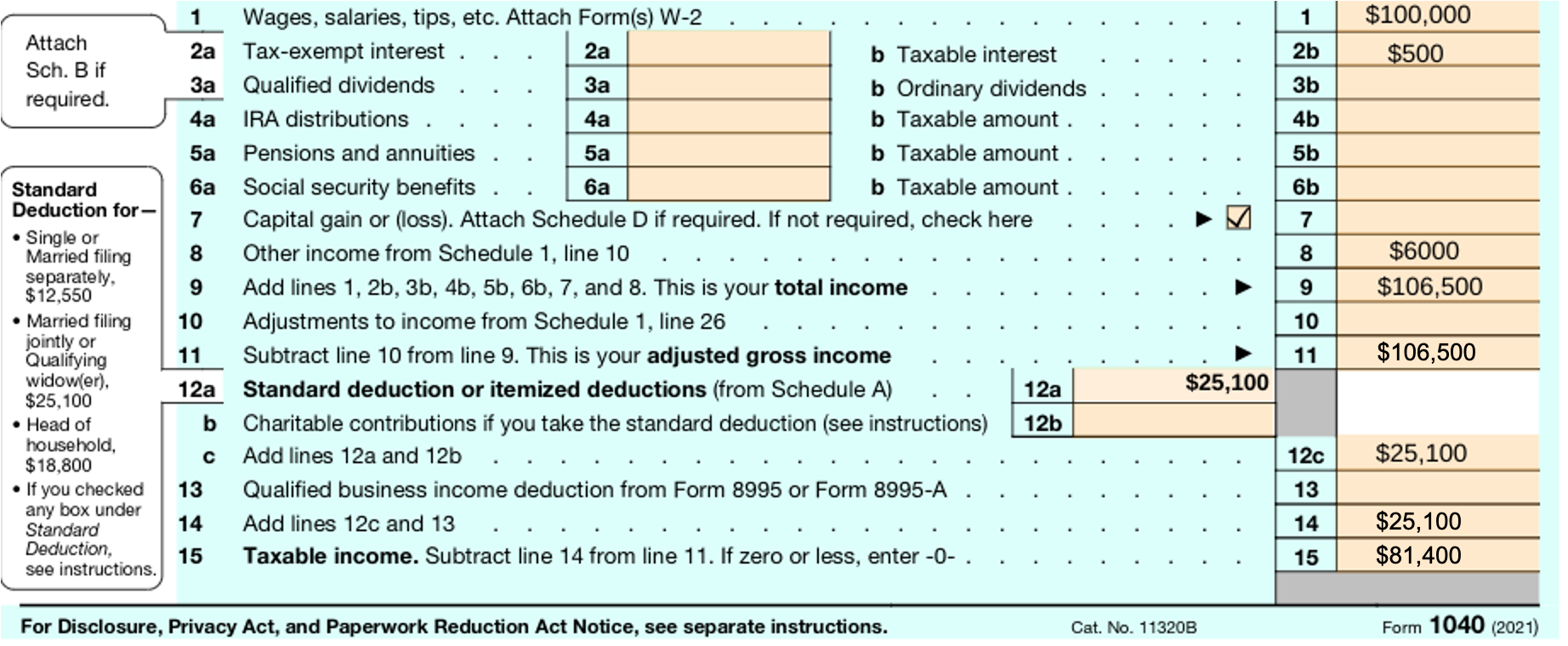

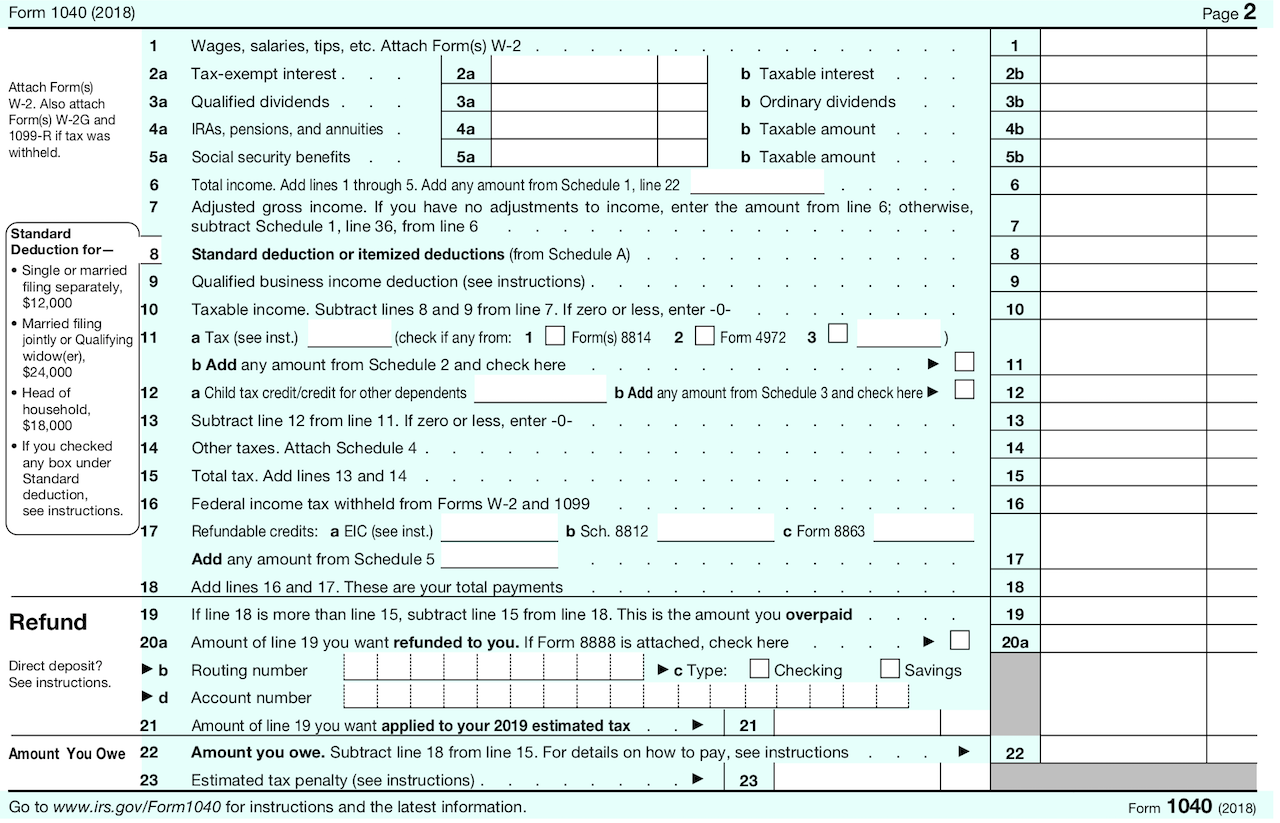

Form 1040 Line 16 Calculation - Use 1 of the following methods to calculate the tax for line 16 of form 1040. Use the tax tables in the form 1040 instructions. This article will guide you through the process of calculating line 16 on form 1040. In most cases if you have qualified. You may only need to le. If you are required to use this worksheet to. Please click here for the text description of the image. Line 16 on form 1040 refers to taxable refunds,. See the instructions for line 16 to see if you must use the worksheet below to figure your tax. See the instructions for line 16 to see if you must use the tax table below to figure your tax.

See the instructions for line 16 to see if you must use the tax table below to figure your tax. In most cases if you have qualified. This article will guide you through the process of calculating line 16 on form 1040. If you are required to use this worksheet to. To the left of line 16 there should be an indication of what was used to calculate the taxes. Line 16 on form 1040 refers to taxable refunds,. See the instructions for line 16 to see if you must use the worksheet below to figure your tax. Use the tax tables in the form 1040 instructions. You may only need to le. Use 1 of the following methods to calculate the tax for line 16 of form 1040.

Use the tax tables in the form 1040 instructions. Please click here for the text description of the image. See the instructions for line 16 to see if you must use the tax table below to figure your tax. This article will guide you through the process of calculating line 16 on form 1040. See the instructions for line 16 to see if you must use the worksheet below to figure your tax. You may only need to le. If you are required to use this worksheet to. In most cases if you have qualified. To the left of line 16 there should be an indication of what was used to calculate the taxes. Use 1 of the following methods to calculate the tax for line 16 of form 1040.

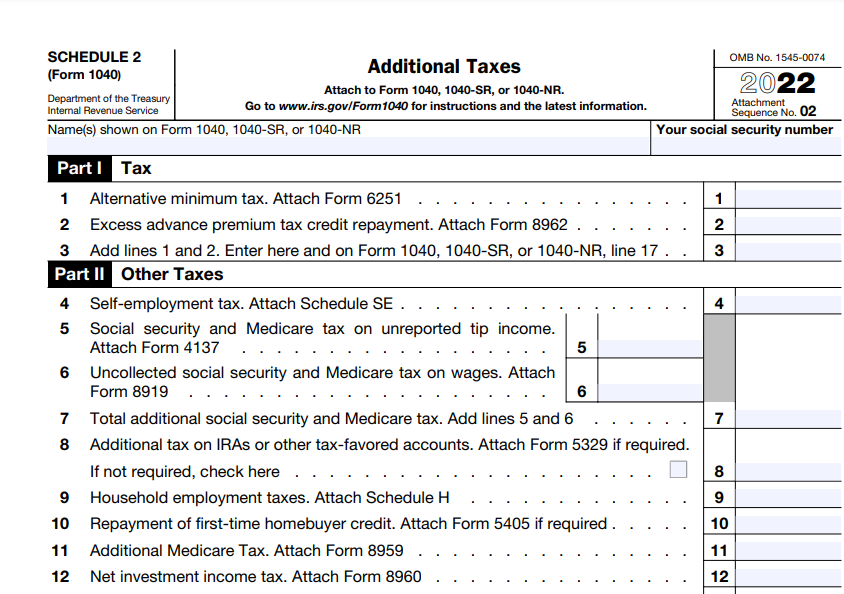

Qualified Dividends And Capital Gain Tax Irs

To the left of line 16 there should be an indication of what was used to calculate the taxes. See the instructions for line 16 to see if you must use the tax table below to figure your tax. You may only need to le. In most cases if you have qualified. This article will guide you through the process.

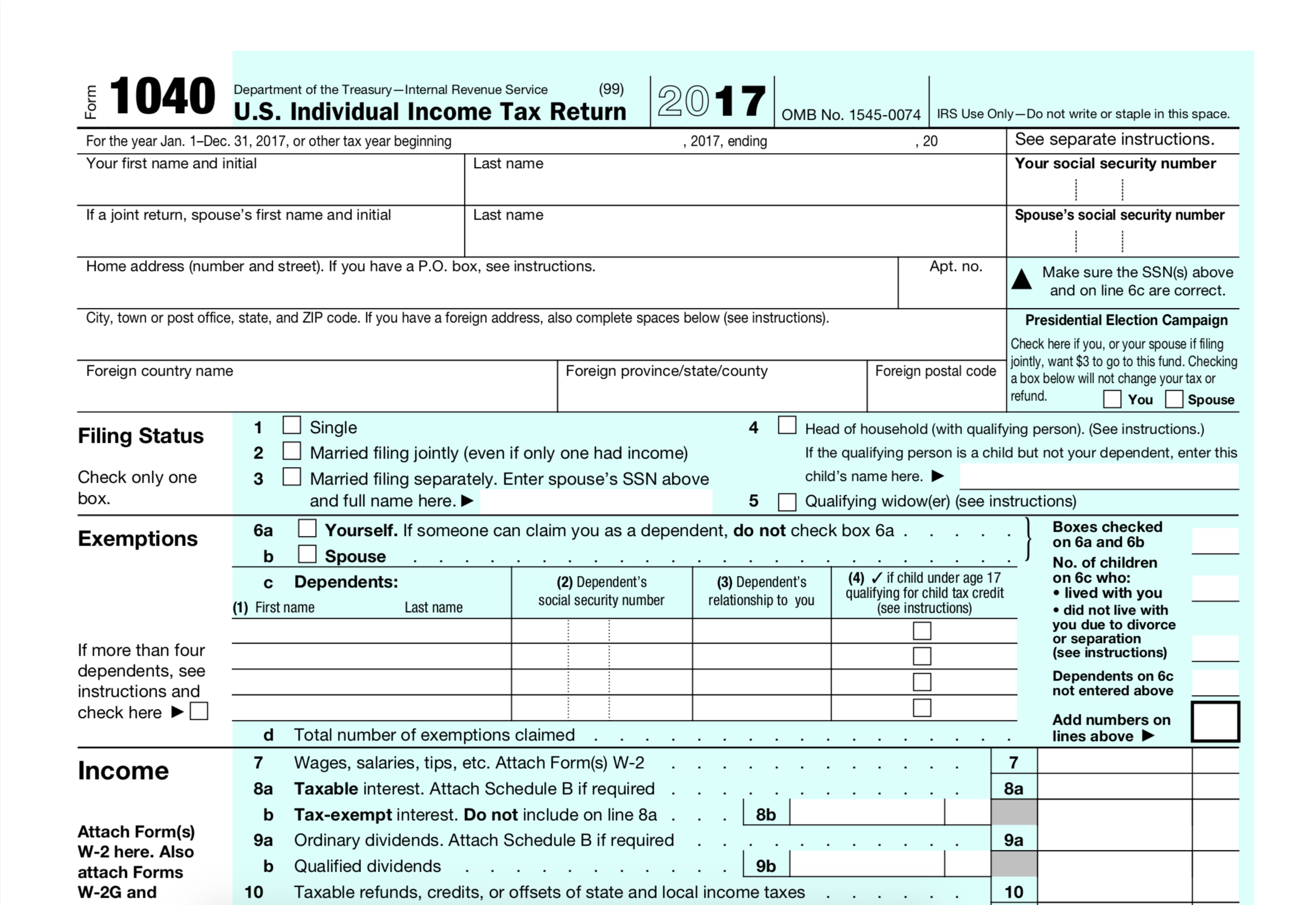

Irs Form 1040 Printable

To the left of line 16 there should be an indication of what was used to calculate the taxes. Please click here for the text description of the image. See the instructions for line 16 to see if you must use the worksheet below to figure your tax. This article will guide you through the process of calculating line 16.

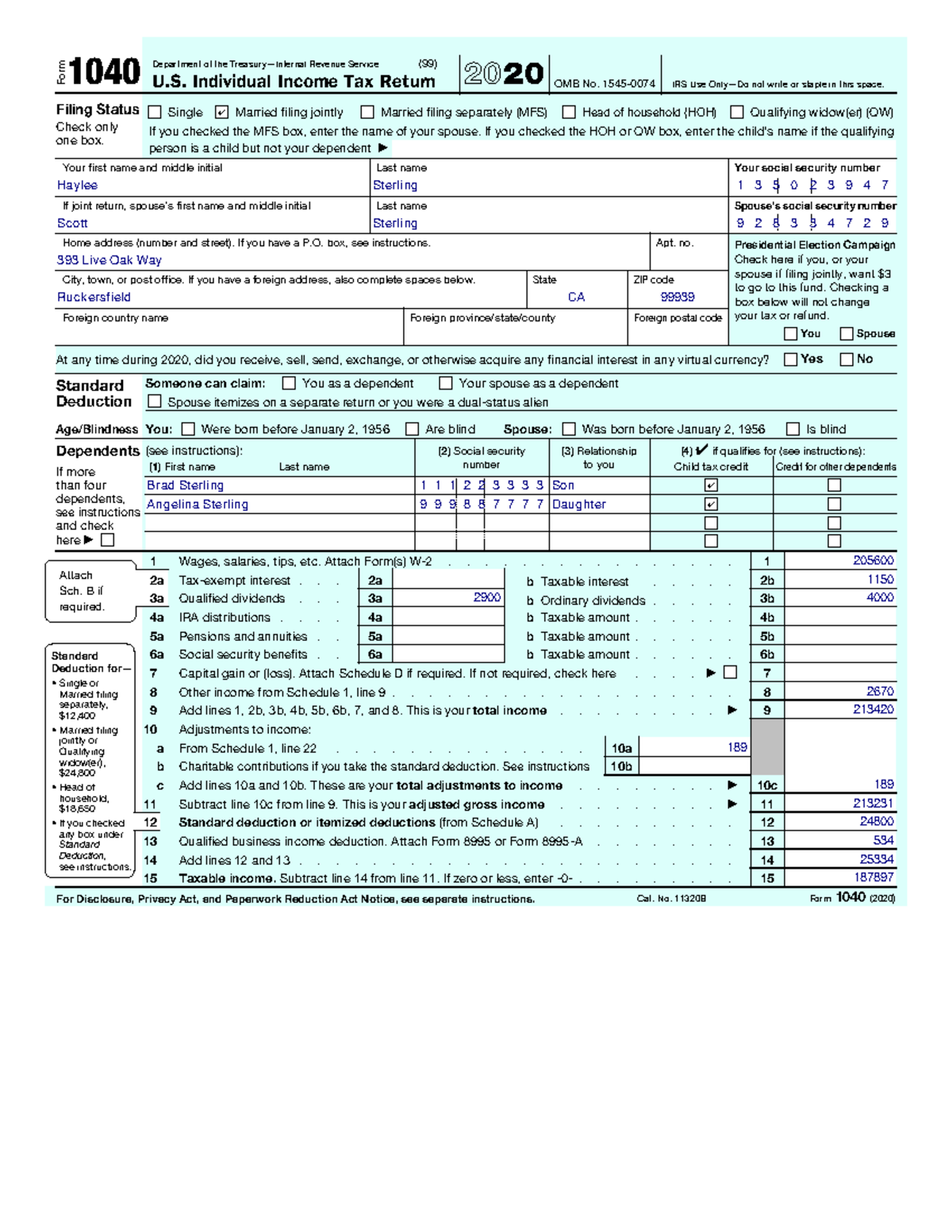

1040 Form 2 334iund Form 1040 U. Individual Tax Return 2020

See the instructions for line 16 to see if you must use the tax table below to figure your tax. Use 1 of the following methods to calculate the tax for line 16 of form 1040. Please click here for the text description of the image. In most cases if you have qualified. To the left of line 16 there.

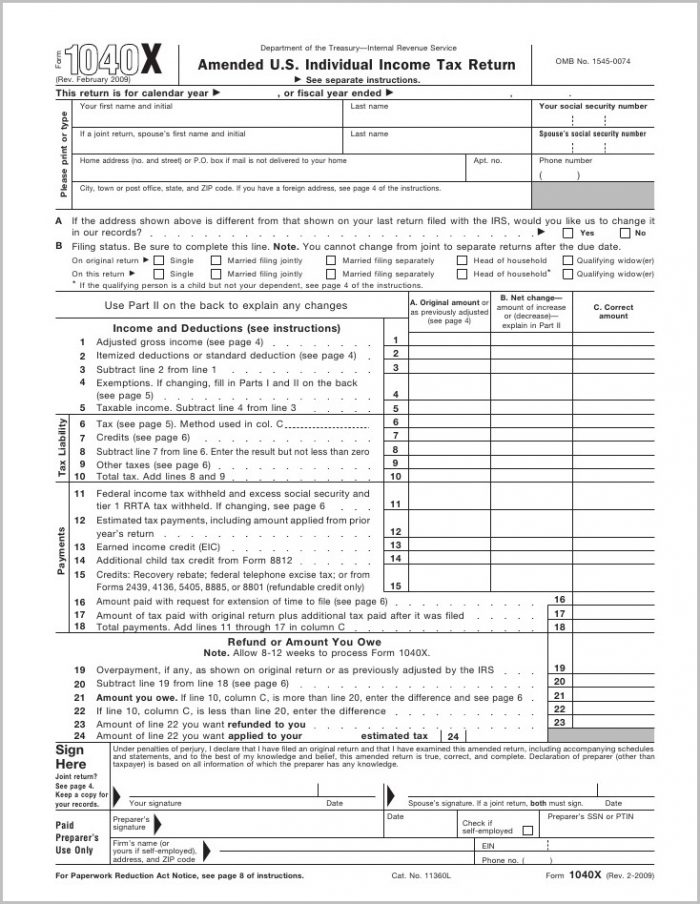

20172023 Form IRS 1040 Lines 16a and 16b Fill Online, Printable

Please click here for the text description of the image. If you are required to use this worksheet to. To the left of line 16 there should be an indication of what was used to calculate the taxes. Use 1 of the following methods to calculate the tax for line 16 of form 1040. See the instructions for line 16.

[Solved] Fill in lines 135a for the 1040 tax form. I filled them in

You may only need to le. To the left of line 16 there should be an indication of what was used to calculate the taxes. Use 1 of the following methods to calculate the tax for line 16 of form 1040. See the instructions for line 16 to see if you must use the tax table below to figure your.

IRS Form 1040NR ≡ Fill Out Printable PDF Forms Online, 47 OFF

This article will guide you through the process of calculating line 16 on form 1040. In most cases if you have qualified. Use 1 of the following methods to calculate the tax for line 16 of form 1040. To the left of line 16 there should be an indication of what was used to calculate the taxes. Use the tax.

[Solved] How do I calculate Line 16 on a 1040 for 2020. Total is

Please click here for the text description of the image. Use 1 of the following methods to calculate the tax for line 16 of form 1040. Line 16 on form 1040 refers to taxable refunds,. See the instructions for line 16 to see if you must use the worksheet below to figure your tax. Use the tax tables in the.

How to Complete Form 1040 With Foreign Earned

Use the tax tables in the form 1040 instructions. If you are required to use this worksheet to. In most cases if you have qualified. You may only need to le. See the instructions for line 16 to see if you must use the tax table below to figure your tax.

Instructions For 1040

Use 1 of the following methods to calculate the tax for line 16 of form 1040. If you are required to use this worksheet to. This article will guide you through the process of calculating line 16 on form 1040. You may only need to le. Please click here for the text description of the image.

Instructions For 1040

If you are required to use this worksheet to. In most cases if you have qualified. See the instructions for line 16 to see if you must use the worksheet below to figure your tax. To the left of line 16 there should be an indication of what was used to calculate the taxes. You may only need to le.

This Article Will Guide You Through The Process Of Calculating Line 16 On Form 1040.

Use 1 of the following methods to calculate the tax for line 16 of form 1040. See the instructions for line 16 to see if you must use the tax table below to figure your tax. Please click here for the text description of the image. If you are required to use this worksheet to.

Use The Tax Tables In The Form 1040 Instructions.

You may only need to le. To the left of line 16 there should be an indication of what was used to calculate the taxes. Line 16 on form 1040 refers to taxable refunds,. In most cases if you have qualified.