Form 1065 Schedule D - Enter any gains or losses from the sale of collectibles, which are. Schedule d (form 1065), capital gains and losses use this schedule to report: Following is a list of lines that are filled in on the tax. The overall capital gains and losses from transactions reported on. Attach schedule d (form 1065).

The overall capital gains and losses from transactions reported on. Attach schedule d (form 1065). Schedule d (form 1065), capital gains and losses use this schedule to report: Enter any gains or losses from the sale of collectibles, which are. Following is a list of lines that are filled in on the tax.

Schedule d (form 1065), capital gains and losses use this schedule to report: The overall capital gains and losses from transactions reported on. Enter any gains or losses from the sale of collectibles, which are. Attach schedule d (form 1065). Following is a list of lines that are filled in on the tax.

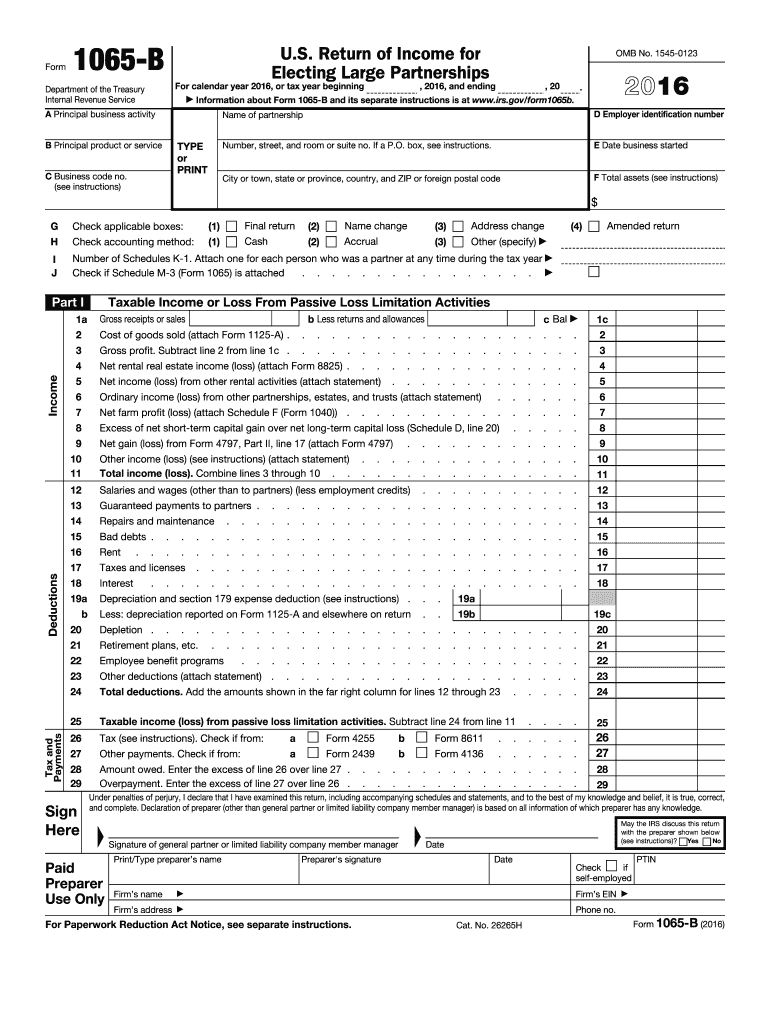

Form 1065 Due Date 2024 Matti Shelley

Enter any gains or losses from the sale of collectibles, which are. Schedule d (form 1065), capital gains and losses use this schedule to report: Attach schedule d (form 1065). Following is a list of lines that are filled in on the tax. The overall capital gains and losses from transactions reported on.

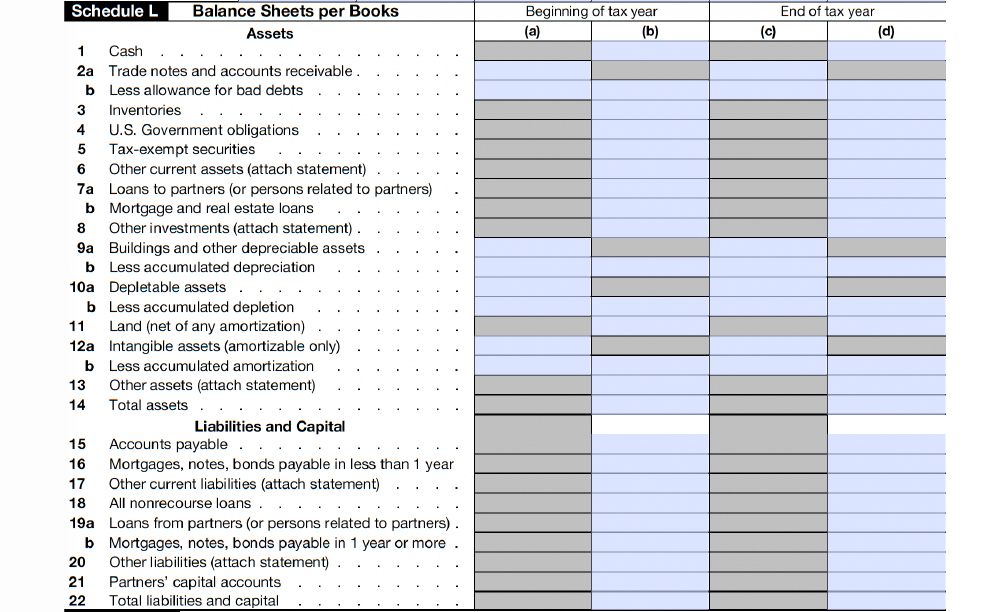

2023 Form 1065 Printable Forms Free Online

Attach schedule d (form 1065). Enter any gains or losses from the sale of collectibles, which are. The overall capital gains and losses from transactions reported on. Schedule d (form 1065), capital gains and losses use this schedule to report: Following is a list of lines that are filled in on the tax.

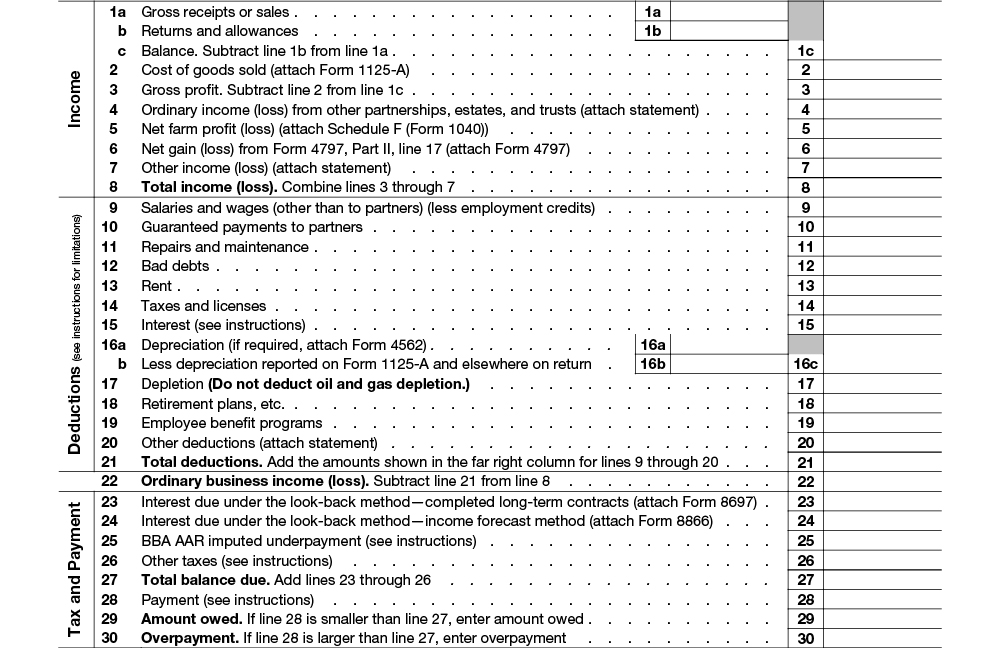

Form 1065 Instructions U.S. Return of Partnership

Following is a list of lines that are filled in on the tax. Attach schedule d (form 1065). The overall capital gains and losses from transactions reported on. Enter any gains or losses from the sale of collectibles, which are. Schedule d (form 1065), capital gains and losses use this schedule to report:

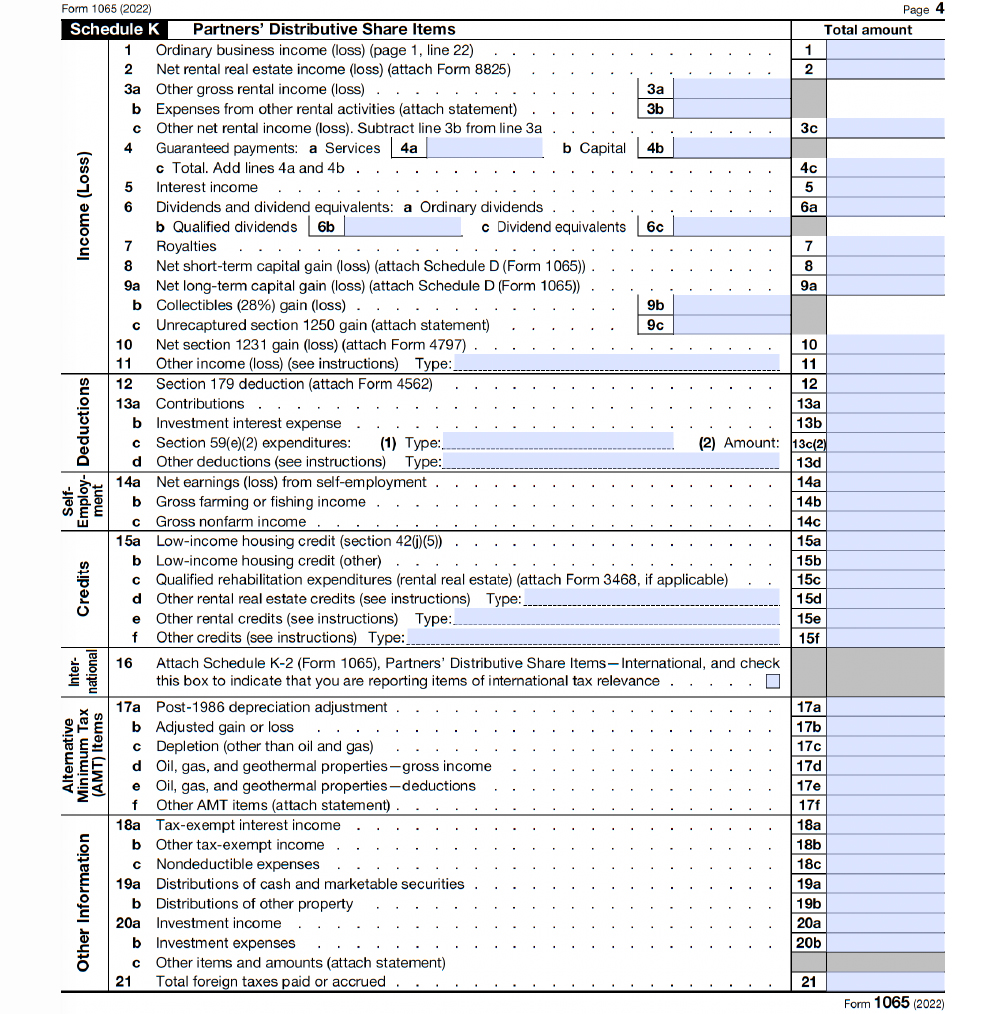

20222023 Form 1065 Schedule D instructions Fill online, Printable

Schedule d (form 1065), capital gains and losses use this schedule to report: Following is a list of lines that are filled in on the tax. The overall capital gains and losses from transactions reported on. Enter any gains or losses from the sale of collectibles, which are. Attach schedule d (form 1065).

Form 1065 tax form bounddarelo

Attach schedule d (form 1065). Following is a list of lines that are filled in on the tax. Schedule d (form 1065), capital gains and losses use this schedule to report: Enter any gains or losses from the sale of collectibles, which are. The overall capital gains and losses from transactions reported on.

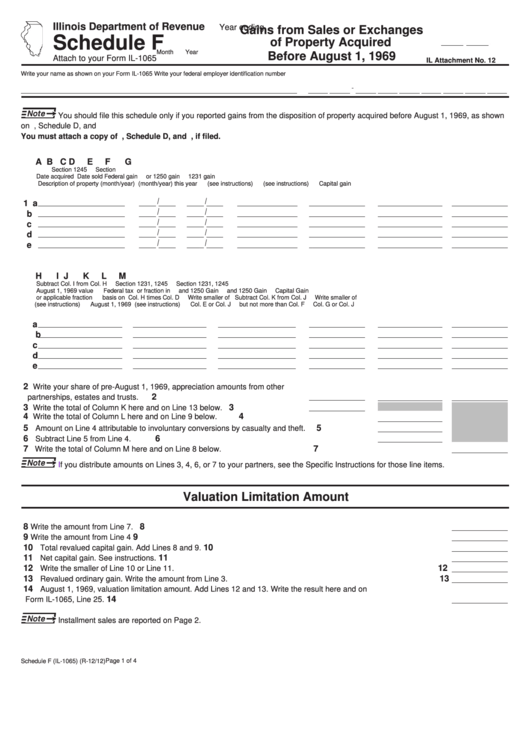

Fillable Schedule F Attach To Your Form Il1065 Gains From Sales Or

Following is a list of lines that are filled in on the tax. The overall capital gains and losses from transactions reported on. Enter any gains or losses from the sale of collectibles, which are. Attach schedule d (form 1065). Schedule d (form 1065), capital gains and losses use this schedule to report:

Form 1065 (Schedule M3) Net (Loss) Reconciliation for Certain

Enter any gains or losses from the sale of collectibles, which are. Attach schedule d (form 1065). The overall capital gains and losses from transactions reported on. Following is a list of lines that are filled in on the tax. Schedule d (form 1065), capital gains and losses use this schedule to report:

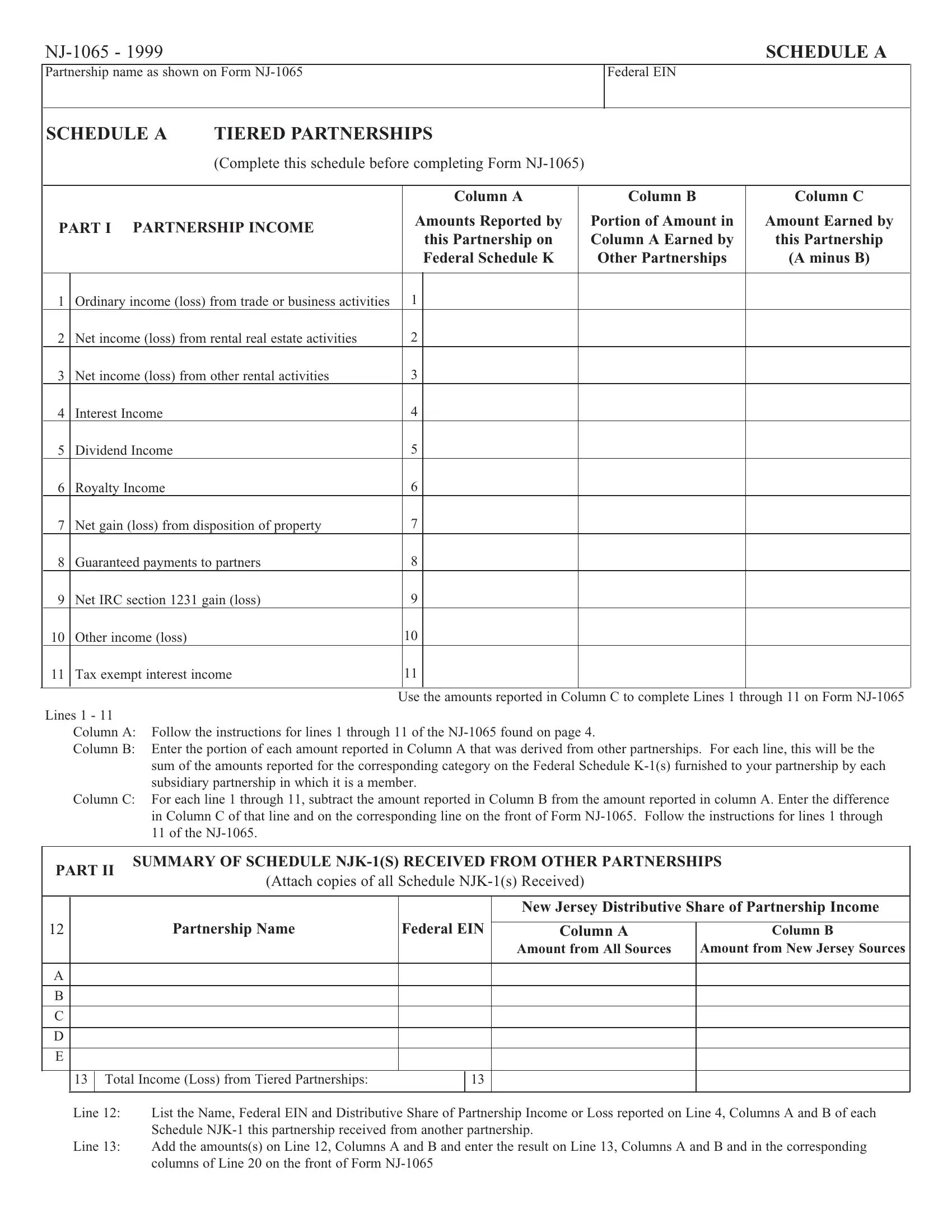

Form Nj 1065 Schedule A ≡ Fill Out Printable PDF Forms Online

Following is a list of lines that are filled in on the tax. Schedule d (form 1065), capital gains and losses use this schedule to report: Enter any gains or losses from the sale of collectibles, which are. The overall capital gains and losses from transactions reported on. Attach schedule d (form 1065).

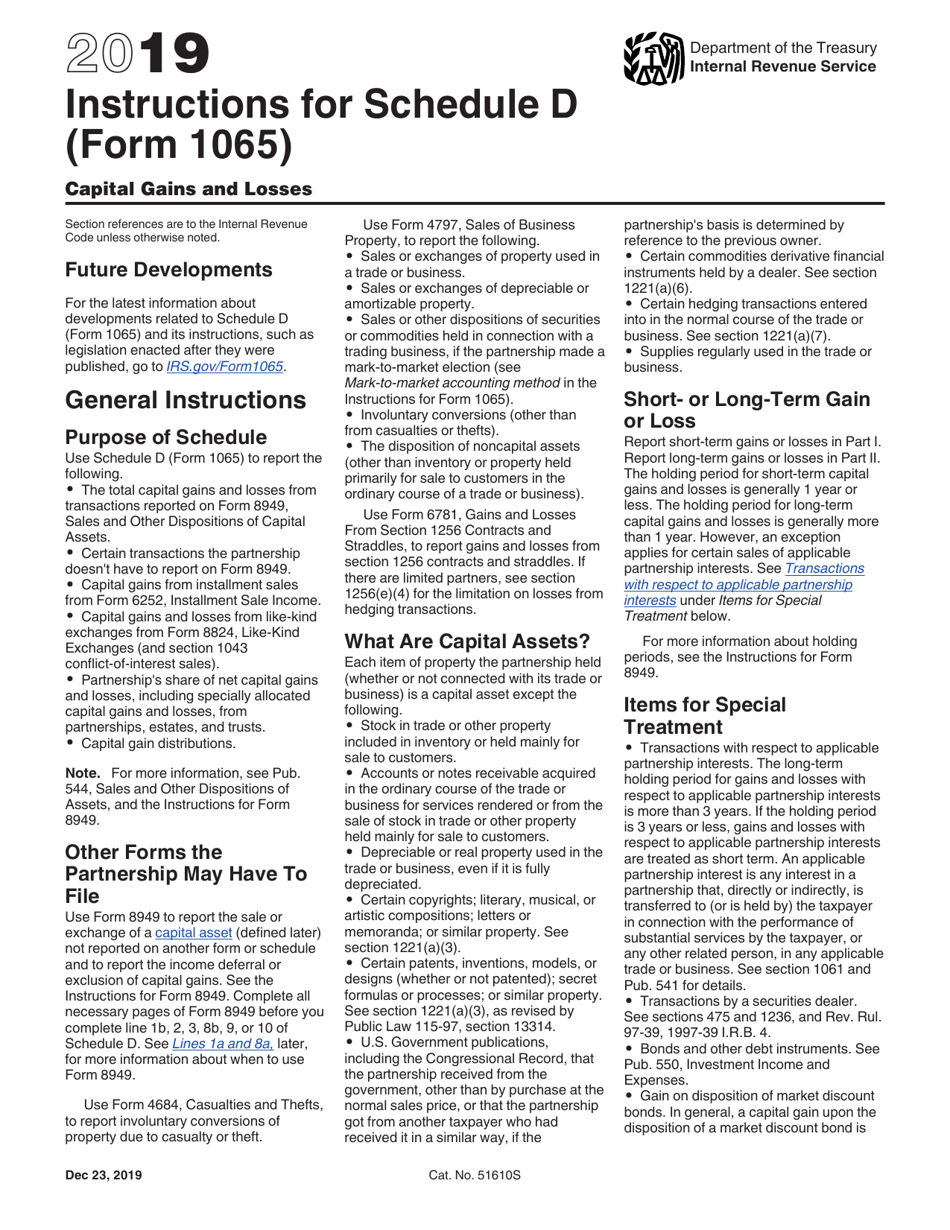

Download Instructions for IRS Form 1065 Schedule D Capital Gains and

Schedule d (form 1065), capital gains and losses use this schedule to report: The overall capital gains and losses from transactions reported on. Attach schedule d (form 1065). Following is a list of lines that are filled in on the tax. Enter any gains or losses from the sale of collectibles, which are.

Form 1065 Due Date 2024 Matti Shelley

Schedule d (form 1065), capital gains and losses use this schedule to report: The overall capital gains and losses from transactions reported on. Enter any gains or losses from the sale of collectibles, which are. Following is a list of lines that are filled in on the tax. Attach schedule d (form 1065).

Schedule D (Form 1065), Capital Gains And Losses Use This Schedule To Report:

Attach schedule d (form 1065). Following is a list of lines that are filled in on the tax. Enter any gains or losses from the sale of collectibles, which are. The overall capital gains and losses from transactions reported on.