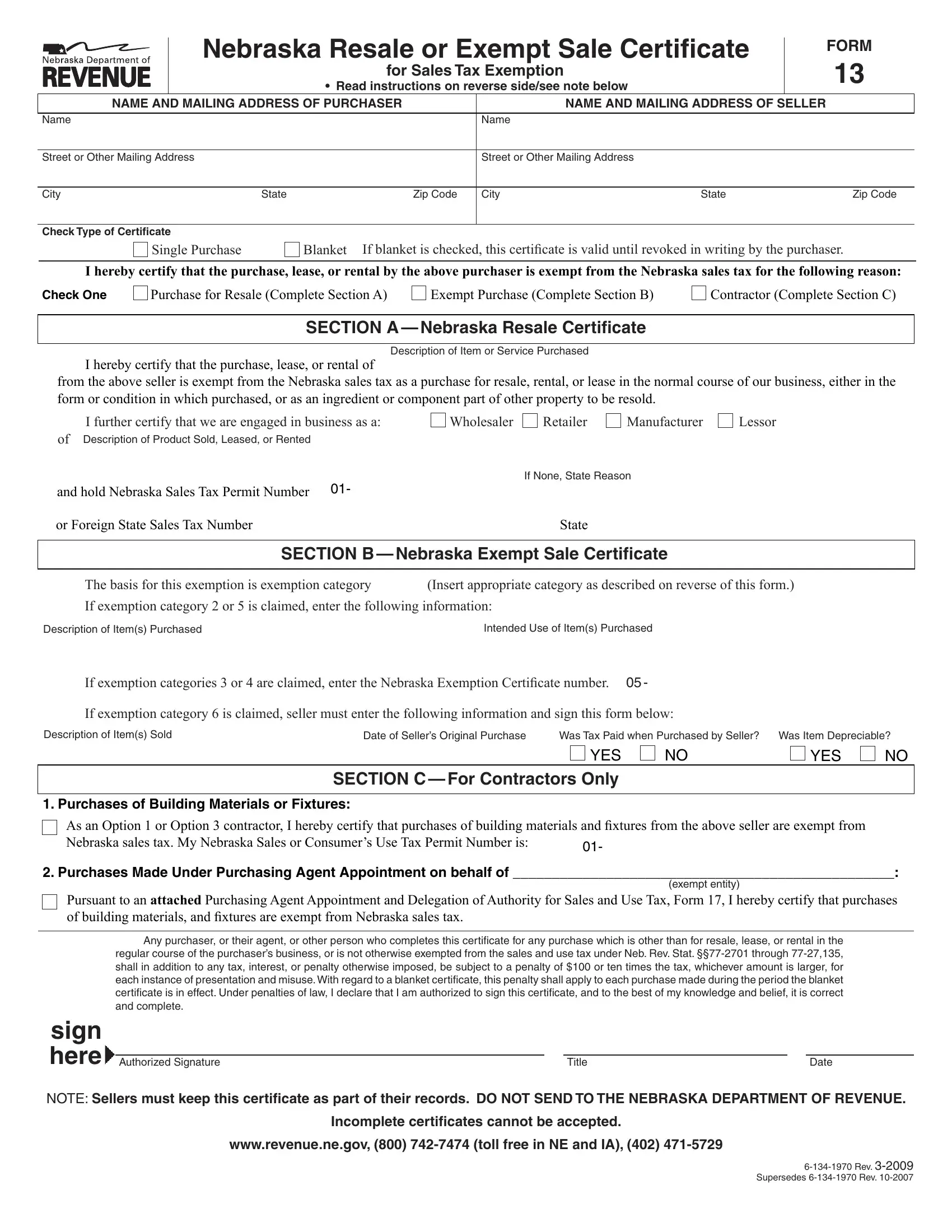

Form 13 Ne - A properly completed form 13, section a, when making purchases of property or taxable services that will subsequently be resold in the. It is unlawful to claim an exemption for purchases. Form 13 may be found guilty of a class iv misdemeanor. 8 rows code, ch.1, § 012 the nebraska department of revenue (dor) is publishing the following sales tax exemption list of most. 013.01 a sale for resale is a sale of property (services) to any purchaser for the purpose of resale in the normal course of the purchaser's. Categories of exemption 1.purchases made directly by certain. The department is committed to the fair administration of the nebraska tax laws.

It is unlawful to claim an exemption for purchases. 8 rows code, ch.1, § 012 the nebraska department of revenue (dor) is publishing the following sales tax exemption list of most. 013.01 a sale for resale is a sale of property (services) to any purchaser for the purpose of resale in the normal course of the purchaser's. A properly completed form 13, section a, when making purchases of property or taxable services that will subsequently be resold in the. The department is committed to the fair administration of the nebraska tax laws. Form 13 may be found guilty of a class iv misdemeanor. Categories of exemption 1.purchases made directly by certain.

013.01 a sale for resale is a sale of property (services) to any purchaser for the purpose of resale in the normal course of the purchaser's. 8 rows code, ch.1, § 012 the nebraska department of revenue (dor) is publishing the following sales tax exemption list of most. Categories of exemption 1.purchases made directly by certain. Form 13 may be found guilty of a class iv misdemeanor. A properly completed form 13, section a, when making purchases of property or taxable services that will subsequently be resold in the. The department is committed to the fair administration of the nebraska tax laws. It is unlawful to claim an exemption for purchases.

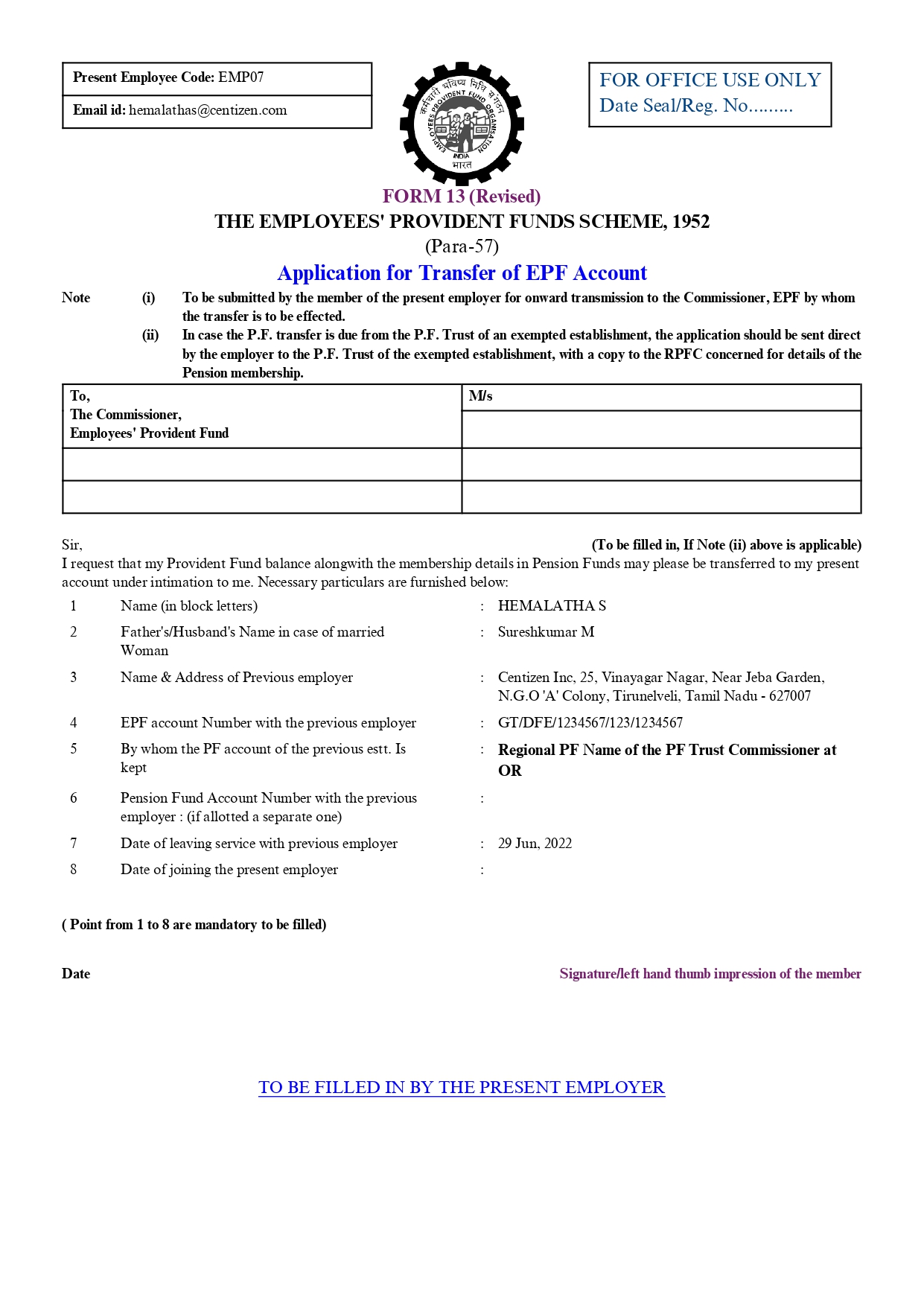

Form 13 Transfer of Installation4 PDF

It is unlawful to claim an exemption for purchases. Categories of exemption 1.purchases made directly by certain. The department is committed to the fair administration of the nebraska tax laws. 8 rows code, ch.1, § 012 the nebraska department of revenue (dor) is publishing the following sales tax exemption list of most. A properly completed form 13, section a, when.

Zenyo Payroll

8 rows code, ch.1, § 012 the nebraska department of revenue (dor) is publishing the following sales tax exemption list of most. 013.01 a sale for resale is a sale of property (services) to any purchaser for the purpose of resale in the normal course of the purchaser's. The department is committed to the fair administration of the nebraska tax.

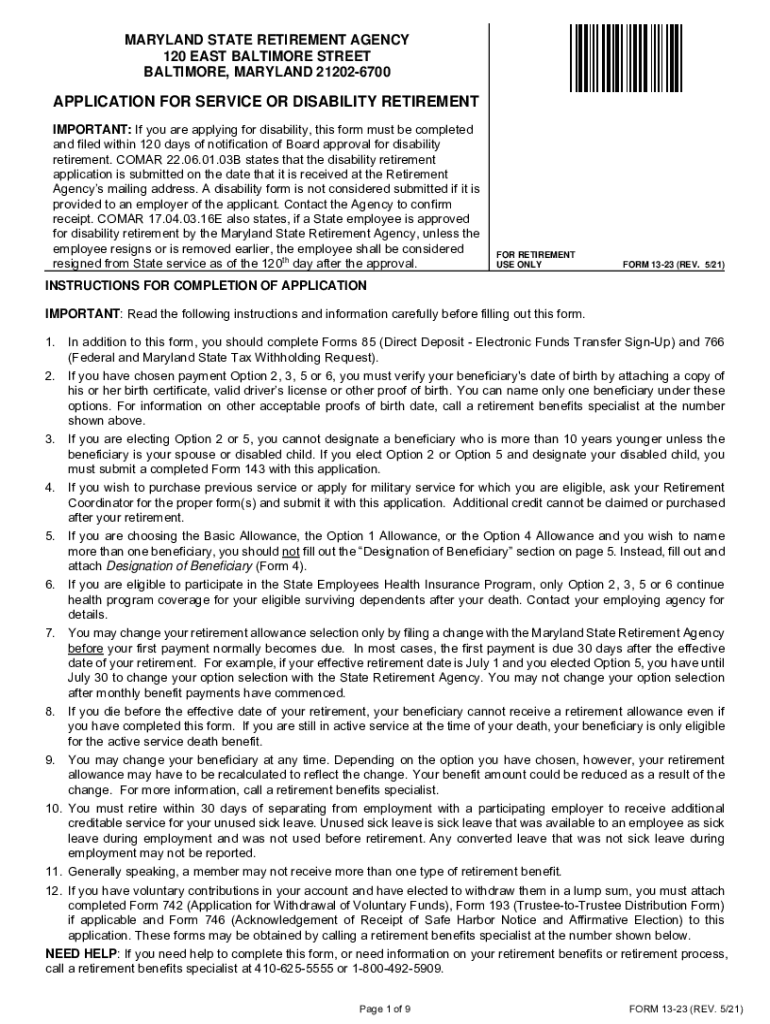

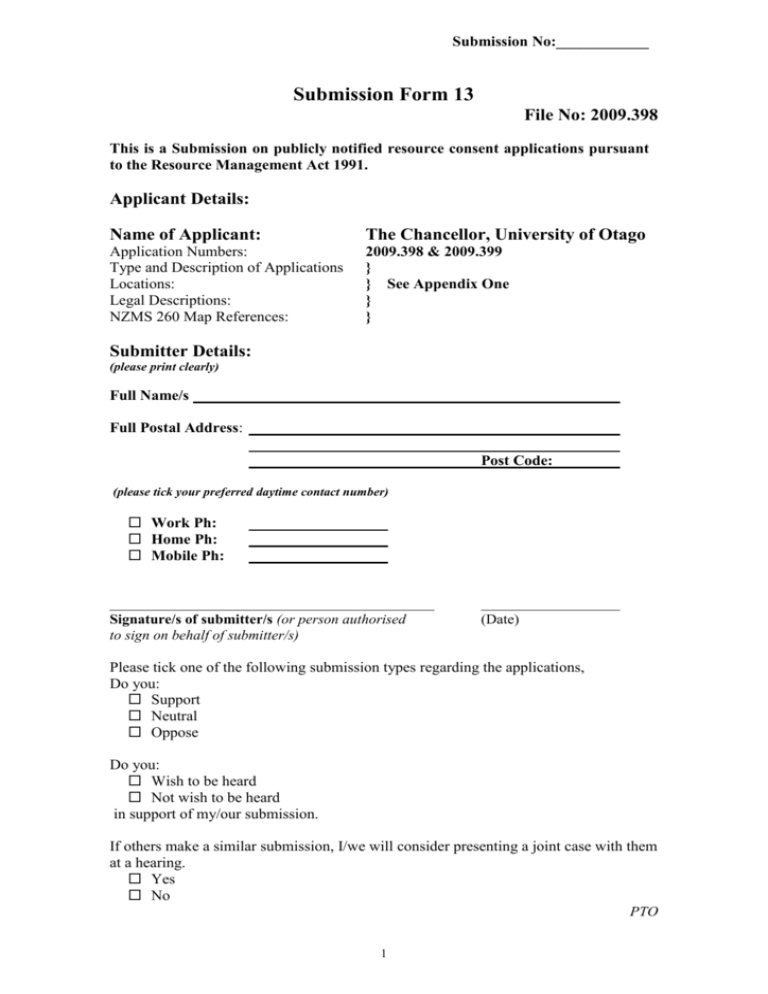

23 Application Form Complete with ease airSlate SignNow

013.01 a sale for resale is a sale of property (services) to any purchaser for the purpose of resale in the normal course of the purchaser's. 8 rows code, ch.1, § 012 the nebraska department of revenue (dor) is publishing the following sales tax exemption list of most. Form 13 may be found guilty of a class iv misdemeanor. The.

Non Resident Tax Exemption Form

A properly completed form 13, section a, when making purchases of property or taxable services that will subsequently be resold in the. Categories of exemption 1.purchases made directly by certain. Form 13 may be found guilty of a class iv misdemeanor. The department is committed to the fair administration of the nebraska tax laws. 8 rows code, ch.1, § 012.

How To Download And Fill Form 13 To Transfer EPF Account? UBS

013.01 a sale for resale is a sale of property (services) to any purchaser for the purpose of resale in the normal course of the purchaser's. The department is committed to the fair administration of the nebraska tax laws. It is unlawful to claim an exemption for purchases. A properly completed form 13, section a, when making purchases of property.

Submission Form 13 Otago Regional Council

013.01 a sale for resale is a sale of property (services) to any purchaser for the purpose of resale in the normal course of the purchaser's. A properly completed form 13, section a, when making purchases of property or taxable services that will subsequently be resold in the. Categories of exemption 1.purchases made directly by certain. 8 rows code, ch.1,.

Nebraska Sales Tax Form ≡ Fill Out Printable PDF Forms Online

It is unlawful to claim an exemption for purchases. Categories of exemption 1.purchases made directly by certain. Form 13 may be found guilty of a class iv misdemeanor. The department is committed to the fair administration of the nebraska tax laws. 013.01 a sale for resale is a sale of property (services) to any purchaser for the purpose of resale.

Ga Sr13 Printable Form Printable Word Searches

013.01 a sale for resale is a sale of property (services) to any purchaser for the purpose of resale in the normal course of the purchaser's. 8 rows code, ch.1, § 012 the nebraska department of revenue (dor) is publishing the following sales tax exemption list of most. The department is committed to the fair administration of the nebraska tax.

Form13

Form 13 may be found guilty of a class iv misdemeanor. Categories of exemption 1.purchases made directly by certain. 8 rows code, ch.1, § 012 the nebraska department of revenue (dor) is publishing the following sales tax exemption list of most. It is unlawful to claim an exemption for purchases. 013.01 a sale for resale is a sale of property.

SCR Form 13 (SCL013) Fill Out, Sign Online and Download Fillable PDF

013.01 a sale for resale is a sale of property (services) to any purchaser for the purpose of resale in the normal course of the purchaser's. It is unlawful to claim an exemption for purchases. Form 13 may be found guilty of a class iv misdemeanor. A properly completed form 13, section a, when making purchases of property or taxable.

It Is Unlawful To Claim An Exemption For Purchases.

013.01 a sale for resale is a sale of property (services) to any purchaser for the purpose of resale in the normal course of the purchaser's. Form 13 may be found guilty of a class iv misdemeanor. A properly completed form 13, section a, when making purchases of property or taxable services that will subsequently be resold in the. The department is committed to the fair administration of the nebraska tax laws.

Categories Of Exemption 1.Purchases Made Directly By Certain.

8 rows code, ch.1, § 012 the nebraska department of revenue (dor) is publishing the following sales tax exemption list of most.