Form 3520 Instructions - The $100,000 number is correct. I am a us citizen. If you and your spouse are filing a joint income tax return for tax year 2021, and you are both transferors, grantors, or. See below the relevant section from form 3520 instructions. According to the instructions for 3520, you would check this box if you also need file form 8938 for the same tax year and include this form in the total number of forms 3520. Since this is a gift from foreign person(s), your spouse only needs to fill. Each of them sent me $45, and $35k respectively. Form 3520 hi, i have similar questions: In year 2023, i received two cash gifts from my parents. The form is filled out with the name of the gift recipient, but the spouse's taxpayer number is also required.

Since this is a gift from foreign person(s), your spouse only needs to fill. See below the relevant section from form 3520 instructions. If you and your spouse are filing a joint income tax return for tax year 2021, and you are both transferors, grantors, or. I am a us citizen. The form is filled out with the name of the gift recipient, but the spouse's taxpayer number is also required. Each of them sent me $45, and $35k respectively. According to the instructions for 3520, you would check this box if you also need file form 8938 for the same tax year and include this form in the total number of forms 3520. Form 3520 hi, i have similar questions: The $100,000 number is correct. In year 2023, i received two cash gifts from my parents.

According to the instructions for 3520, you would check this box if you also need file form 8938 for the same tax year and include this form in the total number of forms 3520. Form 3520 hi, i have similar questions: Each of them sent me $45, and $35k respectively. Since this is a gift from foreign person(s), your spouse only needs to fill. In year 2023, i received two cash gifts from my parents. The form is filled out with the name of the gift recipient, but the spouse's taxpayer number is also required. I am a us citizen. If you and your spouse are filing a joint income tax return for tax year 2021, and you are both transferors, grantors, or. See below the relevant section from form 3520 instructions. The $100,000 number is correct.

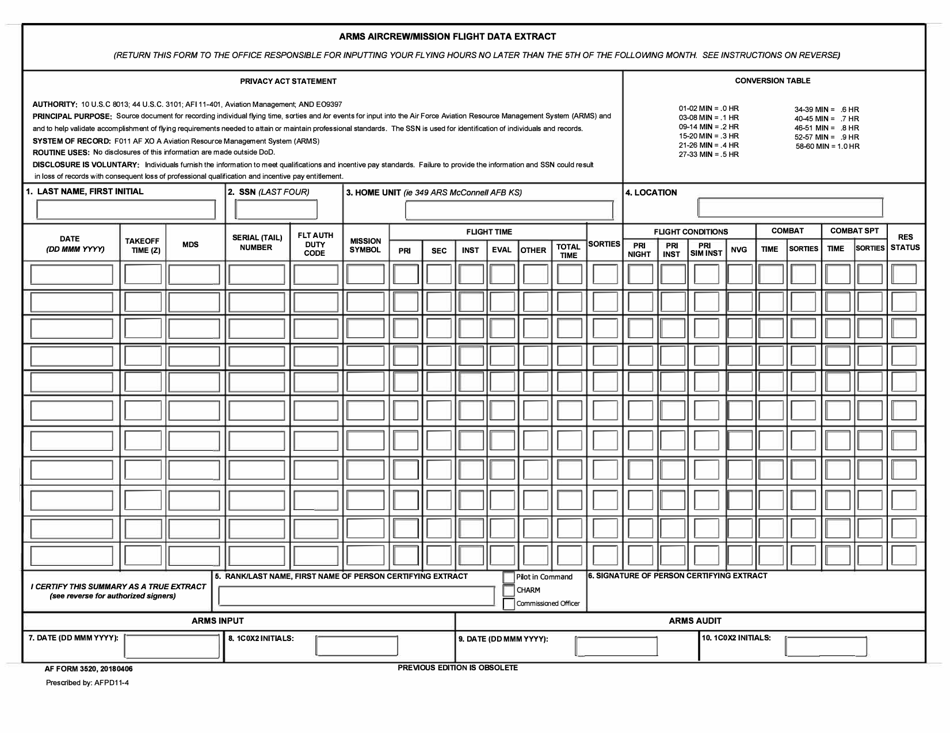

AF Form 3520 Fill Out, Sign Online and Download Fillable PDF

If you and your spouse are filing a joint income tax return for tax year 2021, and you are both transferors, grantors, or. See below the relevant section from form 3520 instructions. In year 2023, i received two cash gifts from my parents. I am a us citizen. Since this is a gift from foreign person(s), your spouse only needs.

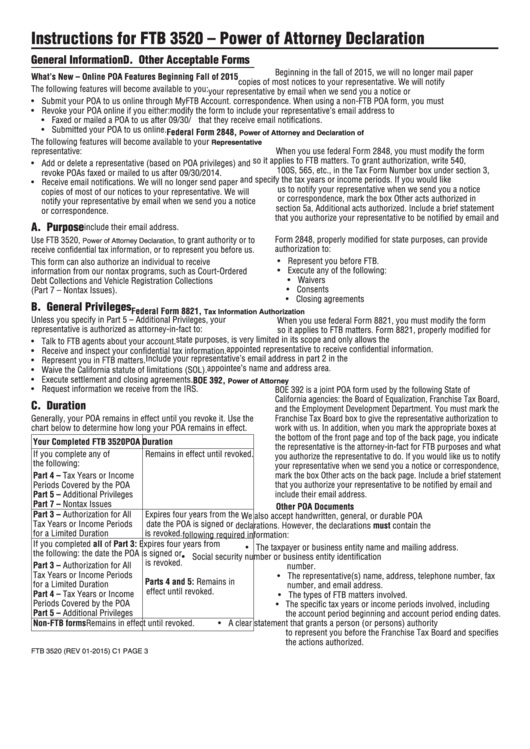

IRS Form 2848 Instructions IRS Power of Attorney Form

Form 3520 hi, i have similar questions: In year 2023, i received two cash gifts from my parents. If you and your spouse are filing a joint income tax return for tax year 2021, and you are both transferors, grantors, or. See below the relevant section from form 3520 instructions. The $100,000 number is correct.

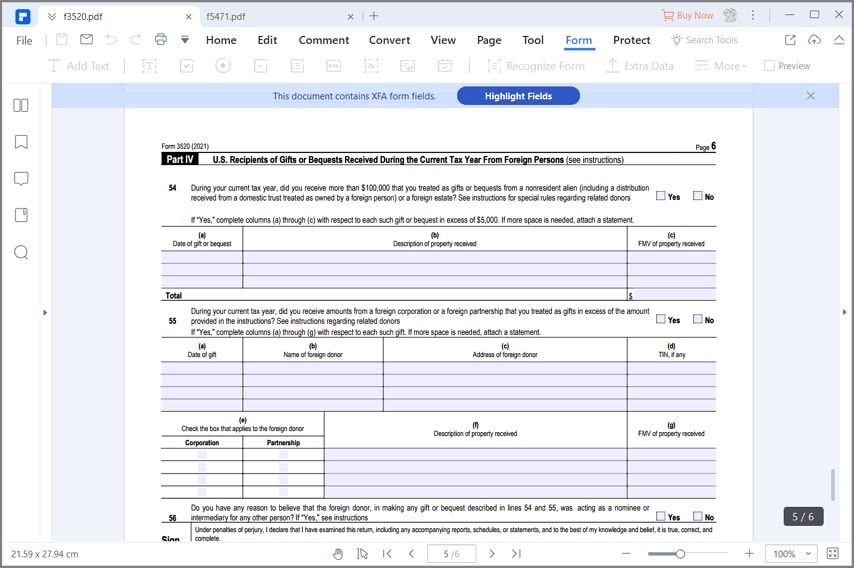

IRS Form 3520 Instructions to Fill it Right in 2020

If you and your spouse are filing a joint income tax return for tax year 2021, and you are both transferors, grantors, or. According to the instructions for 3520, you would check this box if you also need file form 8938 for the same tax year and include this form in the total number of forms 3520. In year 2023,.

Form 3520 example Fill out & sign online DocHub

The $100,000 number is correct. If you and your spouse are filing a joint income tax return for tax year 2021, and you are both transferors, grantors, or. In year 2023, i received two cash gifts from my parents. See below the relevant section from form 3520 instructions. Form 3520 hi, i have similar questions:

Form 3520 Examples and Guide to Filing fro Expats

According to the instructions for 3520, you would check this box if you also need file form 8938 for the same tax year and include this form in the total number of forms 3520. If you and your spouse are filing a joint income tax return for tax year 2021, and you are both transferors, grantors, or. Each of them.

Fillable Online Form 3520 instructions 2021 pdf. Form 3520 instructions

Since this is a gift from foreign person(s), your spouse only needs to fill. I am a us citizen. The form is filled out with the name of the gift recipient, but the spouse's taxpayer number is also required. According to the instructions for 3520, you would check this box if you also need file form 8938 for the same.

Instructions For Form 3520A Annual Information Return of Foreign

In year 2023, i received two cash gifts from my parents. If you and your spouse are filing a joint income tax return for tax year 2021, and you are both transferors, grantors, or. According to the instructions for 3520, you would check this box if you also need file form 8938 for the same tax year and include this.

IRS Form 3520 in a Nutshell SF Tax Counsel

See below the relevant section from form 3520 instructions. Since this is a gift from foreign person(s), your spouse only needs to fill. The form is filled out with the name of the gift recipient, but the spouse's taxpayer number is also required. According to the instructions for 3520, you would check this box if you also need file form.

Instructions For Ftb 3520 Power Of Attorney Declaration 2015

I am a us citizen. If you and your spouse are filing a joint income tax return for tax year 2021, and you are both transferors, grantors, or. The $100,000 number is correct. According to the instructions for 3520, you would check this box if you also need file form 8938 for the same tax year and include this form.

Fillable Online Instructions for Form 3520A (Rev. December 2023

I am a us citizen. If you and your spouse are filing a joint income tax return for tax year 2021, and you are both transferors, grantors, or. Since this is a gift from foreign person(s), your spouse only needs to fill. The form is filled out with the name of the gift recipient, but the spouse's taxpayer number is.

In Year 2023, I Received Two Cash Gifts From My Parents.

The form is filled out with the name of the gift recipient, but the spouse's taxpayer number is also required. Form 3520 hi, i have similar questions: See below the relevant section from form 3520 instructions. According to the instructions for 3520, you would check this box if you also need file form 8938 for the same tax year and include this form in the total number of forms 3520.

I Am A Us Citizen.

Since this is a gift from foreign person(s), your spouse only needs to fill. If you and your spouse are filing a joint income tax return for tax year 2021, and you are both transferors, grantors, or. The $100,000 number is correct. Each of them sent me $45, and $35k respectively.