Form 712 Life Insurance - However, this isn’t a form that you’d include with your personal income tax return. Do i need to report that as income? The irs levies a 1% excise tax on the foreign life insurance. If you are required to file form 706, it would be. * if your foreign life insurance policy is considered a pfic, there may be far more complex tax factors to consider. Form 712 is a statement of valuation to be used in filing a. However, this isn’t a form that you’d include with your personal income tax return. Turbotax software for individuals doesn’t support form 712, life insurance statement. Life insurance death proceeds form 712 if your mother's estate was less than (approximately) $5.4 million, you are not required to file form 706. Turbotax software for individuals doesn’t support form 712, life insurance statement.

Turbotax software for individuals doesn’t support form 712, life insurance statement. It goes to the executor of the. If you are required to file form 706, it would be. Do i need to report that as income? However, this isn’t a form that you’d include with your personal income tax return. Life insurance death proceeds form 712 if your mother's estate was less than (approximately) $5.4 million, you are not required to file form 706. The irs levies a 1% excise tax on the foreign life insurance. However, this isn’t a form that you’d include with your personal income tax return. Turbotax software for individuals doesn’t support form 712, life insurance statement. * if your foreign life insurance policy is considered a pfic, there may be far more complex tax factors to consider.

* if your foreign life insurance policy is considered a pfic, there may be far more complex tax factors to consider. Turbotax software for individuals doesn’t support form 712, life insurance statement. Life insurance death proceeds form 712 if your mother's estate was less than (approximately) $5.4 million, you are not required to file form 706. The irs levies a 1% excise tax on the foreign life insurance. I received form 712 for a $5000 life insurance payout following my husband's death. Do i need to report that as income? It goes to the executor of the. However, this isn’t a form that you’d include with your personal income tax return. Form 712 is a statement of valuation to be used in filing a. If you are required to file form 706, it would be.

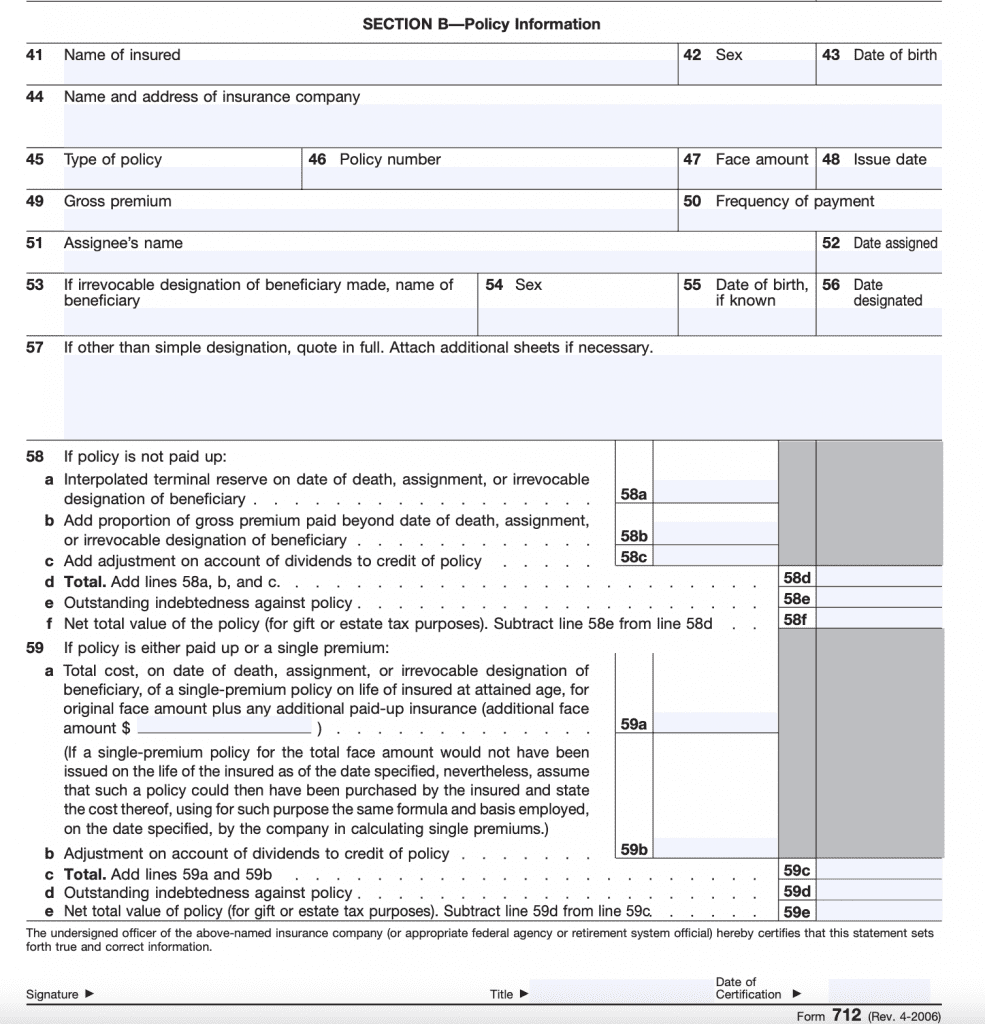

IRS Form 712 Instructions laacib

Turbotax software for individuals doesn’t support form 712, life insurance statement. Turbotax software for individuals doesn’t support form 712, life insurance statement. However, this isn’t a form that you’d include with your personal income tax return. The irs levies a 1% excise tax on the foreign life insurance. If you are required to file form 706, it would be.

Fillable Online Life insurance form. Life insurance form. Life

Do i need to report that as income? * if your foreign life insurance policy is considered a pfic, there may be far more complex tax factors to consider. Turbotax software for individuals doesn’t support form 712, life insurance statement. Life insurance death proceeds form 712 if your mother's estate was less than (approximately) $5.4 million, you are not required.

IRS Form 712 Fill Out, Sign Online and Download Fillable PDF

Do i need to report that as income? Life insurance death proceeds form 712 if your mother's estate was less than (approximately) $5.4 million, you are not required to file form 706. I received form 712 for a $5000 life insurance payout following my husband's death. * if your foreign life insurance policy is considered a pfic, there may be.

Form 712 Life Insurance Statement (2006) Free Download

Form 712 is a statement of valuation to be used in filing a. If you are required to file form 706, it would be. Life insurance death proceeds form 712 if your mother's estate was less than (approximately) $5.4 million, you are not required to file form 706. It goes to the executor of the. Turbotax software for individuals doesn’t.

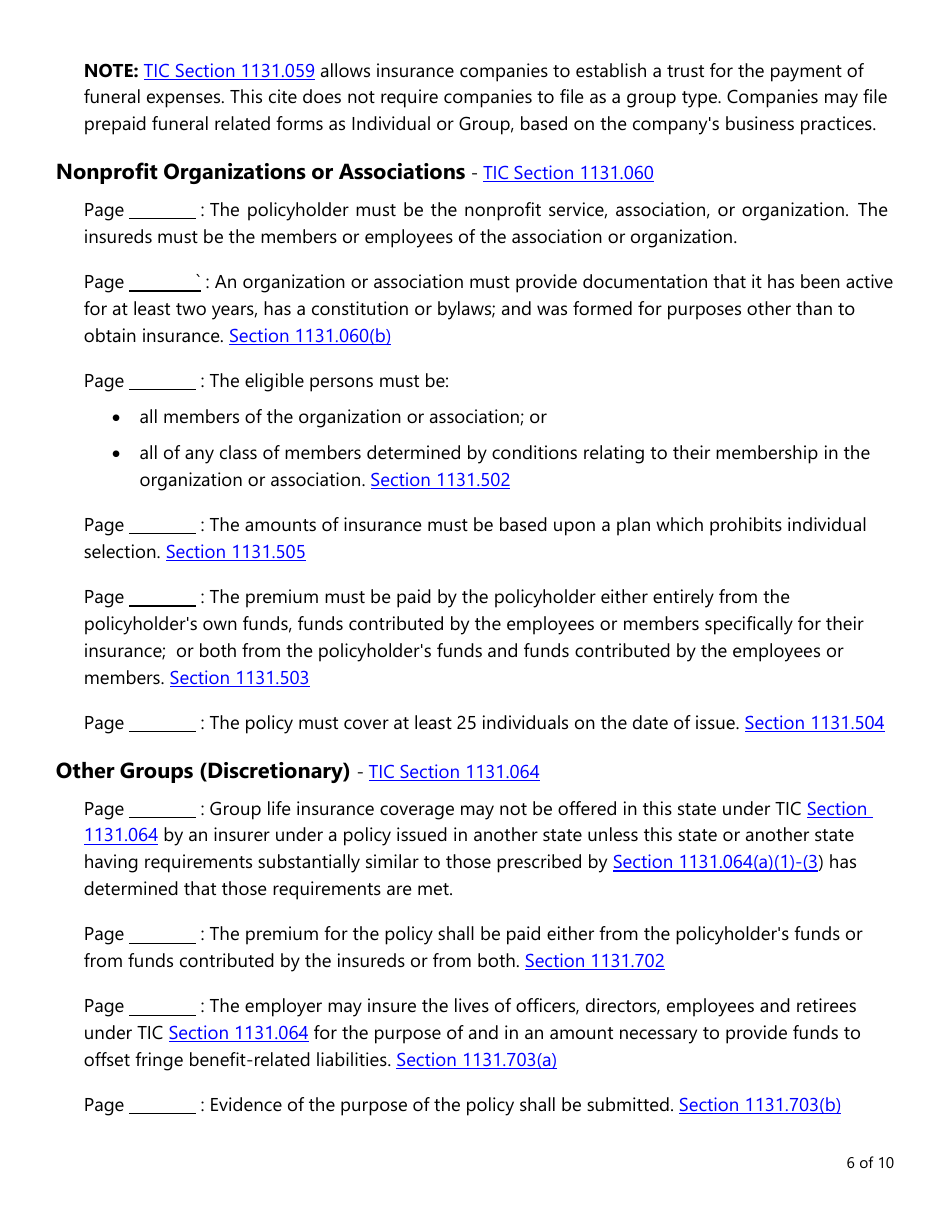

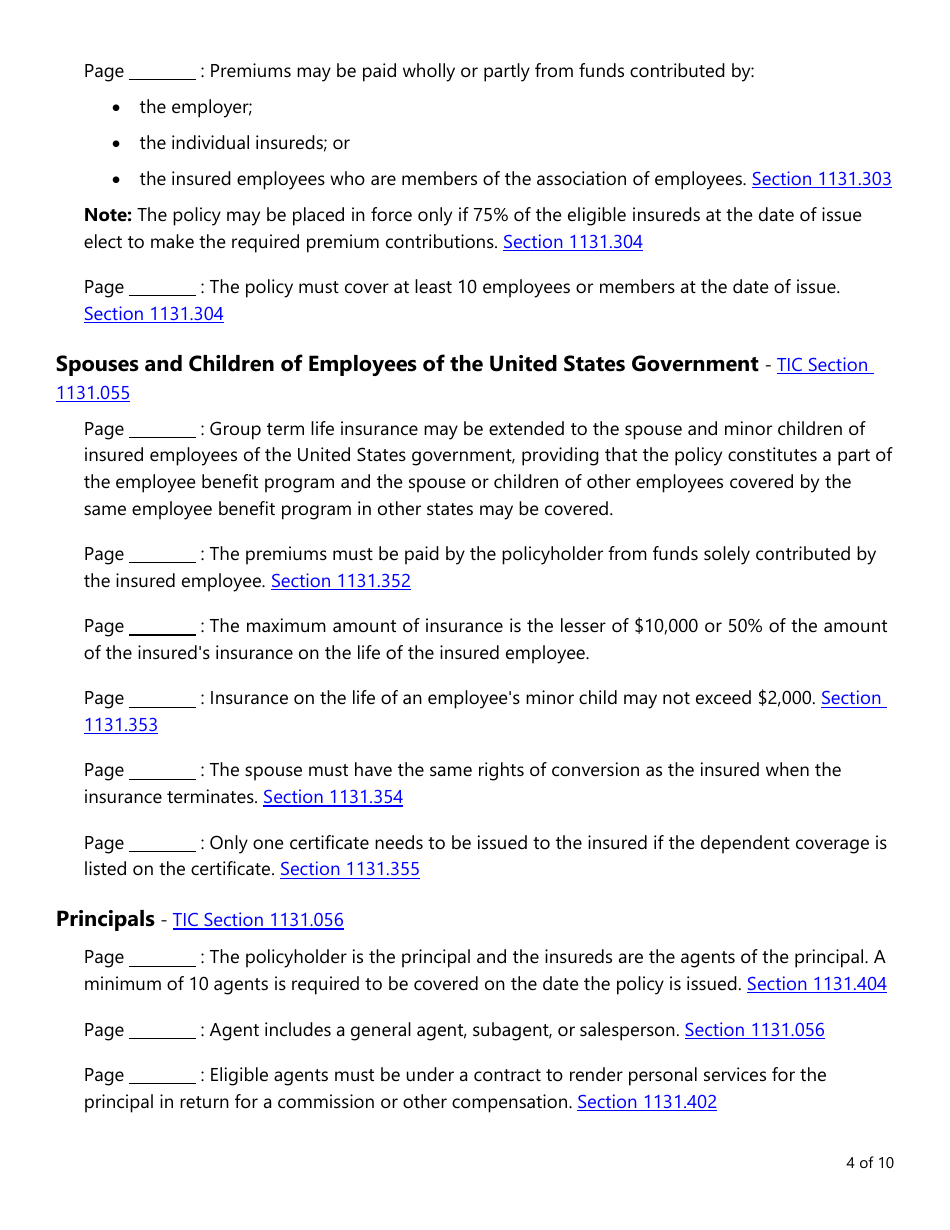

Form LAC005 Download Fillable PDF or Fill Online Group Life Insurance

It goes to the executor of the. * if your foreign life insurance policy is considered a pfic, there may be far more complex tax factors to consider. Turbotax software for individuals doesn’t support form 712, life insurance statement. Life insurance death proceeds form 712 if your mother's estate was less than (approximately) $5.4 million, you are not required to.

Fill Free fillable Form 712 Life Insurance Statement 2006 PDF form

The irs levies a 1% excise tax on the foreign life insurance. However, this isn’t a form that you’d include with your personal income tax return. However, this isn’t a form that you’d include with your personal income tax return. Form 712 is a statement of valuation to be used in filing a. It goes to the executor of the.

Form 712 Life Insurance Statement Stock Image Image of dollar

Turbotax software for individuals doesn’t support form 712, life insurance statement. I received form 712 for a $5000 life insurance payout following my husband's death. If you are required to file form 706, it would be. It goes to the executor of the. Turbotax software for individuals doesn’t support form 712, life insurance statement.

Customer Declaration Form Prudential Life Insurance Printable Pdf

Turbotax software for individuals doesn’t support form 712, life insurance statement. Form 712 is a statement of valuation to be used in filing a. Life insurance death proceeds form 712 if your mother's estate was less than (approximately) $5.4 million, you are not required to file form 706. It goes to the executor of the. I received form 712 for.

Form 712 Life Insurance Statement (2006) Free Download

Turbotax software for individuals doesn’t support form 712, life insurance statement. Life insurance death proceeds form 712 if your mother's estate was less than (approximately) $5.4 million, you are not required to file form 706. I received form 712 for a $5000 life insurance payout following my husband's death. Turbotax software for individuals doesn’t support form 712, life insurance statement..

Form LAC005 Download Fillable PDF or Fill Online Group Life Insurance

If you are required to file form 706, it would be. However, this isn’t a form that you’d include with your personal income tax return. It goes to the executor of the. * if your foreign life insurance policy is considered a pfic, there may be far more complex tax factors to consider. Turbotax software for individuals doesn’t support form.

However, This Isn’t A Form That You’d Include With Your Personal Income Tax Return.

However, this isn’t a form that you’d include with your personal income tax return. I received form 712 for a $5000 life insurance payout following my husband's death. If you are required to file form 706, it would be. * if your foreign life insurance policy is considered a pfic, there may be far more complex tax factors to consider.

Turbotax Software For Individuals Doesn’t Support Form 712, Life Insurance Statement.

Life insurance death proceeds form 712 if your mother's estate was less than (approximately) $5.4 million, you are not required to file form 706. It goes to the executor of the. The irs levies a 1% excise tax on the foreign life insurance. Form 712 is a statement of valuation to be used in filing a.

Do I Need To Report That As Income?

Turbotax software for individuals doesn’t support form 712, life insurance statement.