Form 760Py Instructions - Either form 760 or form 760py, while the nonresident spouse will file form 763, if applicable. To receive the status of your filed income tax refund, enter your social security number and the expected refund amount (to the. File form 763, the nonresident. (a person is considered a resident if they have been living in virginia for more than. File form 760py to report the income attributable to your period of virginia residency. U filing on paper means waiting. On form 760py is checked, preferred contact details and other tax return information will be provided to dmas and dss for purposes of. However, if one spouse is a full. Here are the instructions on how to set up the program. The py stands for part year instead of just the standard 760 resident form.

See page 5 of the 760 instruction booklet for more information. File form 760py to report the income attributable to your period of virginia residency. However, if one spouse is a full. To receive the status of your filed income tax refund, enter your social security number and the expected refund amount (to the. Either form 760 or form 760py, while the nonresident spouse will file form 763, if applicable. Residents of virginia must file a form 760. File form 763, the nonresident. U filing on paper means waiting. Here are the instructions on how to set up the program. On form 760py is checked, preferred contact details and other tax return information will be provided to dmas and dss for purposes of.

To receive the status of your filed income tax refund, enter your social security number and the expected refund amount (to the. File form 763, the nonresident. On form 760py is checked, preferred contact details and other tax return information will be provided to dmas and dss for purposes of. File form 760py to report the income attributable to your period of virginia residency. See page 5 of the 760 instruction booklet for more information. The py stands for part year instead of just the standard 760 resident form. Here are the instructions on how to set up the program. Either form 760 or form 760py, while the nonresident spouse will file form 763, if applicable. However, if one spouse is a full. (a person is considered a resident if they have been living in virginia for more than.

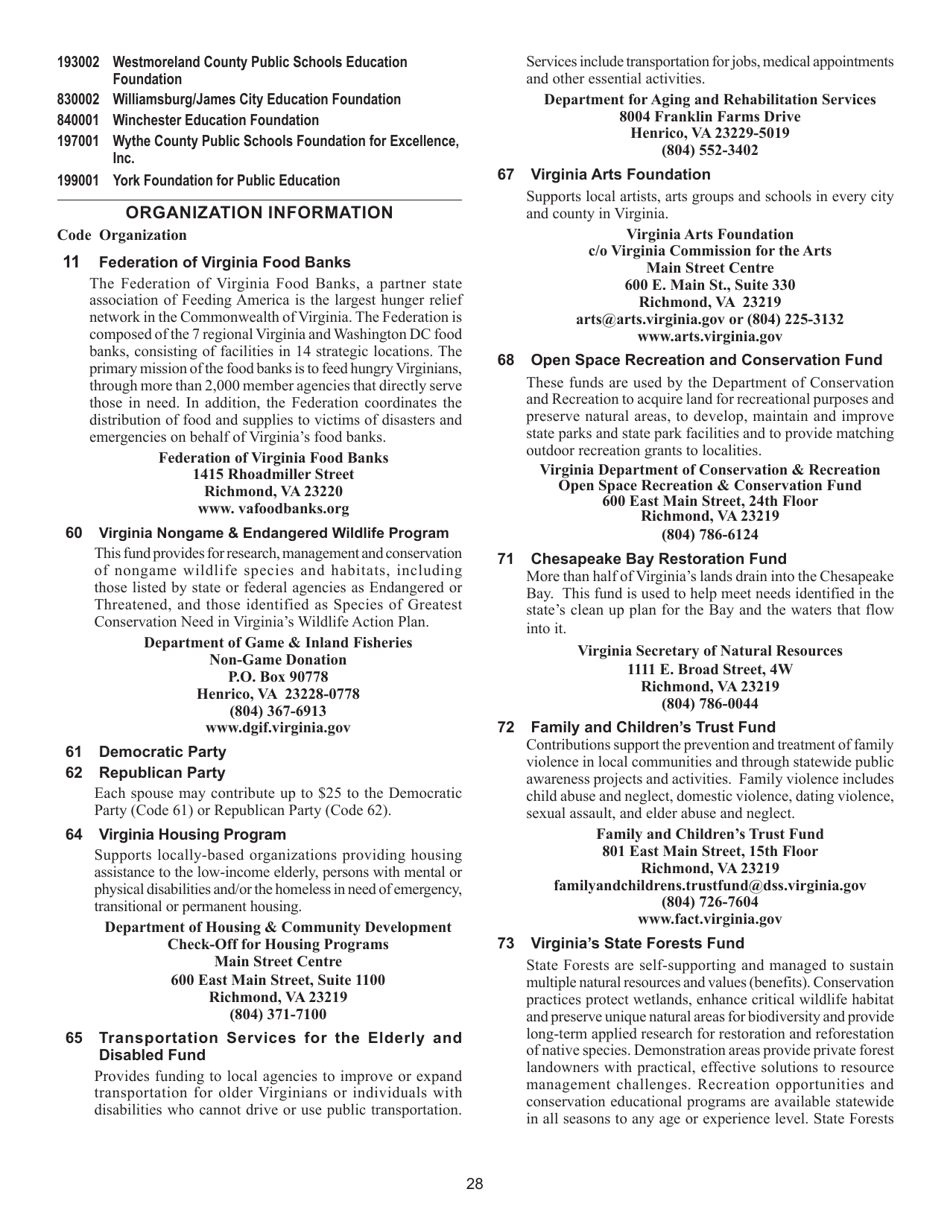

Download Instructions for Form 760PY Virginia PartYear Resident

The py stands for part year instead of just the standard 760 resident form. To receive the status of your filed income tax refund, enter your social security number and the expected refund amount (to the. Either form 760 or form 760py, while the nonresident spouse will file form 763, if applicable. (a person is considered a resident if they.

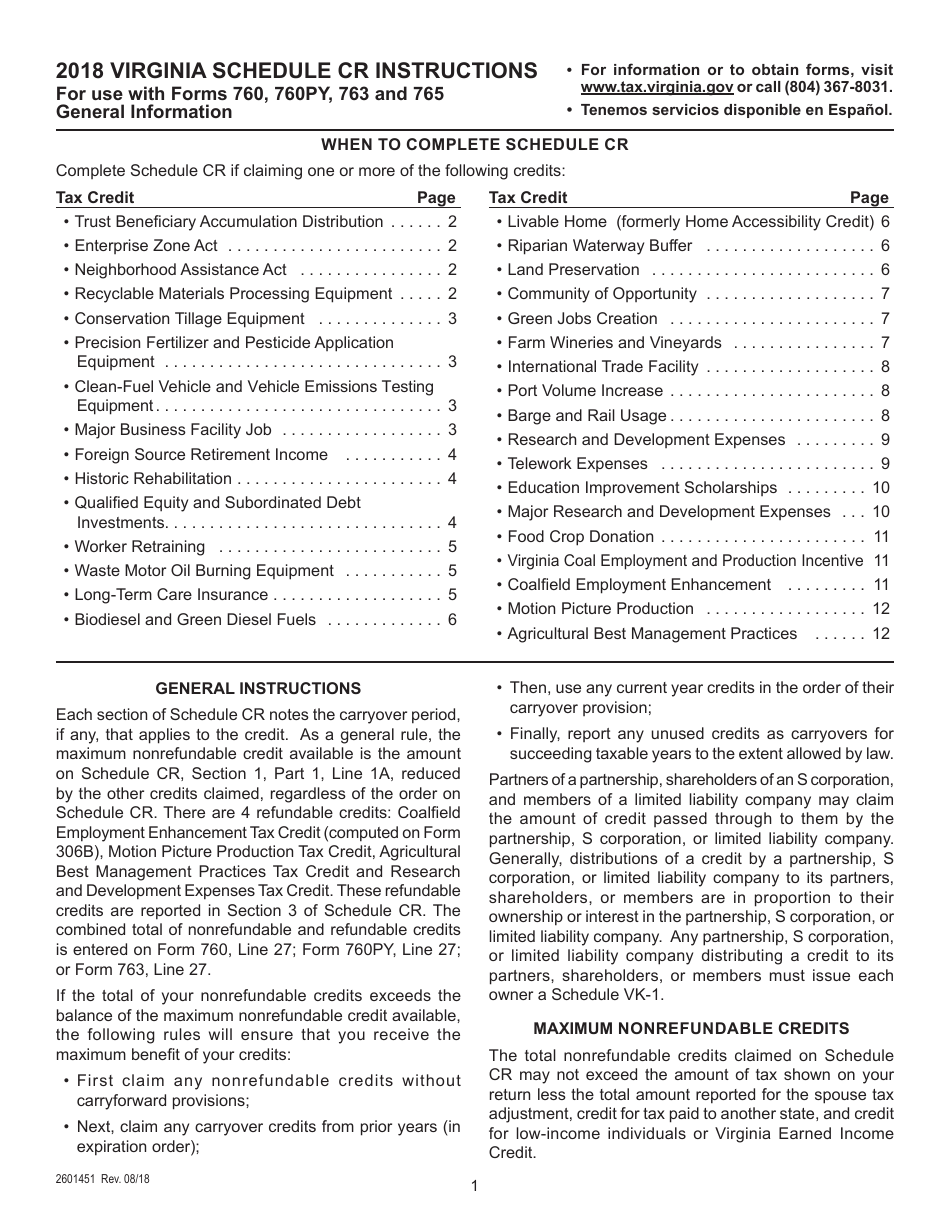

Download Instructions for Form 760, 760PY, 763, 765 Schedule CR PDF

The py stands for part year instead of just the standard 760 resident form. Here are the instructions on how to set up the program. File form 763, the nonresident. U filing on paper means waiting. On form 760py is checked, preferred contact details and other tax return information will be provided to dmas and dss for purposes of.

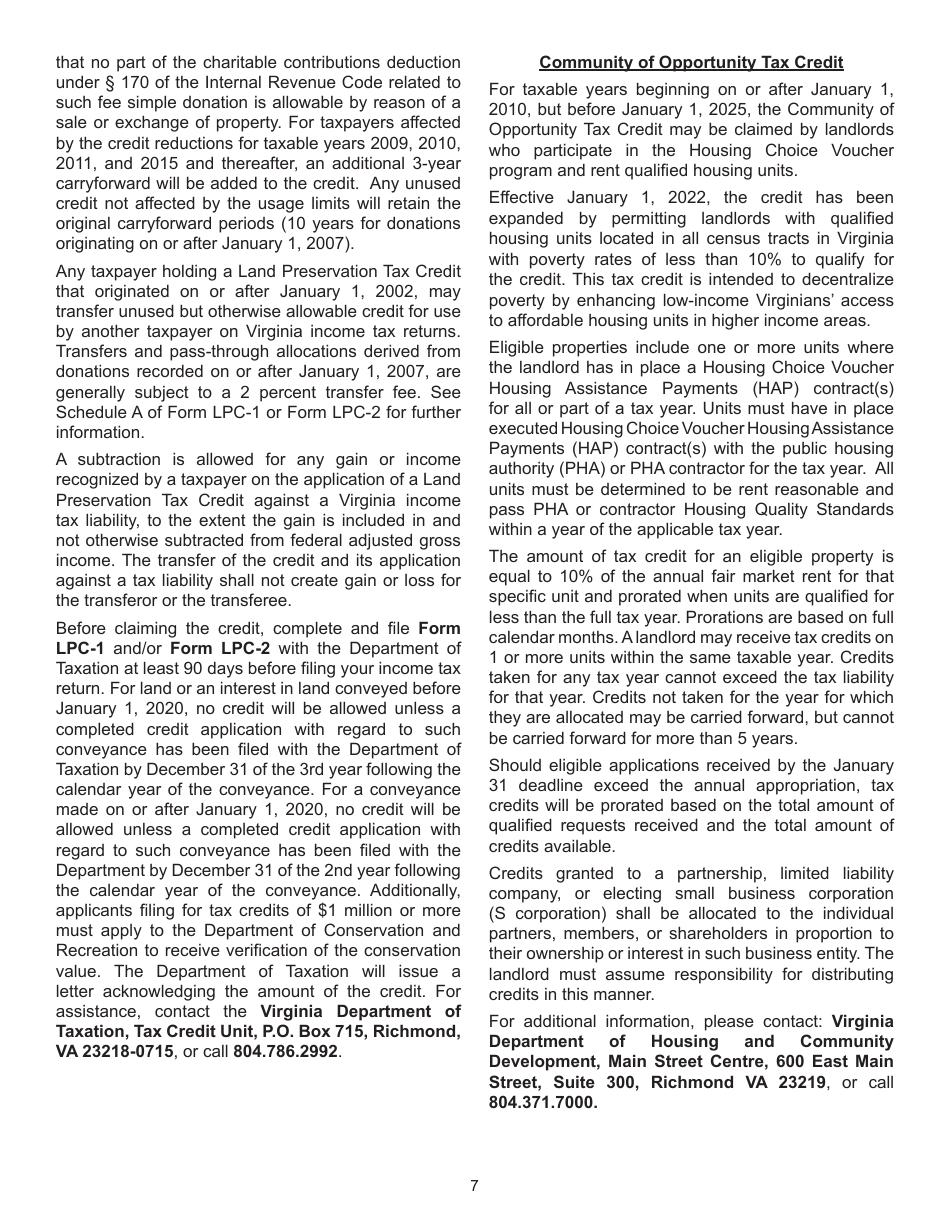

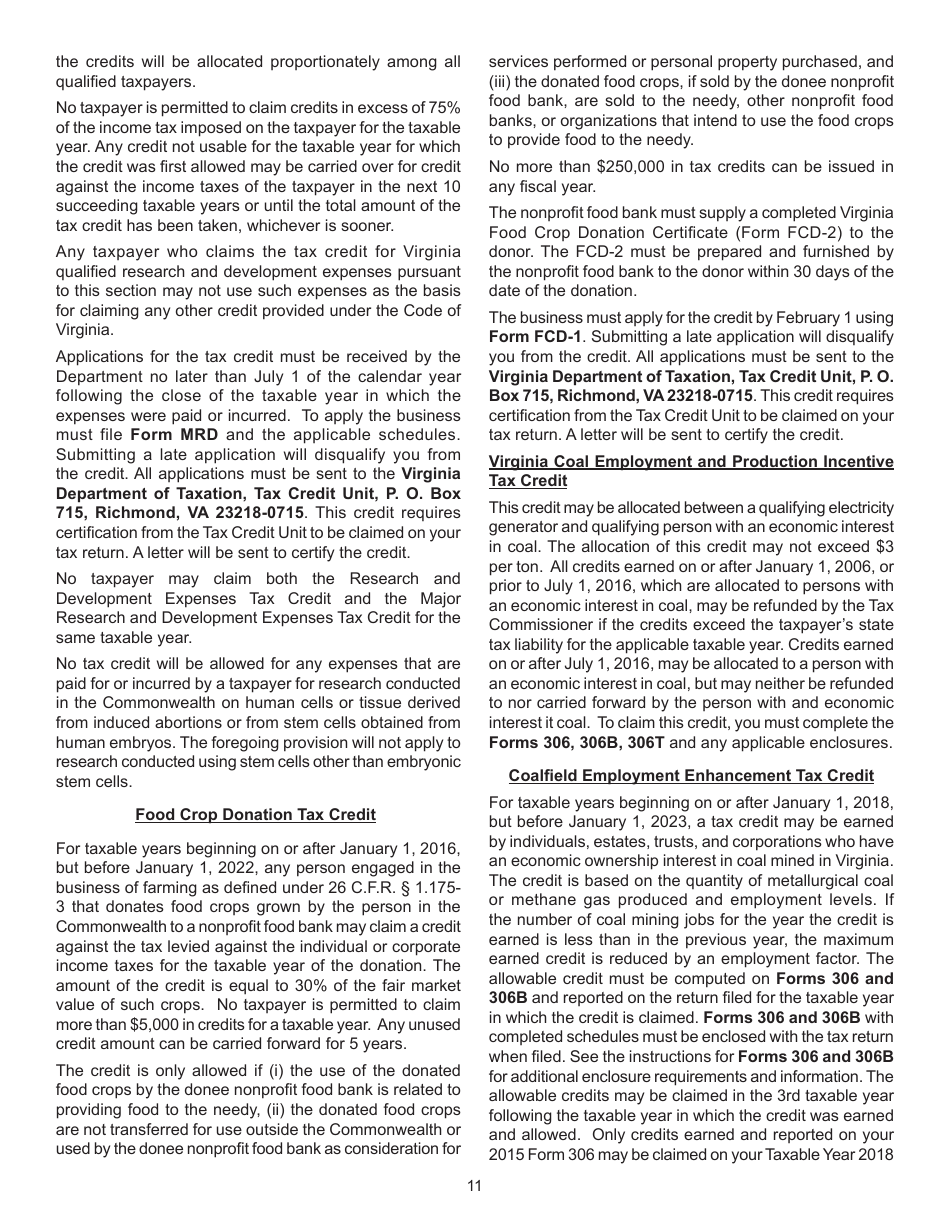

Download Instructions for Form 760, 760PY, 763, 765 Schedule CR Credit

(a person is considered a resident if they have been living in virginia for more than. However, if one spouse is a full. Either form 760 or form 760py, while the nonresident spouse will file form 763, if applicable. The py stands for part year instead of just the standard 760 resident form. See page 5 of the 760 instruction.

Download Instructions for Form 760, 760PY, 763, 765 Schedule CR Credit

File form 760py to report the income attributable to your period of virginia residency. Here are the instructions on how to set up the program. See page 5 of the 760 instruction booklet for more information. Either form 760 or form 760py, while the nonresident spouse will file form 763, if applicable. However, if one spouse is a full.

Download Instructions for Form 760, 760PY, 763, 765 Schedule CR Credit

Here are the instructions on how to set up the program. The py stands for part year instead of just the standard 760 resident form. File form 763, the nonresident. Residents of virginia must file a form 760. File form 760py to report the income attributable to your period of virginia residency.

Download Instructions for Form 760, 760PY, 763, 765 Schedule CR PDF

Here are the instructions on how to set up the program. Either form 760 or form 760py, while the nonresident spouse will file form 763, if applicable. (a person is considered a resident if they have been living in virginia for more than. File form 763, the nonresident. On form 760py is checked, preferred contact details and other tax return.

Download Instructions for Form 760, 760PY, 763, 765 Schedule CR Credit

The py stands for part year instead of just the standard 760 resident form. File form 760py to report the income attributable to your period of virginia residency. Residents of virginia must file a form 760. On form 760py is checked, preferred contact details and other tax return information will be provided to dmas and dss for purposes of. However,.

20222024 Form CT DRS CTW4 Fill Online, Printable,, 09/28/2023

(a person is considered a resident if they have been living in virginia for more than. File form 760py to report the income attributable to your period of virginia residency. On form 760py is checked, preferred contact details and other tax return information will be provided to dmas and dss for purposes of. See page 5 of the 760 instruction.

2021 Form VA 760PY Instructions Fill Online, Printable, Fillable, Blank

Residents of virginia must file a form 760. Either form 760 or form 760py, while the nonresident spouse will file form 763, if applicable. (a person is considered a resident if they have been living in virginia for more than. File form 763, the nonresident. However, if one spouse is a full.

Download Instructions for Form 760, 760PY, 763, 765 Schedule CR Credit

On form 760py is checked, preferred contact details and other tax return information will be provided to dmas and dss for purposes of. File form 763, the nonresident. U filing on paper means waiting. Here are the instructions on how to set up the program. File form 760py to report the income attributable to your period of virginia residency.

However, If One Spouse Is A Full.

U filing on paper means waiting. Here are the instructions on how to set up the program. To receive the status of your filed income tax refund, enter your social security number and the expected refund amount (to the. On form 760py is checked, preferred contact details and other tax return information will be provided to dmas and dss for purposes of.

See Page 5 Of The 760 Instruction Booklet For More Information.

(a person is considered a resident if they have been living in virginia for more than. Residents of virginia must file a form 760. File form 763, the nonresident. The py stands for part year instead of just the standard 760 resident form.

Either Form 760 Or Form 760Py, While The Nonresident Spouse Will File Form 763, If Applicable.

File form 760py to report the income attributable to your period of virginia residency.