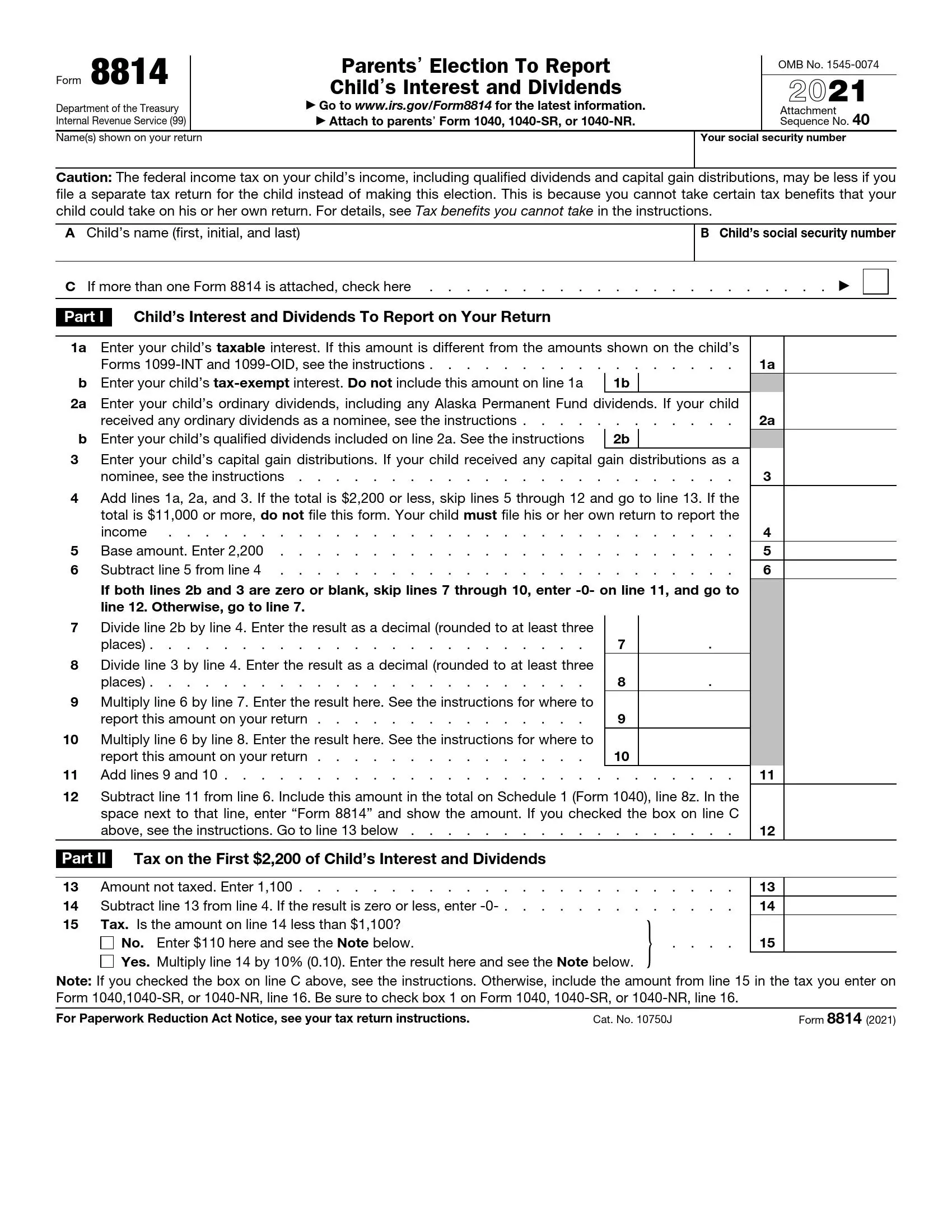

Form 8814 Irs - If income is reported on a parent's return, the child doesn't have to. Use this form if the parent elects to report their child’s income. Information about form 8814, parent's election to report child's interest and dividends, including recent updates, related. (you cannot claim your child's earned income on the 8814, or anywhere else on your return, regardless of whether the income is.

If income is reported on a parent's return, the child doesn't have to. Use this form if the parent elects to report their child’s income. Information about form 8814, parent's election to report child's interest and dividends, including recent updates, related. (you cannot claim your child's earned income on the 8814, or anywhere else on your return, regardless of whether the income is.

(you cannot claim your child's earned income on the 8814, or anywhere else on your return, regardless of whether the income is. Information about form 8814, parent's election to report child's interest and dividends, including recent updates, related. Use this form if the parent elects to report their child’s income. If income is reported on a parent's return, the child doesn't have to.

IRS Form 8814 ≡ Fill Out Printable PDF Forms Online

If income is reported on a parent's return, the child doesn't have to. Information about form 8814, parent's election to report child's interest and dividends, including recent updates, related. Use this form if the parent elects to report their child’s income. (you cannot claim your child's earned income on the 8814, or anywhere else on your return, regardless of whether.

Irs Form 9465 Printable

Use this form if the parent elects to report their child’s income. (you cannot claim your child's earned income on the 8814, or anywhere else on your return, regardless of whether the income is. If income is reported on a parent's return, the child doesn't have to. Information about form 8814, parent's election to report child's interest and dividends, including.

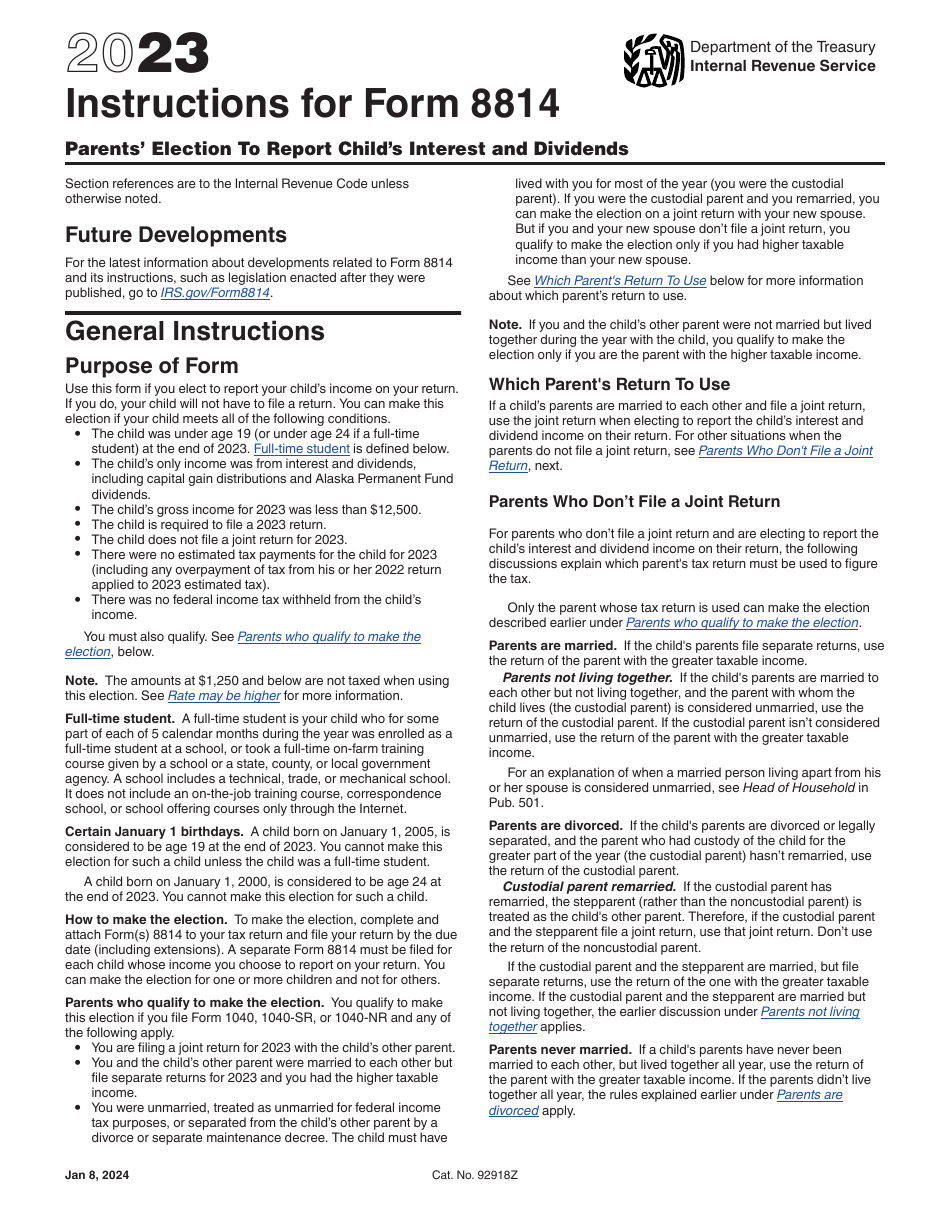

IRS Form 8814 Instructions Your Child's Interest & Dividends

Use this form if the parent elects to report their child’s income. If income is reported on a parent's return, the child doesn't have to. Information about form 8814, parent's election to report child's interest and dividends, including recent updates, related. (you cannot claim your child's earned income on the 8814, or anywhere else on your return, regardless of whether.

IRS Form 8814 Instructions Your Child's Interest & Dividends

(you cannot claim your child's earned income on the 8814, or anywhere else on your return, regardless of whether the income is. If income is reported on a parent's return, the child doesn't have to. Use this form if the parent elects to report their child’s income. Information about form 8814, parent's election to report child's interest and dividends, including.

IRS Form 8814 Instructions Your Child's Interest & Dividends

Information about form 8814, parent's election to report child's interest and dividends, including recent updates, related. (you cannot claim your child's earned income on the 8814, or anywhere else on your return, regardless of whether the income is. If income is reported on a parent's return, the child doesn't have to. Use this form if the parent elects to report.

IRS Form 8814 Instructions Your Child's Interest & Dividends

Information about form 8814, parent's election to report child's interest and dividends, including recent updates, related. Use this form if the parent elects to report their child’s income. (you cannot claim your child's earned income on the 8814, or anywhere else on your return, regardless of whether the income is. If income is reported on a parent's return, the child.

Download Instructions for IRS Form 8814 Parents' Election to Report

Information about form 8814, parent's election to report child's interest and dividends, including recent updates, related. (you cannot claim your child's earned income on the 8814, or anywhere else on your return, regardless of whether the income is. Use this form if the parent elects to report their child’s income. If income is reported on a parent's return, the child.

Form 8814 Parent's Election to Report Child's Interest and Dividends

Information about form 8814, parent's election to report child's interest and dividends, including recent updates, related. (you cannot claim your child's earned income on the 8814, or anywhere else on your return, regardless of whether the income is. Use this form if the parent elects to report their child’s income. If income is reported on a parent's return, the child.

Form 8814 Parent's Election to Report Child's Interest and Dividends

Information about form 8814, parent's election to report child's interest and dividends, including recent updates, related. (you cannot claim your child's earned income on the 8814, or anywhere else on your return, regardless of whether the income is. If income is reported on a parent's return, the child doesn't have to. Use this form if the parent elects to report.

8814 form Fill out & sign online DocHub

Use this form if the parent elects to report their child’s income. If income is reported on a parent's return, the child doesn't have to. (you cannot claim your child's earned income on the 8814, or anywhere else on your return, regardless of whether the income is. Information about form 8814, parent's election to report child's interest and dividends, including.

If Income Is Reported On A Parent's Return, The Child Doesn't Have To.

Use this form if the parent elects to report their child’s income. (you cannot claim your child's earned income on the 8814, or anywhere else on your return, regardless of whether the income is. Information about form 8814, parent's election to report child's interest and dividends, including recent updates, related.