Form 8949 Exception To Reporting - If both exceptions apply, you can use both. You can attach an acceptable statement to form 8949, sales and other dispositions of capital assets instead of reporting each transaction. There are 2 exceptions to filing form 8949. This article will help to report multiple disposition items without entering each one separately in the individual module, such as a. To report amounts directly on schedule d, transactions. Covered activities (showing basis on the 1099b) only need to be. You can send in a form 8949 listing each and every trade or a substitute schedule that conforms to the form 8949 in terms of reporting. You should be aware that your schedule d category box a or box d sales without adjustments do. Make sure it's ok to bypass form 8949.

You can attach an acceptable statement to form 8949, sales and other dispositions of capital assets instead of reporting each transaction. You should be aware that your schedule d category box a or box d sales without adjustments do. This article will help to report multiple disposition items without entering each one separately in the individual module, such as a. To report amounts directly on schedule d, transactions. If both exceptions apply, you can use both. Covered activities (showing basis on the 1099b) only need to be. You can send in a form 8949 listing each and every trade or a substitute schedule that conforms to the form 8949 in terms of reporting. There are 2 exceptions to filing form 8949. Make sure it's ok to bypass form 8949.

Covered activities (showing basis on the 1099b) only need to be. You can send in a form 8949 listing each and every trade or a substitute schedule that conforms to the form 8949 in terms of reporting. To report amounts directly on schedule d, transactions. This article will help to report multiple disposition items without entering each one separately in the individual module, such as a. There are 2 exceptions to filing form 8949. If both exceptions apply, you can use both. You should be aware that your schedule d category box a or box d sales without adjustments do. You can attach an acceptable statement to form 8949, sales and other dispositions of capital assets instead of reporting each transaction. Make sure it's ok to bypass form 8949.

Need To Report Cryptocurrency On Your Taxes? Here's How To Use Form

You should be aware that your schedule d category box a or box d sales without adjustments do. If both exceptions apply, you can use both. You can attach an acceptable statement to form 8949, sales and other dispositions of capital assets instead of reporting each transaction. Make sure it's ok to bypass form 8949. To report amounts directly on.

Free Fillable Copy Of Irs Form 8949 Printable Forms Free Online

Make sure it's ok to bypass form 8949. To report amounts directly on schedule d, transactions. Covered activities (showing basis on the 1099b) only need to be. You can send in a form 8949 listing each and every trade or a substitute schedule that conforms to the form 8949 in terms of reporting. You can attach an acceptable statement to.

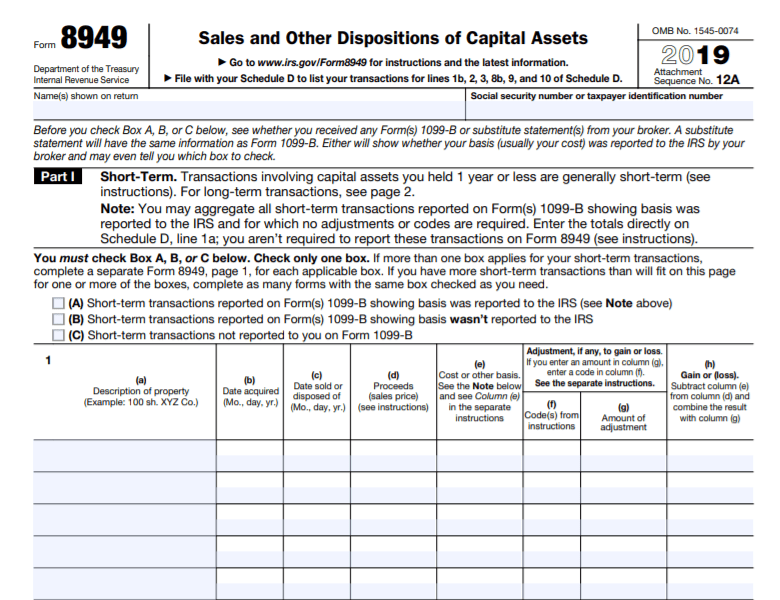

IRS Form 8949 & Schedule D for Traders TradeLog

If both exceptions apply, you can use both. This article will help to report multiple disposition items without entering each one separately in the individual module, such as a. Covered activities (showing basis on the 1099b) only need to be. You should be aware that your schedule d category box a or box d sales without adjustments do. There are.

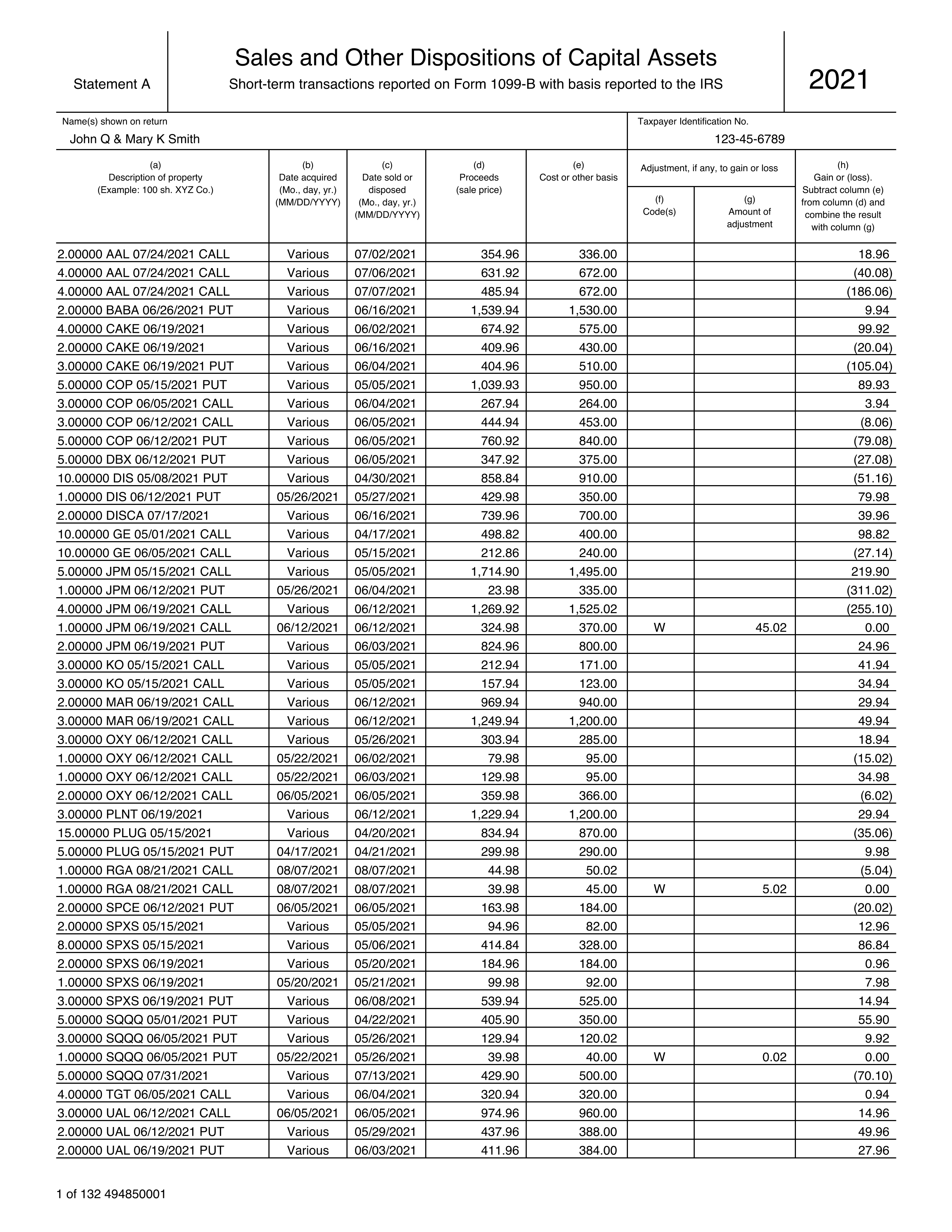

Explanation of IRS Form 8949 Exception 2

To report amounts directly on schedule d, transactions. This article will help to report multiple disposition items without entering each one separately in the individual module, such as a. You can attach an acceptable statement to form 8949, sales and other dispositions of capital assets instead of reporting each transaction. Covered activities (showing basis on the 1099b) only need to.

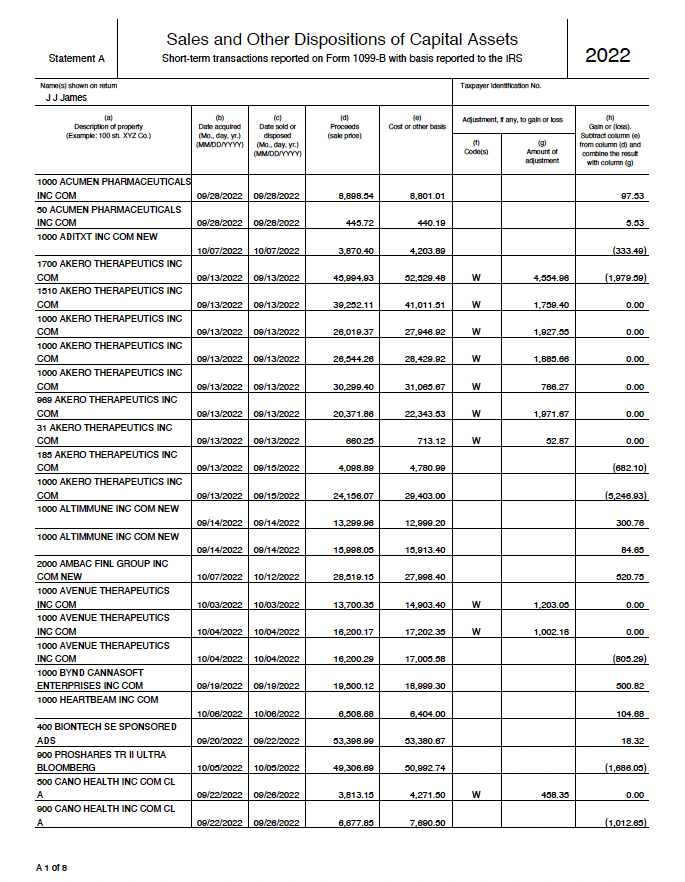

IRS Form 8949 for 2022 📝 Instructions for 8949 Tax Form Printable PDF

This article will help to report multiple disposition items without entering each one separately in the individual module, such as a. Make sure it's ok to bypass form 8949. If both exceptions apply, you can use both. Covered activities (showing basis on the 1099b) only need to be. There are 2 exceptions to filing form 8949.

IRS Form 8949 Instructions

Covered activities (showing basis on the 1099b) only need to be. Make sure it's ok to bypass form 8949. To report amounts directly on schedule d, transactions. You can attach an acceptable statement to form 8949, sales and other dispositions of capital assets instead of reporting each transaction. You can send in a form 8949 listing each and every trade.

8949 Form 2016 Fill Online, Printable, Fillable, Blank pdfFiller

If both exceptions apply, you can use both. There are 2 exceptions to filing form 8949. Make sure it's ok to bypass form 8949. You can send in a form 8949 listing each and every trade or a substitute schedule that conforms to the form 8949 in terms of reporting. You can attach an acceptable statement to form 8949, sales.

What is the IRS Form 8949 and Do You Need It? The Handy Tax Guy

You can send in a form 8949 listing each and every trade or a substitute schedule that conforms to the form 8949 in terms of reporting. There are 2 exceptions to filing form 8949. If both exceptions apply, you can use both. Covered activities (showing basis on the 1099b) only need to be. To report amounts directly on schedule d,.

Form 8949 2023 Printable Forms Free Online

There are 2 exceptions to filing form 8949. This article will help to report multiple disposition items without entering each one separately in the individual module, such as a. Make sure it's ok to bypass form 8949. To report amounts directly on schedule d, transactions. You can send in a form 8949 listing each and every trade or a substitute.

Form 8949 Exception 2 When Electronically Filing Form 1040

Covered activities (showing basis on the 1099b) only need to be. If both exceptions apply, you can use both. You can send in a form 8949 listing each and every trade or a substitute schedule that conforms to the form 8949 in terms of reporting. This article will help to report multiple disposition items without entering each one separately in.

This Article Will Help To Report Multiple Disposition Items Without Entering Each One Separately In The Individual Module, Such As A.

You can attach an acceptable statement to form 8949, sales and other dispositions of capital assets instead of reporting each transaction. Make sure it's ok to bypass form 8949. You should be aware that your schedule d category box a or box d sales without adjustments do. There are 2 exceptions to filing form 8949.

If Both Exceptions Apply, You Can Use Both.

Covered activities (showing basis on the 1099b) only need to be. To report amounts directly on schedule d, transactions. You can send in a form 8949 listing each and every trade or a substitute schedule that conforms to the form 8949 in terms of reporting.

:max_bytes(150000):strip_icc()/Form8949IRS2022-c2328904f30a4929b7e69d11e8caf51b.jpg)