Form 8949 Home Sale Example - Report the sale or exchange of your main home on form 8949, sale and other dispositions of capital assets, if: If you sell real estate, you have to report the gain or loss on the sale to the irs. Form 8949 has two parts: Use form 8949 to report sales and exchanges of capital assets. If you have stocks, your broker’s 1099 should provide all of the necessary information. If you have more than one home, you can exclude gain only from the sale of your. Filling out form 8949 may take a little time, but it isn’t a complex form to fill out. You must report the gain on form 8949 and also on schedule d of your form 1040. Before you get started on your schedule d form (used to file your capital gains), you must fill out a form 8949.

Form 8949 has two parts: Filling out form 8949 may take a little time, but it isn’t a complex form to fill out. If you sell real estate, you have to report the gain or loss on the sale to the irs. Use form 8949 to report sales and exchanges of capital assets. If you have more than one home, you can exclude gain only from the sale of your. If you have stocks, your broker’s 1099 should provide all of the necessary information. Before you get started on your schedule d form (used to file your capital gains), you must fill out a form 8949. You must report the gain on form 8949 and also on schedule d of your form 1040. Report the sale or exchange of your main home on form 8949, sale and other dispositions of capital assets, if:

Before you get started on your schedule d form (used to file your capital gains), you must fill out a form 8949. You must report the gain on form 8949 and also on schedule d of your form 1040. If you sell real estate, you have to report the gain or loss on the sale to the irs. Use form 8949 to report sales and exchanges of capital assets. If you have stocks, your broker’s 1099 should provide all of the necessary information. Filling out form 8949 may take a little time, but it isn’t a complex form to fill out. Report the sale or exchange of your main home on form 8949, sale and other dispositions of capital assets, if: If you have more than one home, you can exclude gain only from the sale of your. Form 8949 has two parts:

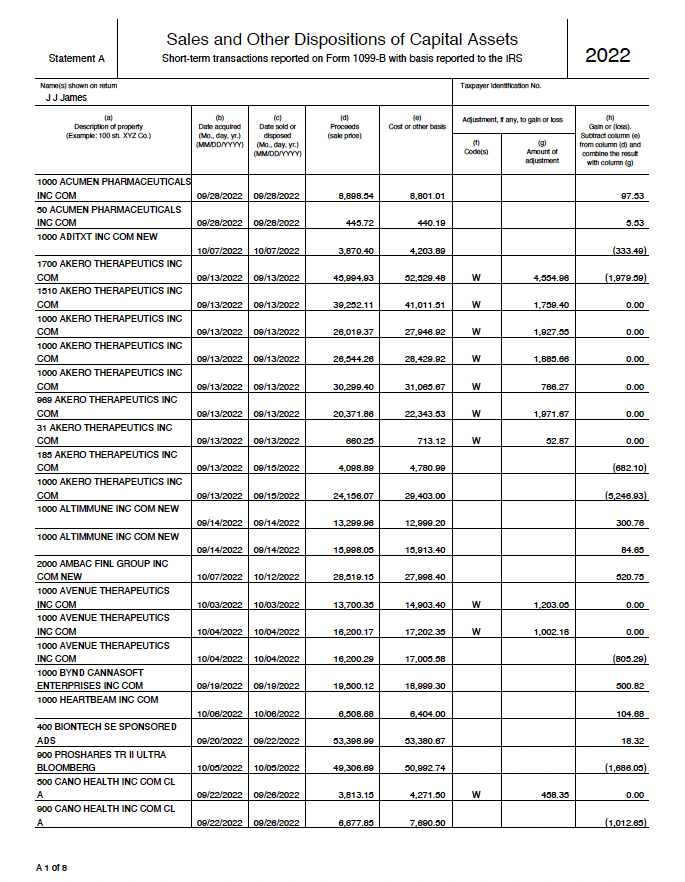

Tax Form 8949 Instructions for Reporting Capital Gains and Losses

If you sell real estate, you have to report the gain or loss on the sale to the irs. Filling out form 8949 may take a little time, but it isn’t a complex form to fill out. Form 8949 has two parts: Before you get started on your schedule d form (used to file your capital gains), you must fill.

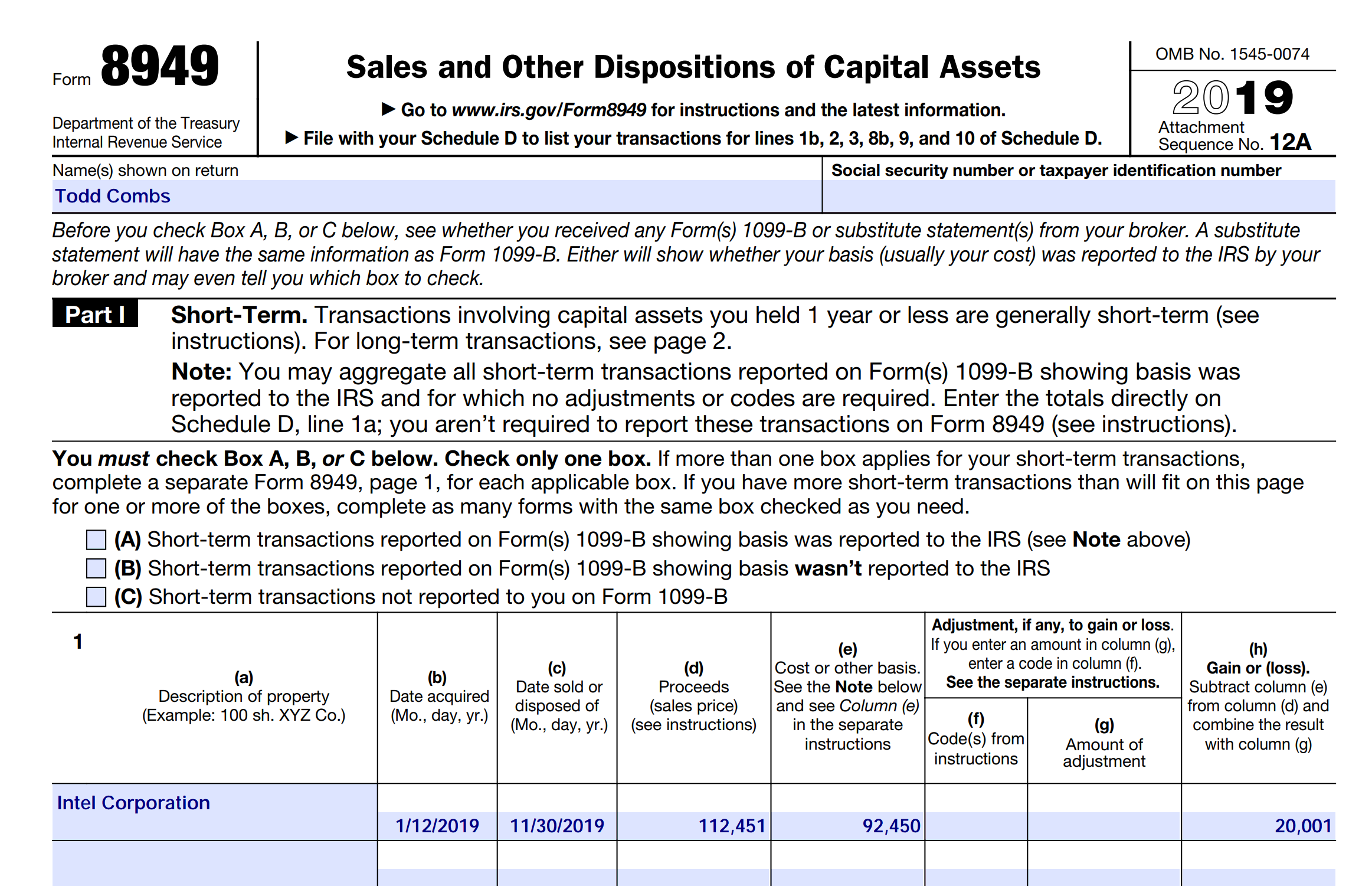

In the following Form 8949 example,the highlighted section below shows

If you have stocks, your broker’s 1099 should provide all of the necessary information. Form 8949 has two parts: Use form 8949 to report sales and exchanges of capital assets. If you have more than one home, you can exclude gain only from the sale of your. Report the sale or exchange of your main home on form 8949, sale.

IRS Form 8949 & Schedule D for Traders TradeLog

If you sell real estate, you have to report the gain or loss on the sale to the irs. If you have more than one home, you can exclude gain only from the sale of your. Report the sale or exchange of your main home on form 8949, sale and other dispositions of capital assets, if: Filling out form 8949.

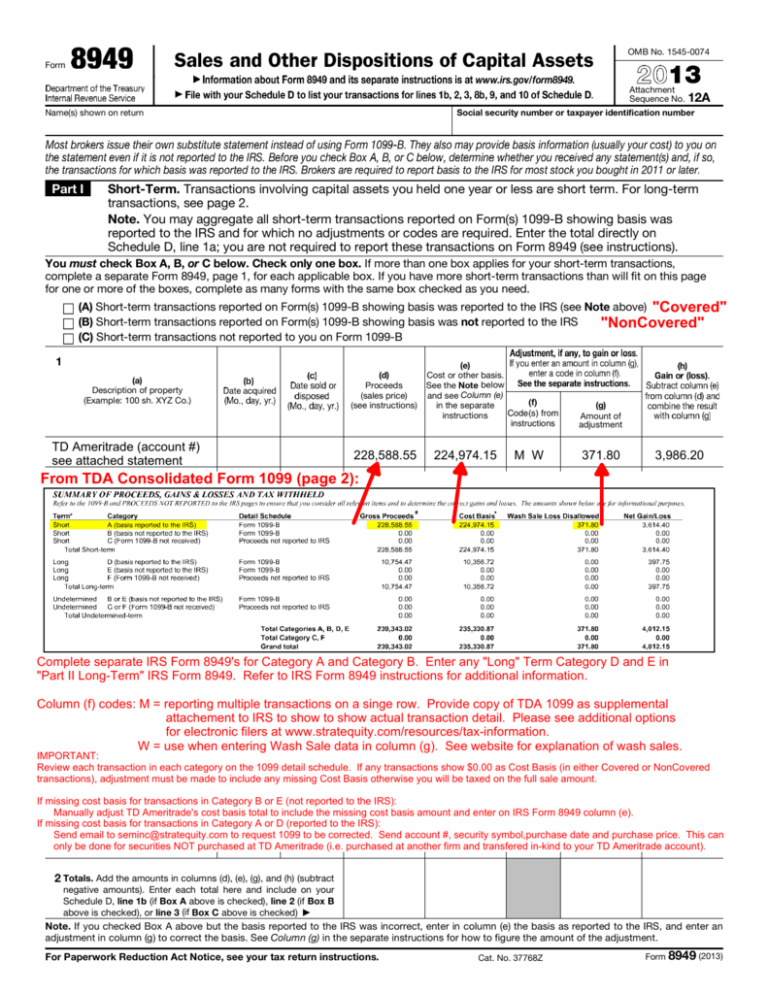

2016 8949 IRS Tax Form Released EquityStat Blog

Form 8949 has two parts: You must report the gain on form 8949 and also on schedule d of your form 1040. Use form 8949 to report sales and exchanges of capital assets. If you have stocks, your broker’s 1099 should provide all of the necessary information. If you sell real estate, you have to report the gain or loss.

IRS Form 8949 SAMPLE 2013

Form 8949 has two parts: If you have stocks, your broker’s 1099 should provide all of the necessary information. Filling out form 8949 may take a little time, but it isn’t a complex form to fill out. You must report the gain on form 8949 and also on schedule d of your form 1040. Use form 8949 to report sales.

Form 8949 Exception 2 When Electronically Filing Form 1040

Report the sale or exchange of your main home on form 8949, sale and other dispositions of capital assets, if: You must report the gain on form 8949 and also on schedule d of your form 1040. Form 8949 has two parts: If you have stocks, your broker’s 1099 should provide all of the necessary information. If you sell real.

Form 8949 Fillable and Editable Digital Blanks in PDF

If you have stocks, your broker’s 1099 should provide all of the necessary information. Report the sale or exchange of your main home on form 8949, sale and other dispositions of capital assets, if: Filling out form 8949 may take a little time, but it isn’t a complex form to fill out. If you sell real estate, you have to.

2016 form 8949 Fill out & sign online DocHub

Use form 8949 to report sales and exchanges of capital assets. You must report the gain on form 8949 and also on schedule d of your form 1040. Before you get started on your schedule d form (used to file your capital gains), you must fill out a form 8949. Report the sale or exchange of your main home on.

Free Fillable Copy Of Irs Form 8949 Printable Forms Free Online

Before you get started on your schedule d form (used to file your capital gains), you must fill out a form 8949. If you have stocks, your broker’s 1099 should provide all of the necessary information. You must report the gain on form 8949 and also on schedule d of your form 1040. Form 8949 has two parts: Report the.

File IRS Form 8949 to Report Your Capital Gains or Losses

Report the sale or exchange of your main home on form 8949, sale and other dispositions of capital assets, if: Use form 8949 to report sales and exchanges of capital assets. If you have more than one home, you can exclude gain only from the sale of your. Filling out form 8949 may take a little time, but it isn’t.

Form 8949 Has Two Parts:

If you have more than one home, you can exclude gain only from the sale of your. If you sell real estate, you have to report the gain or loss on the sale to the irs. Report the sale or exchange of your main home on form 8949, sale and other dispositions of capital assets, if: Filling out form 8949 may take a little time, but it isn’t a complex form to fill out.

You Must Report The Gain On Form 8949 And Also On Schedule D Of Your Form 1040.

Use form 8949 to report sales and exchanges of capital assets. If you have stocks, your broker’s 1099 should provide all of the necessary information. Before you get started on your schedule d form (used to file your capital gains), you must fill out a form 8949.