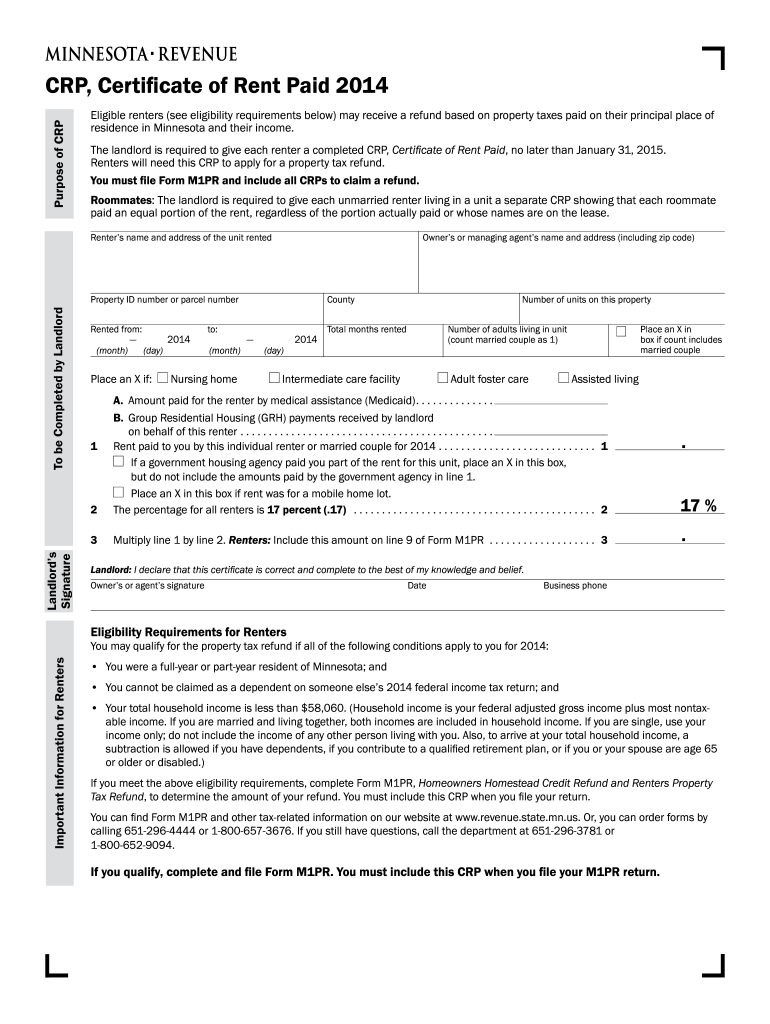

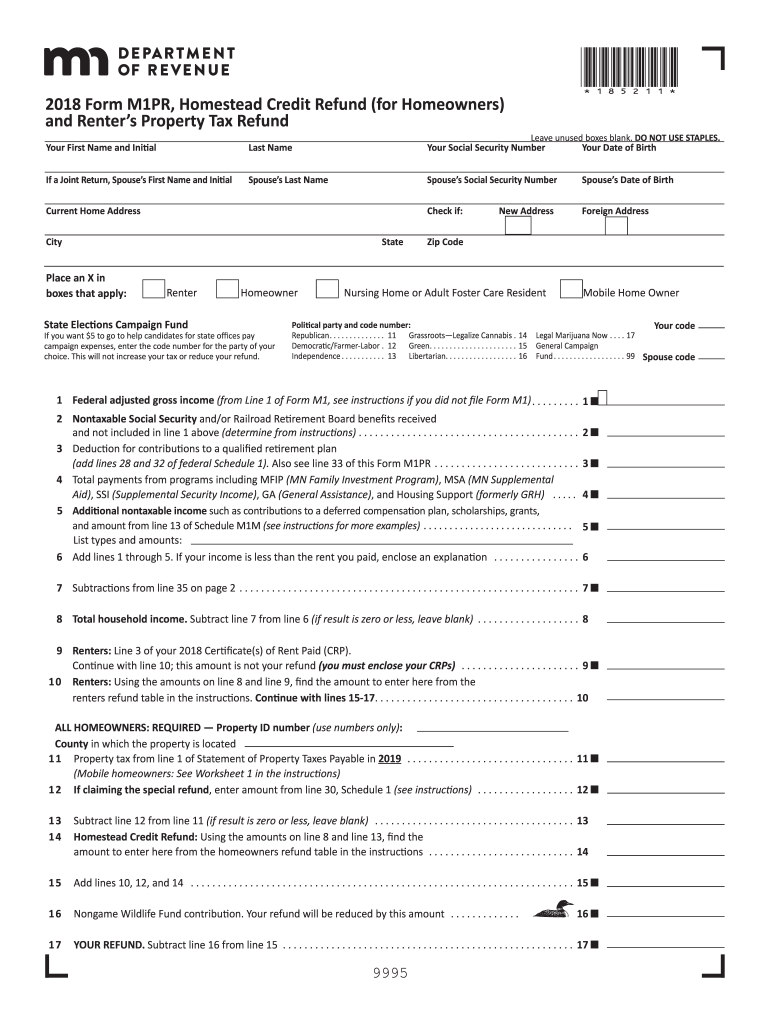

Form M1Pr Mn - What do i need to claim the refund? We'll make sure you qualify, calculate your minnesota. • a completed form m1pr, homestead credit refund (for homeowners) and renter’s property tax. You may be eligible for a refund based on your household income (see pages 8 and 9) and the property taxes or rent paid on your primary. If you are filing as a. Also, include nontaxable payments from the diver. Complete and send us form m1pr, homestead credit refund (for homeowners) and renter's property tax refund. Include nontaxable payments you received from programs listed on line 4 of form m1pr. Property taxes or rent paid on your primary residence in minnesota. Yes, you can file your m1pr when you prepare your minnesota taxes in turbotax.

If you are filing as a. I authorize the minnesota department of revenue to discuss this tax return with the preparer. We'll make sure you qualify, calculate your minnesota. Also, include nontaxable payments from the diver. Include nontaxable payments you received from programs listed on line 4 of form m1pr. Complete and send us form m1pr, homestead credit refund (for homeowners) and renter's property tax refund. Minnesota property tax refund, mail station. What do i need to claim the refund? Property taxes or rent paid on your primary residence in minnesota. Yes, you can file your m1pr when you prepare your minnesota taxes in turbotax.

Minnesota property tax refund, mail station. • a completed form m1pr, homestead credit refund (for homeowners) and renter’s property tax. What do i need to claim the refund? Yes, you can file your m1pr when you prepare your minnesota taxes in turbotax. Also, include nontaxable payments from the diver. If you are filing as a. I authorize the minnesota department of revenue to discuss this tax return with the preparer. You may be eligible for a refund based on your household income (see pages 8 and 9) and the property taxes or rent paid on your primary. Complete and send us form m1pr, homestead credit refund (for homeowners) and renter's property tax refund. Property taxes or rent paid on your primary residence in minnesota.

Fillable Form Arizona Dept Of Revenue Form 600a Printable Forms Free

Complete and send us form m1pr, homestead credit refund (for homeowners) and renter's property tax refund. Include nontaxable payments you received from programs listed on line 4 of form m1pr. You may be eligible for a refund based on your household income (see pages 8 and 9) and the property taxes or rent paid on your primary. I authorize the.

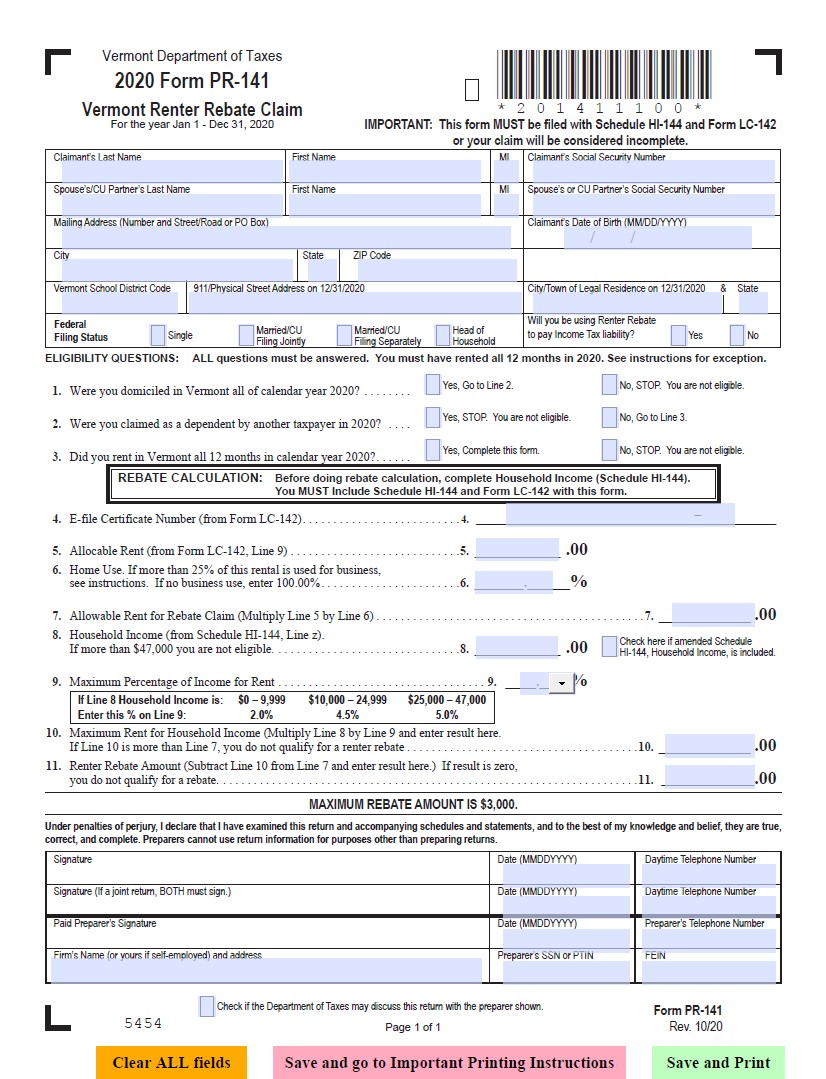

What Kind of MN Renters Rebate Form Can People Enjoy?

You may be eligible for a refund based on your household income (see pages 8 and 9) and the property taxes or rent paid on your primary. Also, include nontaxable payments from the diver. I authorize the minnesota department of revenue to discuss this tax return with the preparer. • a completed form m1pr, homestead credit refund (for homeowners) and.

Download Instructions for Form M1PR Schedule M1PRAI PDF, 2023

Minnesota property tax refund, mail station. We'll make sure you qualify, calculate your minnesota. Include nontaxable payments you received from programs listed on line 4 of form m1pr. If you are filing as a. • a completed form m1pr, homestead credit refund (for homeowners) and renter’s property tax.

Mn M1Pr Form ≡ Fill Out Printable PDF Forms Online

Also, include nontaxable payments from the diver. You may be eligible for a refund based on your household income (see pages 8 and 9) and the property taxes or rent paid on your primary. Include nontaxable payments you received from programs listed on line 4 of form m1pr. Property taxes or rent paid on your primary residence in minnesota. Complete.

Mn Property Tax Refund 2024 Date Hatty Kordula

• a completed form m1pr, homestead credit refund (for homeowners) and renter’s property tax. Yes, you can file your m1pr when you prepare your minnesota taxes in turbotax. If you are filing as a. What do i need to claim the refund? You may be eligible for a refund based on your household income (see pages 8 and 9) and.

How to Get TAX Refund from FBR Method to Get Refundable Tax

What do i need to claim the refund? You may be eligible for a refund based on your household income (see pages 8 and 9) and the property taxes or rent paid on your primary. Minnesota property tax refund, mail station. Include nontaxable payments you received from programs listed on line 4 of form m1pr. If you are filing as.

MN Schedule M15 20202022 Fill out Tax Template Online US Legal Forms

• a completed form m1pr, homestead credit refund (for homeowners) and renter’s property tax. We'll make sure you qualify, calculate your minnesota. You may be eligible for a refund based on your household income (see pages 8 and 9) and the property taxes or rent paid on your primary. Complete and send us form m1pr, homestead credit refund (for homeowners).

2014 Form MN DoR M1PR Fill Online Printable Fillable Blank PdfFiller

If you are filing as a. You may be eligible for a refund based on your household income (see pages 8 and 9) and the property taxes or rent paid on your primary. Yes, you can file your m1pr when you prepare your minnesota taxes in turbotax. Minnesota property tax refund, mail station. I authorize the minnesota department of revenue.

Mn Property Tax Refund 20182024 Form Fill Out and Sign Printable PDF

Yes, you can file your m1pr when you prepare your minnesota taxes in turbotax. If you are filing as a. Complete and send us form m1pr, homestead credit refund (for homeowners) and renter's property tax refund. You may be eligible for a refund based on your household income (see pages 8 and 9) and the property taxes or rent paid.

2016 Form MN DoR M1PR Fill Online, Printable, Fillable, Blank pdfFiller

We'll make sure you qualify, calculate your minnesota. What do i need to claim the refund? Yes, you can file your m1pr when you prepare your minnesota taxes in turbotax. If you are filing as a. You may be eligible for a refund based on your household income (see pages 8 and 9) and the property taxes or rent paid.

Also, Include Nontaxable Payments From The Diver.

Yes, you can file your m1pr when you prepare your minnesota taxes in turbotax. What do i need to claim the refund? Minnesota property tax refund, mail station. Property taxes or rent paid on your primary residence in minnesota.

You May Be Eligible For A Refund Based On Your Household Income (See Pages 8 And 9) And The Property Taxes Or Rent Paid On Your Primary.

Include nontaxable payments you received from programs listed on line 4 of form m1pr. Complete and send us form m1pr, homestead credit refund (for homeowners) and renter's property tax refund. If you are filing as a. We'll make sure you qualify, calculate your minnesota.

• A Completed Form M1Pr, Homestead Credit Refund (For Homeowners) And Renter’s Property Tax.

I authorize the minnesota department of revenue to discuss this tax return with the preparer.