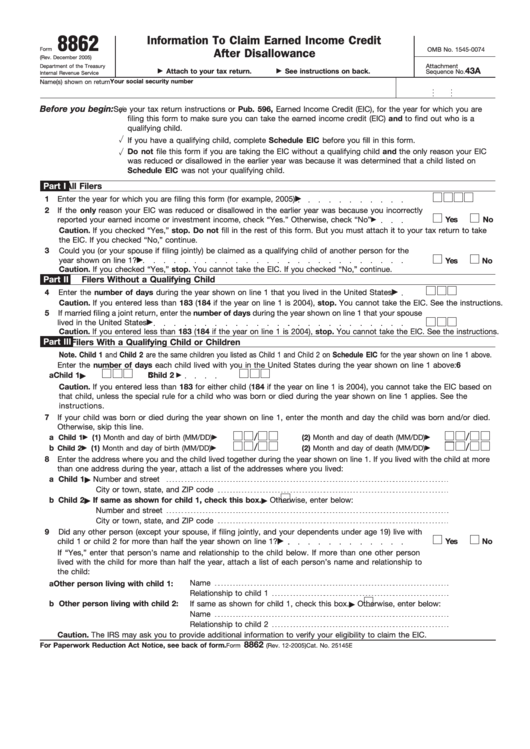

How Do I Get A 8862 Form - You can find tax form. Sign in to your account and open your return. Select federal from the left side menu. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit. Here's how to file form 8862 in turbotax. Here is how to add form 8862 to your tax return. Once the penalty expires, you’ll need to file form 8862 along with your irs tax return in order to reclaim these credits. Taxpayers complete form 8862 and attach it to their tax return if: Form 8862, information to claim earned income credit (eic) after disallowance has been expanded to include the child tax credit (ctc), additional. You must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following criteria.

Taxpayers complete form 8862 and attach it to their tax return if: Here's how to file form 8862 in turbotax. Form 8862, information to claim earned income credit (eic) after disallowance has been expanded to include the child tax credit (ctc), additional. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit. Sign in to your account and open your return. Select federal from the left side menu. You must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following criteria. Here is how to add form 8862 to your tax return. Once the penalty expires, you’ll need to file form 8862 along with your irs tax return in order to reclaim these credits. Open or continue your return.

Select federal from the left side menu. You can find tax form. Form 8862, information to claim earned income credit (eic) after disallowance has been expanded to include the child tax credit (ctc), additional. Sign in to your account and open your return. You must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following criteria. Open or continue your return. Taxpayers complete form 8862 and attach it to their tax return if: Here is how to add form 8862 to your tax return. Here's how to file form 8862 in turbotax. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit.

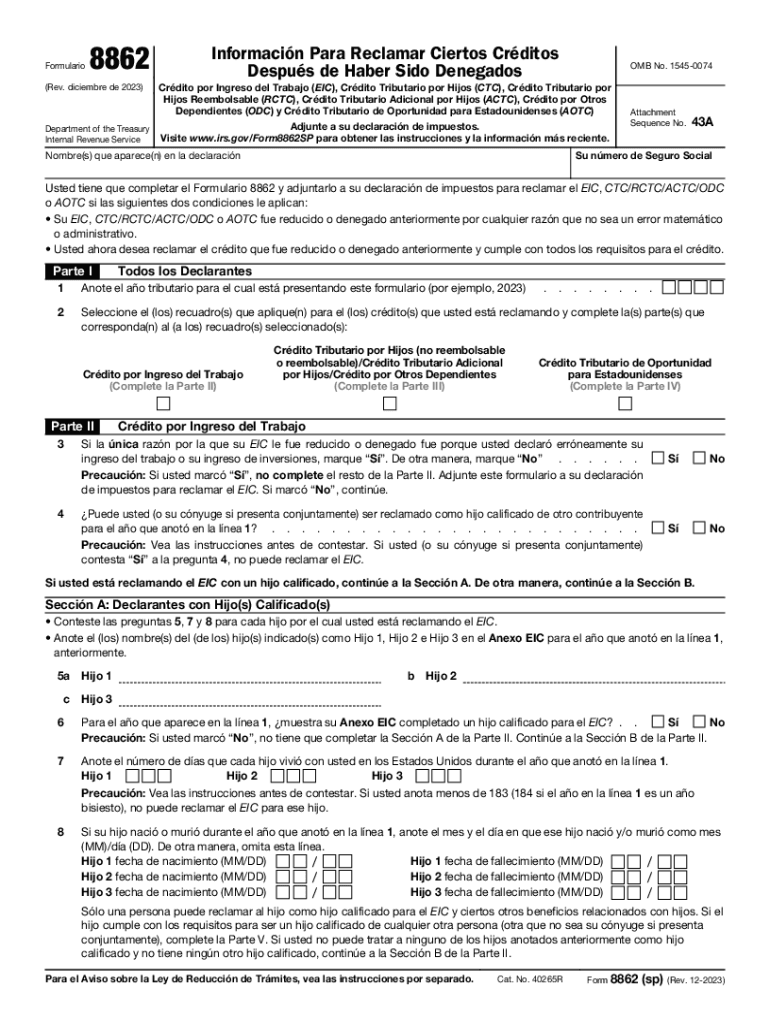

Form 8862 Sp Rev December Information to Claim Earned Credit

Once the penalty expires, you’ll need to file form 8862 along with your irs tax return in order to reclaim these credits. Here's how to file form 8862 in turbotax. Sign in to your account and open your return. Taxpayers complete form 8862 and attach it to their tax return if: You must complete form 8862 and attach it to.

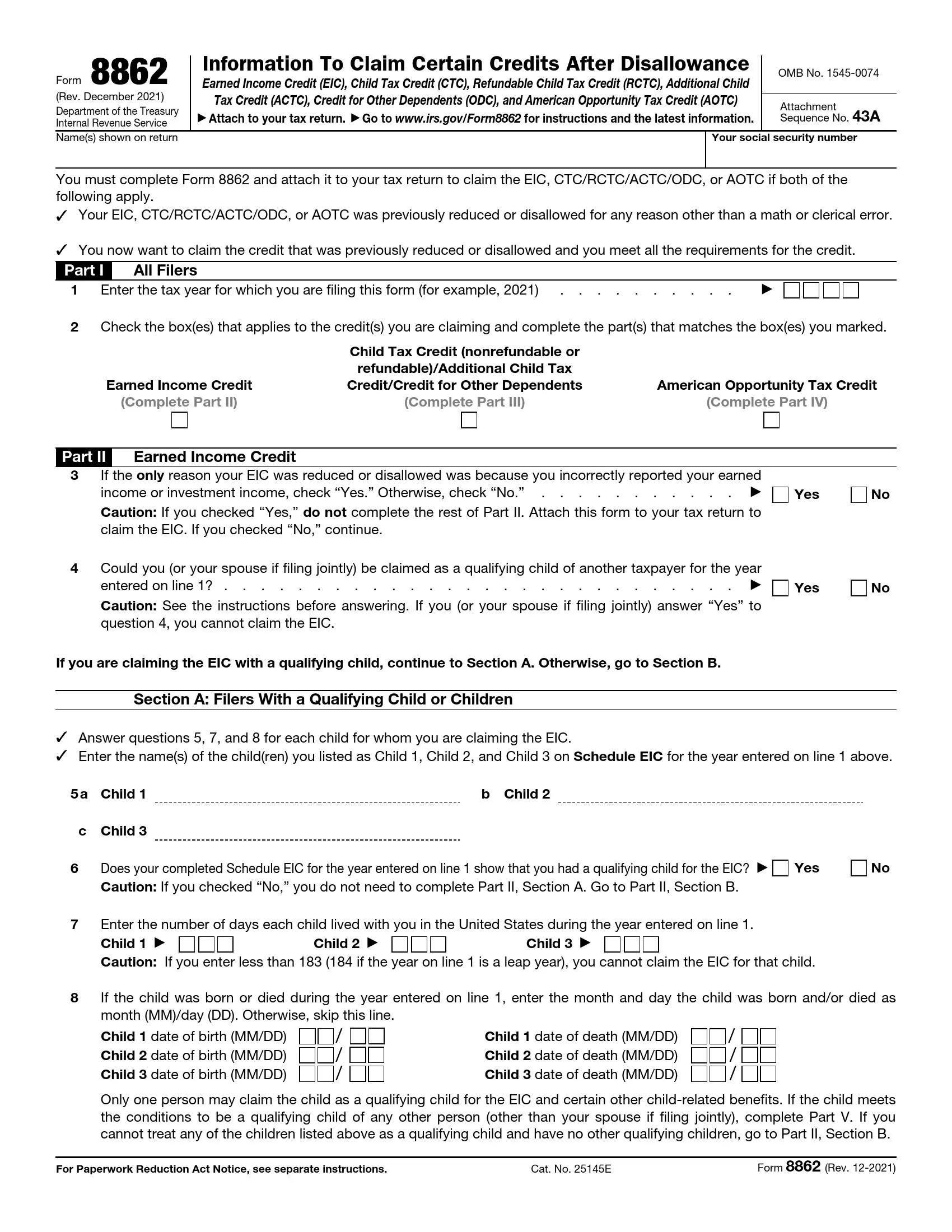

Printable 8862 Form Printable Forms Free Online

Taxpayers complete form 8862 and attach it to their tax return if: Form 8862, information to claim earned income credit (eic) after disallowance has been expanded to include the child tax credit (ctc), additional. You can find tax form. Select federal from the left side menu. Here's how to file form 8862 in turbotax.

Irs Form 8862 Printable Master of Documents

You can find tax form. Select federal from the left side menu. Sign in to your account and open your return. Form 8862, information to claim earned income credit (eic) after disallowance has been expanded to include the child tax credit (ctc), additional. Open or continue your return.

IRS Form 8862 Diagram Quizlet

You must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following criteria. Select federal from the left side menu. Once the penalty expires, you’ll need to file form 8862 along with your irs tax return in order to reclaim these credits. Open or continue.

IRS Form 8862 walkthrough (Information to Claim Certain Credits After

Form 8862, information to claim earned income credit (eic) after disallowance has been expanded to include the child tax credit (ctc), additional. Here is how to add form 8862 to your tax return. Open or continue your return. Sign in to your account and open your return. Select federal from the left side menu.

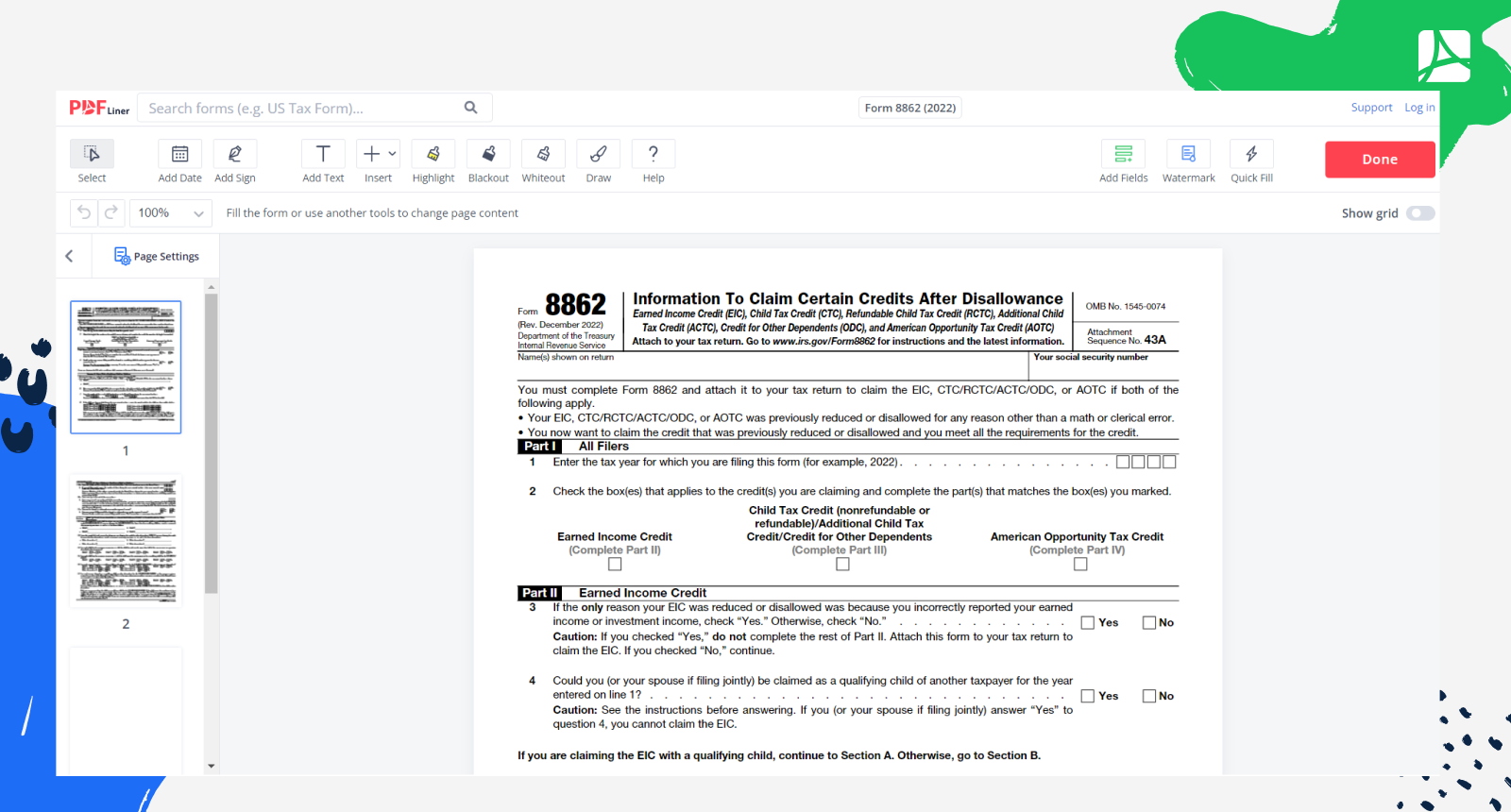

Form 8862 IRS Form 8862 PDF blank, sign forms online — PDFliner

Open or continue your return. Sign in to your account and open your return. Form 8862, information to claim earned income credit (eic) after disallowance has been expanded to include the child tax credit (ctc), additional. Here's how to file form 8862 in turbotax. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit.

IRS Form 8862 ≡ Fill Out Printable PDF Forms Online

Once the penalty expires, you’ll need to file form 8862 along with your irs tax return in order to reclaim these credits. Taxpayers complete form 8862 and attach it to their tax return if: Sign in to your account and open your return. Here's how to file form 8862 in turbotax. Form 8862, information to claim earned income credit (eic).

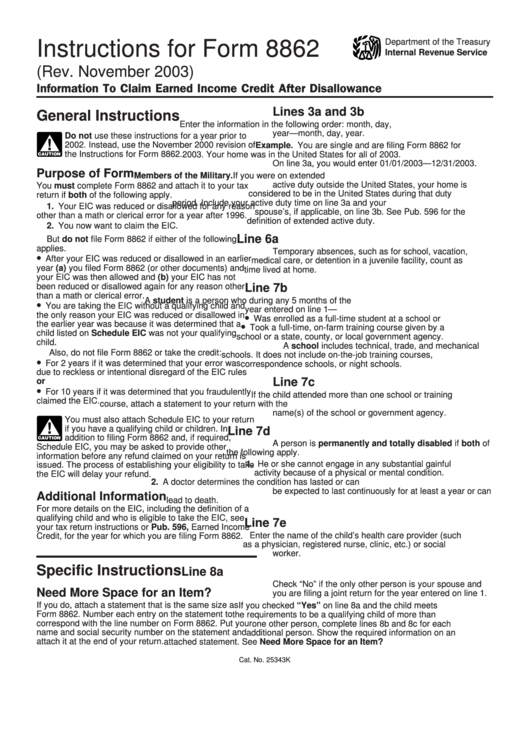

Instructions For Form 8862 Information To Claim Earned Credit

Form 8862, information to claim earned income credit (eic) after disallowance has been expanded to include the child tax credit (ctc), additional. Once the penalty expires, you’ll need to file form 8862 along with your irs tax return in order to reclaim these credits. Select federal from the left side menu. Their earned income credit (eic), child tax credit (ctc)/additional.

Irs Form 8862 Printable Printable Forms Free Online

Here's how to file form 8862 in turbotax. Sign in to your account and open your return. Here is how to add form 8862 to your tax return. Select federal from the left side menu. Taxpayers complete form 8862 and attach it to their tax return if:

Form 8862Information to Claim Earned Credit for Disallowance

You must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following criteria. You can find tax form. Sign in to your account and open your return. Here is how to add form 8862 to your tax return. Form 8862, information to claim earned income.

Here Is How To Add Form 8862 To Your Tax Return.

Open or continue your return. Taxpayers complete form 8862 and attach it to their tax return if: Form 8862, information to claim earned income credit (eic) after disallowance has been expanded to include the child tax credit (ctc), additional. You can find tax form.

Sign In To Your Account And Open Your Return.

You must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following criteria. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit. Select federal from the left side menu. Here's how to file form 8862 in turbotax.