Income Tax Calculator - Median household income (adjusted for inflation) in 2023 was $77,719. Customize using your filing status, deductions, exemptions and more. We use your income & location to estimate your total tax burden. Calculate your 2019 federal, state and local taxes with our free income tax calculator. Find out how much you'll pay in illinois state income taxes given your annual income. Customize using your filing status, deductions, exemptions and more. Find out how much you'll pay in florida state income taxes given your annual income. Federal income tax rates range from 10% up to a top marginal rate of 37%. Calculate your federal, state and local taxes for the current filing year with our free income tax calculator. Customize using your filing status, deductions, exemptions and more.

Use smartasset's tax return calculator to see how your income, withholdings, deductions and credits impact your tax refund or balance due amount. Enter your income and location to estimate your tax burden. Customize using your filing status, deductions, exemptions and more. Calculate your 2019 federal, state and local taxes with our free income tax calculator. This calculator is updated with rates, brackets and. Customize using your filing status, deductions, exemptions and more. Find out how much you'll pay in california state income taxes given your annual income. Calculate your federal, state and local taxes for the current filing year with our free income tax calculator. Find out how much you'll pay in michigan state income taxes given your annual income. States don't impose their own income tax.

This calculator is updated with rates, brackets and. States don't impose their own income tax. Customize using your filing status, deductions, exemptions and more. We use your income & location to estimate your total tax burden. Federal income tax rates range from 10% up to a top marginal rate of 37%. Calculate your 2019 federal, state and local taxes with our free income tax calculator. Find out how much you'll pay in florida state income taxes given your annual income. Next, from agi we subtract exemptions. Find out how much you'll pay in colorado state income taxes given your annual income. Customize using your filing status, deductions, exemptions and more.

Tax Calculation Sheet with Excel Calculator PO TOOLS

Federal income tax rates range from 10% up to a top marginal rate of 37%. Customize using your filing status, deductions, exemptions and more. Customize using your filing status, deductions, exemptions and more. We use your income & location to estimate your total tax burden. Find out how much you'll pay in florida state income taxes given your annual income.

Tax Calculator

This calculator is updated with rates, brackets and. We use your income & location to estimate your total tax burden. Find out how much you'll pay in michigan state income taxes given your annual income. Find out how much you'll pay in florida state income taxes given your annual income. Customize using your filing status, deductions, exemptions and more.

18+ Oklahoma Salary Calculator JordanAriane

We use your income & location to estimate your total tax burden. Customize using your filing status, deductions, exemptions and more. Median household income (adjusted for inflation) in 2023 was $77,719. Use smartasset's tax return calculator to see how your income, withholdings, deductions and credits impact your tax refund or balance due amount. Find out how much you'll pay in.

Tax Calculator 202324 Want to Calculate Your Personal

Use smartasset's tax return calculator to see how your income, withholdings, deductions and credits impact your tax refund or balance due amount. First, we calculate your adjusted gross income (agi) by taking your total household income and reducing it by certain items such as contributions to your 401(k). Enter your income and location to estimate your tax burden. States don't.

FREE 12+ Sample Tax Calculator Templates in PDF

Customize using your filing status, deductions, exemptions and more. Find out how much you'll pay in colorado state income taxes given your annual income. Find out how much you'll pay in illinois state income taxes given your annual income. This calculator is updated with rates, brackets and. Median household income (adjusted for inflation) in 2023 was $77,719.

Tax Calculator Ay 2023 24 Excel For Government Salaried

Enter your income and location to estimate your tax burden. Customize using your filing status, deductions, exemptions and more. Calculate your federal, state and local taxes for the current filing year with our free income tax calculator. Use smartasset's tax return calculator to see how your income, withholdings, deductions and credits impact your tax refund or balance due amount. Median.

Free of Charge Creative Commons tax calculator Image Financial 14

Find out how much you'll pay in colorado state income taxes given your annual income. This calculator is updated with rates, brackets and. Find out how much you'll pay in michigan state income taxes given your annual income. Calculate your 2019 federal, state and local taxes with our free income tax calculator. Customize using your filing status, deductions, exemptions and.

Excel Tax Calculator How To Make Tax SexiezPix Web Porn

Median household income (adjusted for inflation) in 2023 was $77,719. Find out how much you'll pay in florida state income taxes given your annual income. Use smartasset's tax return calculator to see how your income, withholdings, deductions and credits impact your tax refund or balance due amount. Find out how much you'll pay in michigan state income taxes given your.

Tax Calculator For Fy 2021 Tax Withholding Estimator 2021

Next, from agi we subtract exemptions. Customize using your filing status, deductions, exemptions and more. This calculator is updated with rates, brackets and. Calculate your federal, state and local taxes for the current filing year with our free income tax calculator. Find out how much you'll pay in michigan state income taxes given your annual income.

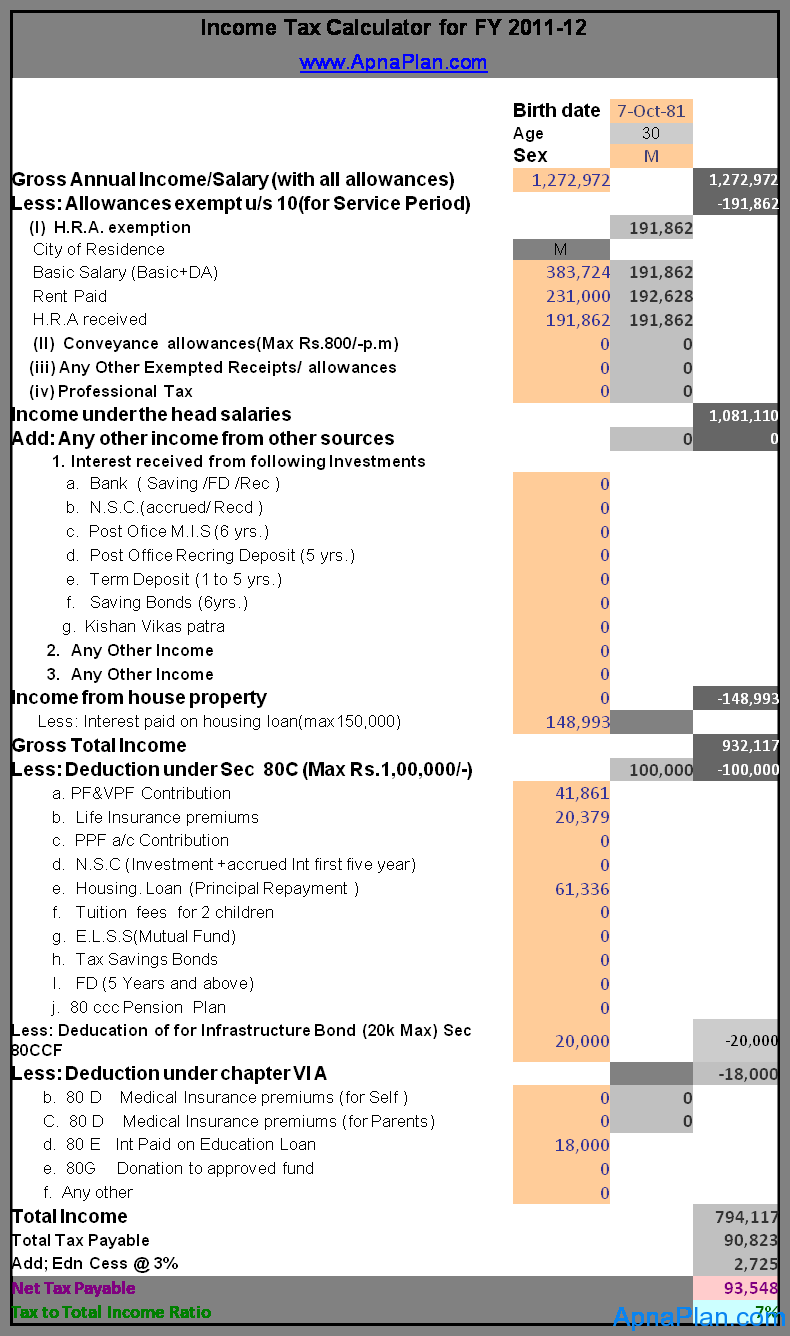

Tax Calculator for FY 201112 (Excel Download)

Median household income (adjusted for inflation) in 2023 was $77,719. Find out how much you'll pay in michigan state income taxes given your annual income. Use smartasset's tax return calculator to see how your income, withholdings, deductions and credits impact your tax refund or balance due amount. We use your income & location to estimate your total tax burden. Find.

Use Smartasset's Tax Return Calculator To See How Your Income, Withholdings, Deductions And Credits Impact Your Tax Refund Or Balance Due Amount.

Find out how much you'll pay in illinois state income taxes given your annual income. This calculator is updated with rates, brackets and. Find out how much you'll pay in michigan state income taxes given your annual income. First, we calculate your adjusted gross income (agi) by taking your total household income and reducing it by certain items such as contributions to your 401(k).

We Use Your Income & Location To Estimate Your Total Tax Burden.

Find out how much you'll pay in colorado state income taxes given your annual income. Customize using your filing status, deductions, exemptions and more. Calculate your 2019 federal, state and local taxes with our free income tax calculator. Calculate your federal, state and local taxes for the current filing year with our free income tax calculator.

Next, From Agi We Subtract Exemptions.

Enter your income and location to estimate your tax burden. Customize using your filing status, deductions, exemptions and more. Find out how much you'll pay in florida state income taxes given your annual income. Find out how much you'll pay in california state income taxes given your annual income.

Customize Using Your Filing Status, Deductions, Exemptions And More.

Federal income tax rates range from 10% up to a top marginal rate of 37%. Customize using your filing status, deductions, exemptions and more. States don't impose their own income tax. Customize using your filing status, deductions, exemptions and more.