Instructions Form 5329 - File requirements for form 5329 a taxpayer must file form 5329 if any of the following apply. If you are filing a return only because you owe this tax, you can file form 5329 by itself. This information is found in publication 501,. They received an early distribution from a roth ira,.

They received an early distribution from a roth ira,. This information is found in publication 501,. If you are filing a return only because you owe this tax, you can file form 5329 by itself. File requirements for form 5329 a taxpayer must file form 5329 if any of the following apply.

If you are filing a return only because you owe this tax, you can file form 5329 by itself. This information is found in publication 501,. They received an early distribution from a roth ira,. File requirements for form 5329 a taxpayer must file form 5329 if any of the following apply.

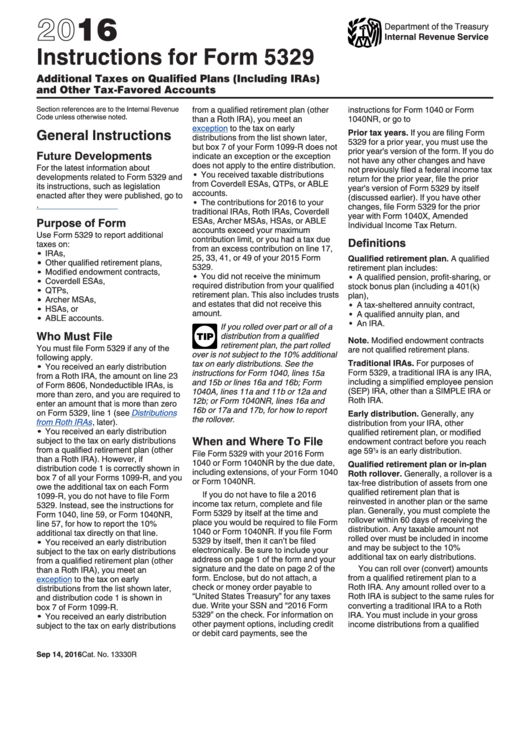

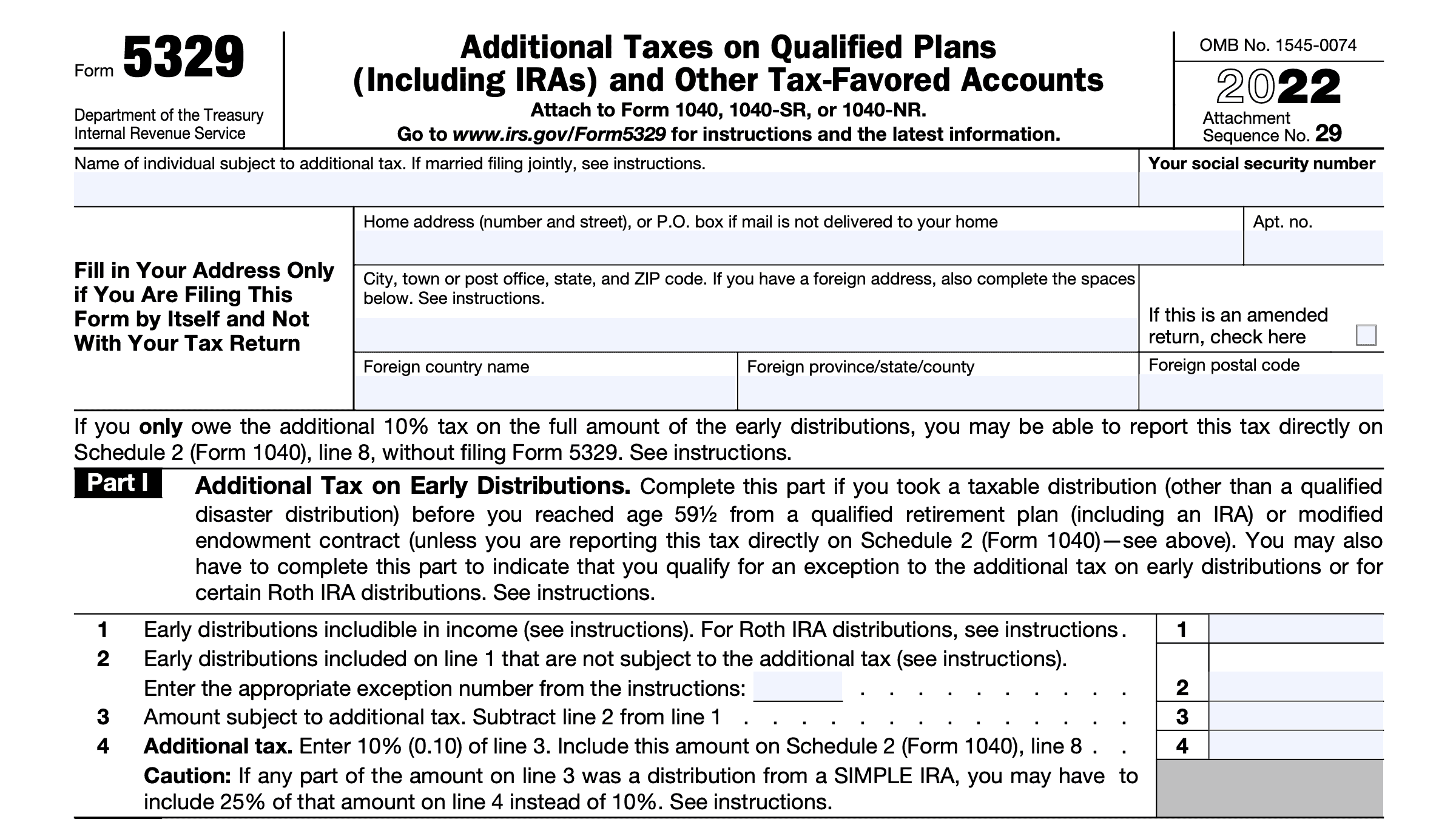

Instructions For Form 5329 2016 printable pdf download

File requirements for form 5329 a taxpayer must file form 5329 if any of the following apply. They received an early distribution from a roth ira,. If you are filing a return only because you owe this tax, you can file form 5329 by itself. This information is found in publication 501,.

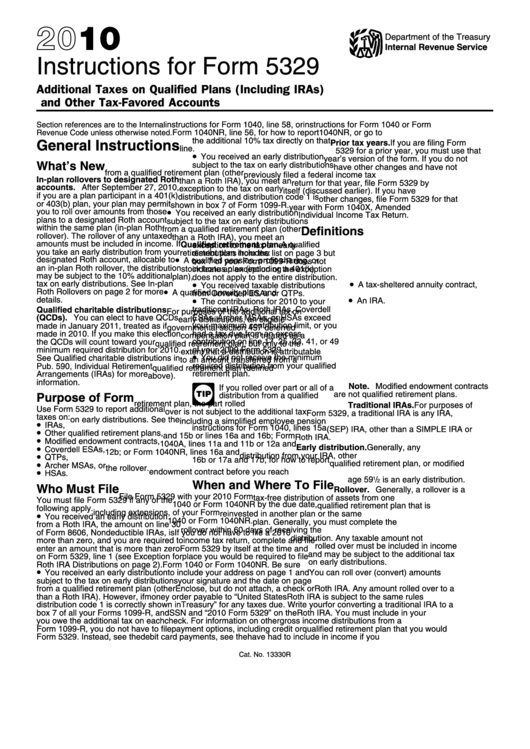

Instructions For Form 5329 2010 printable pdf download

File requirements for form 5329 a taxpayer must file form 5329 if any of the following apply. This information is found in publication 501,. They received an early distribution from a roth ira,. If you are filing a return only because you owe this tax, you can file form 5329 by itself.

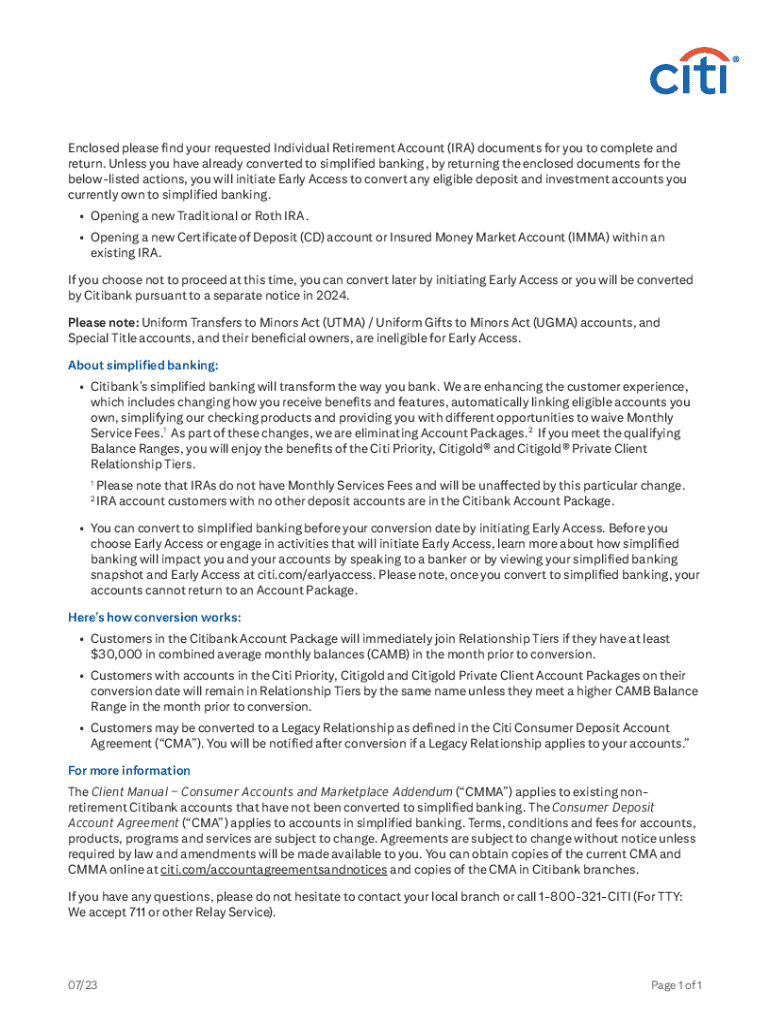

Instructions For Form 5329 Additional Taxes On Qualified Plans And

This information is found in publication 501,. They received an early distribution from a roth ira,. File requirements for form 5329 a taxpayer must file form 5329 if any of the following apply. If you are filing a return only because you owe this tax, you can file form 5329 by itself.

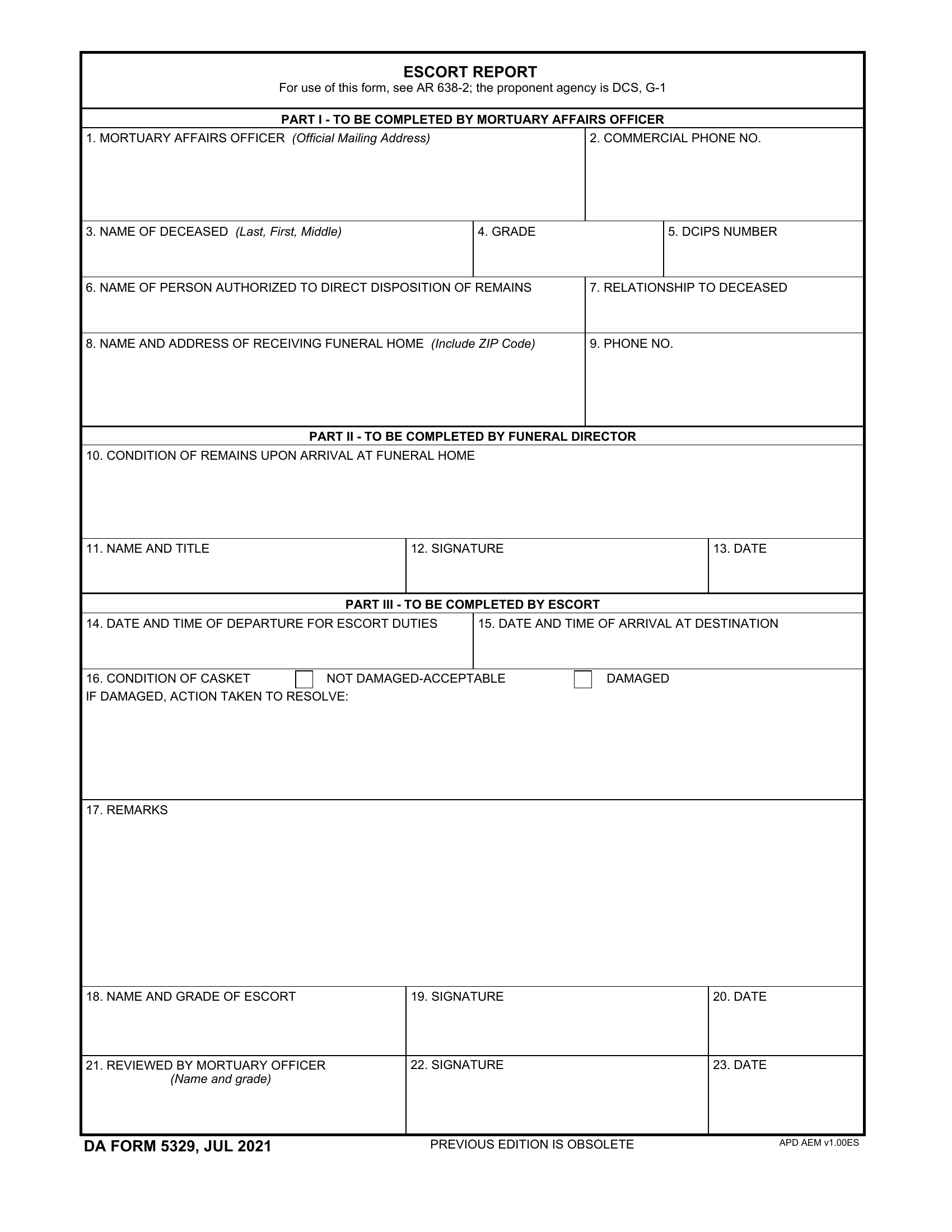

DA Form 5329. Escort Report Forms Docs 2023

If you are filing a return only because you owe this tax, you can file form 5329 by itself. File requirements for form 5329 a taxpayer must file form 5329 if any of the following apply. They received an early distribution from a roth ira,. This information is found in publication 501,.

Form 5329 Additional Taxes on Qualified Plans and Other TaxFavored

They received an early distribution from a roth ira,. File requirements for form 5329 a taxpayer must file form 5329 if any of the following apply. This information is found in publication 501,. If you are filing a return only because you owe this tax, you can file form 5329 by itself.

Form 5329 Edit, Fill, Sign Online Handypdf

They received an early distribution from a roth ira,. If you are filing a return only because you owe this tax, you can file form 5329 by itself. This information is found in publication 501,. File requirements for form 5329 a taxpayer must file form 5329 if any of the following apply.

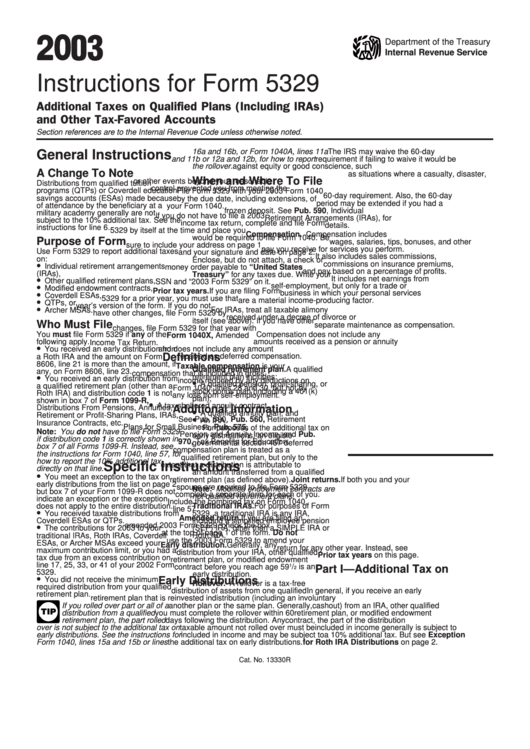

IRS Form 5329 2018 2019 Printable & Fillable Sample in PDF

File requirements for form 5329 a taxpayer must file form 5329 if any of the following apply. This information is found in publication 501,. They received an early distribution from a roth ira,. If you are filing a return only because you owe this tax, you can file form 5329 by itself.

Fillable Online Instructions for Form 5329 (2023)Internal Revenue

They received an early distribution from a roth ira,. If you are filing a return only because you owe this tax, you can file form 5329 by itself. This information is found in publication 501,. File requirements for form 5329 a taxpayer must file form 5329 if any of the following apply.

Irs Form 5329 For 2023 Printable Forms Free Online

They received an early distribution from a roth ira,. This information is found in publication 501,. If you are filing a return only because you owe this tax, you can file form 5329 by itself. File requirements for form 5329 a taxpayer must file form 5329 if any of the following apply.

Instructions For Form 5329 Additional Taxes On Qualified Plans

They received an early distribution from a roth ira,. This information is found in publication 501,. File requirements for form 5329 a taxpayer must file form 5329 if any of the following apply. If you are filing a return only because you owe this tax, you can file form 5329 by itself.

If You Are Filing A Return Only Because You Owe This Tax, You Can File Form 5329 By Itself.

They received an early distribution from a roth ira,. This information is found in publication 501,. File requirements for form 5329 a taxpayer must file form 5329 if any of the following apply.