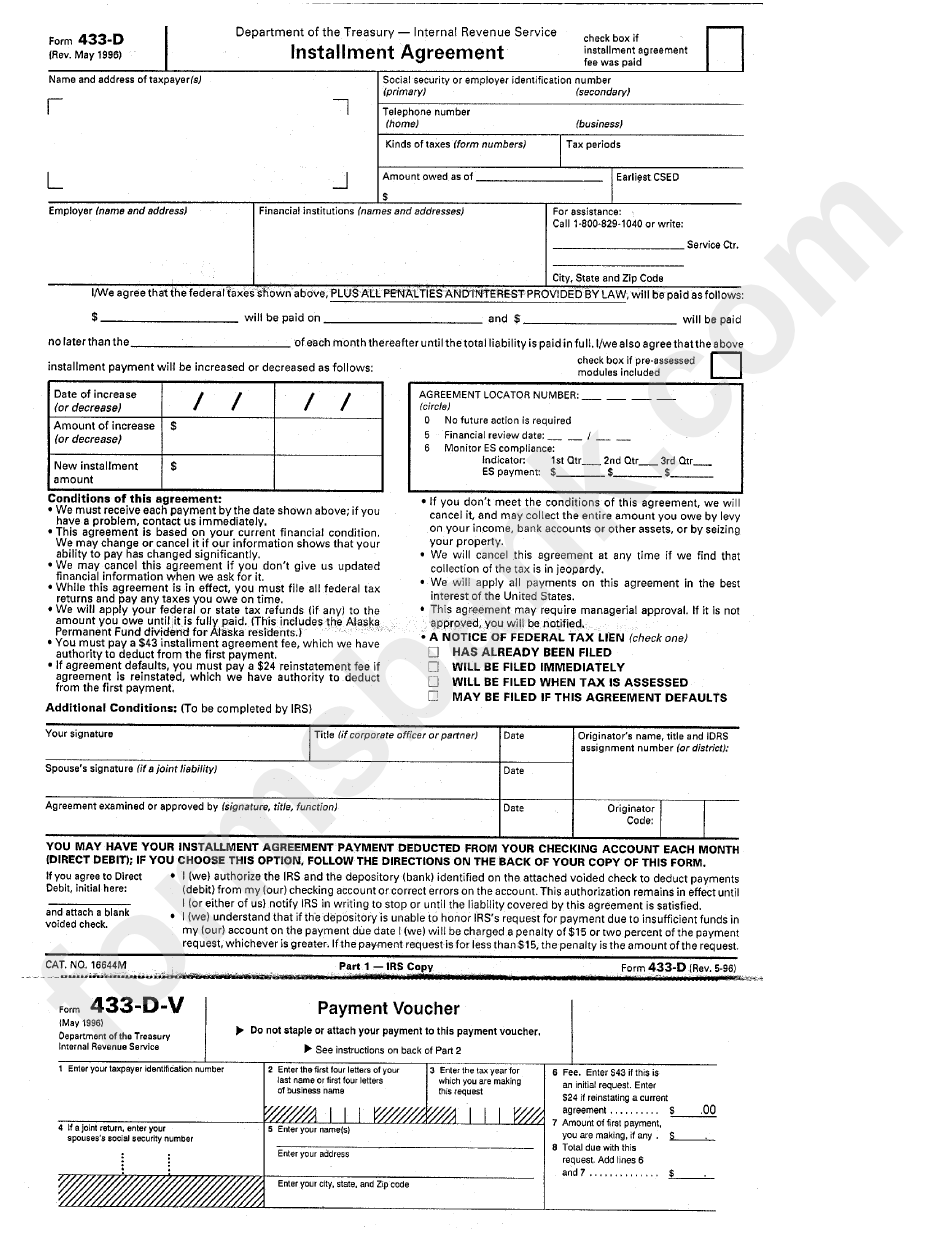

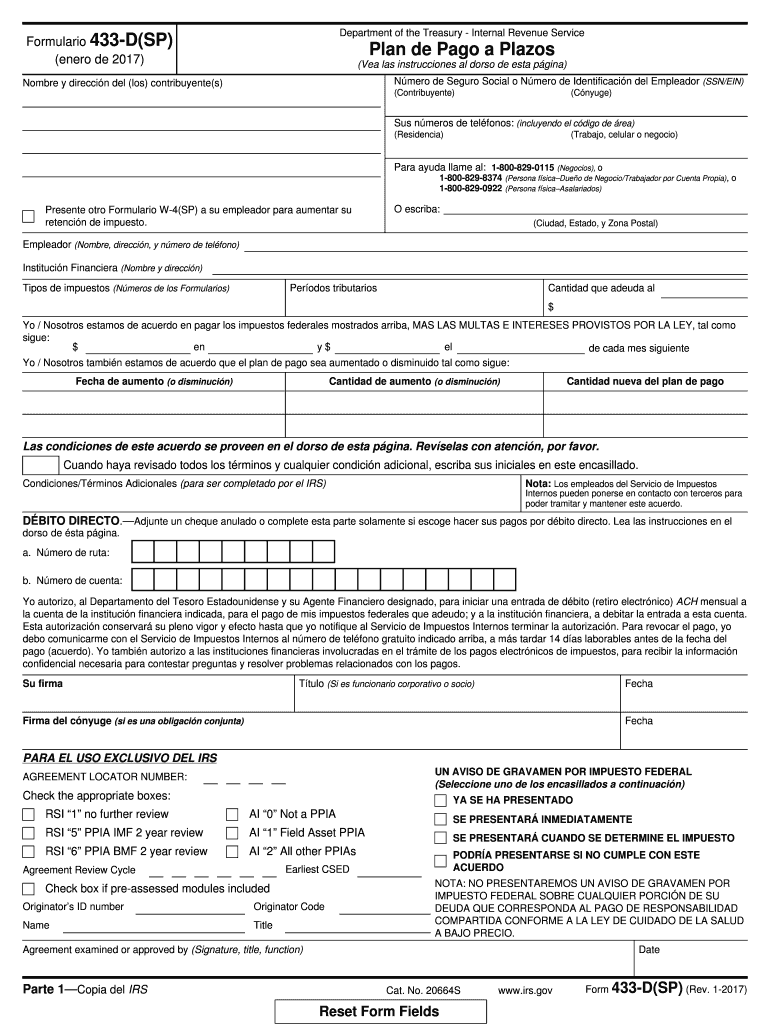

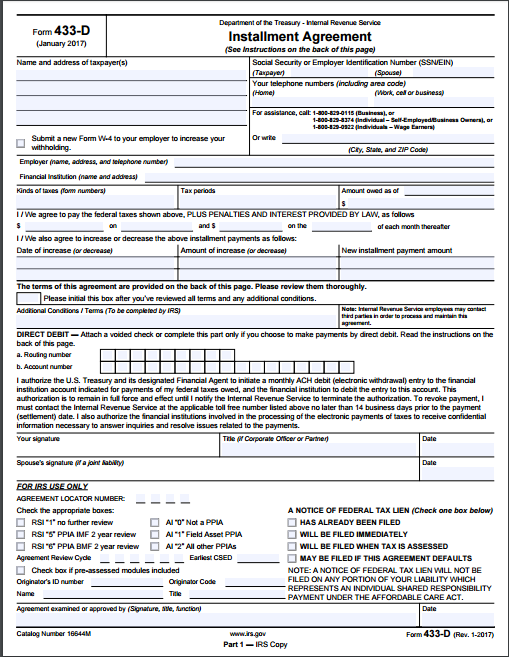

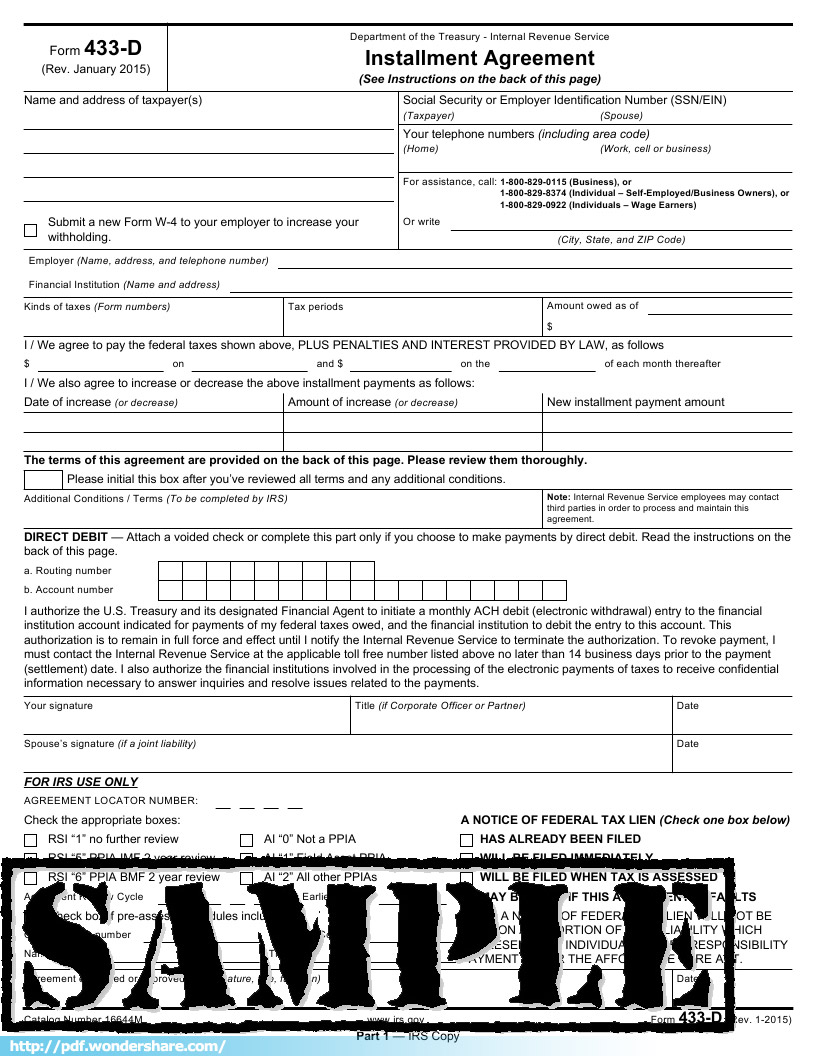

Irs Form 433 D - Return part 1 to irs at the address on the letter. As per the instructions on the form, return part 1 to irs at the address on the letter that came with it, or the address shown in the “for assistance” box on the front of the form. If you are requesting an initial installment agreement, i suggest you use form 9465 and the mailing address for form 9465 is identified on page 2 of the instructions for form 9465. Read the terms of this agreement. Part 2 is your copy you keep for your records. Although the tax filing deadline has been extended to july 15, 2020, from april 15, the irs continues to process electronic tax returns, issue direct deposit refunds and accept electronic. You are authorizing the irs to.

You are authorizing the irs to. Although the tax filing deadline has been extended to july 15, 2020, from april 15, the irs continues to process electronic tax returns, issue direct deposit refunds and accept electronic. Part 2 is your copy you keep for your records. As per the instructions on the form, return part 1 to irs at the address on the letter that came with it, or the address shown in the “for assistance” box on the front of the form. If you are requesting an initial installment agreement, i suggest you use form 9465 and the mailing address for form 9465 is identified on page 2 of the instructions for form 9465. Return part 1 to irs at the address on the letter. Read the terms of this agreement.

Read the terms of this agreement. As per the instructions on the form, return part 1 to irs at the address on the letter that came with it, or the address shown in the “for assistance” box on the front of the form. Part 2 is your copy you keep for your records. You are authorizing the irs to. Although the tax filing deadline has been extended to july 15, 2020, from april 15, the irs continues to process electronic tax returns, issue direct deposit refunds and accept electronic. If you are requesting an initial installment agreement, i suggest you use form 9465 and the mailing address for form 9465 is identified on page 2 of the instructions for form 9465. Return part 1 to irs at the address on the letter.

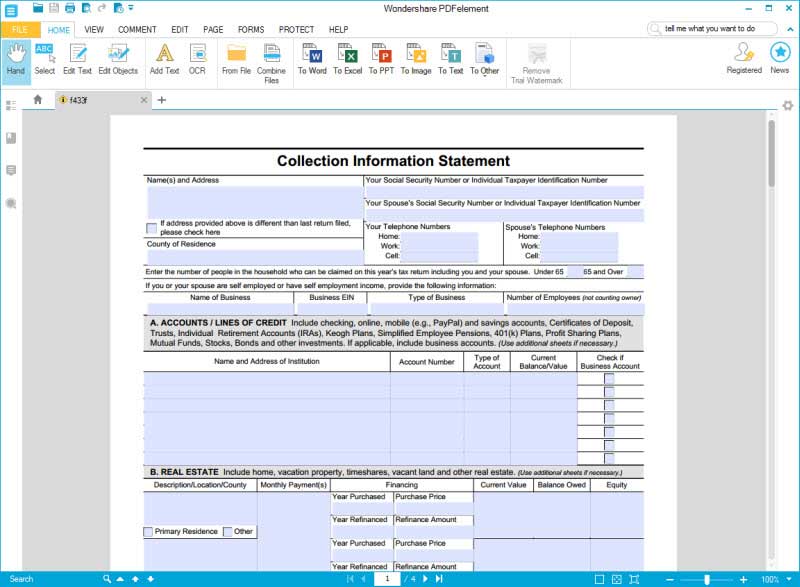

Irs Form 433 D Printable read.iesanfelipe.edu.pe

Part 2 is your copy you keep for your records. As per the instructions on the form, return part 1 to irs at the address on the letter that came with it, or the address shown in the “for assistance” box on the front of the form. Although the tax filing deadline has been extended to july 15, 2020, from.

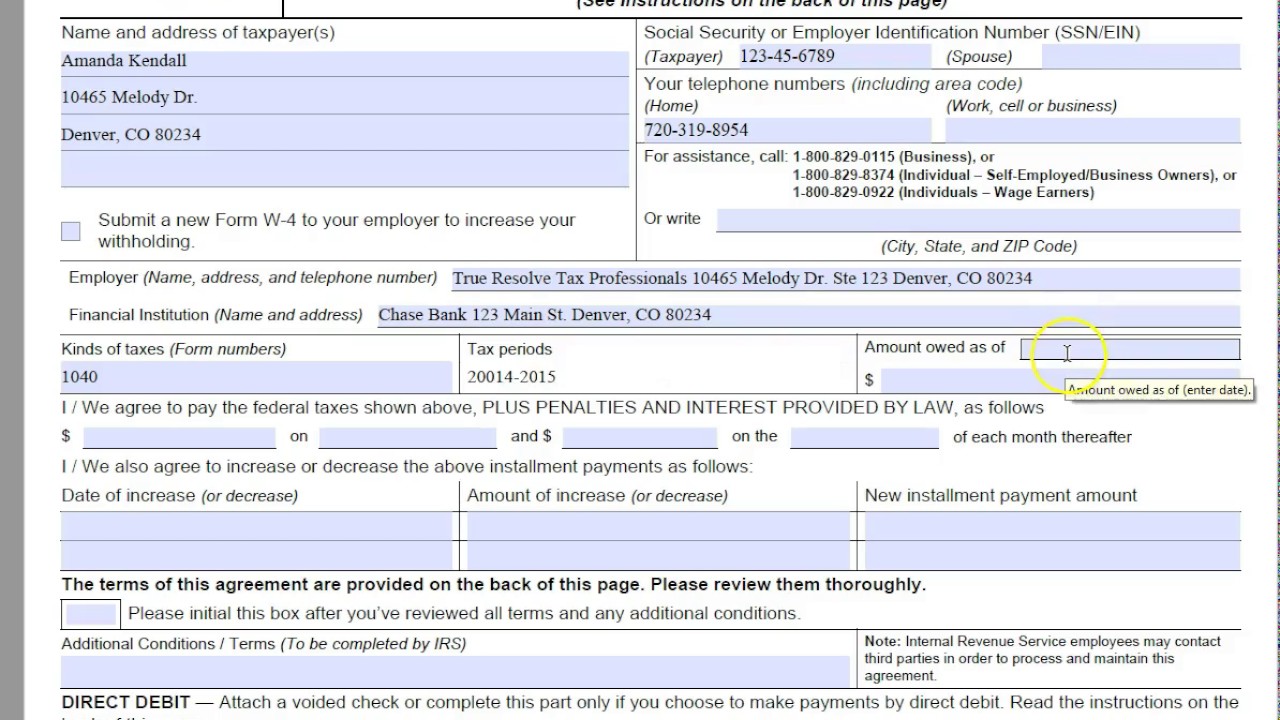

Irs form 433 d Fill out & sign online DocHub

Part 2 is your copy you keep for your records. You are authorizing the irs to. Return part 1 to irs at the address on the letter. Read the terms of this agreement. If you are requesting an initial installment agreement, i suggest you use form 9465 and the mailing address for form 9465 is identified on page 2 of.

Irs Form 433 D Printable Printable Templates

Although the tax filing deadline has been extended to july 15, 2020, from april 15, the irs continues to process electronic tax returns, issue direct deposit refunds and accept electronic. As per the instructions on the form, return part 1 to irs at the address on the letter that came with it, or the address shown in the “for assistance”.

IRS Form 433D Installment Agreement

Part 2 is your copy you keep for your records. You are authorizing the irs to. Return part 1 to irs at the address on the letter. Read the terms of this agreement. If you are requesting an initial installment agreement, i suggest you use form 9465 and the mailing address for form 9465 is identified on page 2 of.

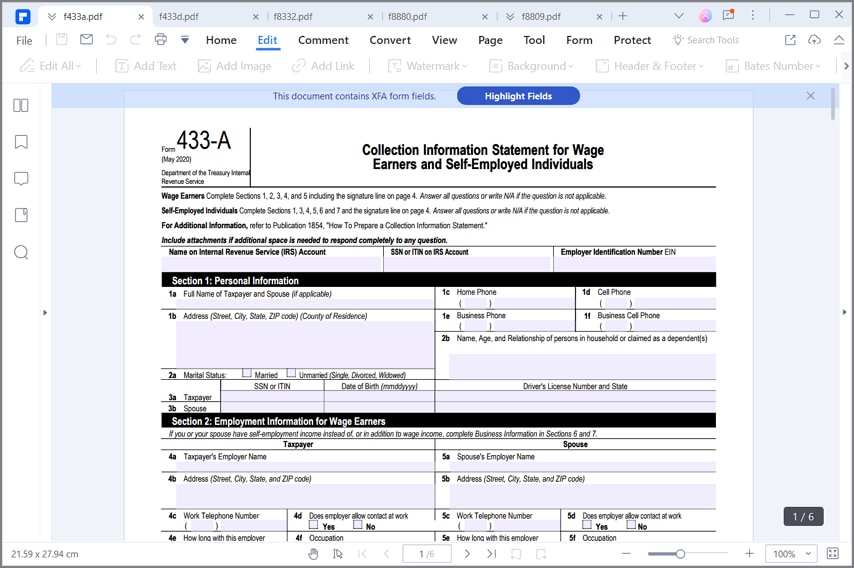

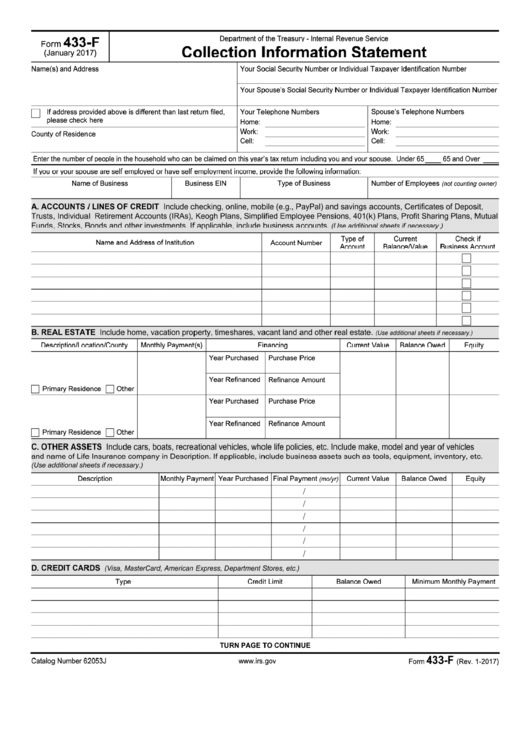

Irs Form 433 A Printable Printable Forms Free Online

As per the instructions on the form, return part 1 to irs at the address on the letter that came with it, or the address shown in the “for assistance” box on the front of the form. You are authorizing the irs to. Part 2 is your copy you keep for your records. Although the tax filing deadline has been.

Irs Form 433 D Printable

Part 2 is your copy you keep for your records. Read the terms of this agreement. Although the tax filing deadline has been extended to july 15, 2020, from april 15, the irs continues to process electronic tax returns, issue direct deposit refunds and accept electronic. Return part 1 to irs at the address on the letter. You are authorizing.

Irs Form 433 D Printable

If you are requesting an initial installment agreement, i suggest you use form 9465 and the mailing address for form 9465 is identified on page 2 of the instructions for form 9465. Read the terms of this agreement. Part 2 is your copy you keep for your records. You are authorizing the irs to. Although the tax filing deadline has.

433D (2017) Edit Forms Online PDFFormPro

You are authorizing the irs to. If you are requesting an initial installment agreement, i suggest you use form 9465 and the mailing address for form 9465 is identified on page 2 of the instructions for form 9465. Return part 1 to irs at the address on the letter. As per the instructions on the form, return part 1 to.

IRS Form 433D Free Download, Create, Edit, Fill and Print

If you are requesting an initial installment agreement, i suggest you use form 9465 and the mailing address for form 9465 is identified on page 2 of the instructions for form 9465. Part 2 is your copy you keep for your records. As per the instructions on the form, return part 1 to irs at the address on the letter.

Irs Form 433 D Printable read.iesanfelipe.edu.pe

You are authorizing the irs to. Read the terms of this agreement. As per the instructions on the form, return part 1 to irs at the address on the letter that came with it, or the address shown in the “for assistance” box on the front of the form. Although the tax filing deadline has been extended to july 15,.

If You Are Requesting An Initial Installment Agreement, I Suggest You Use Form 9465 And The Mailing Address For Form 9465 Is Identified On Page 2 Of The Instructions For Form 9465.

Read the terms of this agreement. As per the instructions on the form, return part 1 to irs at the address on the letter that came with it, or the address shown in the “for assistance” box on the front of the form. Return part 1 to irs at the address on the letter. Part 2 is your copy you keep for your records.

You Are Authorizing The Irs To.

Although the tax filing deadline has been extended to july 15, 2020, from april 15, the irs continues to process electronic tax returns, issue direct deposit refunds and accept electronic.