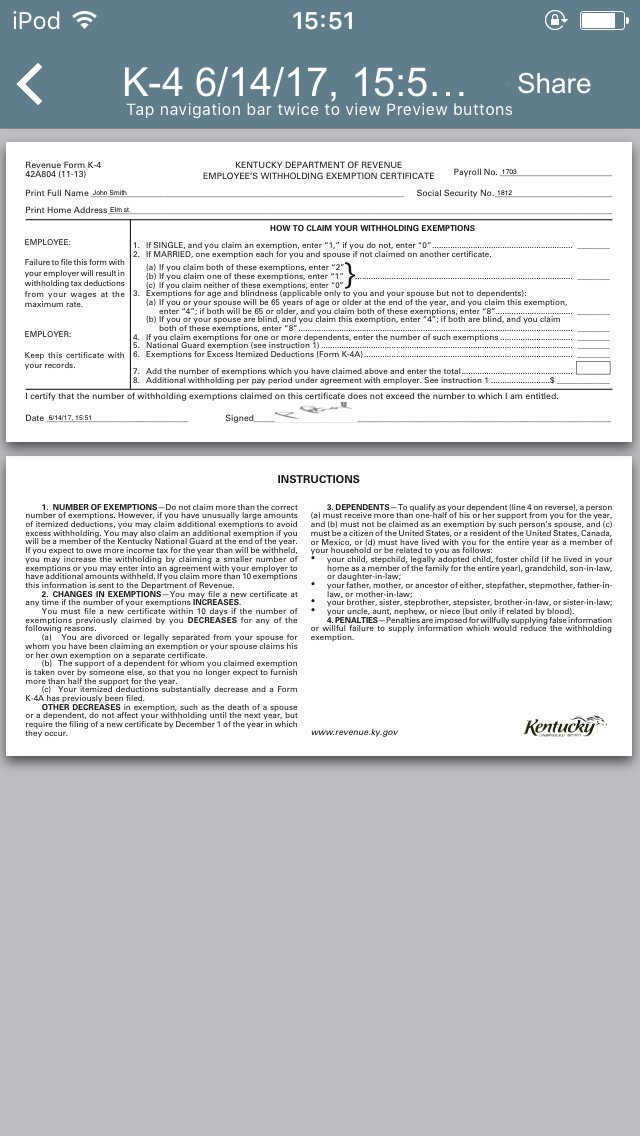

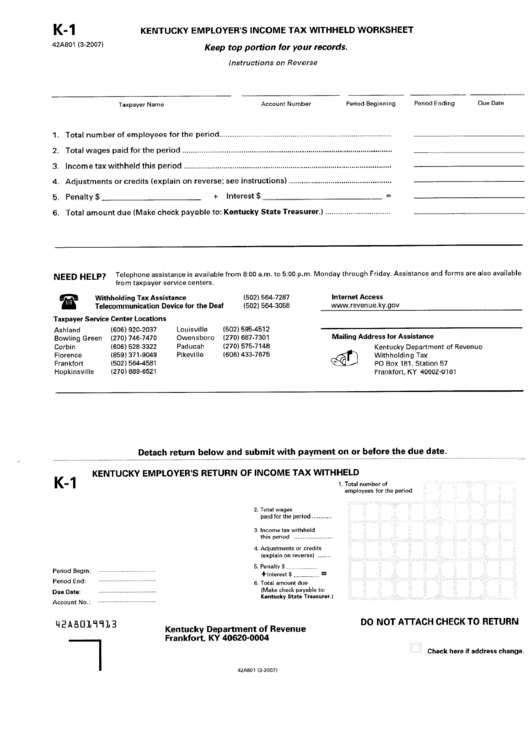

Kentucky State Withholding Form - Failure to file this form with your employer will result in withholding tax deductions maximum rate. However, you must complete this form. Otherwise, kentucky income tax must be withheld from your wages. If you meet any of the four exemptions you are exempted from kentucky withholding. File this form with your employer. Check box 4 if you certify you work in kentucky and reside in a reciprocal state. If you meet any of the four exemptions you are. Keep this certificate with your. Part i — kentucky withholding statement code and totals — select the withholding statement code using the key below for the type of form being.

Check box 4 if you certify you work in kentucky and reside in a reciprocal state. Failure to file this form with your employer will result in withholding tax deductions maximum rate. File this form with your employer. If you meet any of the four exemptions you are. If you meet any of the four exemptions you are exempted from kentucky withholding. Keep this certificate with your. Part i — kentucky withholding statement code and totals — select the withholding statement code using the key below for the type of form being. However, you must complete this form. Otherwise, kentucky income tax must be withheld from your wages.

If you meet any of the four exemptions you are exempted from kentucky withholding. Check box 4 if you certify you work in kentucky and reside in a reciprocal state. Keep this certificate with your. If you meet any of the four exemptions you are. Otherwise, kentucky income tax must be withheld from your wages. However, you must complete this form. Part i — kentucky withholding statement code and totals — select the withholding statement code using the key below for the type of form being. Failure to file this form with your employer will result in withholding tax deductions maximum rate. File this form with your employer.

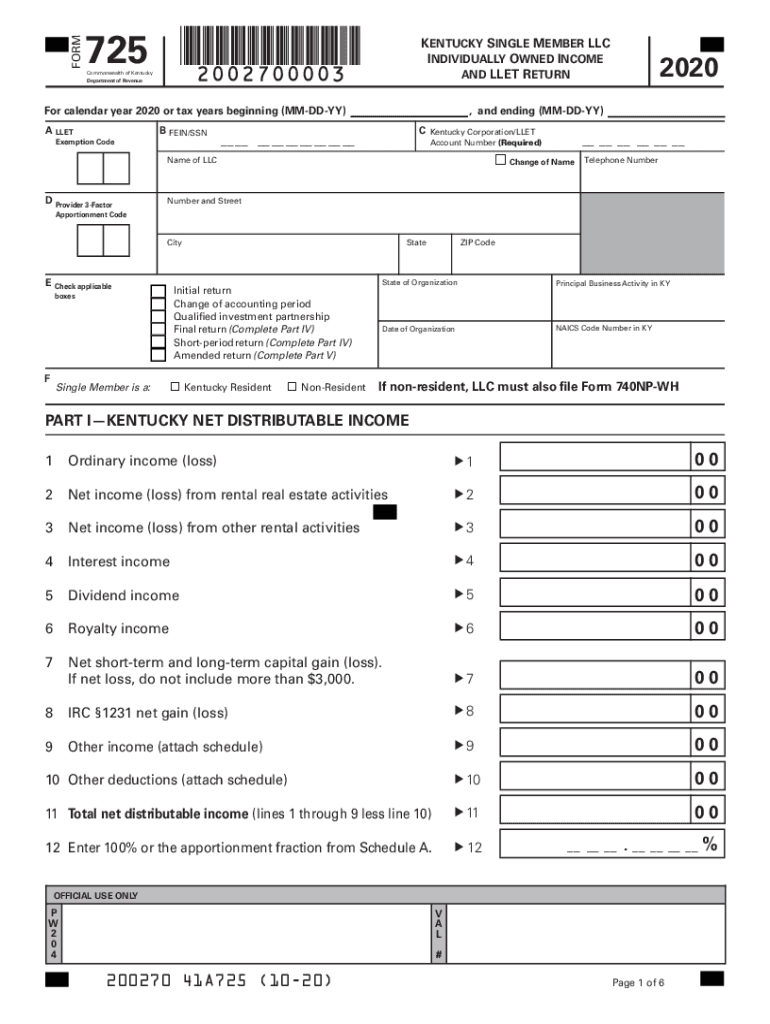

Kentucky State Withholding Form K4

Failure to file this form with your employer will result in withholding tax deductions maximum rate. Part i — kentucky withholding statement code and totals — select the withholding statement code using the key below for the type of form being. Check box 4 if you certify you work in kentucky and reside in a reciprocal state. However, you must.

Top 69 Kentucky Withholding Form Templates free to download in PDF format

Keep this certificate with your. Failure to file this form with your employer will result in withholding tax deductions maximum rate. File this form with your employer. However, you must complete this form. Check box 4 if you certify you work in kentucky and reside in a reciprocal state.

Kentucky State Tax Withholding Form 2022

File this form with your employer. If you meet any of the four exemptions you are exempted from kentucky withholding. Otherwise, kentucky income tax must be withheld from your wages. Part i — kentucky withholding statement code and totals — select the withholding statement code using the key below for the type of form being. Check box 4 if you.

Kentucky State Tax Withholding Form 2024 Van Lilian

File this form with your employer. If you meet any of the four exemptions you are. Check box 4 if you certify you work in kentucky and reside in a reciprocal state. Failure to file this form with your employer will result in withholding tax deductions maximum rate. However, you must complete this form.

Kentucky Tax Withholding Form 2024 Rani Valeda

Failure to file this form with your employer will result in withholding tax deductions maximum rate. If you meet any of the four exemptions you are exempted from kentucky withholding. Keep this certificate with your. Check box 4 if you certify you work in kentucky and reside in a reciprocal state. If you meet any of the four exemptions you.

Alabama State Tax Withholding Form 2022

Part i — kentucky withholding statement code and totals — select the withholding statement code using the key below for the type of form being. Keep this certificate with your. File this form with your employer. If you meet any of the four exemptions you are exempted from kentucky withholding. Failure to file this form with your employer will result.

Kentucky Employee Withholding Form 2024 Dael Casandra

File this form with your employer. Failure to file this form with your employer will result in withholding tax deductions maximum rate. Keep this certificate with your. Check box 4 if you certify you work in kentucky and reside in a reciprocal state. Part i — kentucky withholding statement code and totals — select the withholding statement code using the.

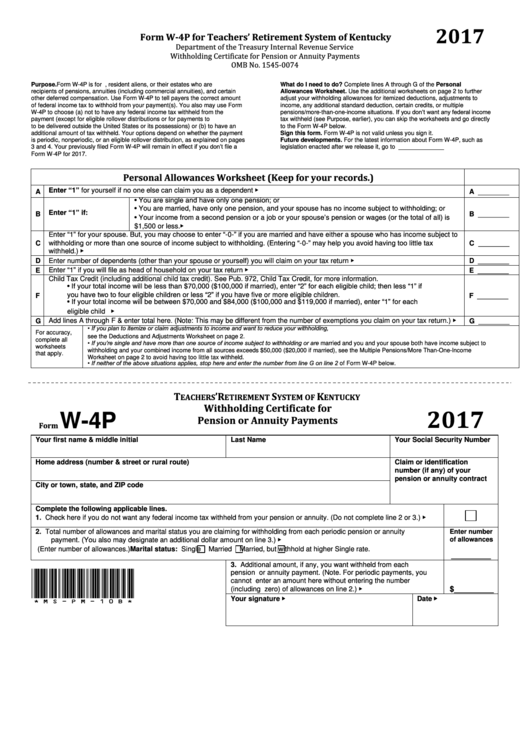

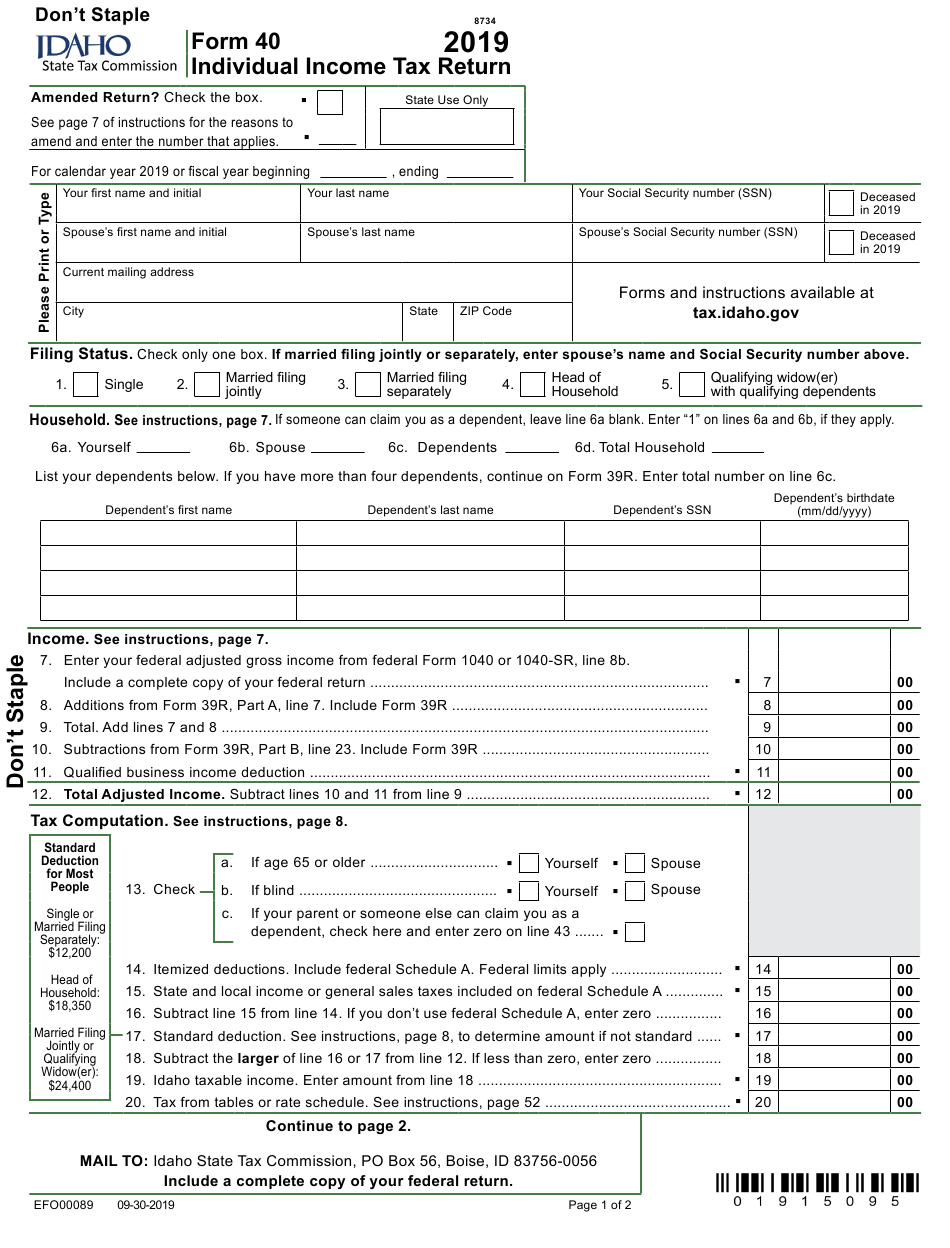

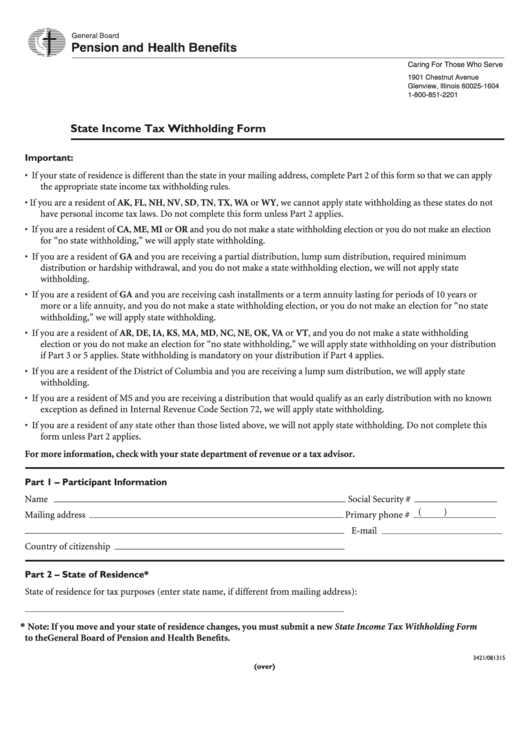

Fillable State Tax Withholding Form Printable Pdf Download

Part i — kentucky withholding statement code and totals — select the withholding statement code using the key below for the type of form being. Otherwise, kentucky income tax must be withheld from your wages. However, you must complete this form. Failure to file this form with your employer will result in withholding tax deductions maximum rate. Check box 4.

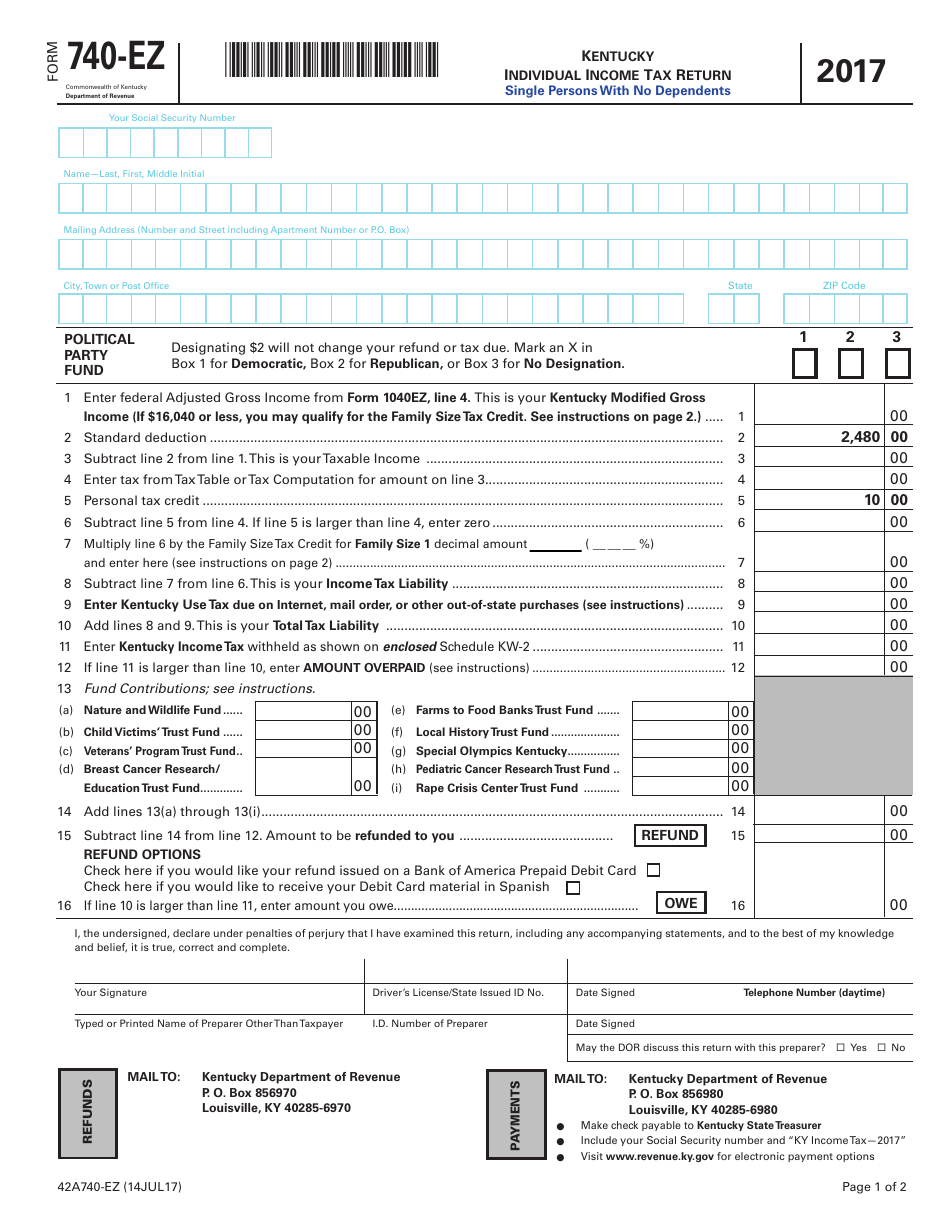

Printable Kentucky State Tax Forms

However, you must complete this form. If you meet any of the four exemptions you are exempted from kentucky withholding. Failure to file this form with your employer will result in withholding tax deductions maximum rate. File this form with your employer. If you meet any of the four exemptions you are.

Kentucky Employee State Withholding Form 2023

File this form with your employer. Check box 4 if you certify you work in kentucky and reside in a reciprocal state. If you meet any of the four exemptions you are exempted from kentucky withholding. Keep this certificate with your. If you meet any of the four exemptions you are.

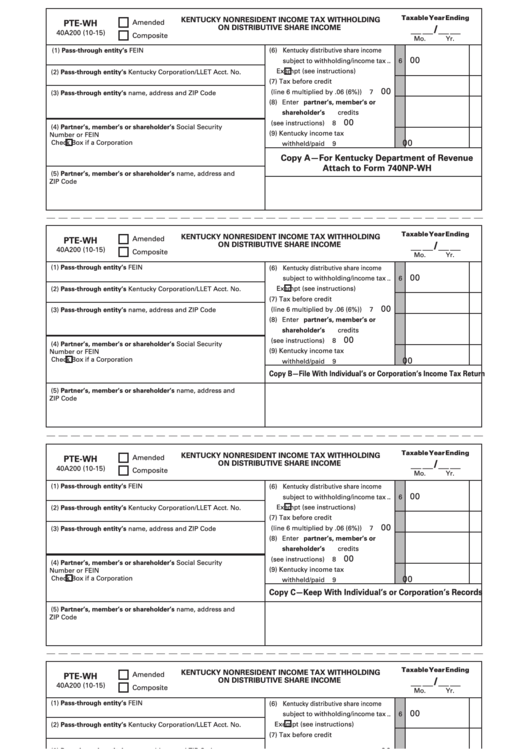

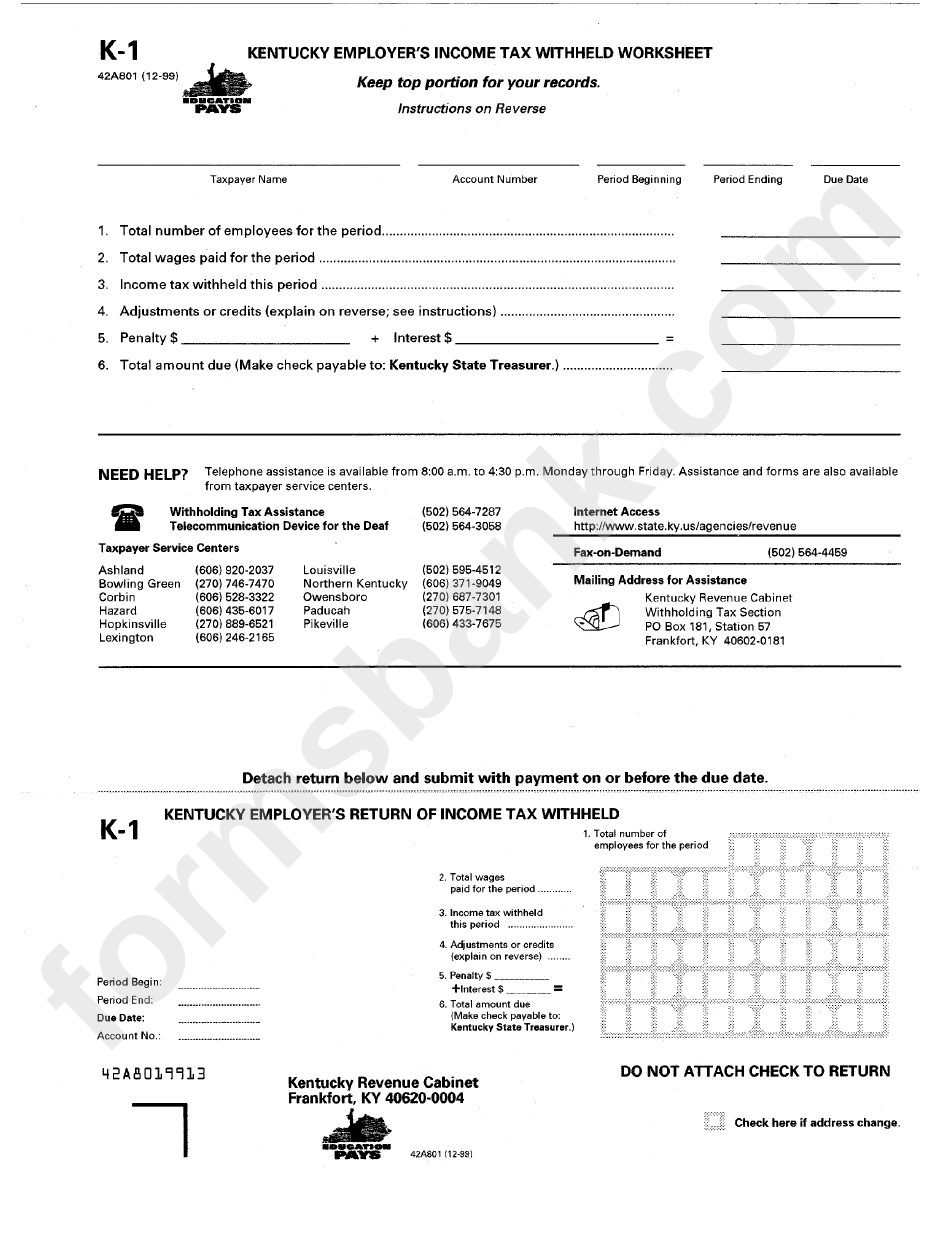

Part I — Kentucky Withholding Statement Code And Totals — Select The Withholding Statement Code Using The Key Below For The Type Of Form Being.

If you meet any of the four exemptions you are exempted from kentucky withholding. Check box 4 if you certify you work in kentucky and reside in a reciprocal state. Keep this certificate with your. Otherwise, kentucky income tax must be withheld from your wages.

Failure To File This Form With Your Employer Will Result In Withholding Tax Deductions Maximum Rate.

File this form with your employer. If you meet any of the four exemptions you are. However, you must complete this form.