List Of Approved Donation Malaysia Tax - Gift of money or cost of contribution in kind for any approved project of national interest approved by ministry of finance. List of guidelines under subsection 44(6) of the income tax act 1967; When donated or given to avenues approved by the lembaga hasil dalam negeri (lhdn), these contributions can qualify for tax. In order for your donation to be eligible for a tax deduction, the organisation you donate to must be officially recognised or “approved” by the.

When donated or given to avenues approved by the lembaga hasil dalam negeri (lhdn), these contributions can qualify for tax. Gift of money or cost of contribution in kind for any approved project of national interest approved by ministry of finance. In order for your donation to be eligible for a tax deduction, the organisation you donate to must be officially recognised or “approved” by the. List of guidelines under subsection 44(6) of the income tax act 1967;

When donated or given to avenues approved by the lembaga hasil dalam negeri (lhdn), these contributions can qualify for tax. In order for your donation to be eligible for a tax deduction, the organisation you donate to must be officially recognised or “approved” by the. List of guidelines under subsection 44(6) of the income tax act 1967; Gift of money or cost of contribution in kind for any approved project of national interest approved by ministry of finance.

Lhdn Approved Donation List Corporate Tax Malaysia 2020 For Smes

When donated or given to avenues approved by the lembaga hasil dalam negeri (lhdn), these contributions can qualify for tax. In order for your donation to be eligible for a tax deduction, the organisation you donate to must be officially recognised or “approved” by the. List of guidelines under subsection 44(6) of the income tax act 1967; Gift of money.

KTP & Company PLT Audit, Tax, Accountancy in Johor Bahru.

In order for your donation to be eligible for a tax deduction, the organisation you donate to must be officially recognised or “approved” by the. List of guidelines under subsection 44(6) of the income tax act 1967; When donated or given to avenues approved by the lembaga hasil dalam negeri (lhdn), these contributions can qualify for tax. Gift of money.

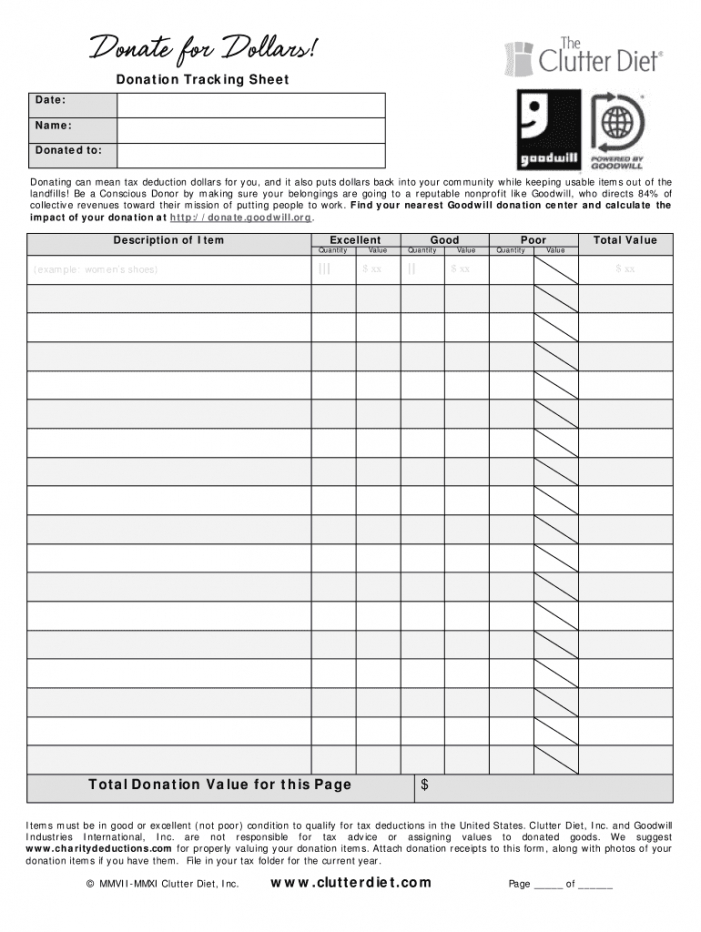

Tax Donation Receipt Template Printable Word Searches

List of guidelines under subsection 44(6) of the income tax act 1967; When donated or given to avenues approved by the lembaga hasil dalam negeri (lhdn), these contributions can qualify for tax. In order for your donation to be eligible for a tax deduction, the organisation you donate to must be officially recognised or “approved” by the. Gift of money.

KTP & Company PLT Audit, Tax, Accountancy in Johor Bahru.

In order for your donation to be eligible for a tax deduction, the organisation you donate to must be officially recognised or “approved” by the. Gift of money or cost of contribution in kind for any approved project of national interest approved by ministry of finance. When donated or given to avenues approved by the lembaga hasil dalam negeri (lhdn),.

Approved Donation For Company In Malaysia

List of guidelines under subsection 44(6) of the income tax act 1967; Gift of money or cost of contribution in kind for any approved project of national interest approved by ministry of finance. In order for your donation to be eligible for a tax deduction, the organisation you donate to must be officially recognised or “approved” by the. When donated.

Itemized Donation List Printable 2023

List of guidelines under subsection 44(6) of the income tax act 1967; Gift of money or cost of contribution in kind for any approved project of national interest approved by ministry of finance. When donated or given to avenues approved by the lembaga hasil dalam negeri (lhdn), these contributions can qualify for tax. In order for your donation to be.

Lhdn Approved Donation List Corporate Tax Malaysia 2020 For Smes

When donated or given to avenues approved by the lembaga hasil dalam negeri (lhdn), these contributions can qualify for tax. In order for your donation to be eligible for a tax deduction, the organisation you donate to must be officially recognised or “approved” by the. List of guidelines under subsection 44(6) of the income tax act 1967; Gift of money.

Lhdn Approved Donation List Corporate Tax Malaysia 2020 For Smes

List of guidelines under subsection 44(6) of the income tax act 1967; In order for your donation to be eligible for a tax deduction, the organisation you donate to must be officially recognised or “approved” by the. When donated or given to avenues approved by the lembaga hasil dalam negeri (lhdn), these contributions can qualify for tax. Gift of money.

Personal Tax Relief Malaysia 2023 (YA 2022) The Updated list of

List of guidelines under subsection 44(6) of the income tax act 1967; In order for your donation to be eligible for a tax deduction, the organisation you donate to must be officially recognised or “approved” by the. Gift of money or cost of contribution in kind for any approved project of national interest approved by ministry of finance. When donated.

Make your recycling count toward conservation Conservation Ecology Centre

List of guidelines under subsection 44(6) of the income tax act 1967; When donated or given to avenues approved by the lembaga hasil dalam negeri (lhdn), these contributions can qualify for tax. Gift of money or cost of contribution in kind for any approved project of national interest approved by ministry of finance. In order for your donation to be.

In Order For Your Donation To Be Eligible For A Tax Deduction, The Organisation You Donate To Must Be Officially Recognised Or “Approved” By The.

List of guidelines under subsection 44(6) of the income tax act 1967; When donated or given to avenues approved by the lembaga hasil dalam negeri (lhdn), these contributions can qualify for tax. Gift of money or cost of contribution in kind for any approved project of national interest approved by ministry of finance.