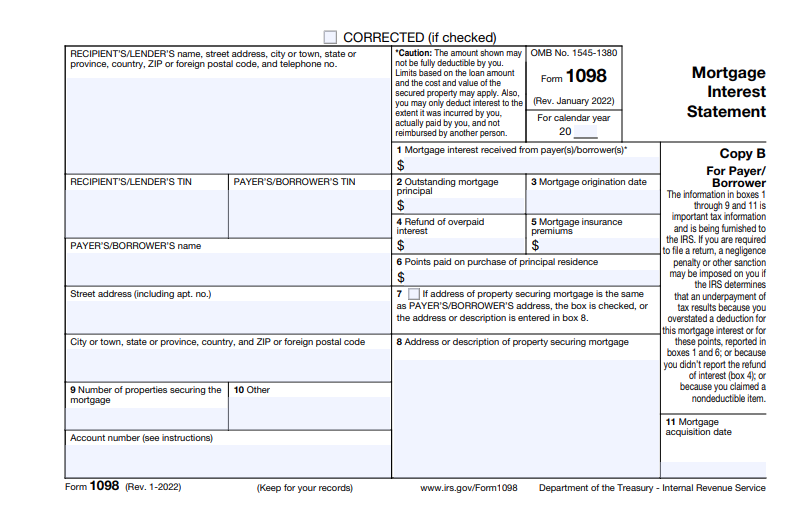

Loandepot 1098 Tax Form - Use form 1098, mortgage interest statement, to report mortgage interest (including points, defined later) of $600 or more you received during the. Make payments and access important information about your account. The form 1098—also known as mortgage interest statement—is used to report the amount of interest and related expenses you paid on your mortgage. Use form 1098 (info copy only) to report mortgage interest of $600 or more received by you during the year in the course of your trade or business from. How come i didn't get a 1098 from both mortgage lenders i had this year? If you receive a current tax bill for any tax item that. Form 1098, mortgage interest statement, is an essential document for reporting mortgage interest paid by borrowers and received by lenders. Form 1098 if you paid at least $600 in interest in a year, your mortgage company is required to send you a copy of form 1098 (also known as the mortgage.

Make payments and access important information about your account. Form 1098 if you paid at least $600 in interest in a year, your mortgage company is required to send you a copy of form 1098 (also known as the mortgage. Use form 1098, mortgage interest statement, to report mortgage interest (including points, defined later) of $600 or more you received during the. The form 1098—also known as mortgage interest statement—is used to report the amount of interest and related expenses you paid on your mortgage. How come i didn't get a 1098 from both mortgage lenders i had this year? If you receive a current tax bill for any tax item that. Use form 1098 (info copy only) to report mortgage interest of $600 or more received by you during the year in the course of your trade or business from. Form 1098, mortgage interest statement, is an essential document for reporting mortgage interest paid by borrowers and received by lenders.

If you receive a current tax bill for any tax item that. How come i didn't get a 1098 from both mortgage lenders i had this year? Use form 1098 (info copy only) to report mortgage interest of $600 or more received by you during the year in the course of your trade or business from. Make payments and access important information about your account. Form 1098 if you paid at least $600 in interest in a year, your mortgage company is required to send you a copy of form 1098 (also known as the mortgage. Use form 1098, mortgage interest statement, to report mortgage interest (including points, defined later) of $600 or more you received during the. The form 1098—also known as mortgage interest statement—is used to report the amount of interest and related expenses you paid on your mortgage. Form 1098, mortgage interest statement, is an essential document for reporting mortgage interest paid by borrowers and received by lenders.

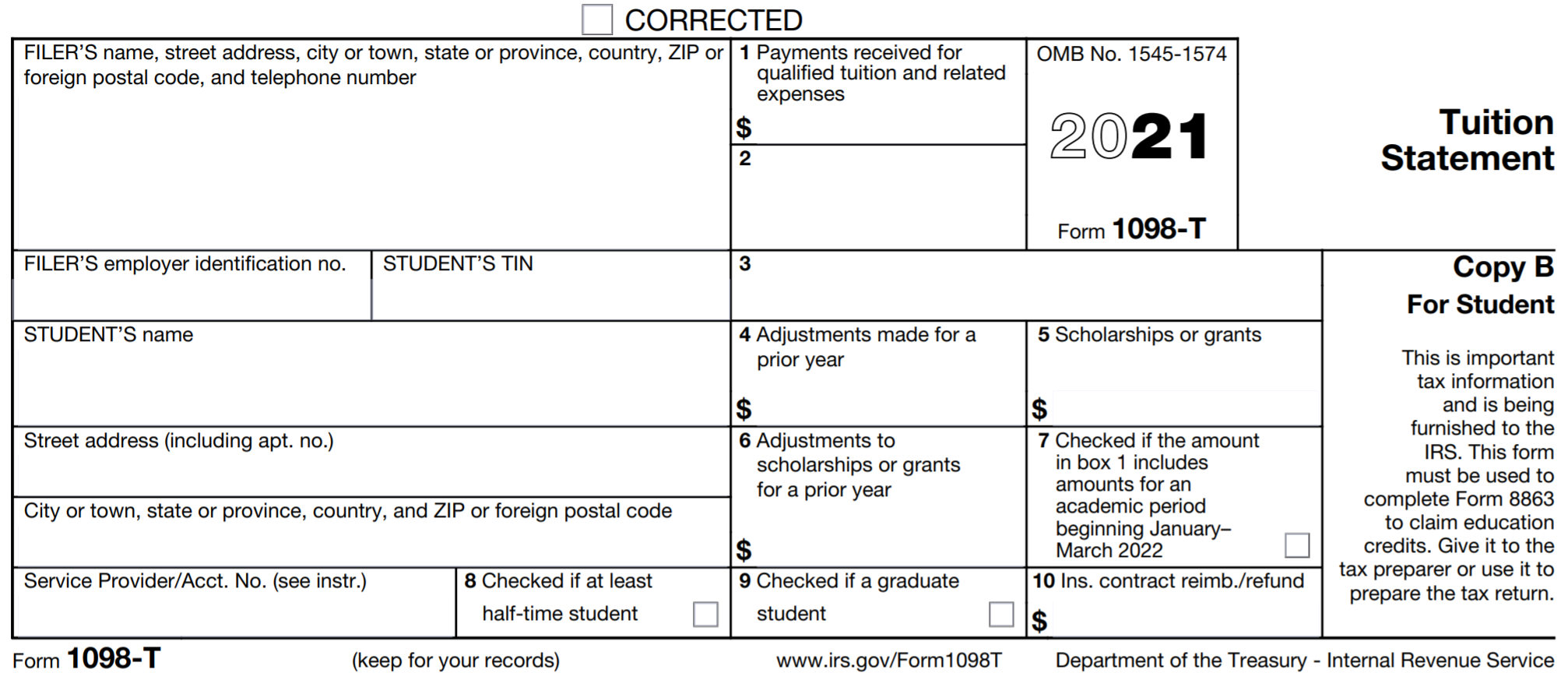

Where to Find the 1098T Form

The form 1098—also known as mortgage interest statement—is used to report the amount of interest and related expenses you paid on your mortgage. How come i didn't get a 1098 from both mortgage lenders i had this year? Form 1098, mortgage interest statement, is an essential document for reporting mortgage interest paid by borrowers and received by lenders. If you.

What is IRS Form 1098?

If you receive a current tax bill for any tax item that. How come i didn't get a 1098 from both mortgage lenders i had this year? Use form 1098 (info copy only) to report mortgage interest of $600 or more received by you during the year in the course of your trade or business from. Make payments and access.

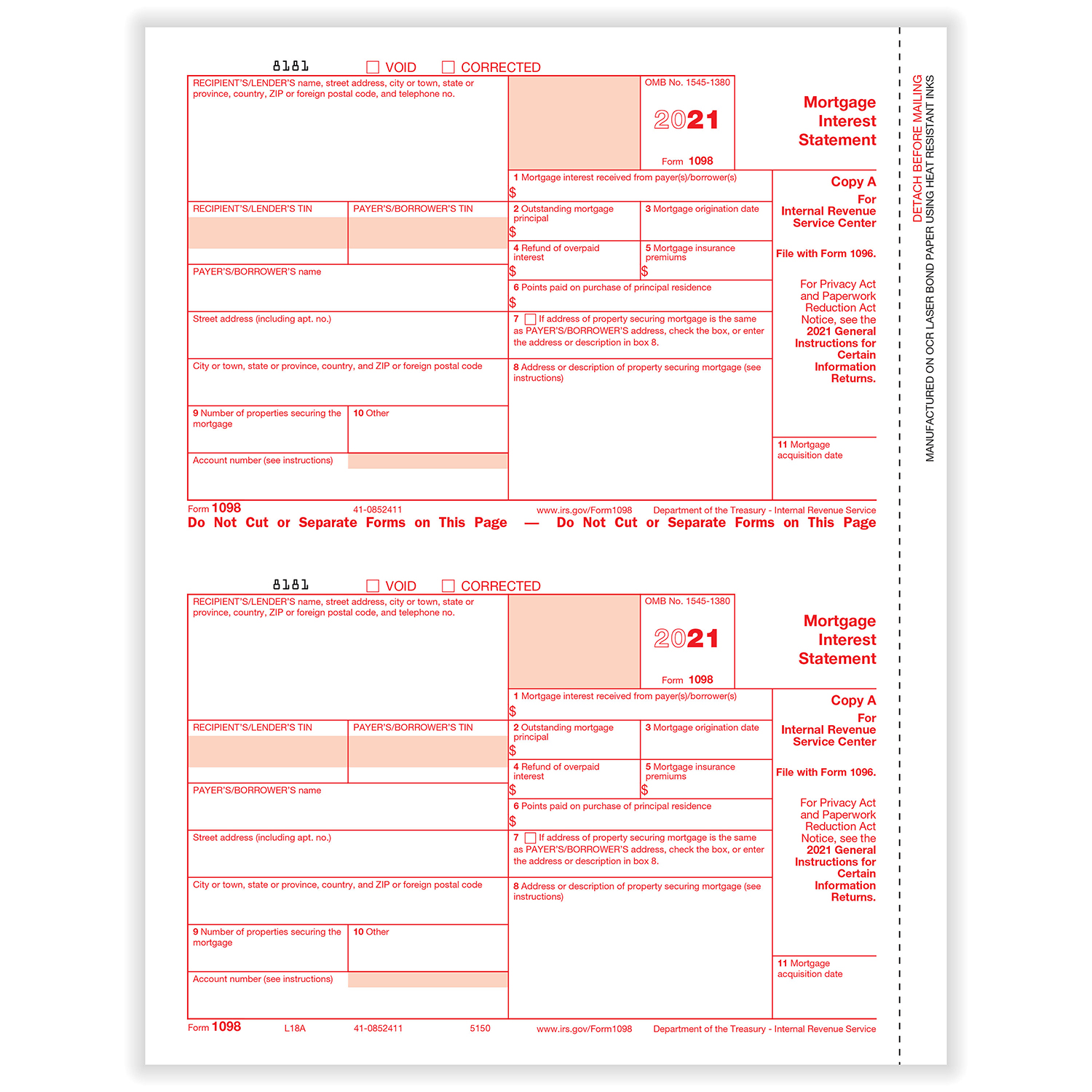

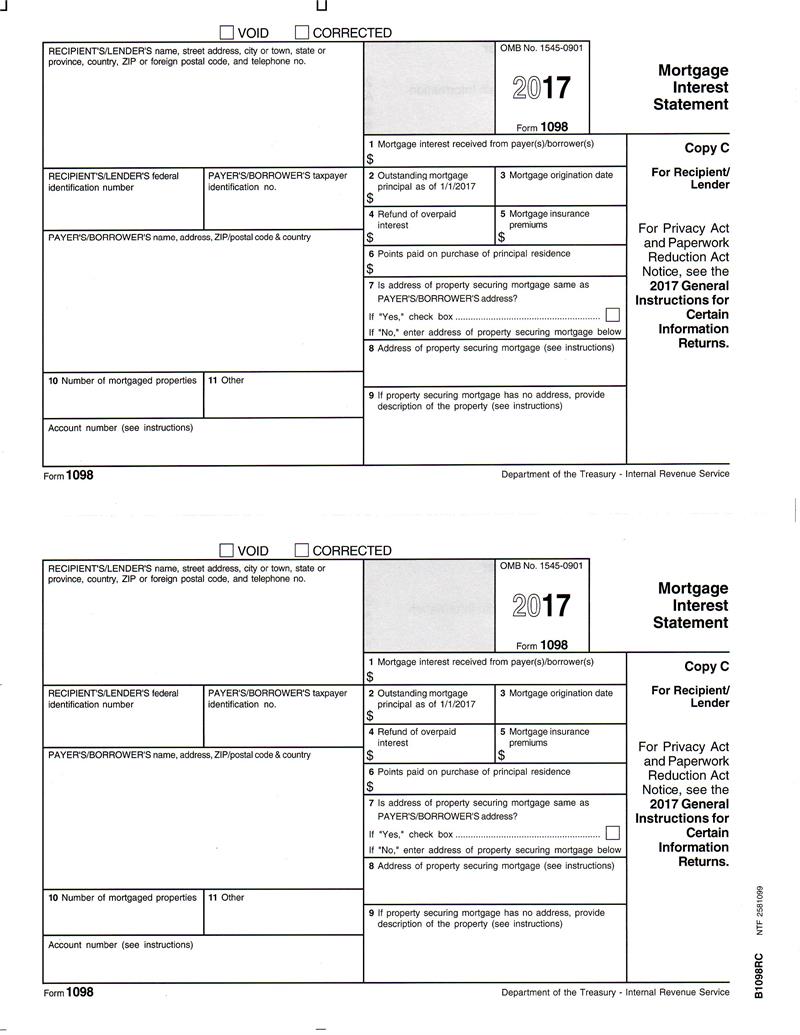

1098 Tax Forms, Lender Copy C

Use form 1098 (info copy only) to report mortgage interest of $600 or more received by you during the year in the course of your trade or business from. Make payments and access important information about your account. Form 1098, mortgage interest statement, is an essential document for reporting mortgage interest paid by borrowers and received by lenders. Form 1098.

1098 Mortgage Interest Federal 1098 Tax Forms Formstax

If you receive a current tax bill for any tax item that. Form 1098 if you paid at least $600 in interest in a year, your mortgage company is required to send you a copy of form 1098 (also known as the mortgage. Form 1098, mortgage interest statement, is an essential document for reporting mortgage interest paid by borrowers and.

Form 1098E, Student Loan Interest Statement, Recipient Copy C

How come i didn't get a 1098 from both mortgage lenders i had this year? If you receive a current tax bill for any tax item that. Use form 1098, mortgage interest statement, to report mortgage interest (including points, defined later) of $600 or more you received during the. Form 1098 if you paid at least $600 in interest in.

Education Credits and Deductions (Form 1098T) Support

Use form 1098 (info copy only) to report mortgage interest of $600 or more received by you during the year in the course of your trade or business from. Make payments and access important information about your account. If you receive a current tax bill for any tax item that. The form 1098—also known as mortgage interest statement—is used to.

Form 1098, Mortgage Interest Statement, Recipient Copy C

How come i didn't get a 1098 from both mortgage lenders i had this year? Use form 1098 (info copy only) to report mortgage interest of $600 or more received by you during the year in the course of your trade or business from. Form 1098, mortgage interest statement, is an essential document for reporting mortgage interest paid by borrowers.

1098T Federal Copy A (L18TA)

Form 1098, mortgage interest statement, is an essential document for reporting mortgage interest paid by borrowers and received by lenders. Use form 1098 (info copy only) to report mortgage interest of $600 or more received by you during the year in the course of your trade or business from. Use form 1098, mortgage interest statement, to report mortgage interest (including.

1098T Ventura County Community College District

If you receive a current tax bill for any tax item that. The form 1098—also known as mortgage interest statement—is used to report the amount of interest and related expenses you paid on your mortgage. Form 1098 if you paid at least $600 in interest in a year, your mortgage company is required to send you a copy of form.

IRS Form 1098C Instructions Qualified Vehicle Contributions

Use form 1098, mortgage interest statement, to report mortgage interest (including points, defined later) of $600 or more you received during the. Use form 1098 (info copy only) to report mortgage interest of $600 or more received by you during the year in the course of your trade or business from. The form 1098—also known as mortgage interest statement—is used.

Make Payments And Access Important Information About Your Account.

Use form 1098 (info copy only) to report mortgage interest of $600 or more received by you during the year in the course of your trade or business from. Use form 1098, mortgage interest statement, to report mortgage interest (including points, defined later) of $600 or more you received during the. Form 1098 if you paid at least $600 in interest in a year, your mortgage company is required to send you a copy of form 1098 (also known as the mortgage. How come i didn't get a 1098 from both mortgage lenders i had this year?

The Form 1098—Also Known As Mortgage Interest Statement—Is Used To Report The Amount Of Interest And Related Expenses You Paid On Your Mortgage.

Form 1098, mortgage interest statement, is an essential document for reporting mortgage interest paid by borrowers and received by lenders. If you receive a current tax bill for any tax item that.