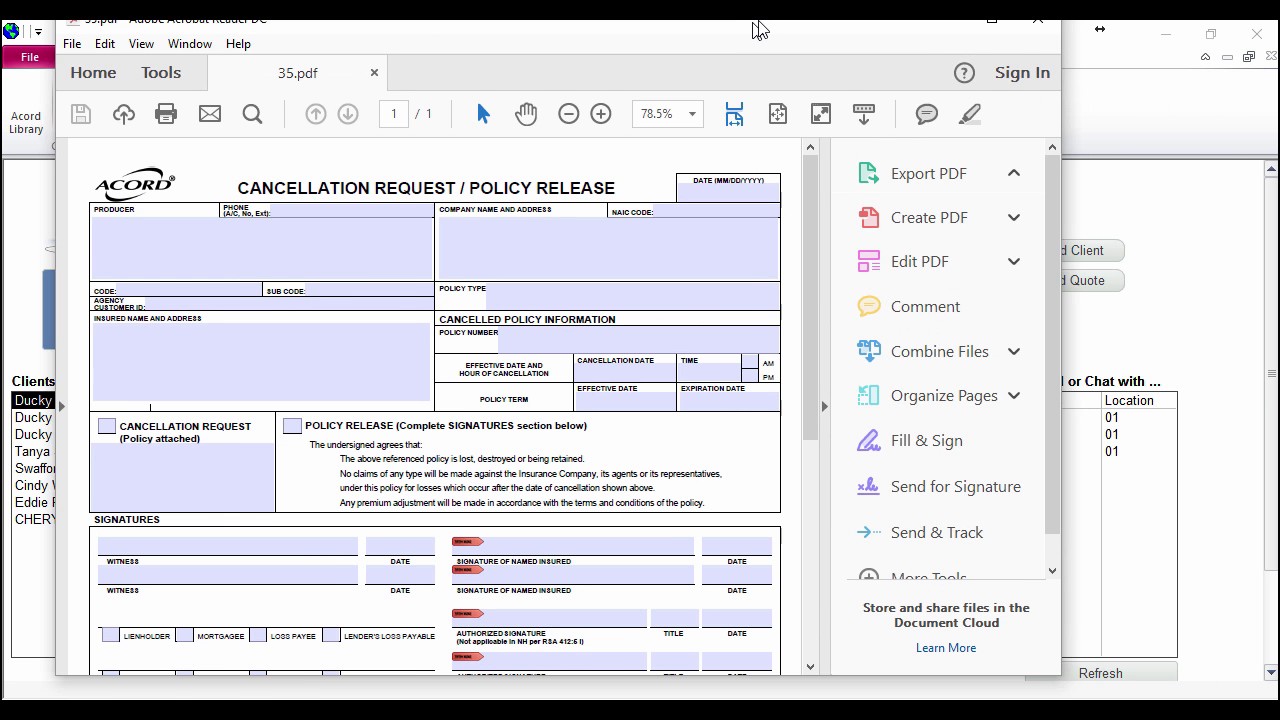

Lost Policy Release Form - The above referenced policy is lost, destroyed or being retained. No claims of any type will be made against the insurance company, its agents or its. The undersigned agrees that the above referenced policy is lost, destroyed, or being retained. No claims of any type will be made against the insurance company under this policy for losses which occur after the date of cancellation shown. It includes the policy information, the reason for. Find a blank lpr form and learn. Download a sample form to release and discharge a company from liability, claims or demands under a policy that was lost or cancelled. Any premium adjustment will be made in accordance. This form is used to cancel a policy and request a policy release from an insurance company. A lost policy release form is a document that allows the insured to cancel a policy when the contract is lost or misplaced.

Download a sample form to release and discharge a company from liability, claims or demands under a policy that was lost or cancelled. The above referenced policy is lost, destroyed or being retained. No claims of any type will be made against the insurance company under this policy for losses which occur after the date of cancellation shown. Any premium adjustment will be made in accordance. The undersigned agrees that the above referenced policy is lost, destroyed, or being retained. A lost policy release form is a document that allows the insured to cancel a policy when the contract is lost or misplaced. It includes the policy information, the reason for. Find a blank lpr form and learn. No claims of any type will be made against the insurance company, its agents or its. This form is used to cancel a policy and request a policy release from an insurance company.

The undersigned agrees that the above referenced policy is lost, destroyed, or being retained. Download a sample form to release and discharge a company from liability, claims or demands under a policy that was lost or cancelled. This form is used to cancel a policy and request a policy release from an insurance company. The above referenced policy is lost, destroyed or being retained. No claims of any type will be made against the insurance company, its agents or its. No claims of any type will be made against the insurance company under this policy for losses which occur after the date of cancellation shown. Find a blank lpr form and learn. It includes the policy information, the reason for. A lost policy release form is a document that allows the insured to cancel a policy when the contract is lost or misplaced. Any premium adjustment will be made in accordance.

Free General Release form Template Best Of Free General Liability

No claims of any type will be made against the insurance company under this policy for losses which occur after the date of cancellation shown. Download a sample form to release and discharge a company from liability, claims or demands under a policy that was lost or cancelled. Find a blank lpr form and learn. This form is used to.

Lost policy release form Fill out & sign online DocHub

It includes the policy information, the reason for. No claims of any type will be made against the insurance company under this policy for losses which occur after the date of cancellation shown. No claims of any type will be made against the insurance company, its agents or its. The undersigned agrees that the above referenced policy is lost, destroyed,.

Fl Cs Form ≡ Fill Out Printable PDF Forms Online

Download a sample form to release and discharge a company from liability, claims or demands under a policy that was lost or cancelled. The above referenced policy is lost, destroyed or being retained. The undersigned agrees that the above referenced policy is lost, destroyed, or being retained. It includes the policy information, the reason for. A lost policy release form.

Insurance Policy Bond Lost Letter Lost Insurance Bond Letters in

The undersigned agrees that the above referenced policy is lost, destroyed, or being retained. This form is used to cancel a policy and request a policy release from an insurance company. Any premium adjustment will be made in accordance. A lost policy release form is a document that allows the insured to cancel a policy when the contract is lost.

FREE 9+ Sample Insurance Release Forms in MS Word PDF

Any premium adjustment will be made in accordance. The undersigned agrees that the above referenced policy is lost, destroyed, or being retained. The above referenced policy is lost, destroyed or being retained. No claims of any type will be made against the insurance company, its agents or its. A lost policy release form is a document that allows the insured.

JenesisClassic Acord 35 (Cancellation Request/Policy Release) YouTube

The undersigned agrees that the above referenced policy is lost, destroyed, or being retained. Any premium adjustment will be made in accordance. Find a blank lpr form and learn. The above referenced policy is lost, destroyed or being retained. This form is used to cancel a policy and request a policy release from an insurance company.

Affidavit of Loss or Release of Interest Template Free Download

No claims of any type will be made against the insurance company, its agents or its. The undersigned agrees that the above referenced policy is lost, destroyed, or being retained. Find a blank lpr form and learn. A lost policy release form is a document that allows the insured to cancel a policy when the contract is lost or misplaced..

Fillable Online Lost Policy Release (LPR) What it is, How it Works Fax

A lost policy release form is a document that allows the insured to cancel a policy when the contract is lost or misplaced. Download a sample form to release and discharge a company from liability, claims or demands under a policy that was lost or cancelled. No claims of any type will be made against the insurance company under this.

Fillable Online LOST POLICY DECLARATION FORM Fax Email Print pdfFiller

A lost policy release form is a document that allows the insured to cancel a policy when the contract is lost or misplaced. Download a sample form to release and discharge a company from liability, claims or demands under a policy that was lost or cancelled. Any premium adjustment will be made in accordance. The above referenced policy is lost,.

Insurance Release Form Template

No claims of any type will be made against the insurance company under this policy for losses which occur after the date of cancellation shown. Any premium adjustment will be made in accordance. The above referenced policy is lost, destroyed or being retained. Find a blank lpr form and learn. Download a sample form to release and discharge a company.

Download A Sample Form To Release And Discharge A Company From Liability, Claims Or Demands Under A Policy That Was Lost Or Cancelled.

Find a blank lpr form and learn. The above referenced policy is lost, destroyed or being retained. No claims of any type will be made against the insurance company under this policy for losses which occur after the date of cancellation shown. A lost policy release form is a document that allows the insured to cancel a policy when the contract is lost or misplaced.

Any Premium Adjustment Will Be Made In Accordance.

This form is used to cancel a policy and request a policy release from an insurance company. It includes the policy information, the reason for. The undersigned agrees that the above referenced policy is lost, destroyed, or being retained. No claims of any type will be made against the insurance company, its agents or its.