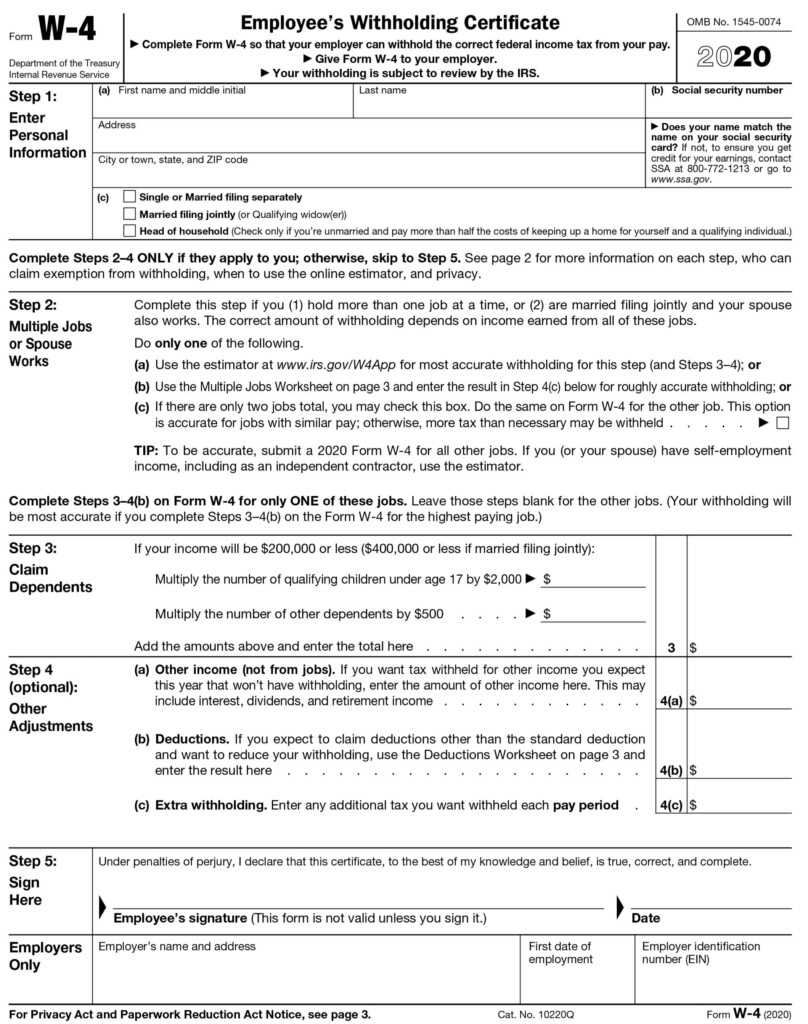

Louisiana Tax Withholding Form - If an employee fails to complete this withholding exemption certificate, the employer must withhold. Learn who is required to withhold louisiana income tax, who must file, when and how to remit tax payments, and how to file an amended return. This form must be filed with your employer. Otherwise he must withhold louisiana income tax from your wages.

This form must be filed with your employer. Otherwise he must withhold louisiana income tax from your wages. Learn who is required to withhold louisiana income tax, who must file, when and how to remit tax payments, and how to file an amended return. If an employee fails to complete this withholding exemption certificate, the employer must withhold.

Otherwise he must withhold louisiana income tax from your wages. Learn who is required to withhold louisiana income tax, who must file, when and how to remit tax payments, and how to file an amended return. This form must be filed with your employer. If an employee fails to complete this withholding exemption certificate, the employer must withhold.

Louisiana State Tax Form 2023 Printable Forms Free Online

Learn who is required to withhold louisiana income tax, who must file, when and how to remit tax payments, and how to file an amended return. Otherwise he must withhold louisiana income tax from your wages. This form must be filed with your employer. If an employee fails to complete this withholding exemption certificate, the employer must withhold.

State Of Alabama Employee Tax Withholding Form 2024

This form must be filed with your employer. Learn who is required to withhold louisiana income tax, who must file, when and how to remit tax payments, and how to file an amended return. Otherwise he must withhold louisiana income tax from your wages. If an employee fails to complete this withholding exemption certificate, the employer must withhold.

Irs Tax Brackets 2023 Chart Printable Forms Free Online

Learn who is required to withhold louisiana income tax, who must file, when and how to remit tax payments, and how to file an amended return. Otherwise he must withhold louisiana income tax from your wages. If an employee fails to complete this withholding exemption certificate, the employer must withhold. This form must be filed with your employer.

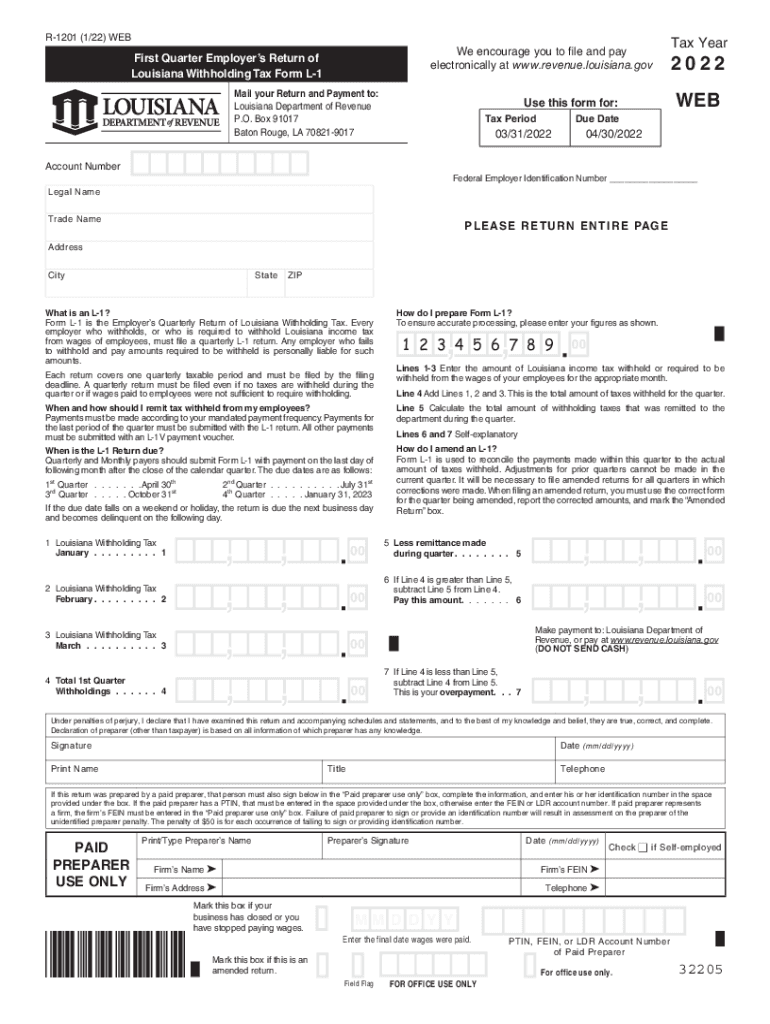

Louisiana Withholding Tax Form L1 2024

This form must be filed with your employer. If an employee fails to complete this withholding exemption certificate, the employer must withhold. Otherwise he must withhold louisiana income tax from your wages. Learn who is required to withhold louisiana income tax, who must file, when and how to remit tax payments, and how to file an amended return.

Louisiana withholding tax form l 1 Fill out & sign online DocHub

Otherwise he must withhold louisiana income tax from your wages. This form must be filed with your employer. If an employee fails to complete this withholding exemption certificate, the employer must withhold. Learn who is required to withhold louisiana income tax, who must file, when and how to remit tax payments, and how to file an amended return.

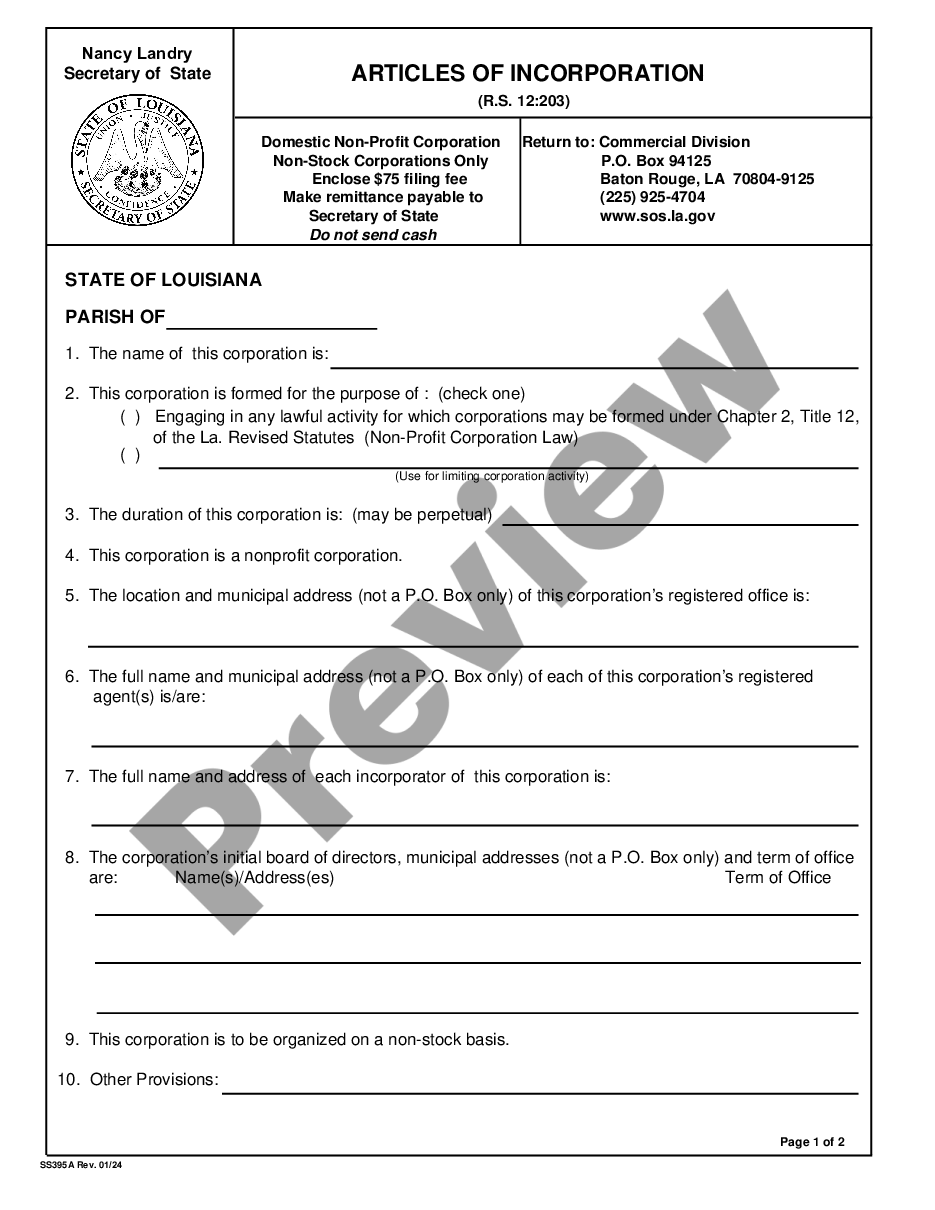

Articles Of Incorporation Louisiana Withholding US Legal Forms

Otherwise he must withhold louisiana income tax from your wages. Learn who is required to withhold louisiana income tax, who must file, when and how to remit tax payments, and how to file an amended return. If an employee fails to complete this withholding exemption certificate, the employer must withhold. This form must be filed with your employer.

Chairman of Louisiana tax writing committee checks into alcohol rehab

If an employee fails to complete this withholding exemption certificate, the employer must withhold. Otherwise he must withhold louisiana income tax from your wages. This form must be filed with your employer. Learn who is required to withhold louisiana income tax, who must file, when and how to remit tax payments, and how to file an amended return.

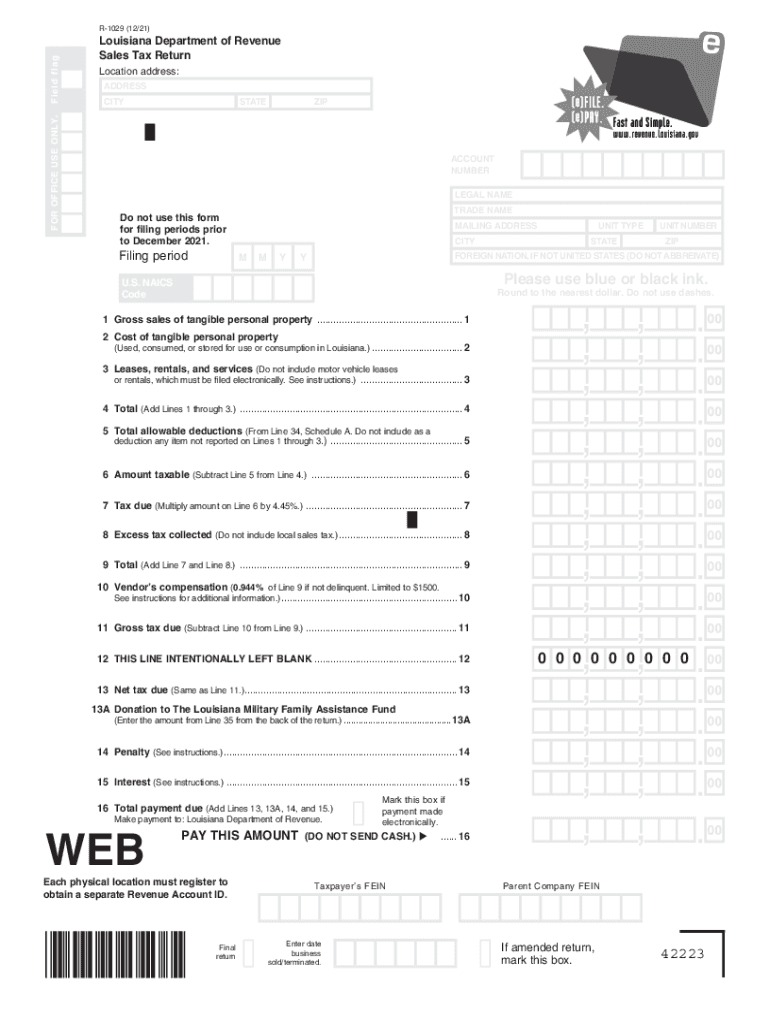

Louisiana tax exempt form 2023 Fill out & sign online DocHub

Learn who is required to withhold louisiana income tax, who must file, when and how to remit tax payments, and how to file an amended return. If an employee fails to complete this withholding exemption certificate, the employer must withhold. Otherwise he must withhold louisiana income tax from your wages. This form must be filed with your employer.

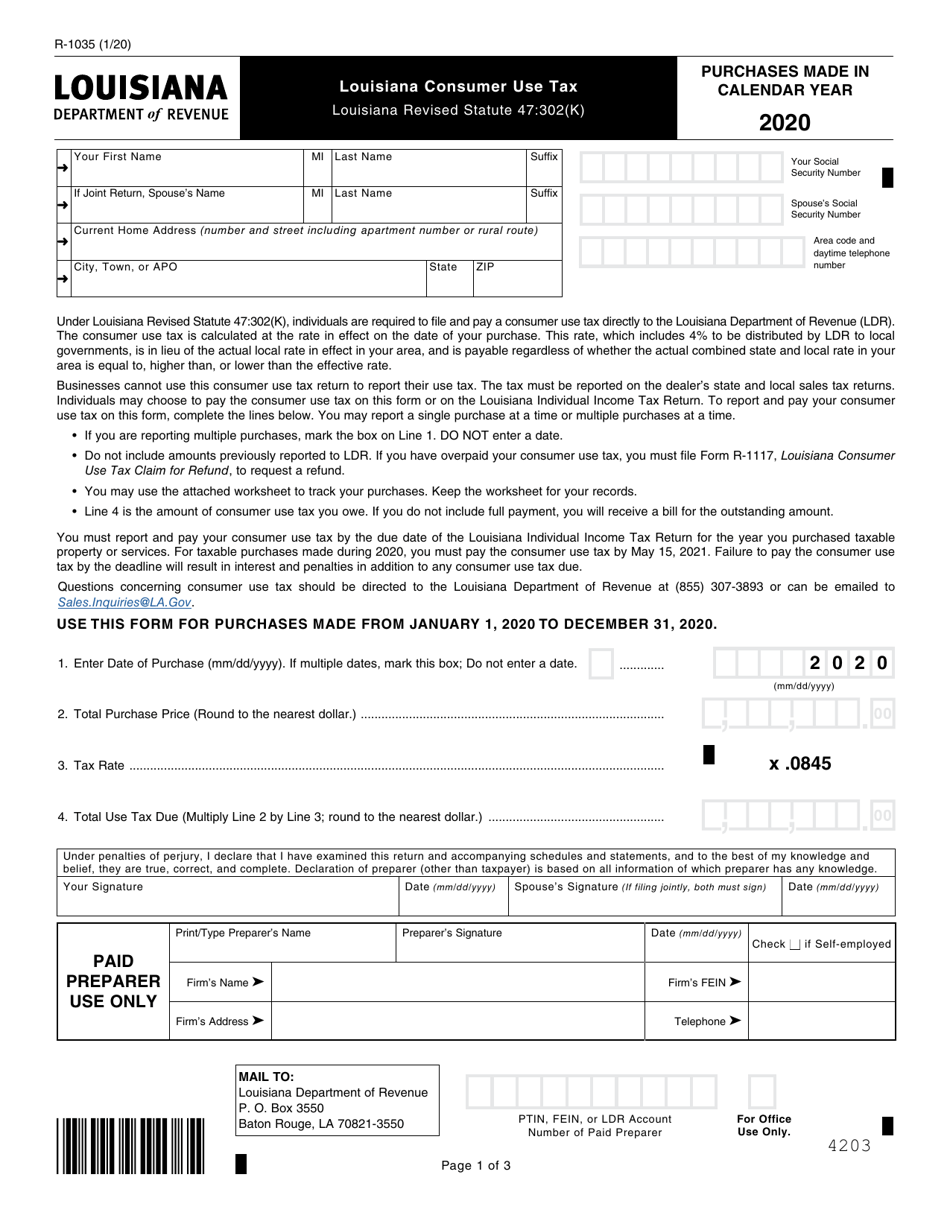

Form R1035 Download Fillable PDF or Fill Online Louisiana Consumer Use

This form must be filed with your employer. Otherwise he must withhold louisiana income tax from your wages. If an employee fails to complete this withholding exemption certificate, the employer must withhold. Learn who is required to withhold louisiana income tax, who must file, when and how to remit tax payments, and how to file an amended return.

L4 form Fill out & sign online DocHub

This form must be filed with your employer. If an employee fails to complete this withholding exemption certificate, the employer must withhold. Otherwise he must withhold louisiana income tax from your wages. Learn who is required to withhold louisiana income tax, who must file, when and how to remit tax payments, and how to file an amended return.

Otherwise He Must Withhold Louisiana Income Tax From Your Wages.

Learn who is required to withhold louisiana income tax, who must file, when and how to remit tax payments, and how to file an amended return. This form must be filed with your employer. If an employee fails to complete this withholding exemption certificate, the employer must withhold.