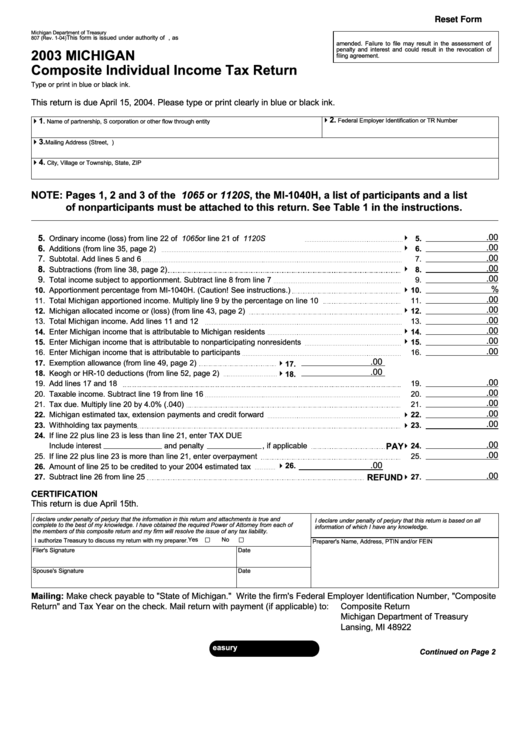

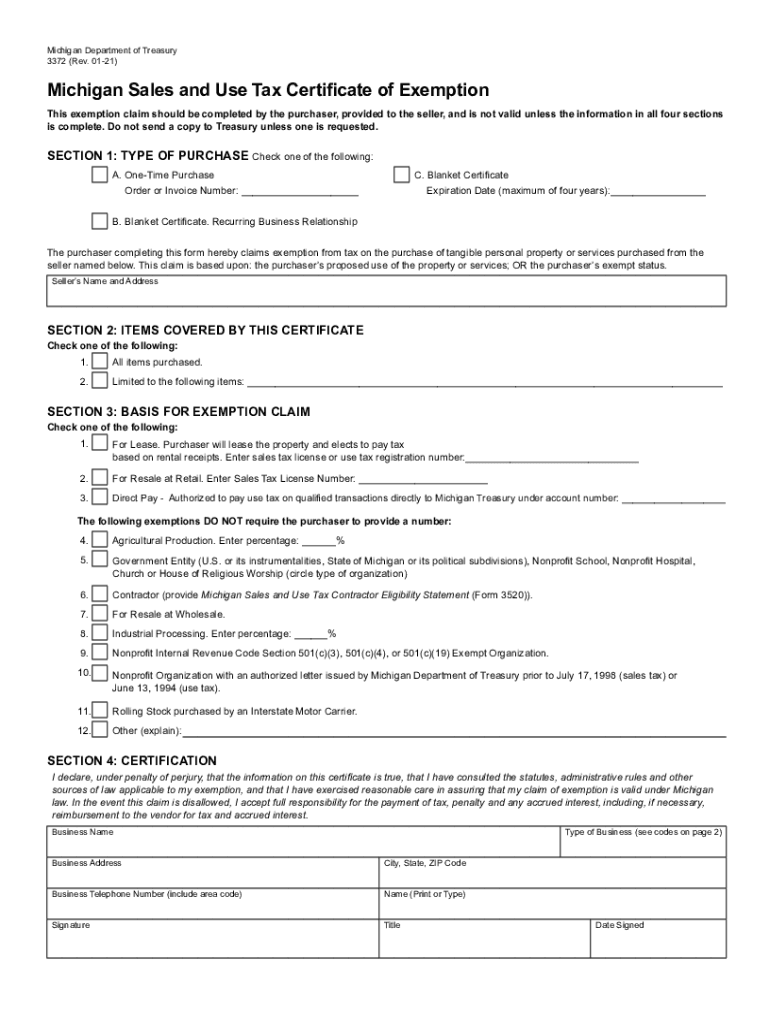

Mi Sales And Use Tax Form - This is a return for sales tax, use tax and/or withholding tax. If you received a letter of inquiry regarding annual return for the return period of 2023, visit. Form 5081 is available for submission electronically using michigan treasury online (mto) at mto.treasury.michigan.gov or by using. Purchasers may use this form to claim exemption from michigan sales and use tax on qualified transactions. This is a return for sales tax, use tax and/or withholding tax. It is the purchaser’s responsibility. If the taxpayer inserts a zero on or leaves blank any line reporting sales tax, use. It is the purchaser’s responsibility. Click the link to see. Sales and use tax forms index by year.

Purchasers may use this form to claim exemption from michigan sales and use tax on qualifi ed transactions. Form 5081 is available for submission electronically using michigan treasury online (mto) at mto.treasury.michigan.gov or by using. This is a return for sales tax, use tax and/or withholding tax. It is the purchaser’s responsibility. It is the purchaser’s responsibility. If the taxpayer inserts a zero on or leaves blank any line reporting sales tax, use. This is a return for sales tax, use tax and/or withholding tax. Click the link to see the 2024 form instructions. If you received a letter of inquiry regarding annual return for the return period of 2023, visit. Click the link to see.

Sales and use tax forms index by year. It is the purchaser’s responsibility. It is the purchaser’s responsibility. If the taxpayer inserts a zero on or leaves blank any line reporting sales tax, use. Click the link to see the 2024 form instructions. Form 5081 is available for submission electronically using michigan treasury online (mto) at mto.treasury.michigan.gov or by using. This is a return for sales tax, use tax and/or withholding tax. If you received a letter of inquiry regarding annual return for the return period of 2023, visit. Purchasers may use this form to claim exemption from michigan sales and use tax on qualified transactions. Click the link to see.

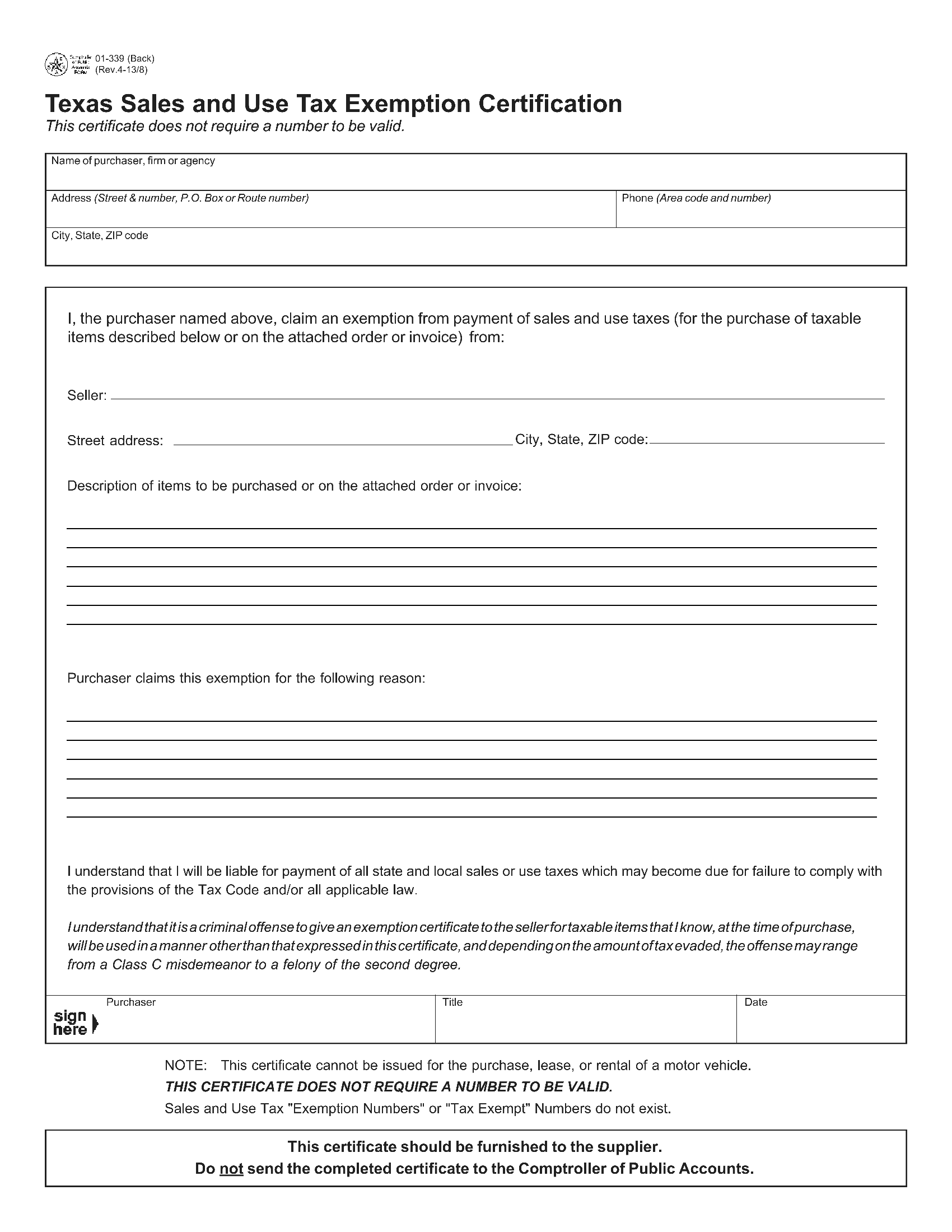

Types Of Sales Tax Exemption Certificates Form example download

If you received a letter of inquiry regarding annual return for the return period of 2023, visit. Purchasers may use this form to claim exemption from michigan sales and use tax on qualified transactions. If the taxpayer inserts a zero on or leaves blank any line reporting sales tax, use. It is the purchaser’s responsibility. It is the purchaser’s responsibility.

Mi sales tax Fill out & sign online DocHub

Purchasers may use this form to claim exemption from michigan sales and use tax on qualifi ed transactions. Purchasers may use this form to claim exemption from michigan sales and use tax on qualified transactions. Sales and use tax forms index by year. It is the purchaser’s responsibility. Click the link to see.

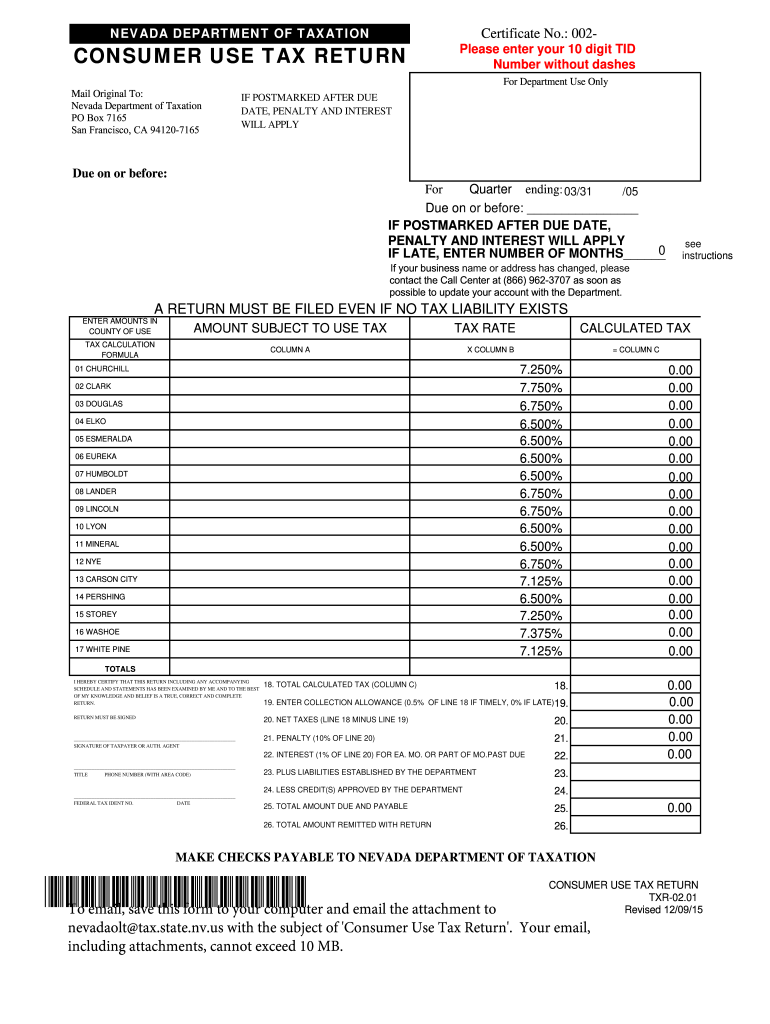

Nevada Use Tax 20152024 Form Fill Out and Sign Printable PDF

Form 5081 is available for submission electronically using michigan treasury online (mto) at mto.treasury.michigan.gov or by using. It is the purchaser’s responsibility. Purchasers may use this form to claim exemption from michigan sales and use tax on qualifi ed transactions. It is the purchaser’s responsibility. If you received a letter of inquiry regarding annual return for the return period of.

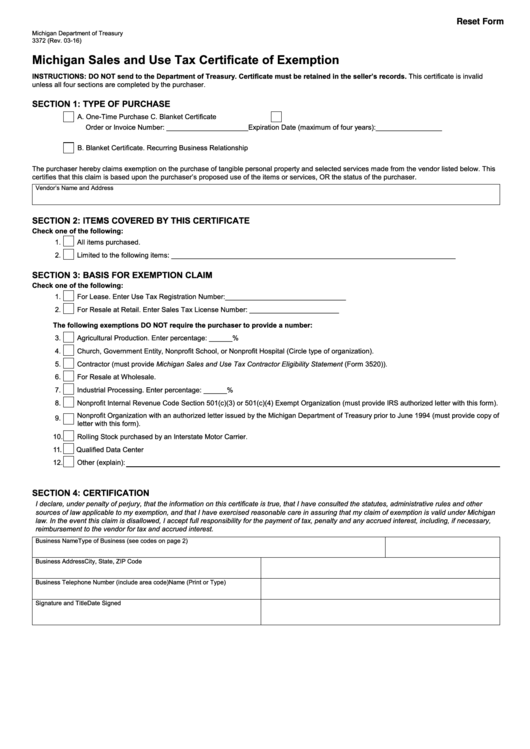

Fillable Form 3372 Michigan Sales And Use Tax Certificate Of

Purchasers may use this form to claim exemption from michigan sales and use tax on qualifi ed transactions. Form 5081 is available for submission electronically using michigan treasury online (mto) at mto.treasury.michigan.gov or by using. This is a return for sales tax, use tax and/or withholding tax. It is the purchaser’s responsibility. It is the purchaser’s responsibility.

State Of Michigan Sales Tax Forms 2024 Blisse Martie

Purchasers may use this form to claim exemption from michigan sales and use tax on qualifi ed transactions. Form 5081 is available for submission electronically using michigan treasury online (mto) at mto.treasury.michigan.gov or by using. It is the purchaser’s responsibility. Sales and use tax forms index by year. Click the link to see.

Alaska Sales And Use Tax Exemption Form

Sales and use tax forms index by year. Click the link to see the 2024 form instructions. It is the purchaser’s responsibility. If the taxpayer inserts a zero on or leaves blank any line reporting sales tax, use. This is a return for sales tax, use tax and/or withholding tax.

Texas Sales and Use Tax Exemption Certification Forms Docs 2023

This is a return for sales tax, use tax and/or withholding tax. This is a return for sales tax, use tax and/or withholding tax. If the taxpayer inserts a zero on or leaves blank any line reporting sales tax, use. It is the purchaser’s responsibility. Purchasers may use this form to claim exemption from michigan sales and use tax on.

Michigan Sales Tax Exemption 20212024 Form Fill Out and Sign

Sales and use tax forms index by year. Purchasers may use this form to claim exemption from michigan sales and use tax on qualified transactions. If you received a letter of inquiry regarding annual return for the return period of 2023, visit. This is a return for sales tax, use tax and/or withholding tax. It is the purchaser’s responsibility.

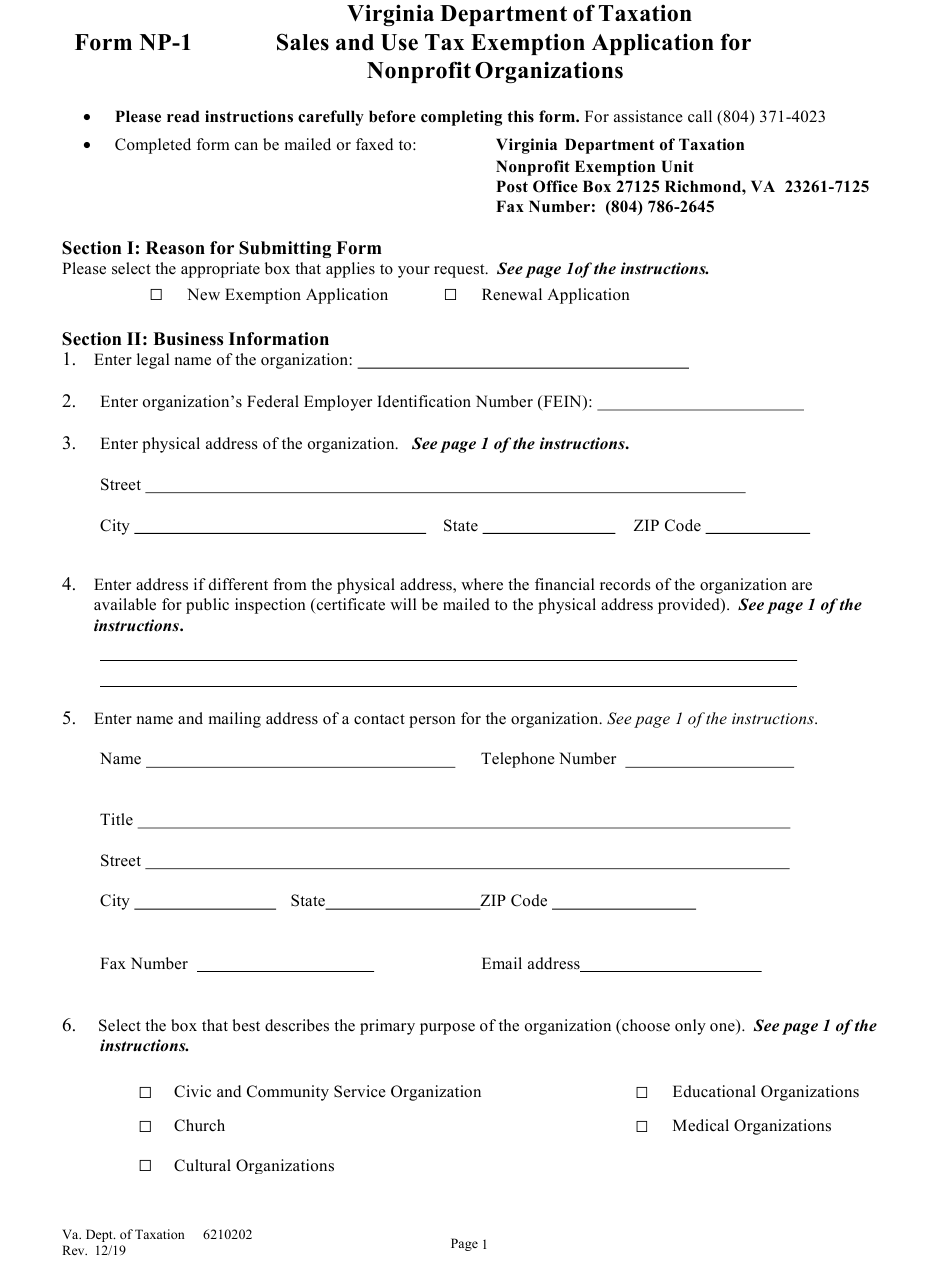

Form NP 1 Download Fillable PDF Or Fill Online Sales And Use Tax

This is a return for sales tax, use tax and/or withholding tax. Sales and use tax forms index by year. This is a return for sales tax, use tax and/or withholding tax. Click the link to see the 2024 form instructions. Form 5081 is available for submission electronically using michigan treasury online (mto) at mto.treasury.michigan.gov or by using.

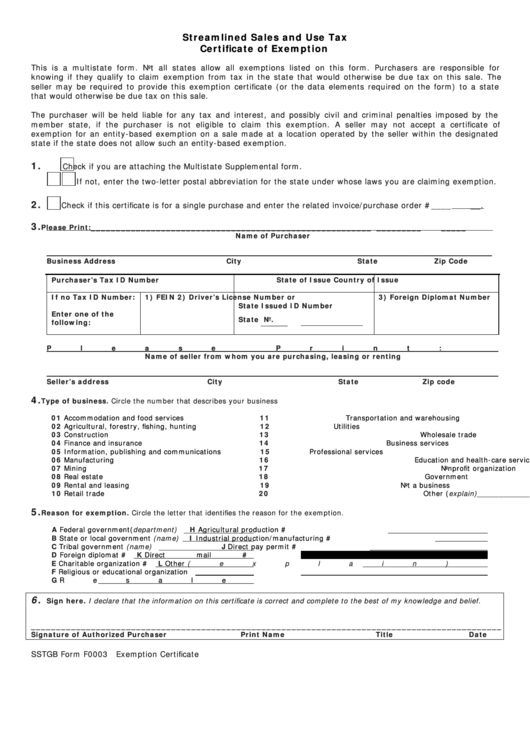

Streamlined Sales & Use Tax Certificate Of Exemption Form

It is the purchaser’s responsibility. If you received a letter of inquiry regarding annual return for the return period of 2023, visit. Click the link to see the 2024 form instructions. If the taxpayer inserts a zero on or leaves blank any line reporting sales tax, use. This is a return for sales tax, use tax and/or withholding tax.

Purchasers May Use This Form To Claim Exemption From Michigan Sales And Use Tax On Qualified Transactions.

It is the purchaser’s responsibility. Click the link to see. Purchasers may use this form to claim exemption from michigan sales and use tax on qualifi ed transactions. This is a return for sales tax, use tax and/or withholding tax.

Click The Link To See The 2024 Form Instructions.

This is a return for sales tax, use tax and/or withholding tax. It is the purchaser’s responsibility. Sales and use tax forms index by year. If you received a letter of inquiry regarding annual return for the return period of 2023, visit.

If The Taxpayer Inserts A Zero On Or Leaves Blank Any Line Reporting Sales Tax, Use.

Form 5081 is available for submission electronically using michigan treasury online (mto) at mto.treasury.michigan.gov or by using.