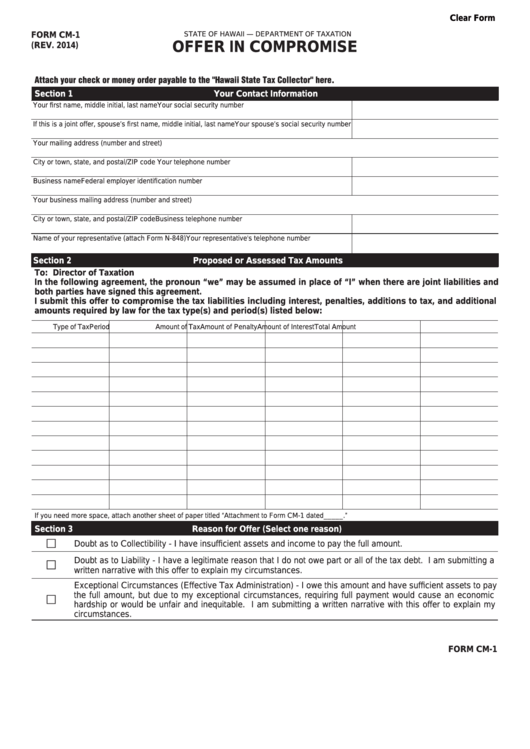

Michigan Offer In Compromise Form 5181 - Michigan form 5181 is used to request an offer in compromise from the state of michigan. Michigan department of treasury allows taxpayers to submit three different offer types to compromise a tax debt for less than what is. This package includes the forms required for a business to file an offer in compromise based on doubt as to liability. Under the offer in compromise program, treasury may compromise all or part of any outstanding tax debt that is subject to administration under the. An offer in compromise (offer) is an agreement between you (the taxpayer) and the michigan department of treasury (treasury) that settles. The taxpayer must state on the form the. You can request a michigan offer in compromise if you. Taxpayer can offer the state less than the actual liability to eliminate unpaid taxes if. 11 they must submit this form along with all. A taxpayer must submit an offer in compromise on michigan offer in compromise (form 5181).

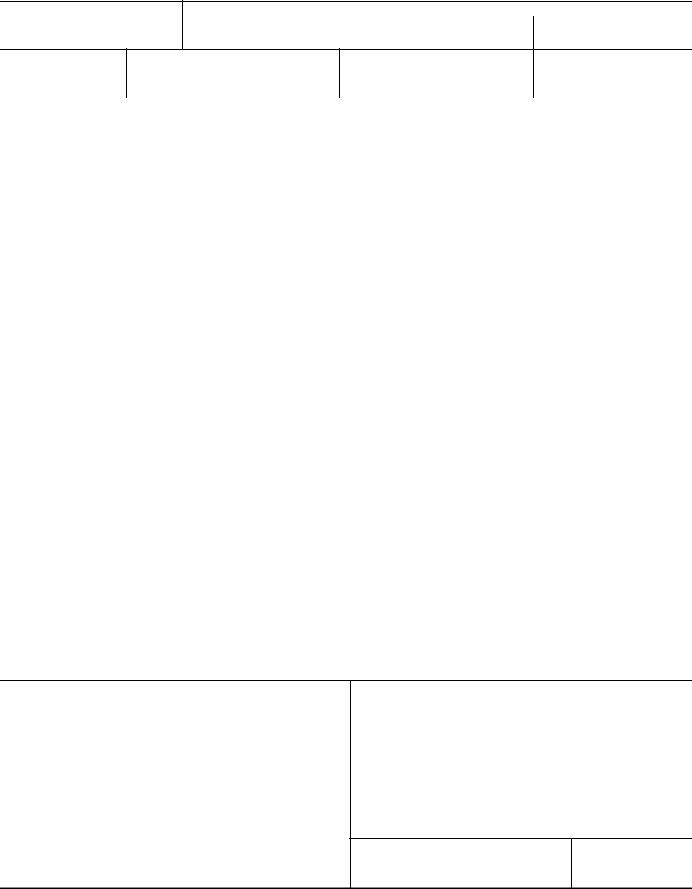

You can request a michigan offer in compromise if you. Michigan form 5181 is used to request an offer in compromise from the state of michigan. An offer in compromise (offer) is an agreement between you (the taxpayer) and the michigan department of treasury (treasury) that settles. What is a michigan offer in compromise? Taxpayer can offer the state less than the actual liability to eliminate unpaid taxes if. Under the offer in compromise program, treasury may compromise all or part of any outstanding tax debt that is subject to administration under the. Taxpayers who wish to submit an oic must submit the offer using form 5181. The taxpayer must state on the form the. This package includes the forms required for a business to file an offer in compromise based on doubt as to liability. Michigan department of treasury allows taxpayers to submit three different offer types to compromise a tax debt for less than what is.

Michigan department of treasury allows taxpayers to submit three different offer types to compromise a tax debt for less than what is. Under the offer in compromise program, treasury may compromise all or part of any outstanding tax debt that is subject to administration under the. A taxpayer must submit an offer in compromise on michigan offer in compromise (form 5181). The taxpayer must state on the form the. Taxpayers who wish to submit an oic must submit the offer using form 5181. A taxpayer will need to. An offer in compromise (offer) is an agreement between you (the taxpayer) and the michigan department of treasury (treasury) that settles. What is a michigan offer in compromise? 11 they must submit this form along with all. Taxpayer can offer the state less than the actual liability to eliminate unpaid taxes if.

How To Write An Offer In Compromise Letter Amelie Text

A taxpayer must submit an offer in compromise on michigan offer in compromise (form 5181). Under the offer in compromise program, treasury may compromise all or part of any outstanding tax debt that is subject to administration under the. Michigan form 5181 is used to request an offer in compromise from the state of michigan. You can request a michigan.

Form 14773 Offer in Compromise Withdrawal Sign on the Sheet Stock Photo

Michigan department of treasury allows taxpayers to submit three different offer types to compromise a tax debt for less than what is. 11 they must submit this form along with all. Michigan form 5181 is used to request an offer in compromise from the state of michigan. What is a michigan offer in compromise? A taxpayer must submit an offer.

Da Form 5181 R ≡ Fill Out Printable PDF Forms Online

Michigan form 5181 is used to request an offer in compromise from the state of michigan. Taxpayers who wish to submit an oic must submit the offer using form 5181. An offer in compromise (offer) is an agreement between you (the taxpayer) and the michigan department of treasury (treasury) that settles. What is a michigan offer in compromise? A taxpayer.

Offer In Compromise Letter Template Fill Online, Printable, Fillable

The taxpayer must state on the form the. An offer in compromise (offer) is an agreement between you (the taxpayer) and the michigan department of treasury (treasury) that settles. Taxpayers who wish to submit an oic must submit the offer using form 5181. You can request a michigan offer in compromise if you. 11 they must submit this form along.

Michigan Offer In Compromise How To Settle MI Tax Debt

Under the offer in compromise program, treasury may compromise all or part of any outstanding tax debt that is subject to administration under the. Taxpayers who wish to submit an oic must submit the offer using form 5181. A taxpayer will need to. Taxpayer can offer the state less than the actual liability to eliminate unpaid taxes if. Michigan form.

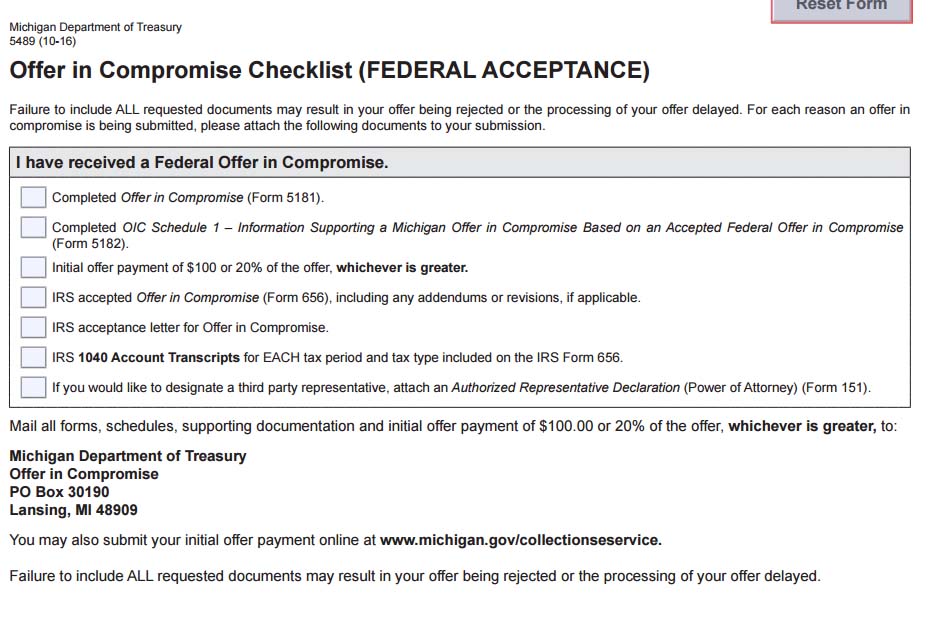

Fillable Form Cm1 Offer In Compromise printable pdf download

What is a michigan offer in compromise? An offer in compromise (offer) is an agreement between you (the taxpayer) and the michigan department of treasury (treasury) that settles. The taxpayer must state on the form the. A taxpayer must submit an offer in compromise on michigan offer in compromise (form 5181). Taxpayer can offer the state less than the actual.

Fillable Online Offer in compromise fillable form Fax Email Print

Michigan form 5181 is used to request an offer in compromise from the state of michigan. A taxpayer must submit an offer in compromise on michigan offer in compromise (form 5181). Taxpayer can offer the state less than the actual liability to eliminate unpaid taxes if. A taxpayer will need to. You can request a michigan offer in compromise if.

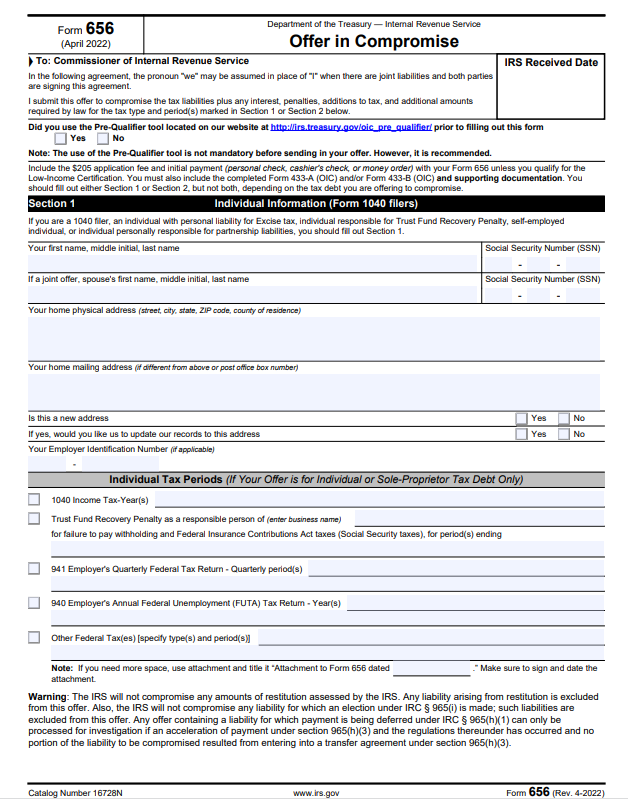

IRS Form 656 Understanding Offer in Compromise YouTube

The taxpayer must state on the form the. You can request a michigan offer in compromise if you. 11 they must submit this form along with all. Taxpayer can offer the state less than the actual liability to eliminate unpaid taxes if. Michigan form 5181 is used to request an offer in compromise from the state of michigan.

Michigan Offer In Compromise How To Settle MI Tax Debt

Taxpayer can offer the state less than the actual liability to eliminate unpaid taxes if. What is a michigan offer in compromise? Michigan department of treasury allows taxpayers to submit three different offer types to compromise a tax debt for less than what is. Michigan form 5181 is used to request an offer in compromise from the state of michigan..

Form 656 Fillable Offer In Compromise Printable Forms Free Online

Taxpayer can offer the state less than the actual liability to eliminate unpaid taxes if. You can request a michigan offer in compromise if you. Michigan department of treasury allows taxpayers to submit three different offer types to compromise a tax debt for less than what is. 11 they must submit this form along with all. Under the offer in.

An Offer In Compromise (Offer) Is An Agreement Between You (The Taxpayer) And The Michigan Department Of Treasury (Treasury) That Settles.

A taxpayer must submit an offer in compromise on michigan offer in compromise (form 5181). Michigan department of treasury allows taxpayers to submit three different offer types to compromise a tax debt for less than what is. The taxpayer must state on the form the. Michigan form 5181 is used to request an offer in compromise from the state of michigan.

Under The Offer In Compromise Program, Treasury May Compromise All Or Part Of Any Outstanding Tax Debt That Is Subject To Administration Under The.

11 they must submit this form along with all. You can request a michigan offer in compromise if you. What is a michigan offer in compromise? A taxpayer will need to.

Taxpayer Can Offer The State Less Than The Actual Liability To Eliminate Unpaid Taxes If.

This package includes the forms required for a business to file an offer in compromise based on doubt as to liability. Taxpayers who wish to submit an oic must submit the offer using form 5181.