Minnesota Form M3 - For state tax purposes, the partnership completes form m3, partnership return and files it with the department of revenue along with a copy of. If you choose not to use the. Here is how tax filing requirements are broken down for various minnesota business entities: Minnesota s corporation & partnership tax deadlines for 2024. All entities required to file a federal form 1065, u.s. Fein and minnesota id are required. Mail form m3 and all completed minnesota and federal forms and schedules using a mailing label (see page 19). If you don’t have a minnesota id number, you must first apply for one. Return of partnership income, and have minnesota gross income must file form m3,. All partnerships must complete m3a to determine its minnesota source income and minimum fee.

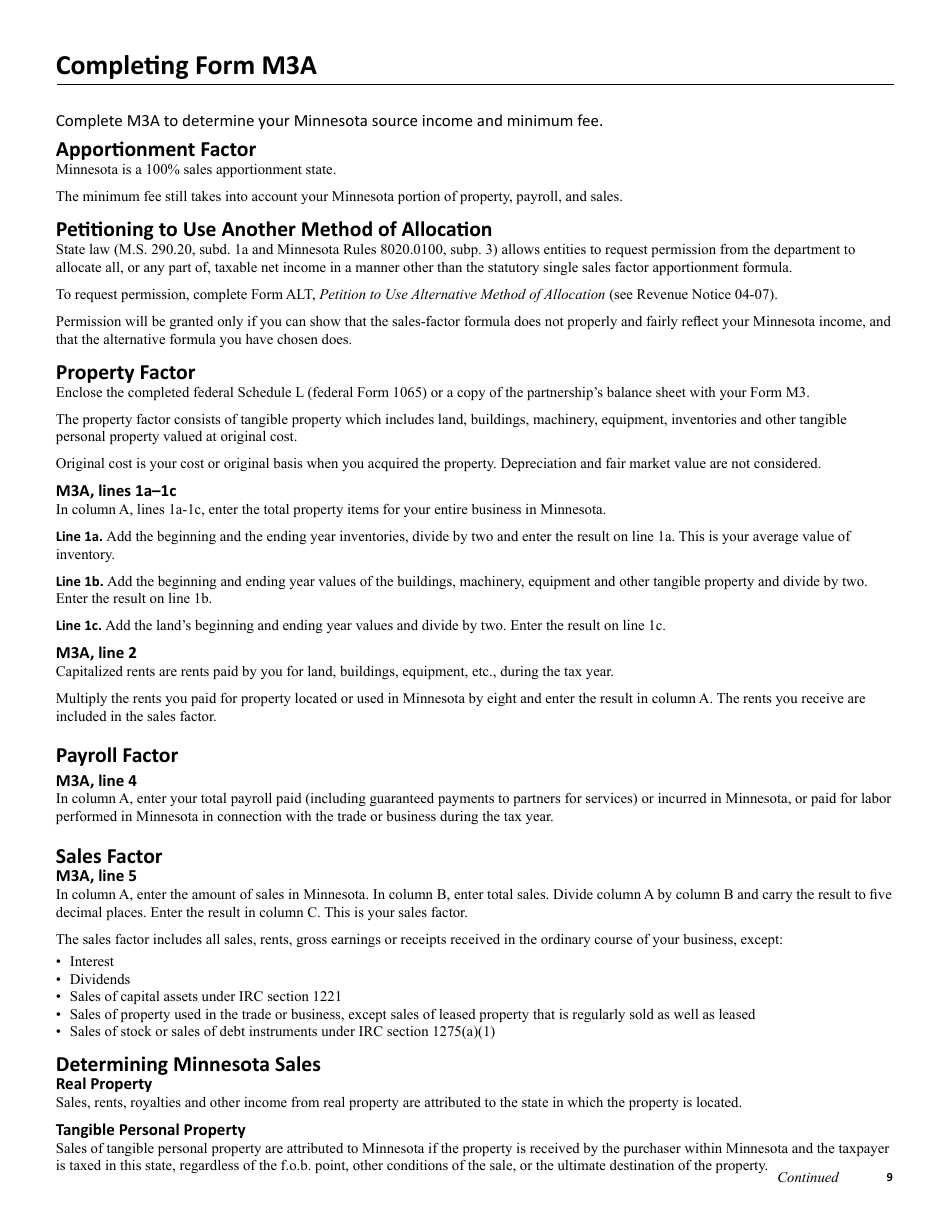

All entities required to file a federal form 1065, u.s. Here is how tax filing requirements are broken down for various minnesota business entities: All partnerships must complete m3a to determine its minnesota source income and minimum fee. See m3a instructions beginning on page 9. Minnesota s corporation & partnership tax deadlines for 2024. Return of partnership income, and have minnesota gross income must file form m3,. You must file in minnesota by march 15, 2025. Mail form m3 and all completed minnesota and federal forms and schedules using a mailing label (see page 19). For state tax purposes, the partnership completes form m3, partnership return and files it with the department of revenue along with a copy of. If you choose not to use the.

Return of partnership income, and have minnesota gross income must file form m3,. All partnerships must complete m3a to determine its minnesota source income and minimum fee. Mail form m3 and all completed minnesota and federal forms and schedules using a mailing label (see page 19). Here is how tax filing requirements are broken down for various minnesota business entities: Fein and minnesota id are required. You must file in minnesota by march 15, 2025. For state tax purposes, the partnership completes form m3, partnership return and files it with the department of revenue along with a copy of. All entities required to file a federal form 1065, u.s. If you don’t have a minnesota id number, you must first apply for one. See m3a instructions beginning on page 9.

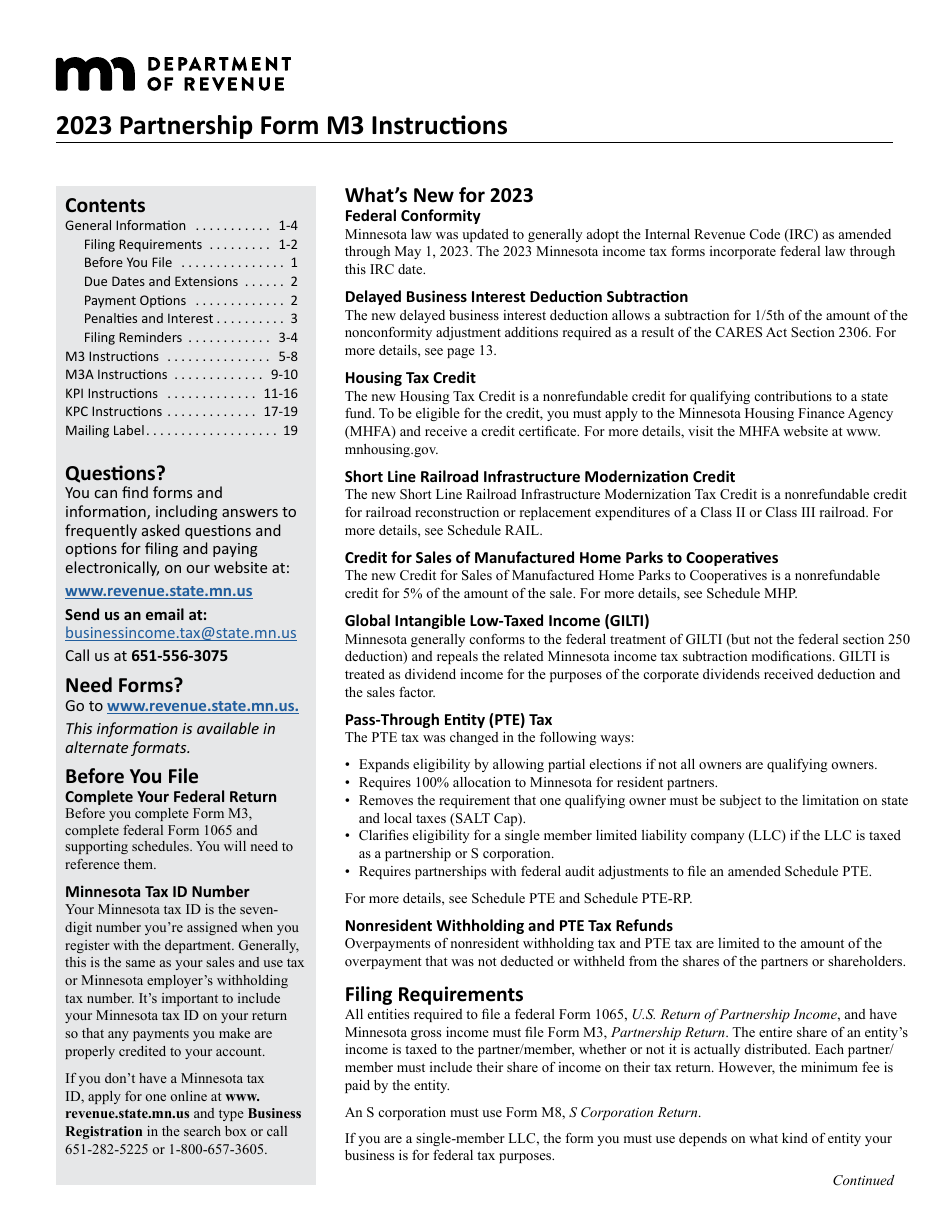

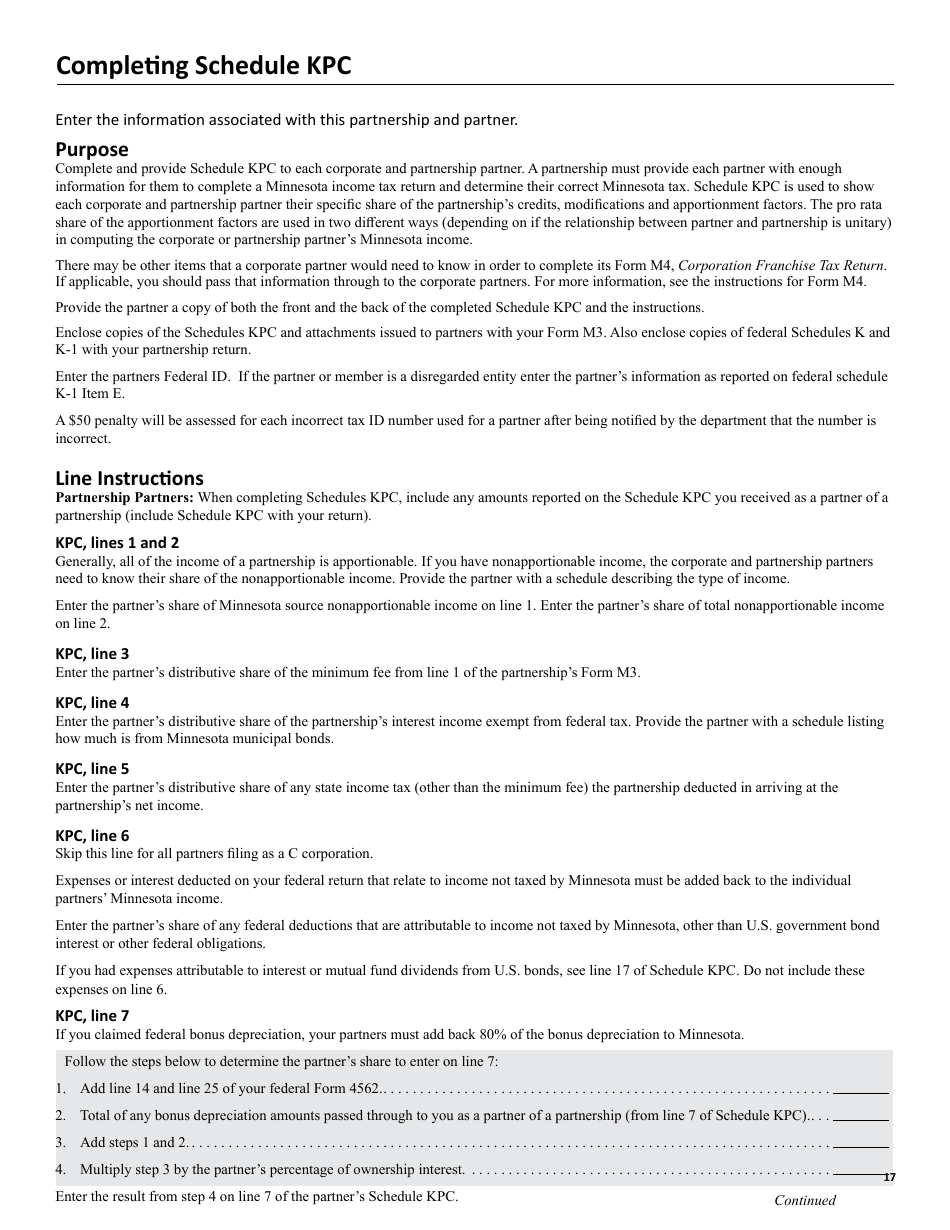

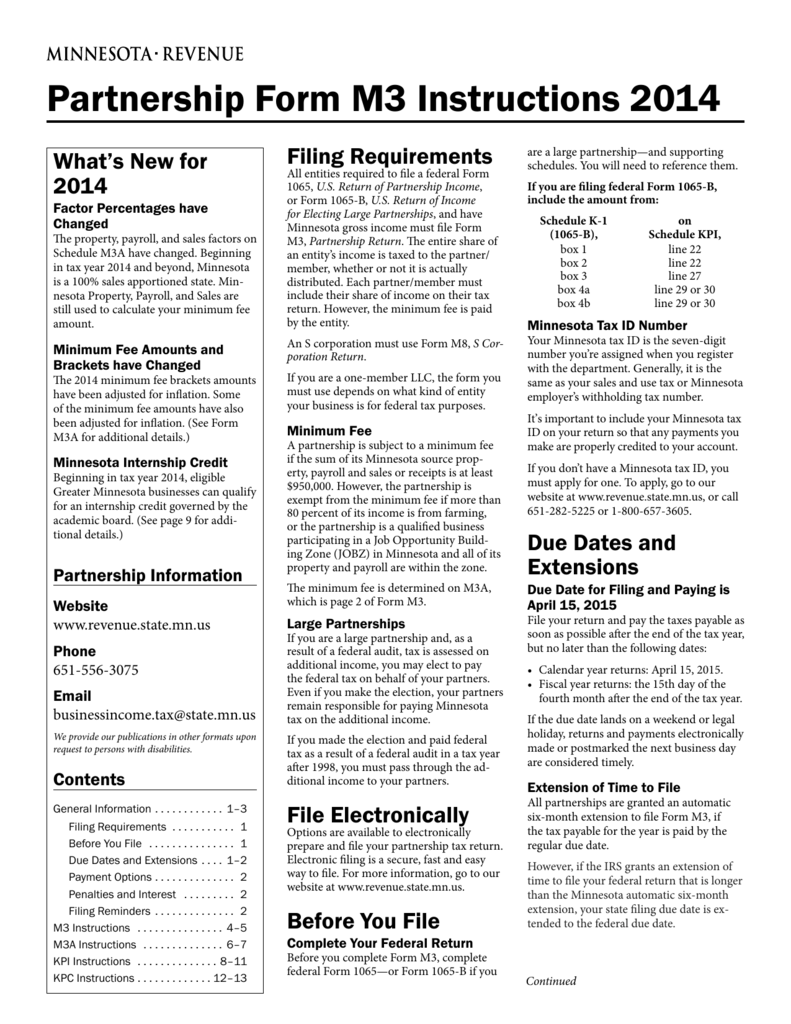

Download Instructions for Form M3 Partnership Return PDF, 2023

All partnerships must complete m3a to determine its minnesota source income and minimum fee. You must file in minnesota by march 15, 2025. All entities required to file a federal form 1065, u.s. If you choose not to use the. Fein and minnesota id are required.

Download Instructions for Form M3 Partnership Return PDF, 2023

Here is how tax filing requirements are broken down for various minnesota business entities: Mail form m3 and all completed minnesota and federal forms and schedules using a mailing label (see page 19). See m3a instructions beginning on page 9. If you choose not to use the. For state tax purposes, the partnership completes form m3, partnership return and files.

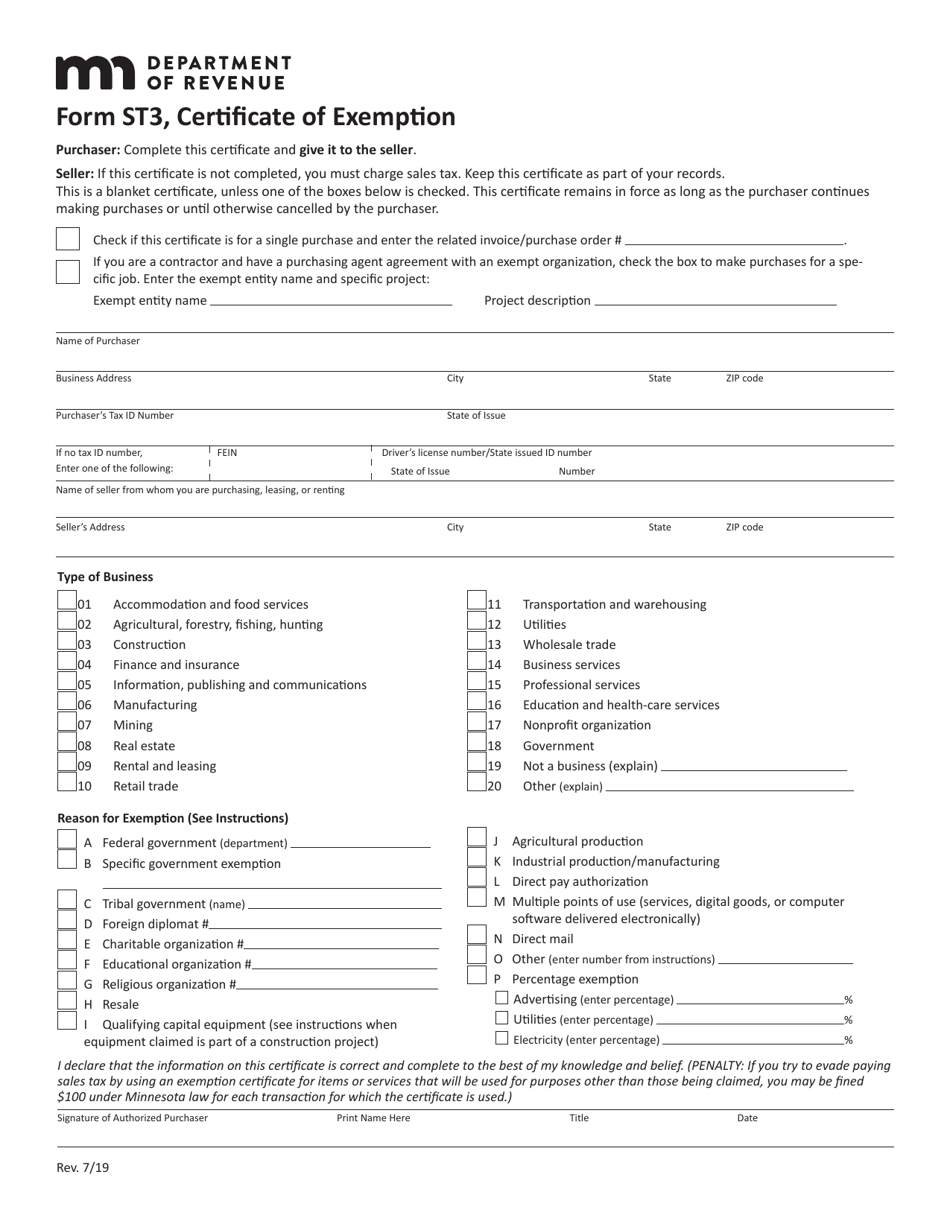

Minnesota St3 Form Fillable Printable Forms Free Online

Return of partnership income, and have minnesota gross income must file form m3,. If you choose not to use the. For state tax purposes, the partnership completes form m3, partnership return and files it with the department of revenue along with a copy of. Mail form m3 and all completed minnesota and federal forms and schedules using a mailing label.

M3_example Minnesota

Fein and minnesota id are required. See m3a instructions beginning on page 9. Here is how tax filing requirements are broken down for various minnesota business entities: If you don’t have a minnesota id number, you must first apply for one. Mail form m3 and all completed minnesota and federal forms and schedules using a mailing label (see page 19).

Minnesota State Tax Form 2023 Printable Forms Free Online

See m3a instructions beginning on page 9. Mail form m3 and all completed minnesota and federal forms and schedules using a mailing label (see page 19). You must file in minnesota by march 15, 2025. Minnesota s corporation & partnership tax deadlines for 2024. Here is how tax filing requirements are broken down for various minnesota business entities:

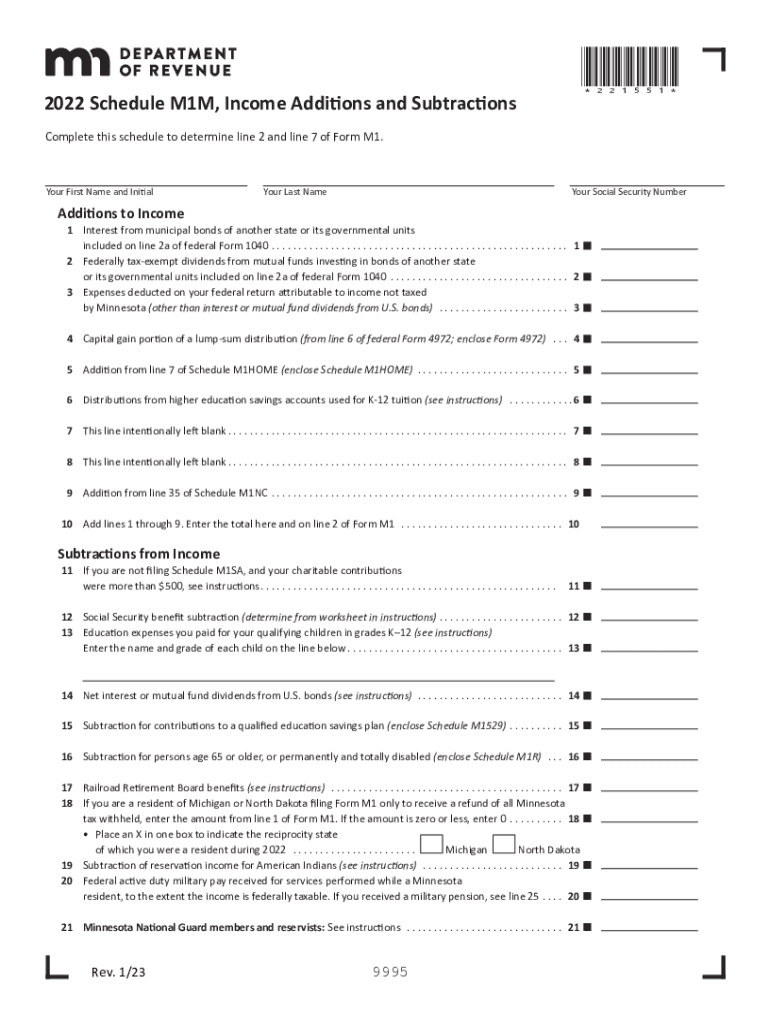

2022 Form MN DoR Schedule M1M Fill Online, Printable, Fillable, Blank

If you choose not to use the. Mail form m3 and all completed minnesota and federal forms and schedules using a mailing label (see page 19). Here is how tax filing requirements are broken down for various minnesota business entities: Fein and minnesota id are required. For state tax purposes, the partnership completes form m3, partnership return and files it.

Download Instructions for Form M3 Partnership Return PDF, 2023

Return of partnership income, and have minnesota gross income must file form m3,. All entities required to file a federal form 1065, u.s. If you don’t have a minnesota id number, you must first apply for one. You must file in minnesota by march 15, 2025. Mail form m3 and all completed minnesota and federal forms and schedules using a.

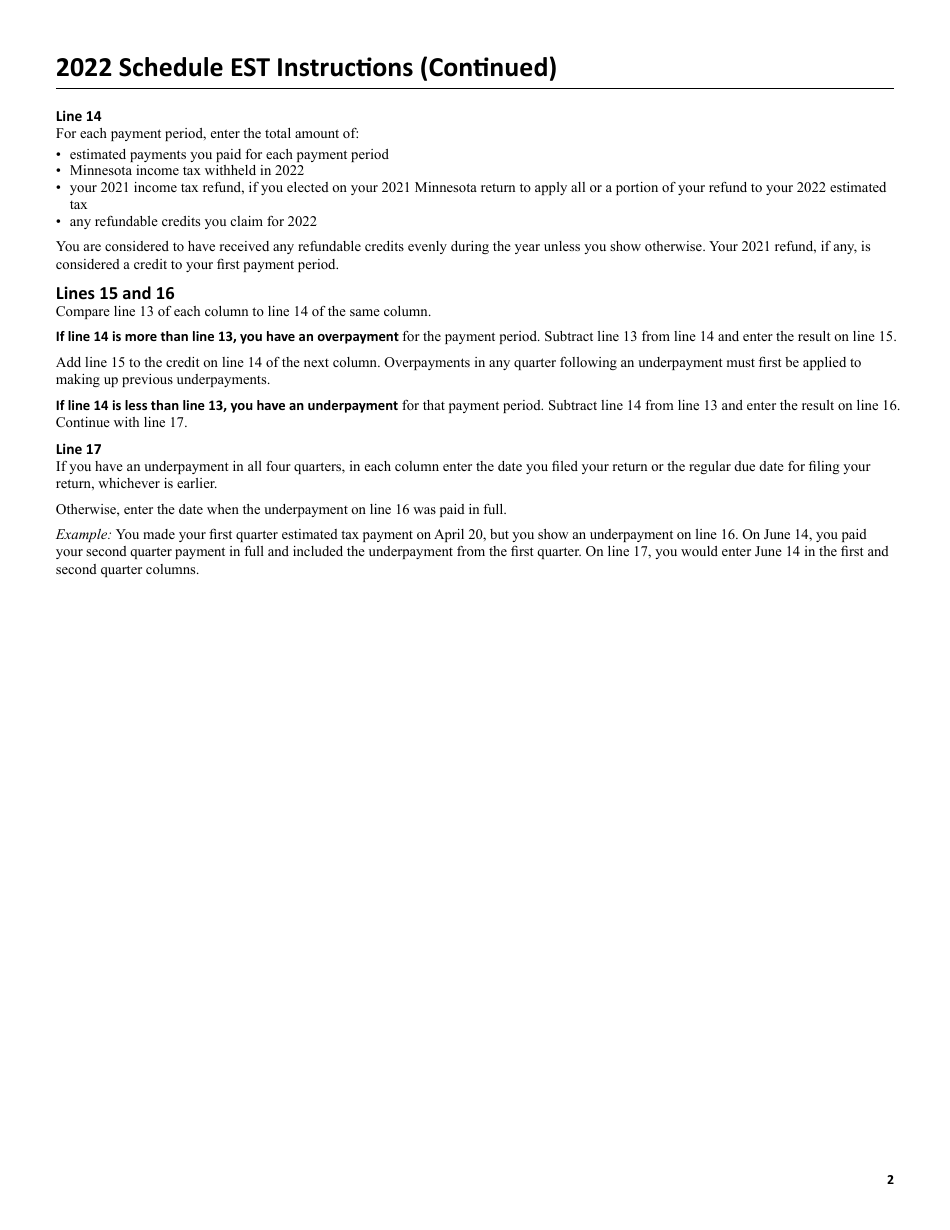

Form EST 2022 Fill Out, Sign Online and Download Fillable PDF

See m3a instructions beginning on page 9. All partnerships must complete m3a to determine its minnesota source income and minimum fee. All entities required to file a federal form 1065, u.s. If you choose not to use the. For state tax purposes, the partnership completes form m3, partnership return and files it with the department of revenue along with a.

Download Instructions for Form M3 Partnership Return PDF, 2023

Fein and minnesota id are required. Minnesota s corporation & partnership tax deadlines for 2024. If you don’t have a minnesota id number, you must first apply for one. See m3a instructions beginning on page 9. For state tax purposes, the partnership completes form m3, partnership return and files it with the department of revenue along with a copy of.

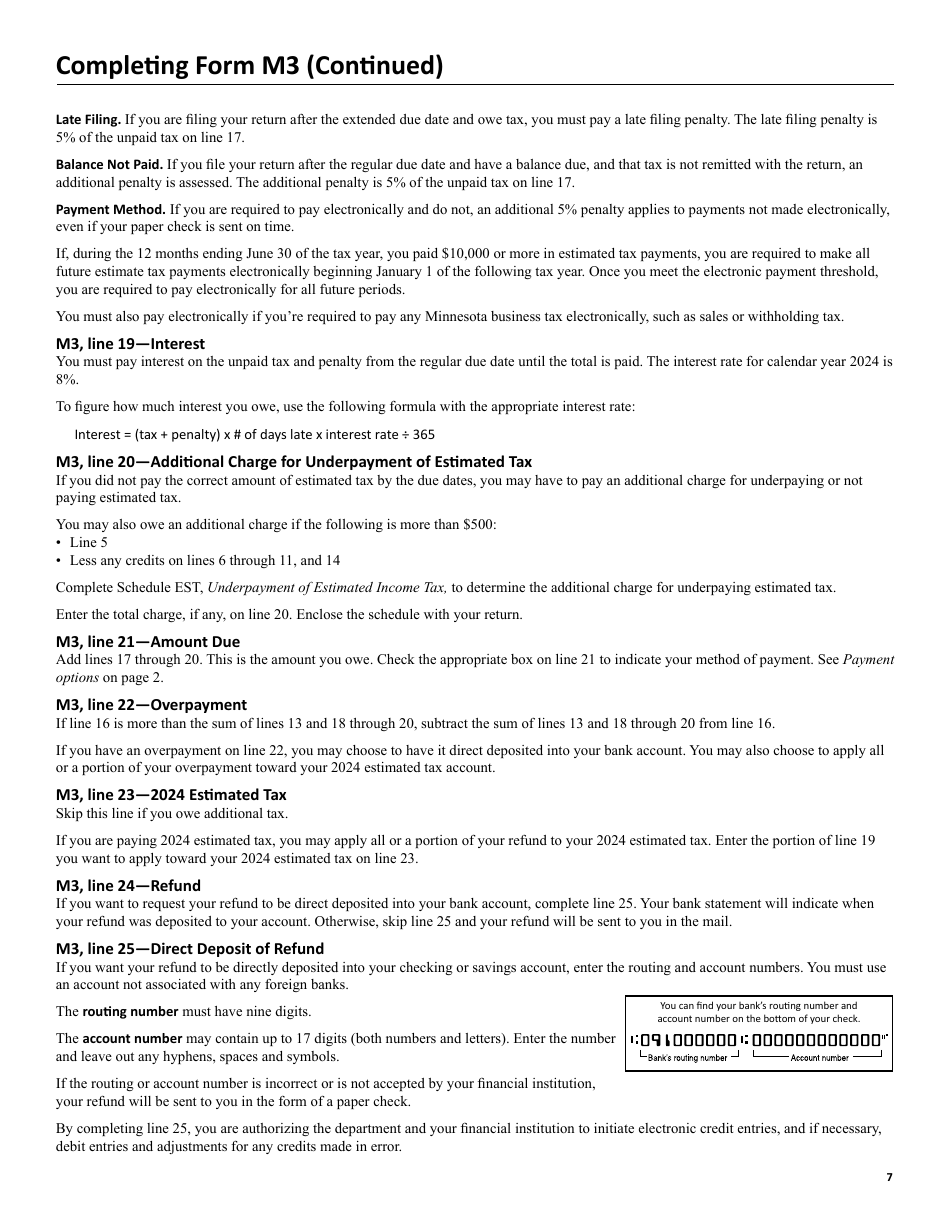

(Form M3) instructions Minnesota Department of Revenue

If you don’t have a minnesota id number, you must first apply for one. Minnesota s corporation & partnership tax deadlines for 2024. You must file in minnesota by march 15, 2025. For state tax purposes, the partnership completes form m3, partnership return and files it with the department of revenue along with a copy of. All partnerships must complete.

If You Don’t Have A Minnesota Id Number, You Must First Apply For One.

All entities required to file a federal form 1065, u.s. Return of partnership income, and have minnesota gross income must file form m3,. If you choose not to use the. Minnesota s corporation & partnership tax deadlines for 2024.

Fein And Minnesota Id Are Required.

You must file in minnesota by march 15, 2025. Mail form m3 and all completed minnesota and federal forms and schedules using a mailing label (see page 19). For state tax purposes, the partnership completes form m3, partnership return and files it with the department of revenue along with a copy of. All partnerships must complete m3a to determine its minnesota source income and minimum fee.

Here Is How Tax Filing Requirements Are Broken Down For Various Minnesota Business Entities:

See m3a instructions beginning on page 9.