Mississippi Sales Tax Exemption Form Pdf - Qualify to claim exemption from tax in the state that would otherwise be due tax on this sale. Sales of property, labor, services or products are exempt from mississippi sales tax when sold to the united states government, the state of. Once an application for a sales and/or use tax permit is approved and issued, a sales or use tax permit and two return forms are mailed. Use this form to claim exemption from sales tax on purchases of otherwise taxable items. The purchaser must complete all fields on the. Exemptions provided in these sections do not apply to taxes levied by miss. The seller may be required to provide this. An exemption from sales tax must be specifically provided by law.

Once an application for a sales and/or use tax permit is approved and issued, a sales or use tax permit and two return forms are mailed. Exemptions provided in these sections do not apply to taxes levied by miss. The purchaser must complete all fields on the. Sales of property, labor, services or products are exempt from mississippi sales tax when sold to the united states government, the state of. The seller may be required to provide this. An exemption from sales tax must be specifically provided by law. Use this form to claim exemption from sales tax on purchases of otherwise taxable items. Qualify to claim exemption from tax in the state that would otherwise be due tax on this sale.

Sales of property, labor, services or products are exempt from mississippi sales tax when sold to the united states government, the state of. Qualify to claim exemption from tax in the state that would otherwise be due tax on this sale. An exemption from sales tax must be specifically provided by law. The seller may be required to provide this. Use this form to claim exemption from sales tax on purchases of otherwise taxable items. Exemptions provided in these sections do not apply to taxes levied by miss. The purchaser must complete all fields on the. Once an application for a sales and/or use tax permit is approved and issued, a sales or use tax permit and two return forms are mailed.

Mississippi Tax Tables 2024 Barrie Lucinda

Qualify to claim exemption from tax in the state that would otherwise be due tax on this sale. Once an application for a sales and/or use tax permit is approved and issued, a sales or use tax permit and two return forms are mailed. Sales of property, labor, services or products are exempt from mississippi sales tax when sold to.

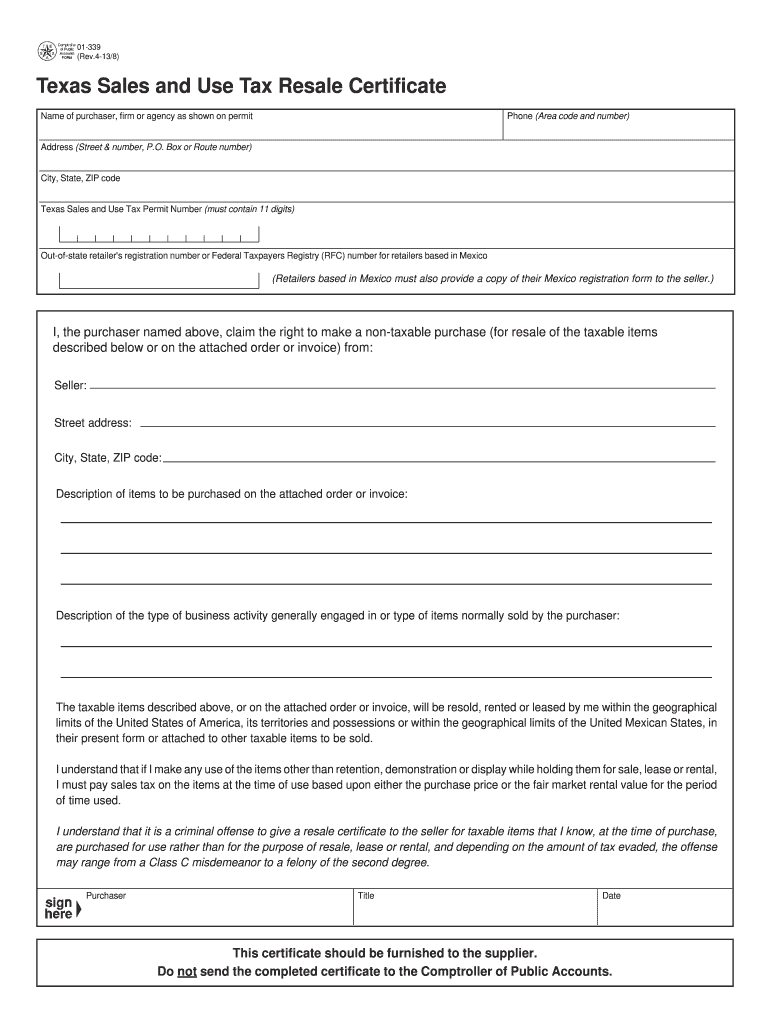

Texas Sales And Use Tax Permit Fill and Sign Printable Template

Use this form to claim exemption from sales tax on purchases of otherwise taxable items. The purchaser must complete all fields on the. Exemptions provided in these sections do not apply to taxes levied by miss. An exemption from sales tax must be specifically provided by law. Once an application for a sales and/or use tax permit is approved and.

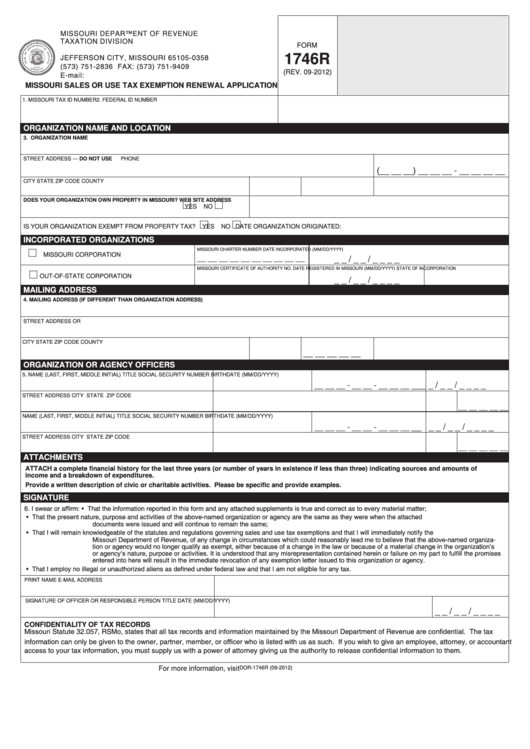

Mississippi Sales And Use Tax Exemption Form

Once an application for a sales and/or use tax permit is approved and issued, a sales or use tax permit and two return forms are mailed. The seller may be required to provide this. An exemption from sales tax must be specifically provided by law. Sales of property, labor, services or products are exempt from mississippi sales tax when sold.

Louisiana sales tax exemption form pdf Fill out & sign online DocHub

Sales of property, labor, services or products are exempt from mississippi sales tax when sold to the united states government, the state of. Exemptions provided in these sections do not apply to taxes levied by miss. The purchaser must complete all fields on the. An exemption from sales tax must be specifically provided by law. Use this form to claim.

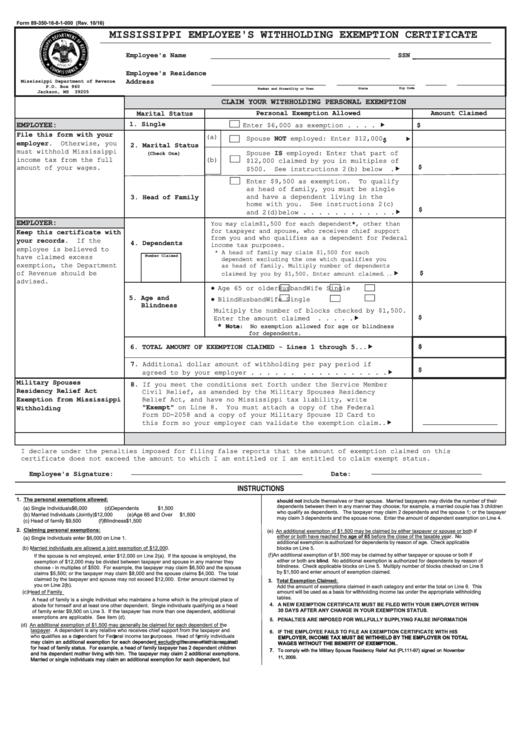

Top 8 Mississippi Withholding Form Templates free to download in PDF format

Once an application for a sales and/or use tax permit is approved and issued, a sales or use tax permit and two return forms are mailed. Use this form to claim exemption from sales tax on purchases of otherwise taxable items. An exemption from sales tax must be specifically provided by law. The seller may be required to provide this..

Mississippi Tax Reform Details & Evaluation Tax Foundation

The seller may be required to provide this. The purchaser must complete all fields on the. Use this form to claim exemption from sales tax on purchases of otherwise taxable items. Sales of property, labor, services or products are exempt from mississippi sales tax when sold to the united states government, the state of. Qualify to claim exemption from tax.

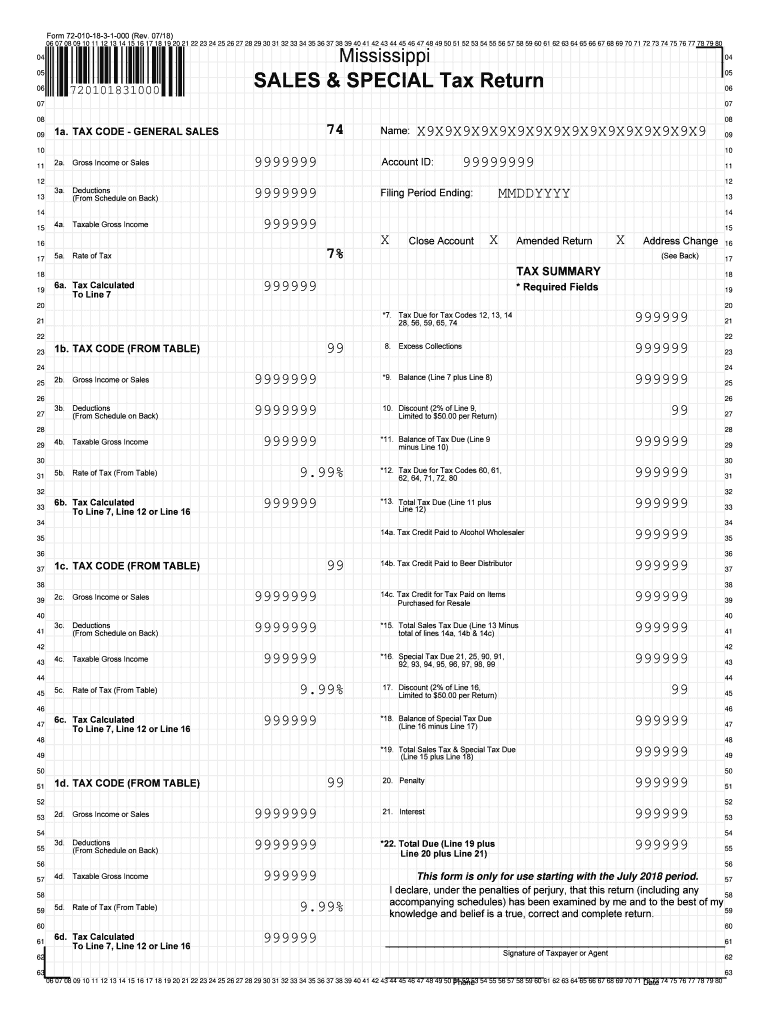

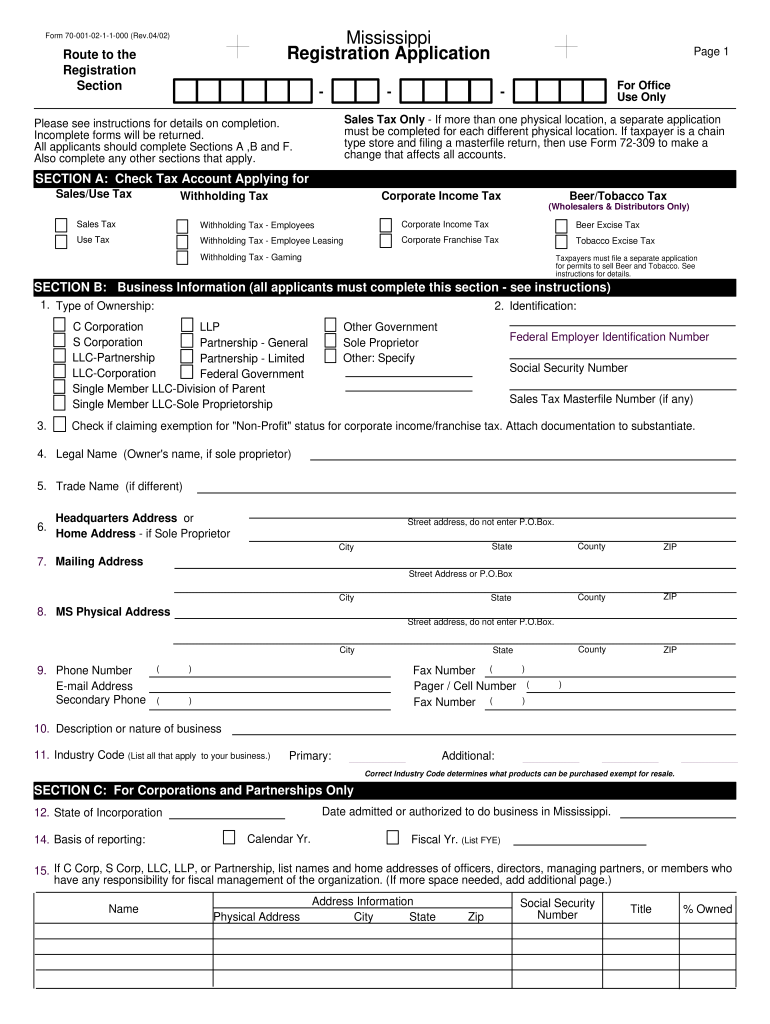

20202023 Form MS DoR 72010 Fill Online, Printable, Fillable, Blank

Sales of property, labor, services or products are exempt from mississippi sales tax when sold to the united states government, the state of. The purchaser must complete all fields on the. Once an application for a sales and/or use tax permit is approved and issued, a sales or use tax permit and two return forms are mailed. The seller may.

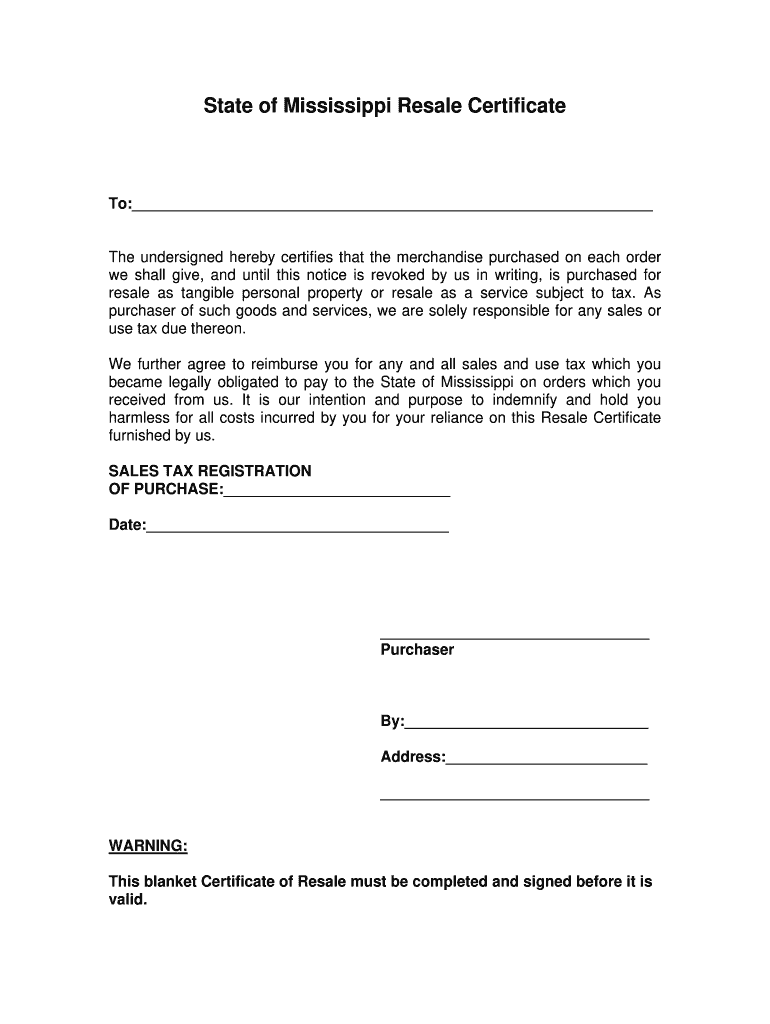

Mississippi resale certificate pdf Fill out & sign online DocHub

Exemptions provided in these sections do not apply to taxes levied by miss. The seller may be required to provide this. Sales of property, labor, services or products are exempt from mississippi sales tax when sold to the united states government, the state of. An exemption from sales tax must be specifically provided by law. Once an application for a.

Mississippi tax exempt form pdf Fill out & sign online DocHub

The seller may be required to provide this. Qualify to claim exemption from tax in the state that would otherwise be due tax on this sale. The purchaser must complete all fields on the. Exemptions provided in these sections do not apply to taxes levied by miss. An exemption from sales tax must be specifically provided by law.

Tax exemption form Fill out & sign online DocHub

Exemptions provided in these sections do not apply to taxes levied by miss. The purchaser must complete all fields on the. The seller may be required to provide this. Sales of property, labor, services or products are exempt from mississippi sales tax when sold to the united states government, the state of. Use this form to claim exemption from sales.

Qualify To Claim Exemption From Tax In The State That Would Otherwise Be Due Tax On This Sale.

Once an application for a sales and/or use tax permit is approved and issued, a sales or use tax permit and two return forms are mailed. Exemptions provided in these sections do not apply to taxes levied by miss. The purchaser must complete all fields on the. The seller may be required to provide this.

Use This Form To Claim Exemption From Sales Tax On Purchases Of Otherwise Taxable Items.

Sales of property, labor, services or products are exempt from mississippi sales tax when sold to the united states government, the state of. An exemption from sales tax must be specifically provided by law.