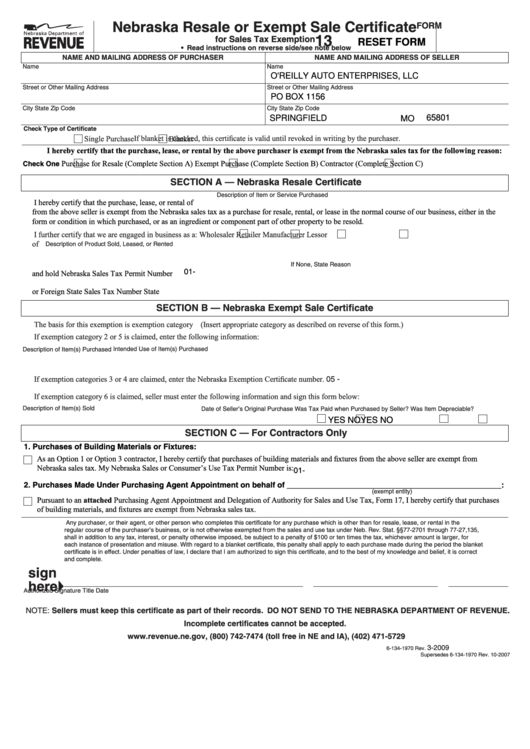

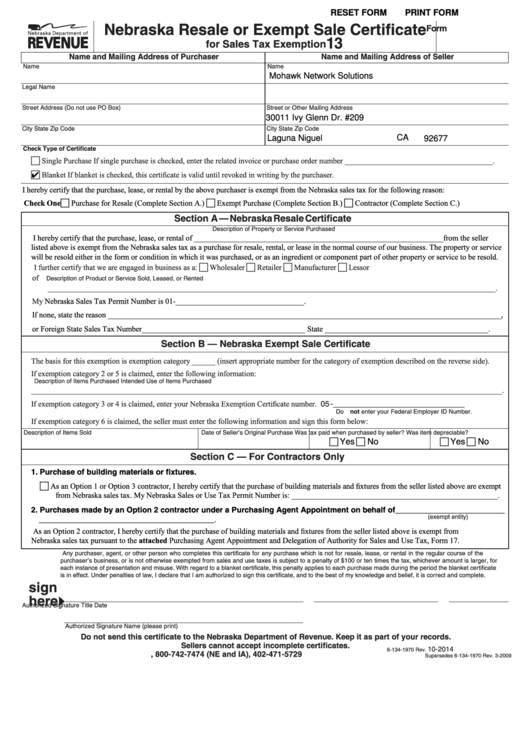

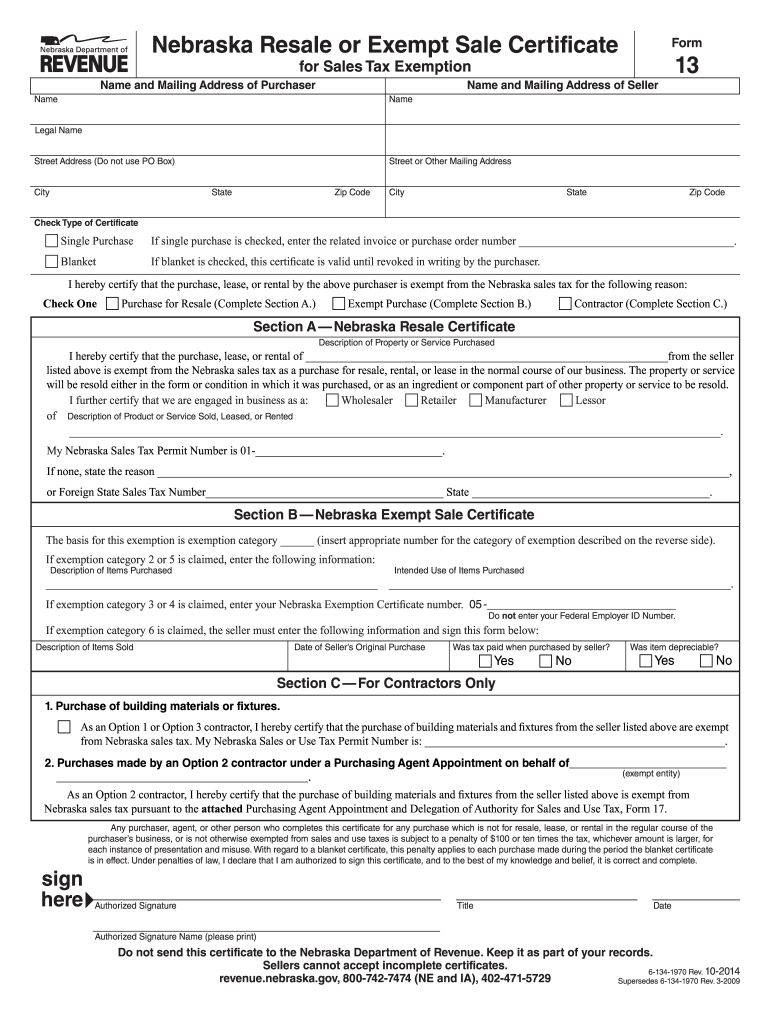

Nebraska Form 13 - Find out the requirements, exemptions,. It is unlawful to claim an exemption for purchases. Learn who can issue and. I hereby certify that the purchase, lease, or rental by the above purchaser is exempt from the nebraska sales tax for the following reason:. 64 rows find various forms for reporting and paying sales and use tax in nebraska, including form 13 for motor vehicle and trailer sales. Form 13 is used to claim exemption from nebraska sales tax for resale, lease, rental, or other purposes. The department is committed to the fair administration of the nebraska tax laws. Download and print form 13, a certificate for purchasers or sellers to claim exemption from nebraska sales tax. Learn how to determine if a sale is for resale and how to complete a resale certificate in nebraska. Form 13 is used to claim sales tax exemption for purchases of property or services in nebraska.

64 rows find various forms for reporting and paying sales and use tax in nebraska, including form 13 for motor vehicle and trailer sales. It has three sections for different types of. Find out the requirements, exemptions,. Learn who can issue and. The department is committed to the fair administration of the nebraska tax laws. Form 13 is used to claim exemption from nebraska sales tax for resale, lease, rental, or other purposes. It is unlawful to claim an exemption for purchases. Download and print form 13, a certificate for purchasers or sellers to claim exemption from nebraska sales tax. I hereby certify that the purchase, lease, or rental by the above purchaser is exempt from the nebraska sales tax for the following reason:. Form 13 is used to claim sales tax exemption for purchases of property or services in nebraska.

64 rows find various forms for reporting and paying sales and use tax in nebraska, including form 13 for motor vehicle and trailer sales. Learn how to determine if a sale is for resale and how to complete a resale certificate in nebraska. Learn who can issue and. Find out the requirements, exemptions,. It has three sections for different types of. It is unlawful to claim an exemption for purchases. Form 13 is used to claim sales tax exemption for purchases of property or services in nebraska. I hereby certify that the purchase, lease, or rental by the above purchaser is exempt from the nebraska sales tax for the following reason:. Form 13 is used to claim exemption from nebraska sales tax for resale, lease, rental, or other purposes. Download and print form 13, a certificate for purchasers or sellers to claim exemption from nebraska sales tax.

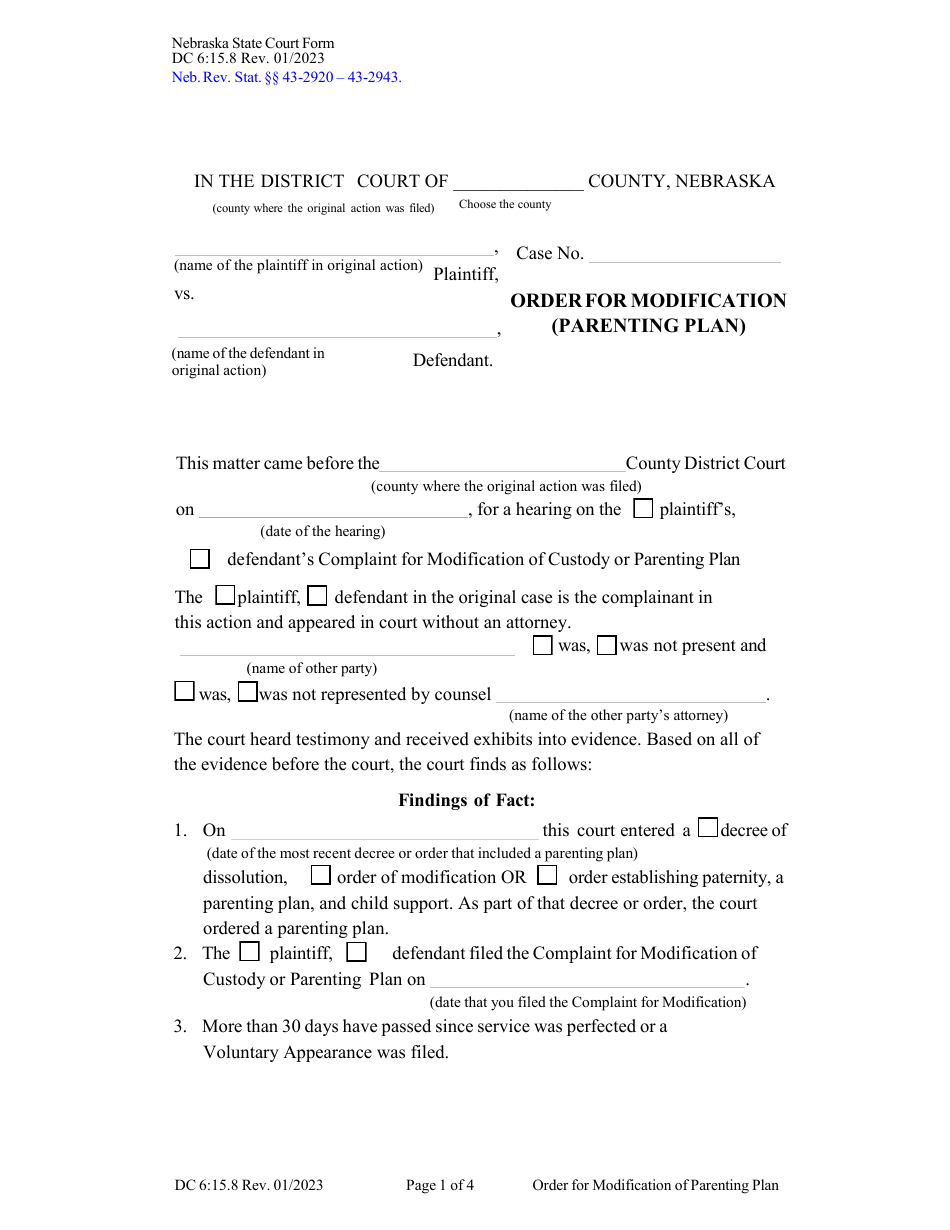

Form DC615.8 Download Fillable PDF or Fill Online Order for

Form 13 is used to claim exemption from nebraska sales tax for resale, lease, rental, or other purposes. The department is committed to the fair administration of the nebraska tax laws. Find out the requirements, exemptions,. Learn how to determine if a sale is for resale and how to complete a resale certificate in nebraska. Learn who can issue and.

Nebraska Form Ptc Fill Online, Printable, Fillable, Blank pdfFiller

Learn who can issue and. The department is committed to the fair administration of the nebraska tax laws. It is unlawful to claim an exemption for purchases. It has three sections for different types of. Form 13 is used to claim exemption from nebraska sales tax for resale, lease, rental, or other purposes.

Fillable Form 13 Nebraska Resale Or Exempt Sale Certificate For Sales

Find out the requirements, exemptions,. Download and print form 13, a certificate for purchasers or sellers to claim exemption from nebraska sales tax. Learn how to determine if a sale is for resale and how to complete a resale certificate in nebraska. It is unlawful to claim an exemption for purchases. Form 13 is used to claim exemption from nebraska.

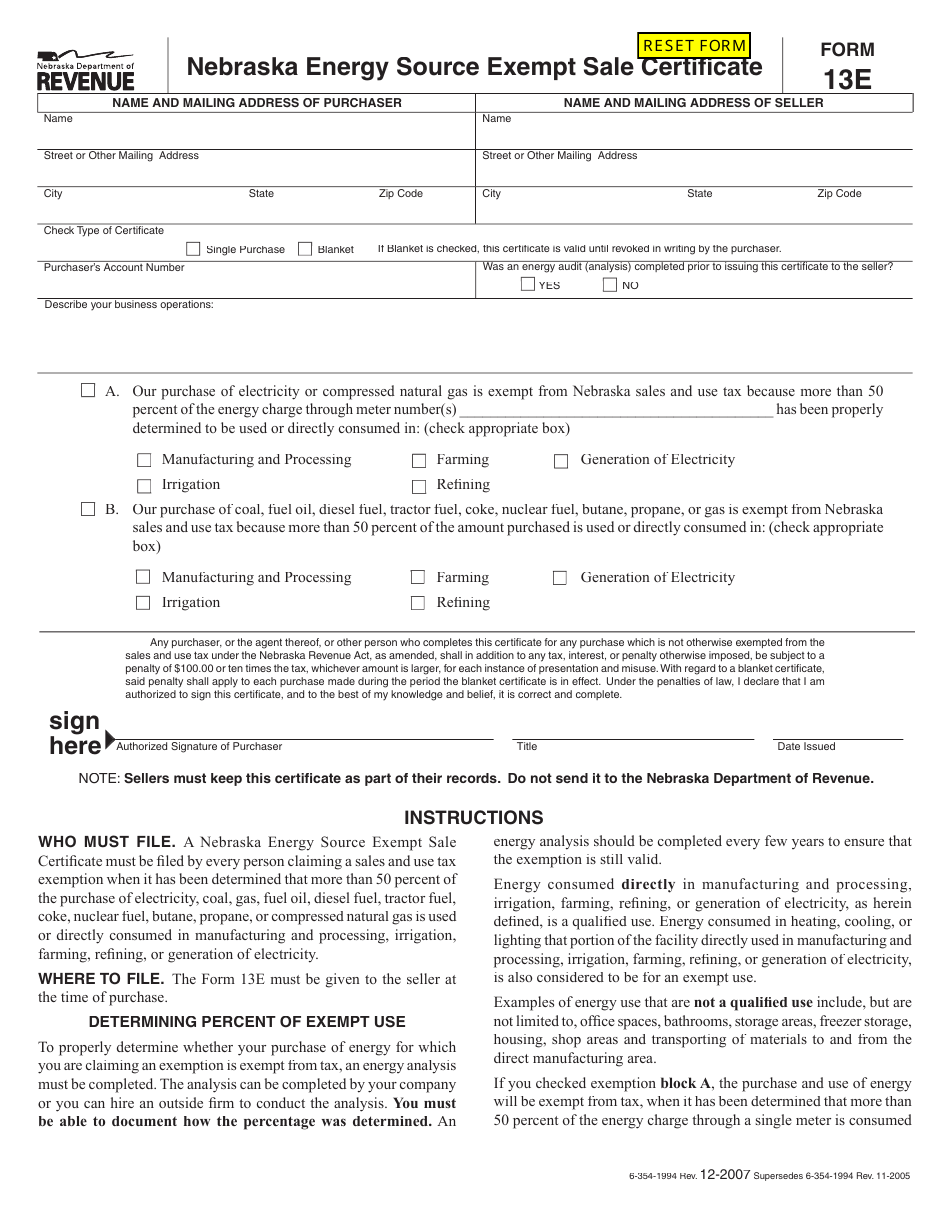

Form 13E Fill Out, Sign Online and Download Fillable PDF, Nebraska

It has three sections for different types of. Form 13 is used to claim sales tax exemption for purchases of property or services in nebraska. 64 rows find various forms for reporting and paying sales and use tax in nebraska, including form 13 for motor vehicle and trailer sales. Find out the requirements, exemptions,. I hereby certify that the purchase,.

Nebraska Eviction Notice Template

I hereby certify that the purchase, lease, or rental by the above purchaser is exempt from the nebraska sales tax for the following reason:. Find out the requirements, exemptions,. Learn who can issue and. 64 rows find various forms for reporting and paying sales and use tax in nebraska, including form 13 for motor vehicle and trailer sales. It is.

Fillable Form 13 Nebraska Resale Or Exempt Sale Certificate printable

64 rows find various forms for reporting and paying sales and use tax in nebraska, including form 13 for motor vehicle and trailer sales. Form 13 is used to claim exemption from nebraska sales tax for resale, lease, rental, or other purposes. Learn who can issue and. I hereby certify that the purchase, lease, or rental by the above purchaser.

How To Get A Nebraska Resale Certificate StartUp 101

Download and print form 13, a certificate for purchasers or sellers to claim exemption from nebraska sales tax. It is unlawful to claim an exemption for purchases. I hereby certify that the purchase, lease, or rental by the above purchaser is exempt from the nebraska sales tax for the following reason:. Learn who can issue and. The department is committed.

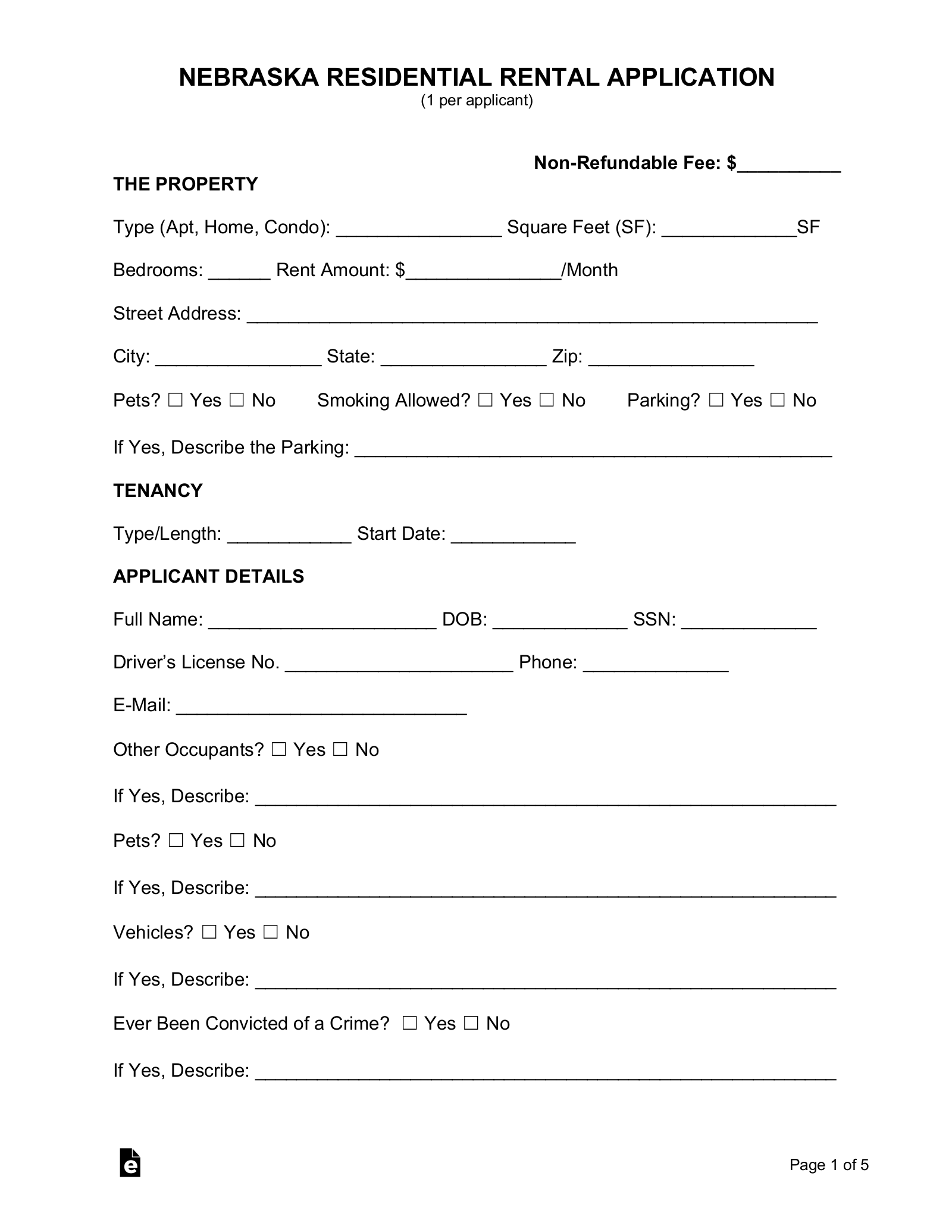

Free Nebraska Rental Application Template PDF Word eForms

Form 13 is used to claim exemption from nebraska sales tax for resale, lease, rental, or other purposes. Find out the requirements, exemptions,. Download and print form 13, a certificate for purchasers or sellers to claim exemption from nebraska sales tax. I hereby certify that the purchase, lease, or rental by the above purchaser is exempt from the nebraska sales.

Ne form 13 Fill out & sign online DocHub

Form 13 is used to claim sales tax exemption for purchases of property or services in nebraska. I hereby certify that the purchase, lease, or rental by the above purchaser is exempt from the nebraska sales tax for the following reason:. Form 13 is used to claim exemption from nebraska sales tax for resale, lease, rental, or other purposes. Learn.

Nebraska map Black and White Stock Photos & Images Alamy

Form 13 is used to claim exemption from nebraska sales tax for resale, lease, rental, or other purposes. Download and print form 13, a certificate for purchasers or sellers to claim exemption from nebraska sales tax. It is unlawful to claim an exemption for purchases. Learn how to determine if a sale is for resale and how to complete a.

Form 13 Is Used To Claim Exemption From Nebraska Sales Tax For Resale, Lease, Rental, Or Other Purposes.

Find out the requirements, exemptions,. It has three sections for different types of. The department is committed to the fair administration of the nebraska tax laws. It is unlawful to claim an exemption for purchases.

Learn How To Determine If A Sale Is For Resale And How To Complete A Resale Certificate In Nebraska.

64 rows find various forms for reporting and paying sales and use tax in nebraska, including form 13 for motor vehicle and trailer sales. I hereby certify that the purchase, lease, or rental by the above purchaser is exempt from the nebraska sales tax for the following reason:. Download and print form 13, a certificate for purchasers or sellers to claim exemption from nebraska sales tax. Form 13 is used to claim sales tax exemption for purchases of property or services in nebraska.