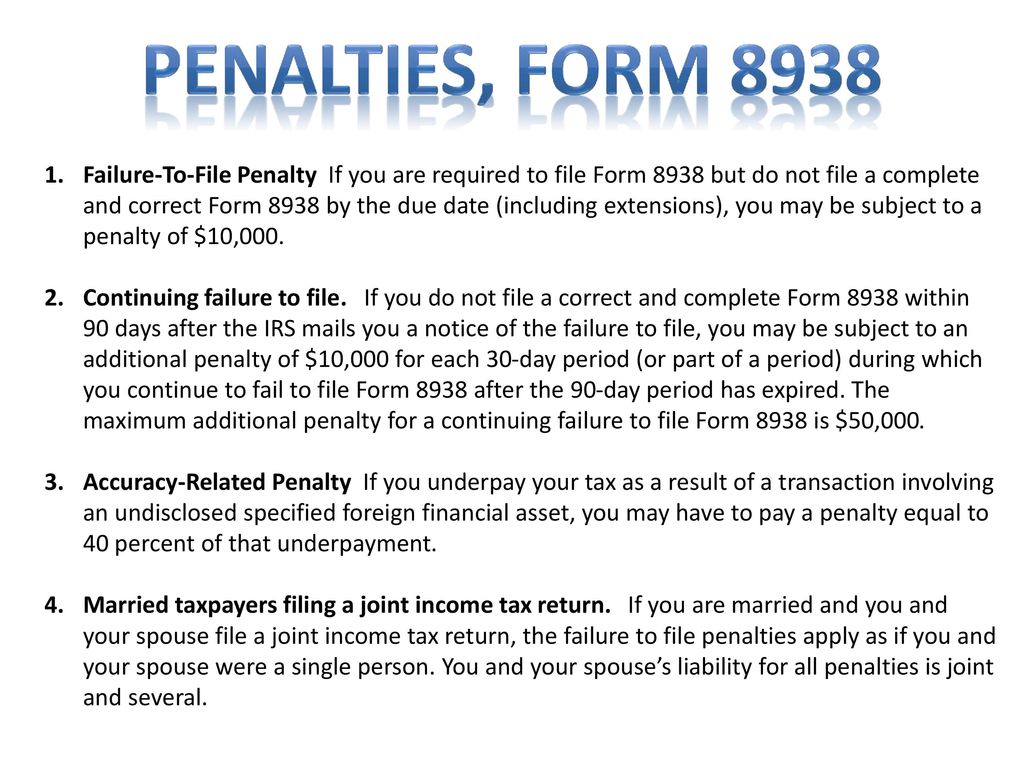

Penalty For Not Filing Form 8938 - If you failed to file a form 8938, or filed one that was incorrect, incomplete, or late/delinquent, you are potentially subject to a. Specifically, there is an additional penalty of $10,000 for each 30 day period (or part of a period) during which the failure to file continues after. If you are required to file form 8938 but do not file a complete and correct form 8938 by the due date (including. No penalty will be imposed if you fail to file form 8938 or to disclose one or more specified foreign financial assets on form 8938 and the failure is.

If you are required to file form 8938 but do not file a complete and correct form 8938 by the due date (including. No penalty will be imposed if you fail to file form 8938 or to disclose one or more specified foreign financial assets on form 8938 and the failure is. Specifically, there is an additional penalty of $10,000 for each 30 day period (or part of a period) during which the failure to file continues after. If you failed to file a form 8938, or filed one that was incorrect, incomplete, or late/delinquent, you are potentially subject to a.

Specifically, there is an additional penalty of $10,000 for each 30 day period (or part of a period) during which the failure to file continues after. If you failed to file a form 8938, or filed one that was incorrect, incomplete, or late/delinquent, you are potentially subject to a. If you are required to file form 8938 but do not file a complete and correct form 8938 by the due date (including. No penalty will be imposed if you fail to file form 8938 or to disclose one or more specified foreign financial assets on form 8938 and the failure is.

Penalty for Late Filing of Tax Return(ITR) 5paisa

If you failed to file a form 8938, or filed one that was incorrect, incomplete, or late/delinquent, you are potentially subject to a. No penalty will be imposed if you fail to file form 8938 or to disclose one or more specified foreign financial assets on form 8938 and the failure is. If you are required to file form 8938.

FATCA Reporting Filing Form 8938 Gordon Law Group

If you failed to file a form 8938, or filed one that was incorrect, incomplete, or late/delinquent, you are potentially subject to a. No penalty will be imposed if you fail to file form 8938 or to disclose one or more specified foreign financial assets on form 8938 and the failure is. Specifically, there is an additional penalty of $10,000.

Penalty Section 234F for Late Tax Return Filers

If you are required to file form 8938 but do not file a complete and correct form 8938 by the due date (including. Specifically, there is an additional penalty of $10,000 for each 30 day period (or part of a period) during which the failure to file continues after. No penalty will be imposed if you fail to file form.

Is Form 8938 Reporting Required for Foreign Pension Plans?

If you are required to file form 8938 but do not file a complete and correct form 8938 by the due date (including. If you failed to file a form 8938, or filed one that was incorrect, incomplete, or late/delinquent, you are potentially subject to a. No penalty will be imposed if you fail to file form 8938 or to.

Section 271B Penalty not Applicable when Reasonable Cause for Failure

If you are required to file form 8938 but do not file a complete and correct form 8938 by the due date (including. No penalty will be imposed if you fail to file form 8938 or to disclose one or more specified foreign financial assets on form 8938 and the failure is. Specifically, there is an additional penalty of $10,000.

Form 8938 Vs. FBAR Filing, Reporting & Penalties Explained AKIF CPA

If you failed to file a form 8938, or filed one that was incorrect, incomplete, or late/delinquent, you are potentially subject to a. If you are required to file form 8938 but do not file a complete and correct form 8938 by the due date (including. No penalty will be imposed if you fail to file form 8938 or to.

Sample IRS Penalty Abatement Request Letter PDF Internal Revenue

If you failed to file a form 8938, or filed one that was incorrect, incomplete, or late/delinquent, you are potentially subject to a. If you are required to file form 8938 but do not file a complete and correct form 8938 by the due date (including. No penalty will be imposed if you fail to file form 8938 or to.

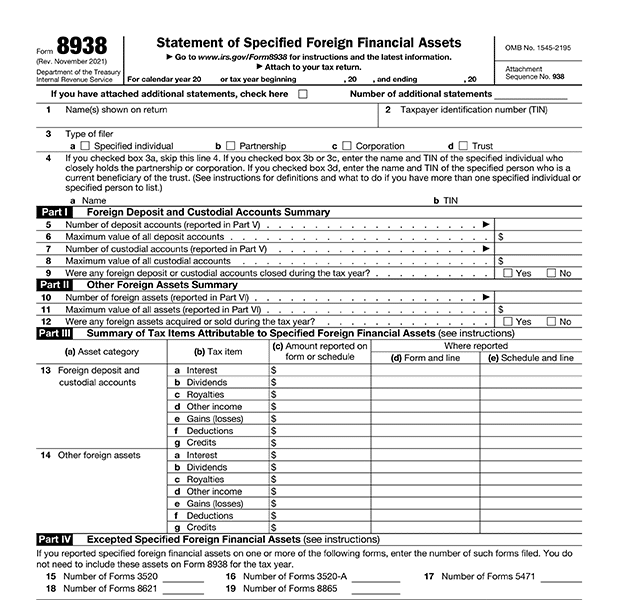

Report of Foreign Financial Assets (Form 8938)

If you failed to file a form 8938, or filed one that was incorrect, incomplete, or late/delinquent, you are potentially subject to a. If you are required to file form 8938 but do not file a complete and correct form 8938 by the due date (including. Specifically, there is an additional penalty of $10,000 for each 30 day period (or.

Foreign Accounts Form 8938/ FinCEN ppt download

Specifically, there is an additional penalty of $10,000 for each 30 day period (or part of a period) during which the failure to file continues after. If you failed to file a form 8938, or filed one that was incorrect, incomplete, or late/delinquent, you are potentially subject to a. If you are required to file form 8938 but do not.

Form 8938 Vs. FBAR Filing, Reporting & Penalties Explained AKIF CPA

No penalty will be imposed if you fail to file form 8938 or to disclose one or more specified foreign financial assets on form 8938 and the failure is. Specifically, there is an additional penalty of $10,000 for each 30 day period (or part of a period) during which the failure to file continues after. If you are required to.

No Penalty Will Be Imposed If You Fail To File Form 8938 Or To Disclose One Or More Specified Foreign Financial Assets On Form 8938 And The Failure Is.

If you failed to file a form 8938, or filed one that was incorrect, incomplete, or late/delinquent, you are potentially subject to a. Specifically, there is an additional penalty of $10,000 for each 30 day period (or part of a period) during which the failure to file continues after. If you are required to file form 8938 but do not file a complete and correct form 8938 by the due date (including.