Puerto Rico Tax Return Form 482 In English - You can still file your federal tax return however, you would need to file the puerto rico state return directly with the commonwealth of puerto. If “no”, indicate the corresponding information: Resident of puerto rico during the entire year? Every resident of puerto rico with gross income reduced by the exemptions provided in §1031.02 greater than $0, must file the income. Individual income tax return for calendar. For additional details, please refer. The individual income tax return (form 482.0) for tax year 2023 must be filed electronically. Government of puerto rico department of the treasury individual income tax return for calendar year 2021 or taxable year.

Every resident of puerto rico with gross income reduced by the exemptions provided in §1031.02 greater than $0, must file the income. If “no”, indicate the corresponding information: You can still file your federal tax return however, you would need to file the puerto rico state return directly with the commonwealth of puerto. The individual income tax return (form 482.0) for tax year 2023 must be filed electronically. Resident of puerto rico during the entire year? For additional details, please refer. Government of puerto rico department of the treasury individual income tax return for calendar year 2021 or taxable year. Individual income tax return for calendar.

If “no”, indicate the corresponding information: Resident of puerto rico during the entire year? The individual income tax return (form 482.0) for tax year 2023 must be filed electronically. Every resident of puerto rico with gross income reduced by the exemptions provided in §1031.02 greater than $0, must file the income. Individual income tax return for calendar. Government of puerto rico department of the treasury individual income tax return for calendar year 2021 or taxable year. For additional details, please refer. You can still file your federal tax return however, you would need to file the puerto rico state return directly with the commonwealth of puerto.

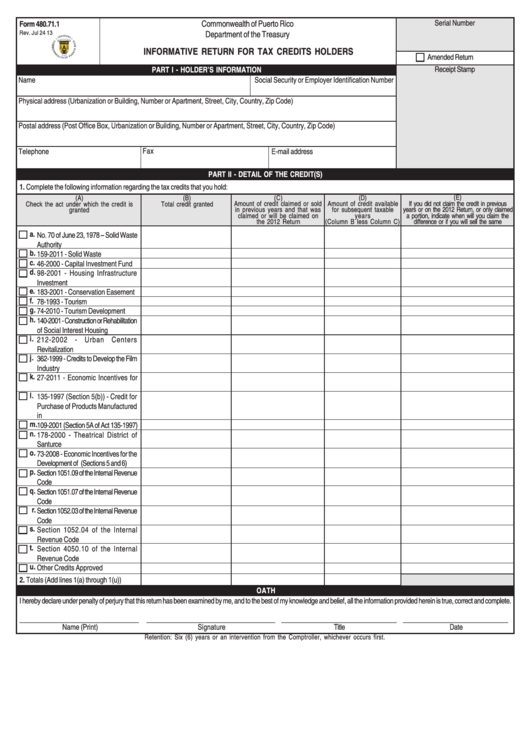

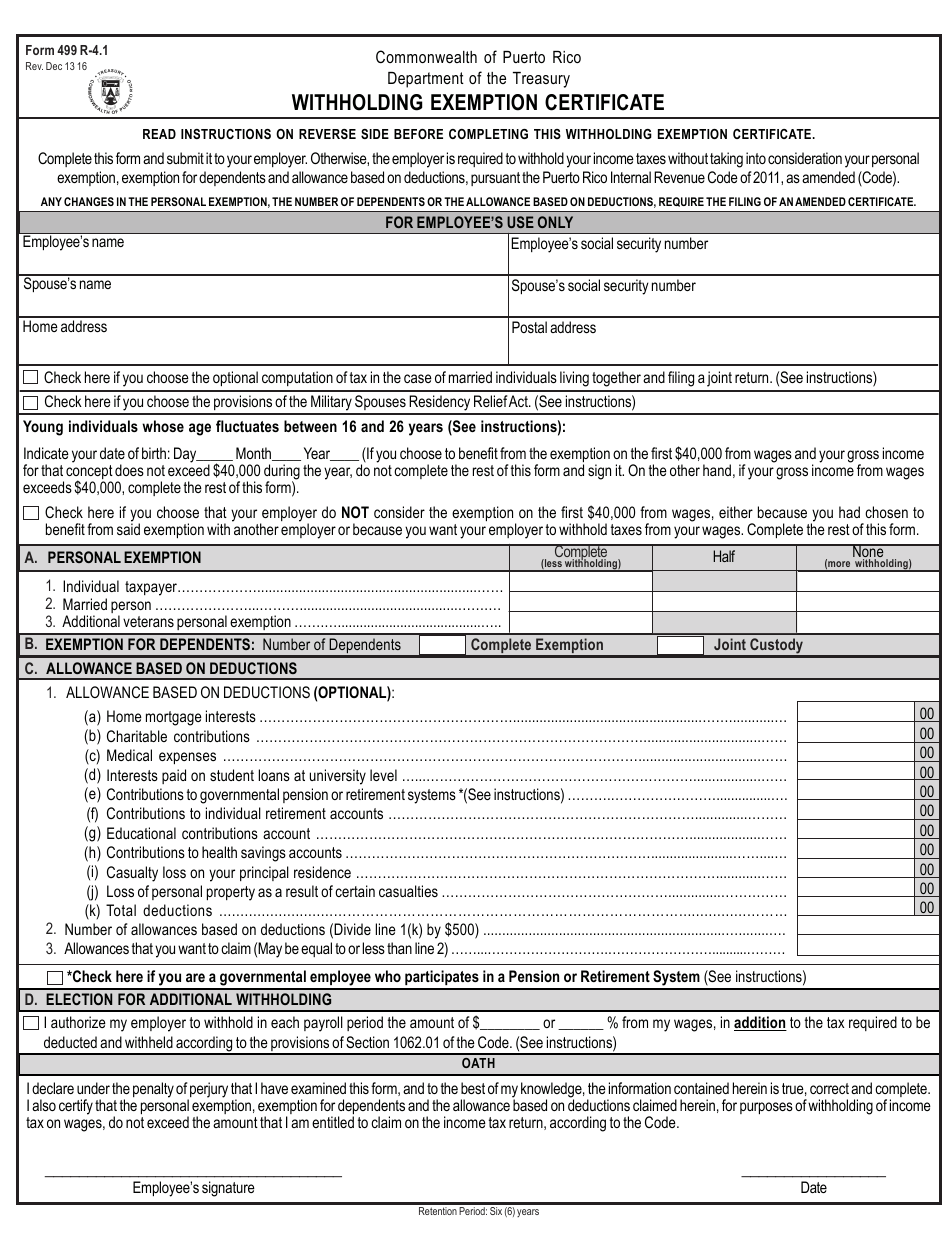

Top 601 Puerto Rico Department Of Treasury Forms And Templates free to

Every resident of puerto rico with gross income reduced by the exemptions provided in §1031.02 greater than $0, must file the income. If “no”, indicate the corresponding information: For additional details, please refer. You can still file your federal tax return however, you would need to file the puerto rico state return directly with the commonwealth of puerto. Government of.

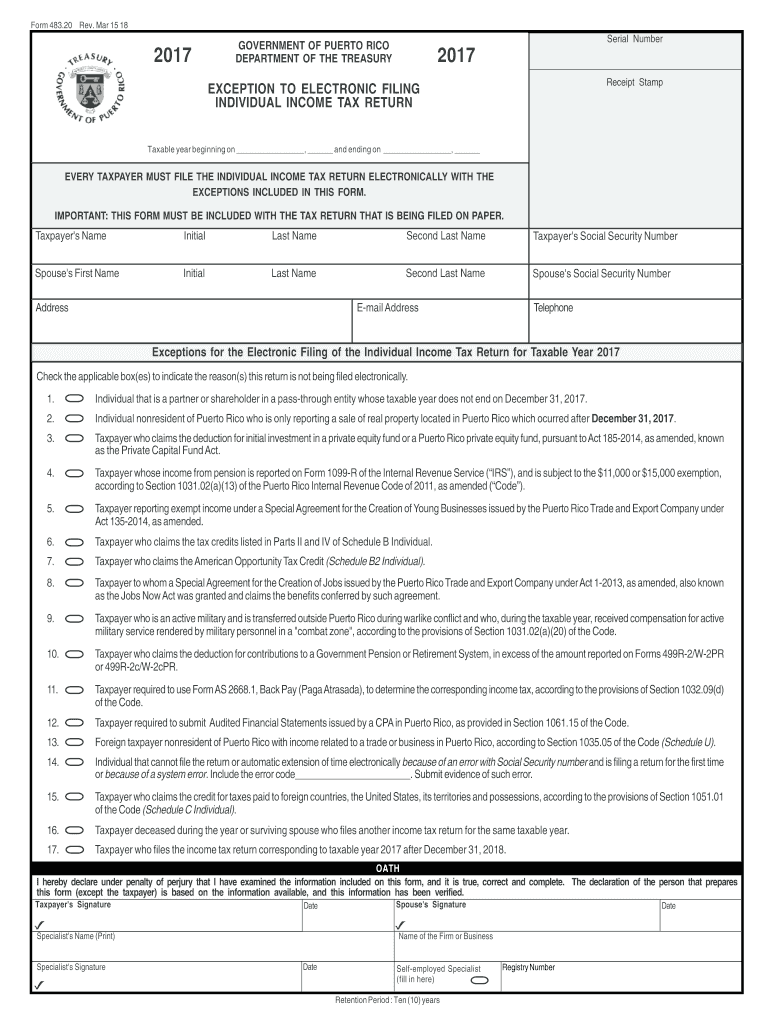

Compulsory Electronic Filing of the 2015 Puerto Rico Individual

You can still file your federal tax return however, you would need to file the puerto rico state return directly with the commonwealth of puerto. Every resident of puerto rico with gross income reduced by the exemptions provided in §1031.02 greater than $0, must file the income. Resident of puerto rico during the entire year? Individual income tax return for.

Puerto Rico Tax Return 482 in English 20172024 Form Fill Out and

If “no”, indicate the corresponding information: For additional details, please refer. Individual income tax return for calendar. You can still file your federal tax return however, you would need to file the puerto rico state return directly with the commonwealth of puerto. The individual income tax return (form 482.0) for tax year 2023 must be filed electronically.

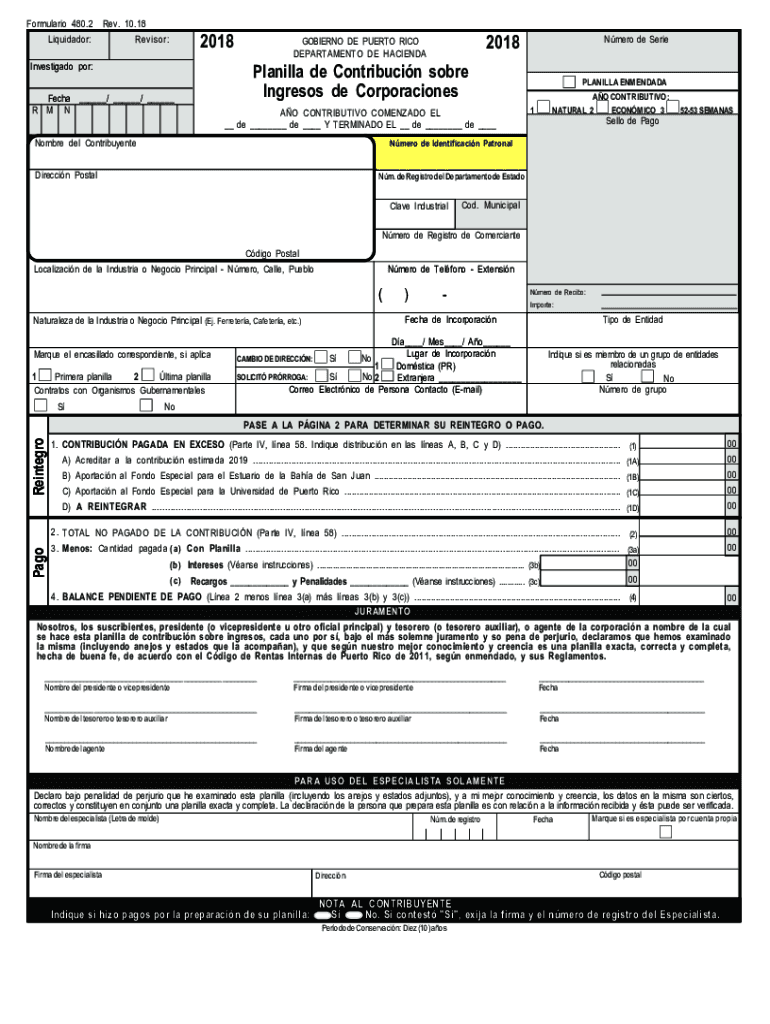

Planilla De Puerto Rico

Individual income tax return for calendar. Resident of puerto rico during the entire year? Government of puerto rico department of the treasury individual income tax return for calendar year 2021 or taxable year. The individual income tax return (form 482.0) for tax year 2023 must be filed electronically. For additional details, please refer.

20182024 Form PR 482.0 Fill Online, Printable, Fillable, Blank pdfFiller

For additional details, please refer. You can still file your federal tax return however, you would need to file the puerto rico state return directly with the commonwealth of puerto. Individual income tax return for calendar. If “no”, indicate the corresponding information: Government of puerto rico department of the treasury individual income tax return for calendar year 2021 or taxable.

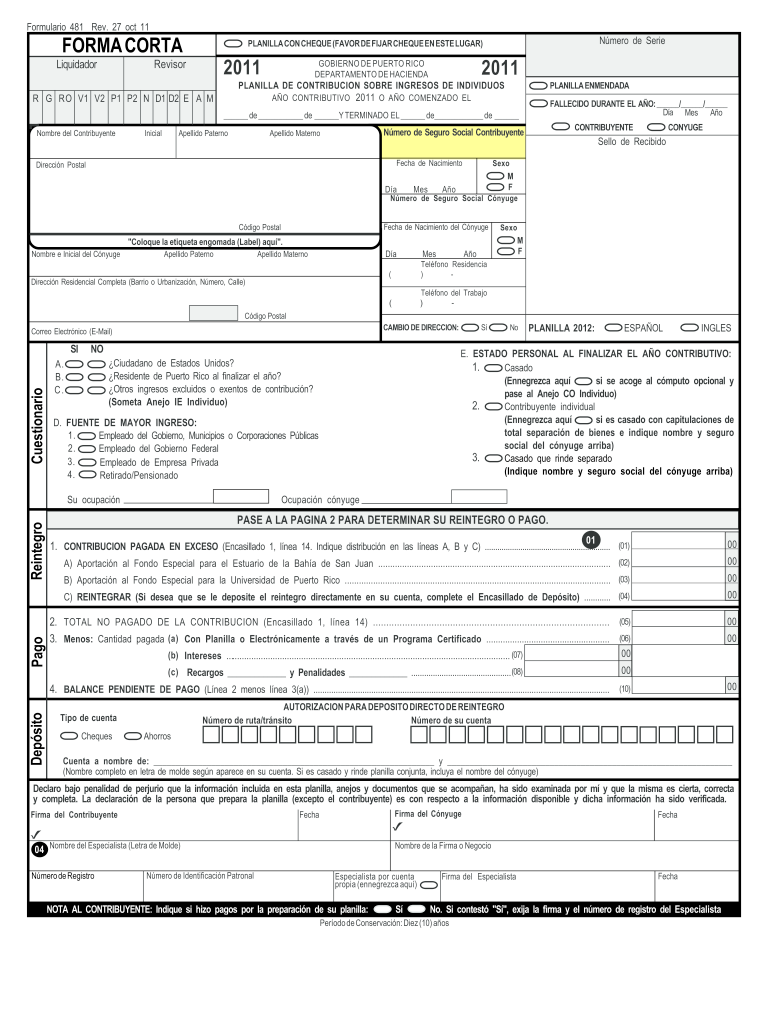

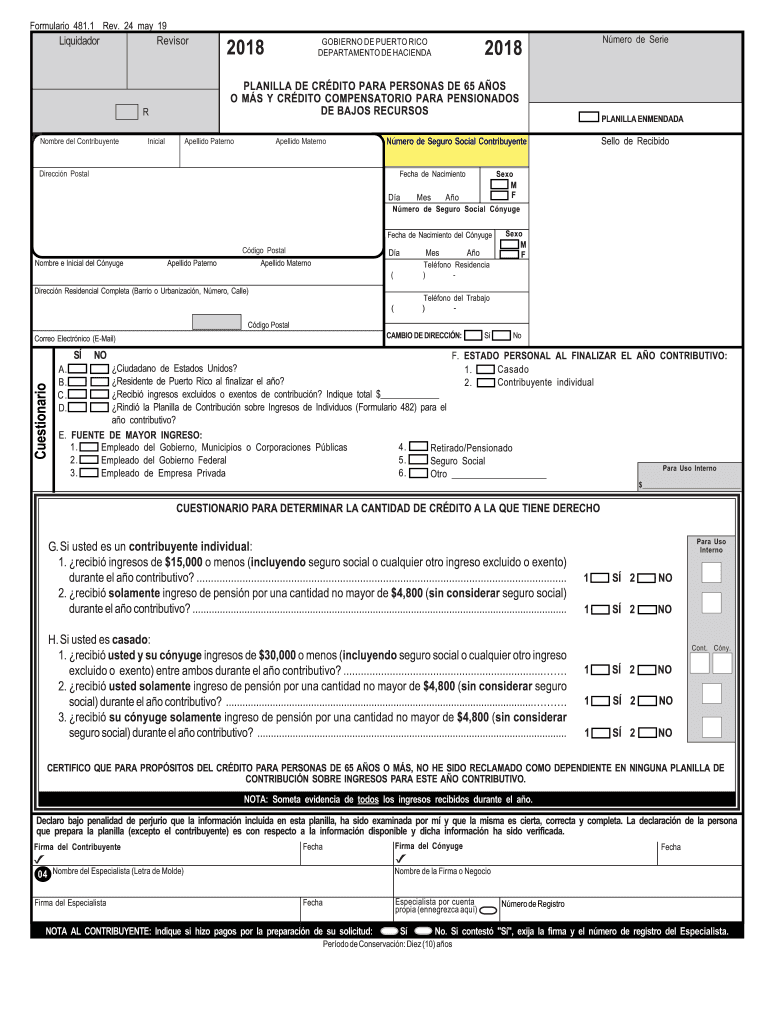

Puerto rico 481 2011 form Rellena, firma y envía para firmar DocHub

Government of puerto rico department of the treasury individual income tax return for calendar year 2021 or taxable year. Every resident of puerto rico with gross income reduced by the exemptions provided in §1031.02 greater than $0, must file the income. You can still file your federal tax return however, you would need to file the puerto rico state return.

Puerto Rico Hotel Tax Exempt Form

Every resident of puerto rico with gross income reduced by the exemptions provided in §1031.02 greater than $0, must file the income. You can still file your federal tax return however, you would need to file the puerto rico state return directly with the commonwealth of puerto. If “no”, indicate the corresponding information: The individual income tax return (form 482.0).

Pr 481 1 2018 2022 Fill Out Tax Template Online Us Legal Forms Free

Individual income tax return for calendar. You can still file your federal tax return however, you would need to file the puerto rico state return directly with the commonwealth of puerto. Every resident of puerto rico with gross income reduced by the exemptions provided in §1031.02 greater than $0, must file the income. The individual income tax return (form 482.0).

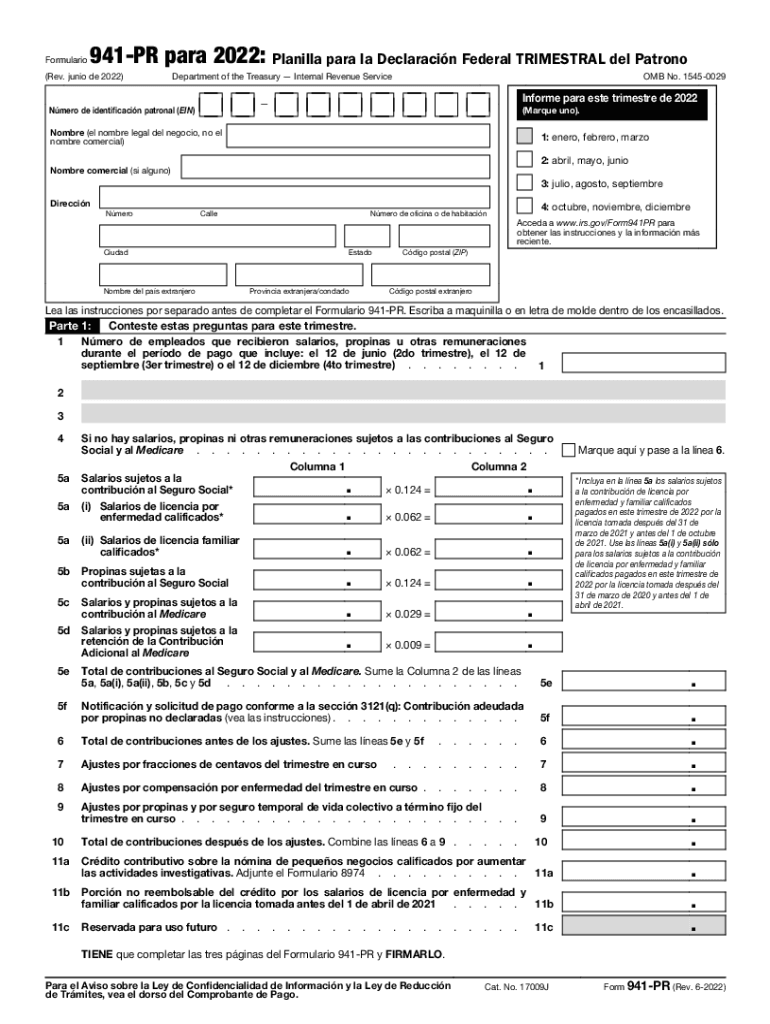

Formulario 941 Fill out & sign online DocHub

Resident of puerto rico during the entire year? The individual income tax return (form 482.0) for tax year 2023 must be filed electronically. Government of puerto rico department of the treasury individual income tax return for calendar year 2021 or taxable year. If “no”, indicate the corresponding information: For additional details, please refer.

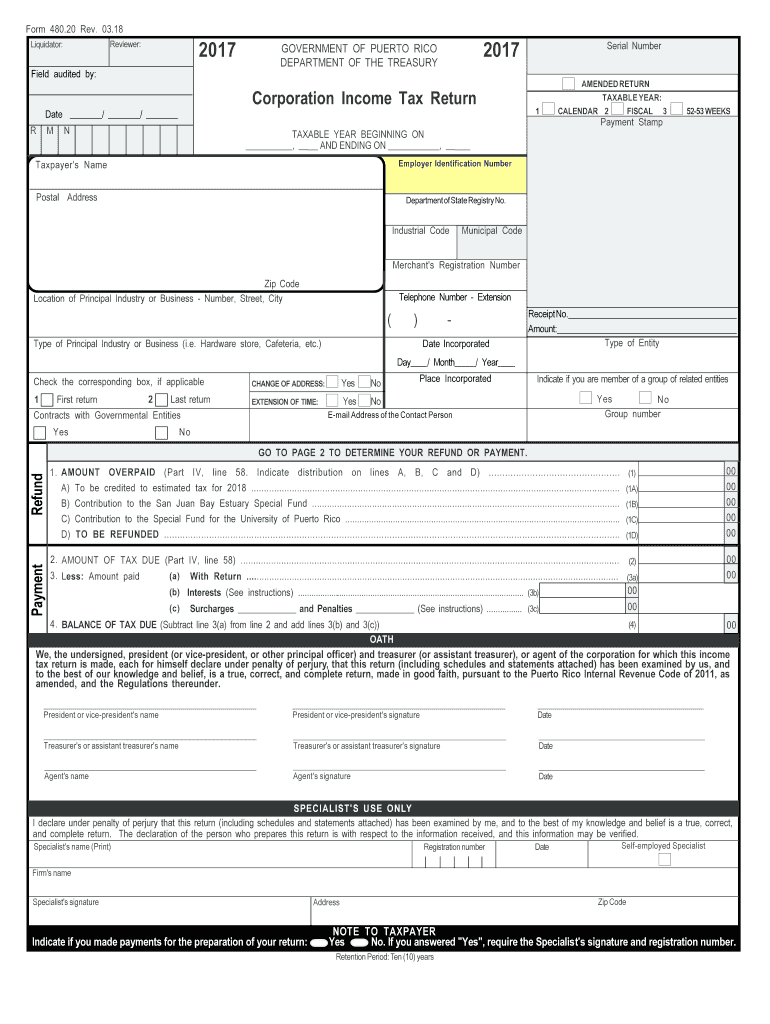

PDF Filler 480 20 20182024 Form Fill Out and Sign Printable PDF

Individual income tax return for calendar. Government of puerto rico department of the treasury individual income tax return for calendar year 2021 or taxable year. Resident of puerto rico during the entire year? The individual income tax return (form 482.0) for tax year 2023 must be filed electronically. If “no”, indicate the corresponding information:

The Individual Income Tax Return (Form 482.0) For Tax Year 2023 Must Be Filed Electronically.

Every resident of puerto rico with gross income reduced by the exemptions provided in §1031.02 greater than $0, must file the income. For additional details, please refer. Government of puerto rico department of the treasury individual income tax return for calendar year 2021 or taxable year. Individual income tax return for calendar.

Resident Of Puerto Rico During The Entire Year?

If “no”, indicate the corresponding information: You can still file your federal tax return however, you would need to file the puerto rico state return directly with the commonwealth of puerto.