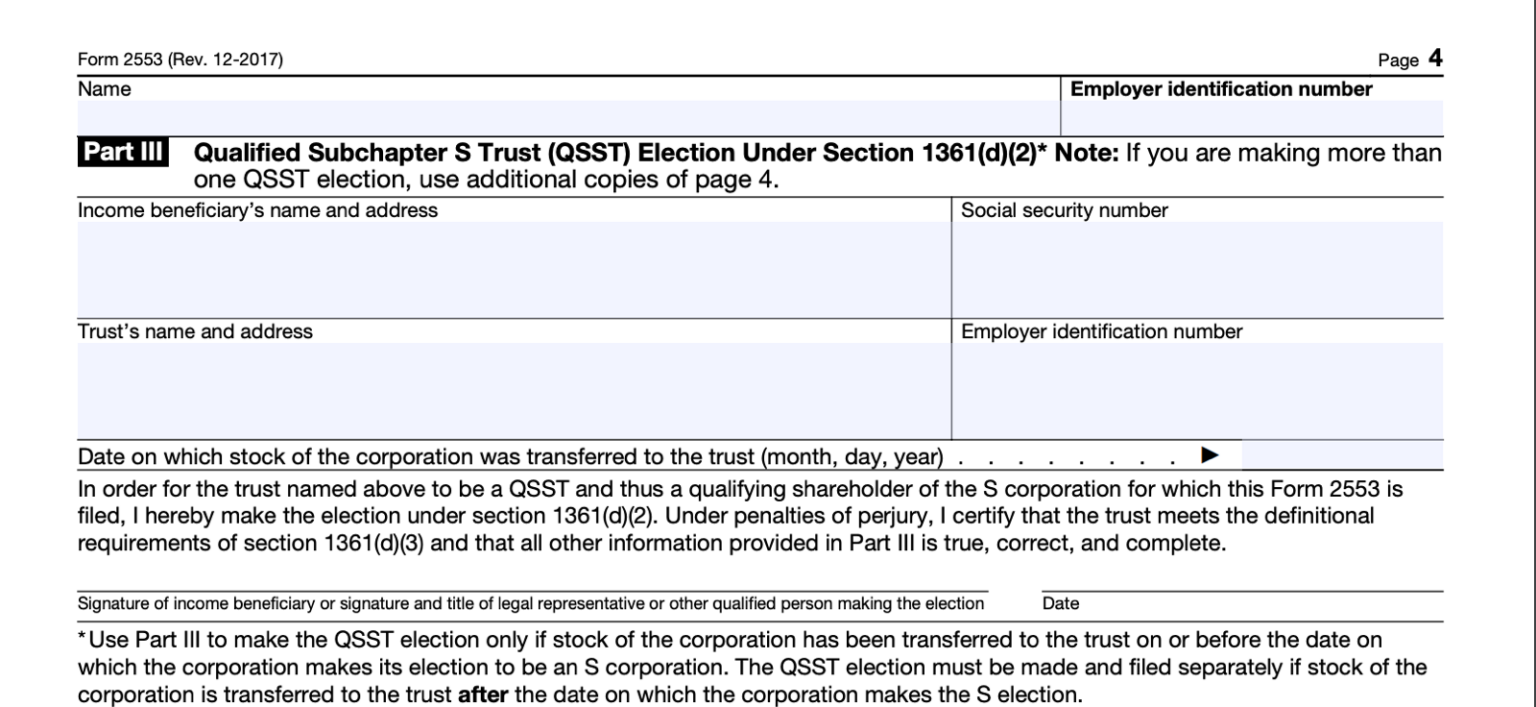

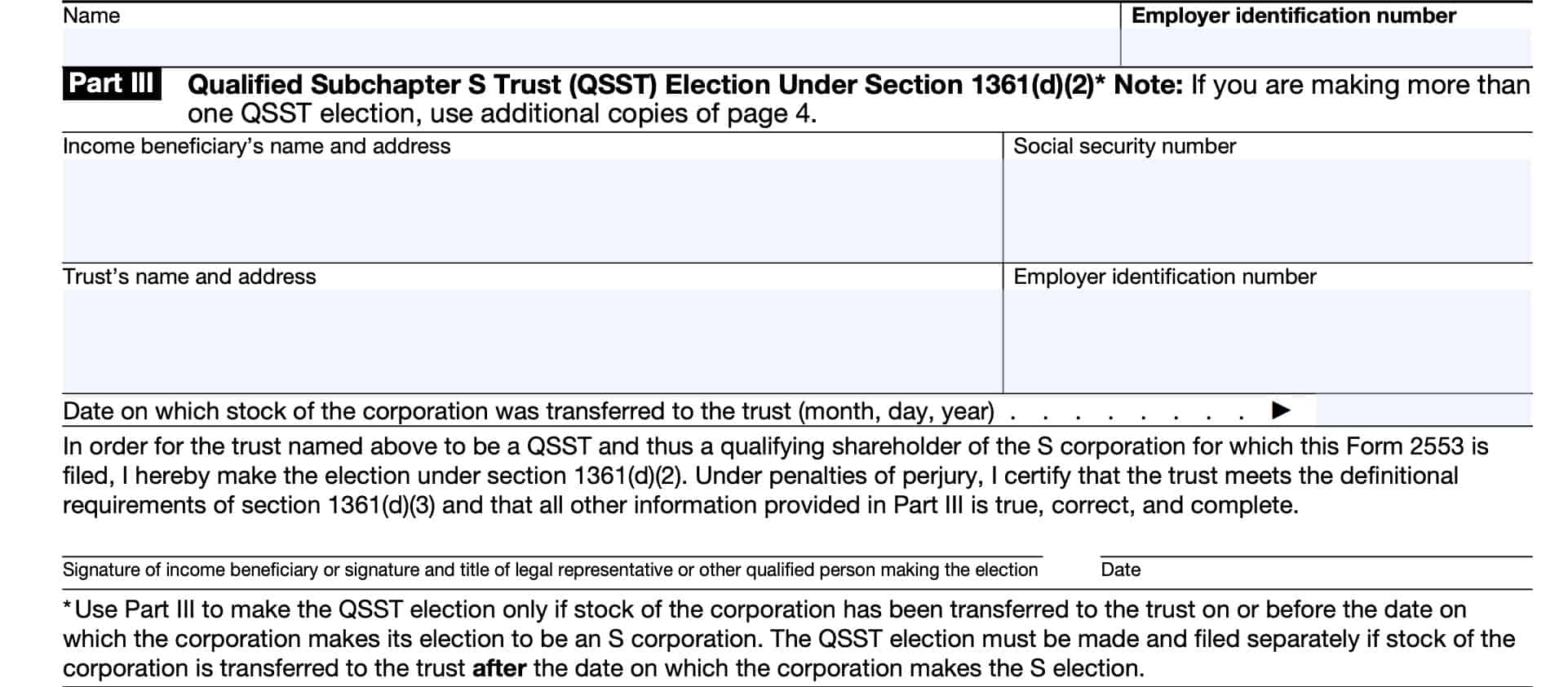

Qsst Election Form - Use part iii to make the qsst election only if stock of the corporation has been transferred to the trust on or before the date on which the corporation. The beneficiary must elect qsst status, and the qsst must meet the following requirements (regs. A qsst may have only one (1) beneficiary who is treated as the owner of the s corporation stock that is held by the trust for.

The beneficiary must elect qsst status, and the qsst must meet the following requirements (regs. Use part iii to make the qsst election only if stock of the corporation has been transferred to the trust on or before the date on which the corporation. A qsst may have only one (1) beneficiary who is treated as the owner of the s corporation stock that is held by the trust for.

Use part iii to make the qsst election only if stock of the corporation has been transferred to the trust on or before the date on which the corporation. The beneficiary must elect qsst status, and the qsst must meet the following requirements (regs. A qsst may have only one (1) beneficiary who is treated as the owner of the s corporation stock that is held by the trust for.

Fill Free fillable form 2553 election by a small business corporation

The beneficiary must elect qsst status, and the qsst must meet the following requirements (regs. A qsst may have only one (1) beneficiary who is treated as the owner of the s corporation stock that is held by the trust for. Use part iii to make the qsst election only if stock of the corporation has been transferred to the.

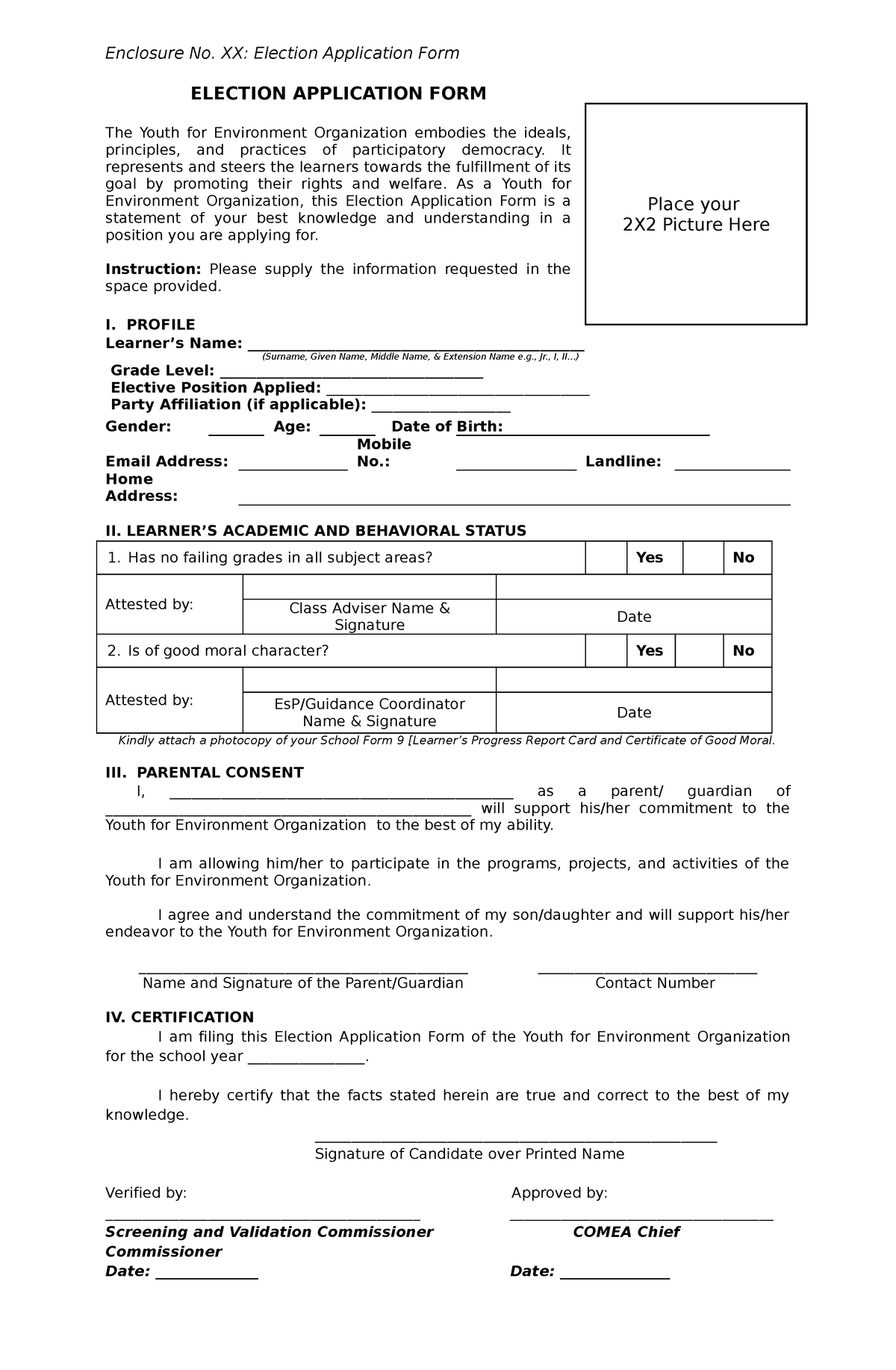

Election Form PDF

A qsst may have only one (1) beneficiary who is treated as the owner of the s corporation stock that is held by the trust for. The beneficiary must elect qsst status, and the qsst must meet the following requirements (regs. Use part iii to make the qsst election only if stock of the corporation has been transferred to the.

Sample Qsst Election Form Fill Online, Printable, Fillable, Blank

A qsst may have only one (1) beneficiary who is treated as the owner of the s corporation stock that is held by the trust for. Use part iii to make the qsst election only if stock of the corporation has been transferred to the trust on or before the date on which the corporation. The beneficiary must elect qsst.

Election form icon color outline vector 15064305 Vector Art at Vecteezy

The beneficiary must elect qsst status, and the qsst must meet the following requirements (regs. A qsst may have only one (1) beneficiary who is treated as the owner of the s corporation stock that is held by the trust for. Use part iii to make the qsst election only if stock of the corporation has been transferred to the.

3.13.2 BMF Account Numbers Internal Revenue Service

A qsst may have only one (1) beneficiary who is treated as the owner of the s corporation stock that is held by the trust for. Use part iii to make the qsst election only if stock of the corporation has been transferred to the trust on or before the date on which the corporation. The beneficiary must elect qsst.

Foreign Trust System Internal Revenue Service, 59 OFF

The beneficiary must elect qsst status, and the qsst must meet the following requirements (regs. Use part iii to make the qsst election only if stock of the corporation has been transferred to the trust on or before the date on which the corporation. A qsst may have only one (1) beneficiary who is treated as the owner of the.

Form 2553 Explained and How to Complete it in 2024 OnPay

Use part iii to make the qsst election only if stock of the corporation has been transferred to the trust on or before the date on which the corporation. The beneficiary must elect qsst status, and the qsst must meet the following requirements (regs. A qsst may have only one (1) beneficiary who is treated as the owner of the.

Enc m,nmm, Enclosure No. XX Election Application Form ELECTION

Use part iii to make the qsst election only if stock of the corporation has been transferred to the trust on or before the date on which the corporation. A qsst may have only one (1) beneficiary who is treated as the owner of the s corporation stock that is held by the trust for. The beneficiary must elect qsst.

108050108172947122820241020t220107z_906177678_rc2moaaodod3_rtrmadp_0

The beneficiary must elect qsst status, and the qsst must meet the following requirements (regs. Use part iii to make the qsst election only if stock of the corporation has been transferred to the trust on or before the date on which the corporation. A qsst may have only one (1) beneficiary who is treated as the owner of the.

IRS Form 2553 Instructions Electing S Corporation Status

The beneficiary must elect qsst status, and the qsst must meet the following requirements (regs. A qsst may have only one (1) beneficiary who is treated as the owner of the s corporation stock that is held by the trust for. Use part iii to make the qsst election only if stock of the corporation has been transferred to the.

The Beneficiary Must Elect Qsst Status, And The Qsst Must Meet The Following Requirements (Regs.

Use part iii to make the qsst election only if stock of the corporation has been transferred to the trust on or before the date on which the corporation. A qsst may have only one (1) beneficiary who is treated as the owner of the s corporation stock that is held by the trust for.