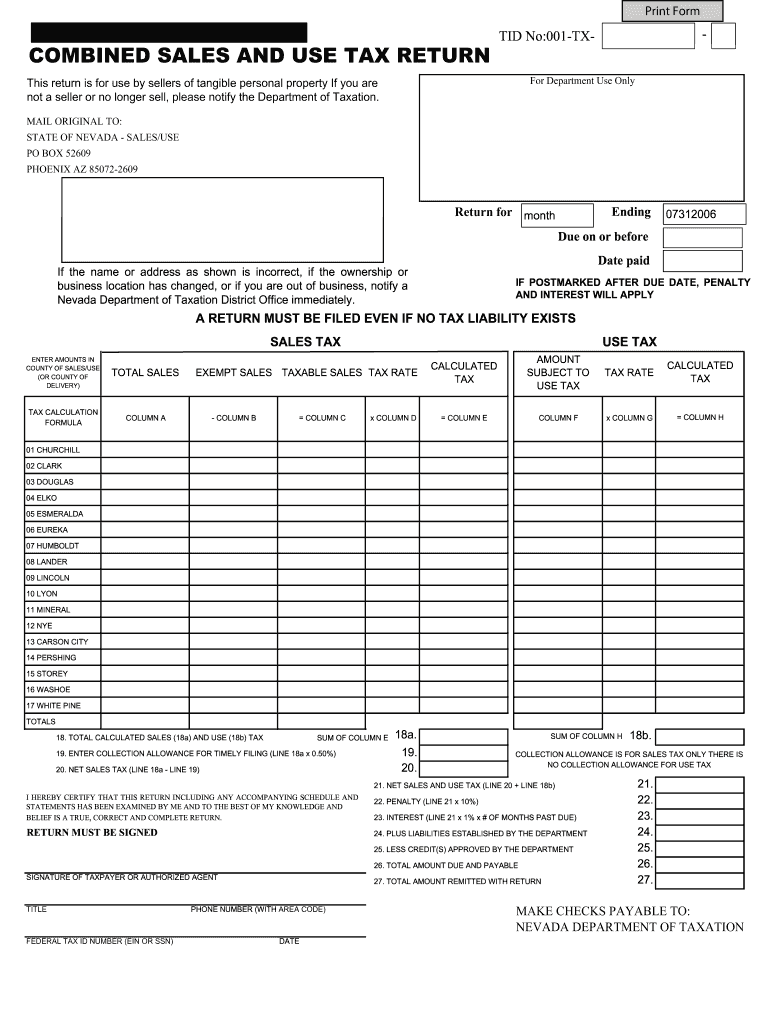

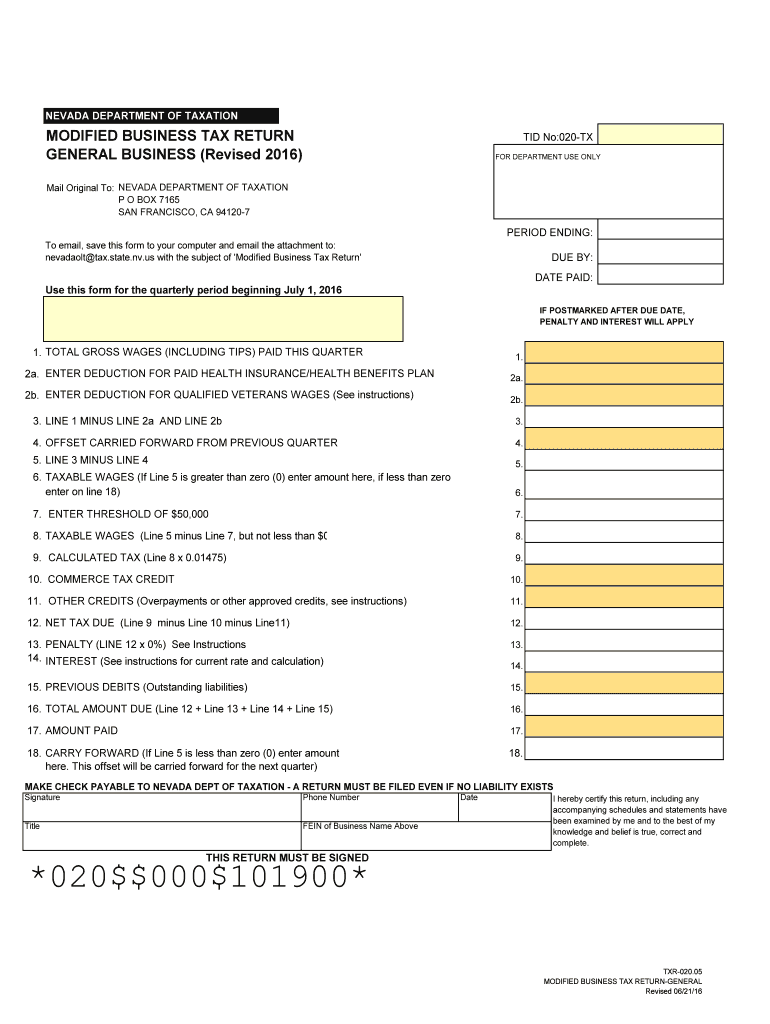

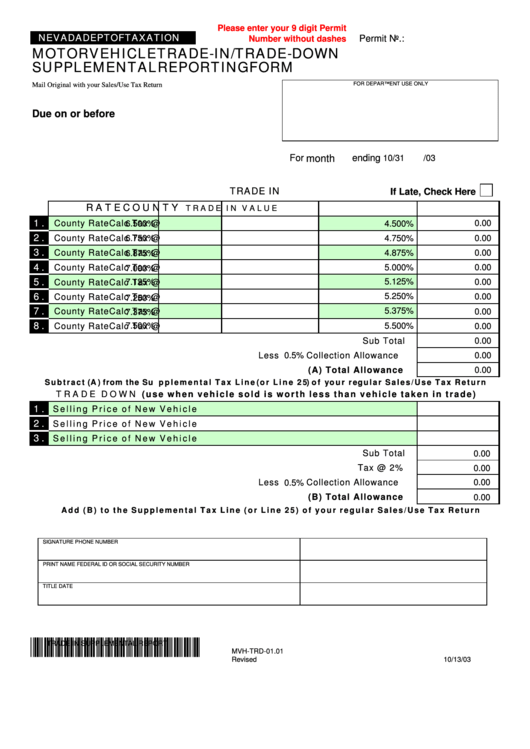

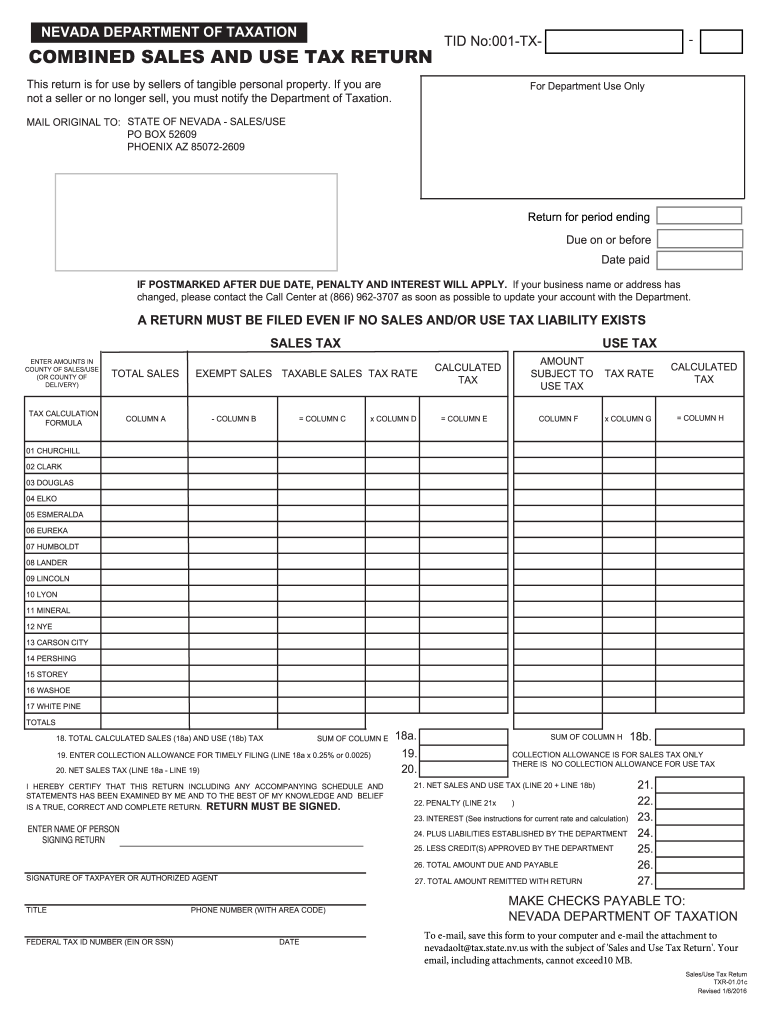

Sales And Use Tax Form Nevada - Sales & use tax return. Enter collection allowance for timely filing (line 18a x 0.25%) net sales tax. Total calculated sales (18a) and use (18b) tax 16 washoe 19. (b) the use tax, a return must be filed by each retailer maintaining a place of business in the state and by each person purchasing tangible. Sales and use tax return. Sales & use tax forms.

Total calculated sales (18a) and use (18b) tax 16 washoe 19. Sales and use tax return. (b) the use tax, a return must be filed by each retailer maintaining a place of business in the state and by each person purchasing tangible. Enter collection allowance for timely filing (line 18a x 0.25%) net sales tax. Sales & use tax forms. Sales & use tax return.

Sales & use tax return. (b) the use tax, a return must be filed by each retailer maintaining a place of business in the state and by each person purchasing tangible. Sales & use tax forms. Enter collection allowance for timely filing (line 18a x 0.25%) net sales tax. Total calculated sales (18a) and use (18b) tax 16 washoe 19. Sales and use tax return.

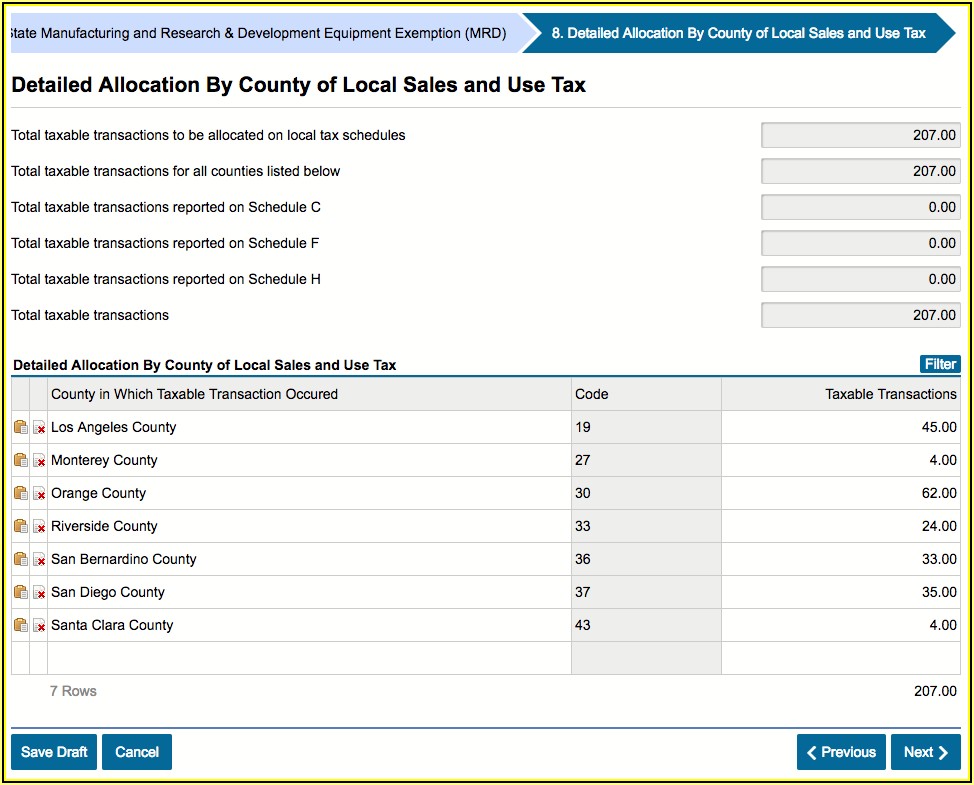

Las vegas sales tax clothing Fill out & sign online DocHub

Sales & use tax return. Total calculated sales (18a) and use (18b) tax 16 washoe 19. (b) the use tax, a return must be filed by each retailer maintaining a place of business in the state and by each person purchasing tangible. Sales & use tax forms. Enter collection allowance for timely filing (line 18a x 0.25%) net sales tax.

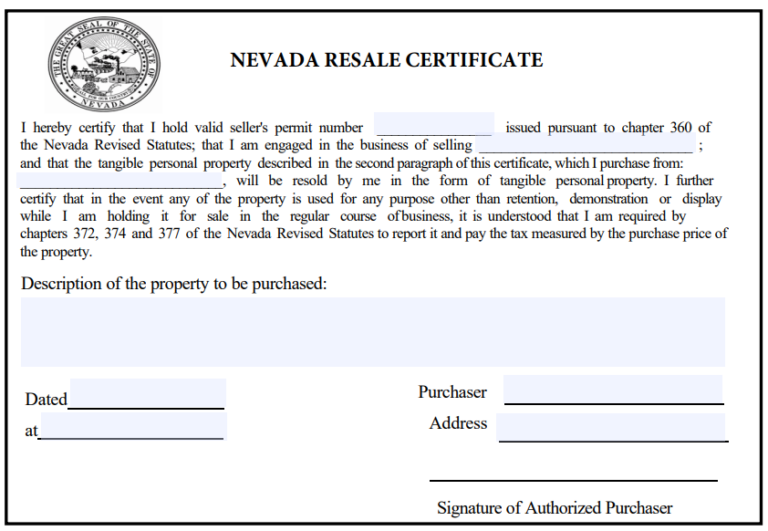

Nevada Sales Tax Exemption Certificate Form

(b) the use tax, a return must be filed by each retailer maintaining a place of business in the state and by each person purchasing tangible. Total calculated sales (18a) and use (18b) tax 16 washoe 19. Enter collection allowance for timely filing (line 18a x 0.25%) net sales tax. Sales & use tax forms. Sales & use tax return.

Nevada Combined Sales And Use Tax Return Form Form Resume Examples

Enter collection allowance for timely filing (line 18a x 0.25%) net sales tax. Sales and use tax return. (b) the use tax, a return must be filed by each retailer maintaining a place of business in the state and by each person purchasing tangible. Total calculated sales (18a) and use (18b) tax 16 washoe 19. Sales & use tax return.

Nevada Monthly Sales Tax Return Due Date

Total calculated sales (18a) and use (18b) tax 16 washoe 19. Enter collection allowance for timely filing (line 18a x 0.25%) net sales tax. (b) the use tax, a return must be filed by each retailer maintaining a place of business in the state and by each person purchasing tangible. Sales & use tax forms. Sales and use tax return.

Email Fill Out Form Printable Printable Forms Free Online

Sales & use tax forms. Sales and use tax return. Sales & use tax return. Total calculated sales (18a) and use (18b) tax 16 washoe 19. Enter collection allowance for timely filing (line 18a x 0.25%) net sales tax.

Blank Nv Sales And Use Tax Form Nevada Fillable Durable Power Of

Sales and use tax return. Enter collection allowance for timely filing (line 18a x 0.25%) net sales tax. (b) the use tax, a return must be filed by each retailer maintaining a place of business in the state and by each person purchasing tangible. Sales & use tax forms. Sales & use tax return.

Nevada State Sales Tax Form 2020 Paul Smith

(b) the use tax, a return must be filed by each retailer maintaining a place of business in the state and by each person purchasing tangible. Sales & use tax forms. Sales and use tax return. Total calculated sales (18a) and use (18b) tax 16 washoe 19. Enter collection allowance for timely filing (line 18a x 0.25%) net sales tax.

Top 6 Nevada Sales Tax Form Templates free to download in PDF format

Sales & use tax forms. Sales and use tax return. Total calculated sales (18a) and use (18b) tax 16 washoe 19. (b) the use tax, a return must be filed by each retailer maintaining a place of business in the state and by each person purchasing tangible. Enter collection allowance for timely filing (line 18a x 0.25%) net sales tax.

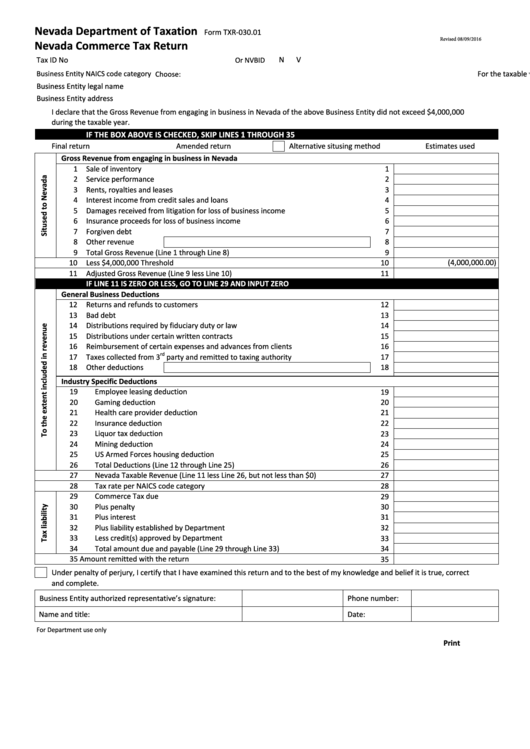

Fillable Form Txr030.01 Nevada Department Of Taxation Nevada

Enter collection allowance for timely filing (line 18a x 0.25%) net sales tax. (b) the use tax, a return must be filed by each retailer maintaining a place of business in the state and by each person purchasing tangible. Sales & use tax forms. Total calculated sales (18a) and use (18b) tax 16 washoe 19. Sales and use tax return.

Nevada State Withholding Tax Form

(b) the use tax, a return must be filed by each retailer maintaining a place of business in the state and by each person purchasing tangible. Sales & use tax return. Sales and use tax return. Enter collection allowance for timely filing (line 18a x 0.25%) net sales tax. Sales & use tax forms.

Sales & Use Tax Forms.

Total calculated sales (18a) and use (18b) tax 16 washoe 19. (b) the use tax, a return must be filed by each retailer maintaining a place of business in the state and by each person purchasing tangible. Enter collection allowance for timely filing (line 18a x 0.25%) net sales tax. Sales & use tax return.