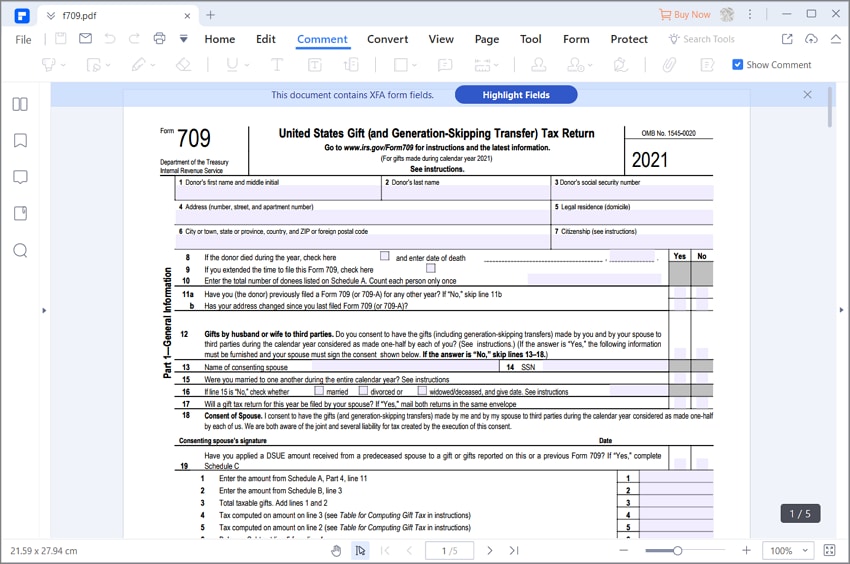

Sample Completed Irs Form 709 - Why does a gift tax return need to be completed correctly? The irs form 709 is filed by u.s. If you made substantial gifts this year, you may need to fill out form 709. In this example, we look at a taxpayer. Individuals to report taxable gifts made during the tax year. Use form 709 to report the following. This guide breaks down the steps for reporting gift taxes. • a gift tax return needs to be completed correctly and accurately to start the.

In this example, we look at a taxpayer. Why does a gift tax return need to be completed correctly? If you made substantial gifts this year, you may need to fill out form 709. The irs form 709 is filed by u.s. Individuals to report taxable gifts made during the tax year. • a gift tax return needs to be completed correctly and accurately to start the. This guide breaks down the steps for reporting gift taxes. Use form 709 to report the following.

If you made substantial gifts this year, you may need to fill out form 709. In this example, we look at a taxpayer. Individuals to report taxable gifts made during the tax year. The irs form 709 is filed by u.s. Why does a gift tax return need to be completed correctly? • a gift tax return needs to be completed correctly and accurately to start the. This guide breaks down the steps for reporting gift taxes. Use form 709 to report the following.

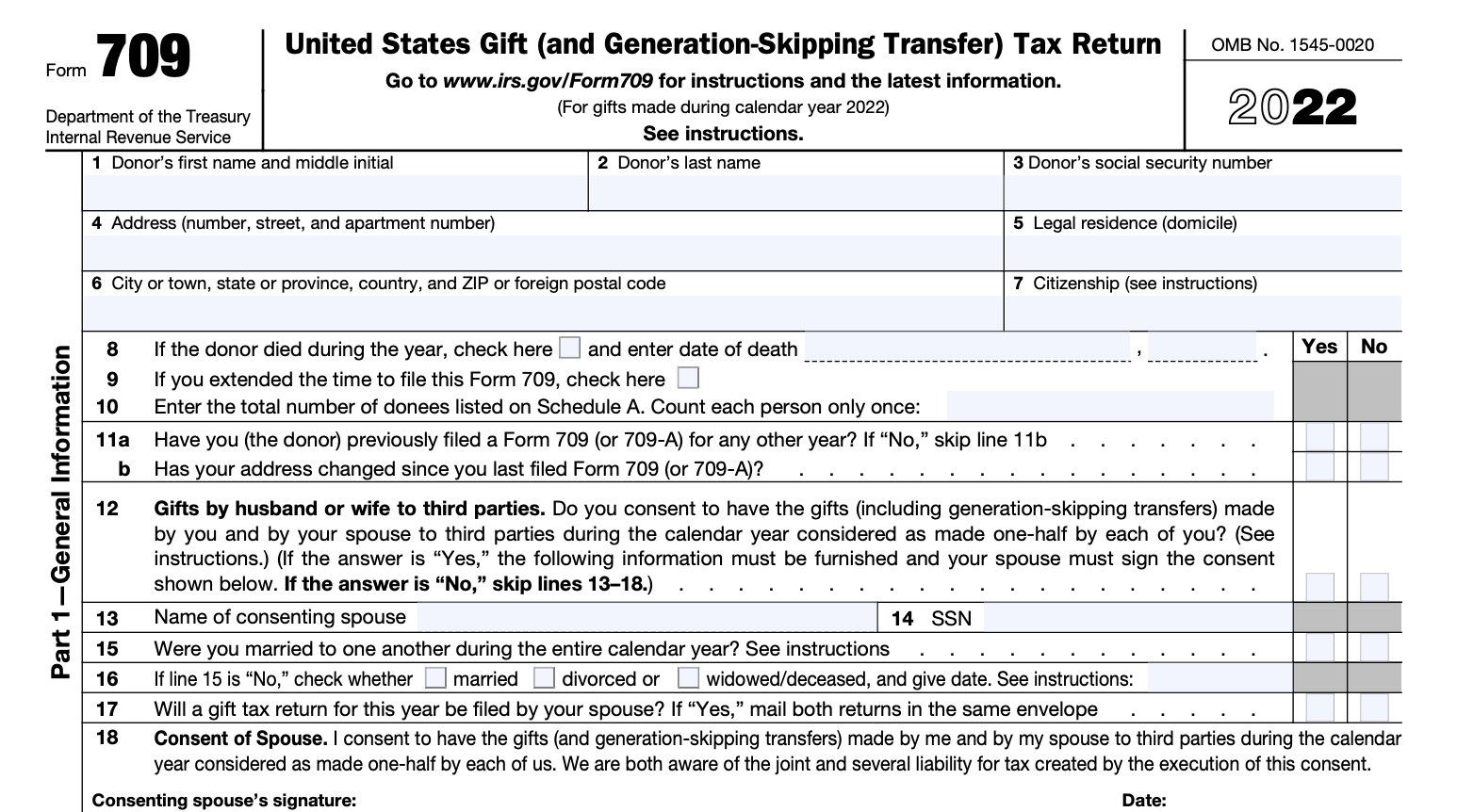

2023 Gift Tax Form 709 Printable Forms Free Online

This guide breaks down the steps for reporting gift taxes. Use form 709 to report the following. Why does a gift tax return need to be completed correctly? If you made substantial gifts this year, you may need to fill out form 709. Individuals to report taxable gifts made during the tax year.

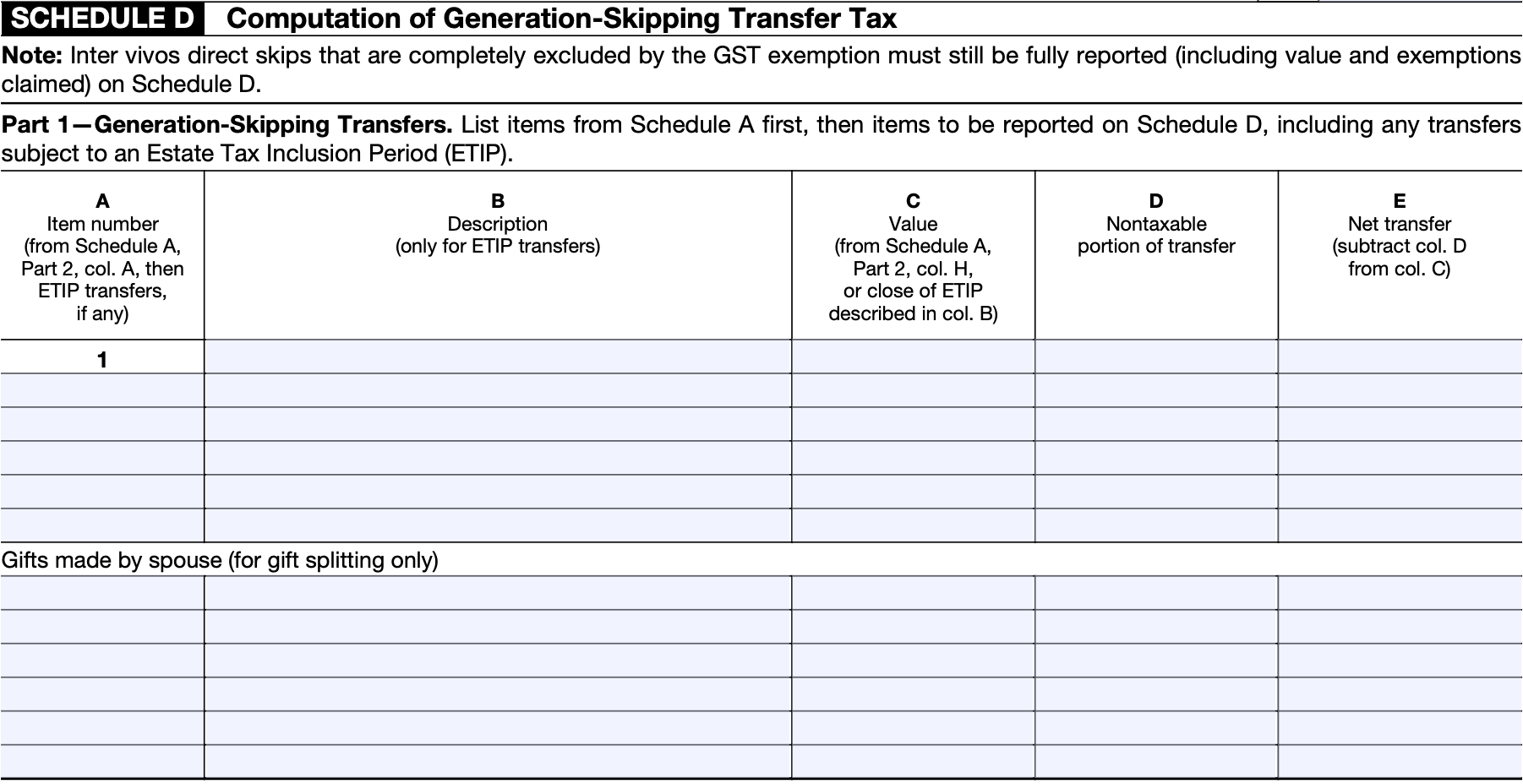

Form 709 Table For Computing Gift Tax Tax Walls

Individuals to report taxable gifts made during the tax year. • a gift tax return needs to be completed correctly and accurately to start the. This guide breaks down the steps for reporting gift taxes. Use form 709 to report the following. In this example, we look at a taxpayer.

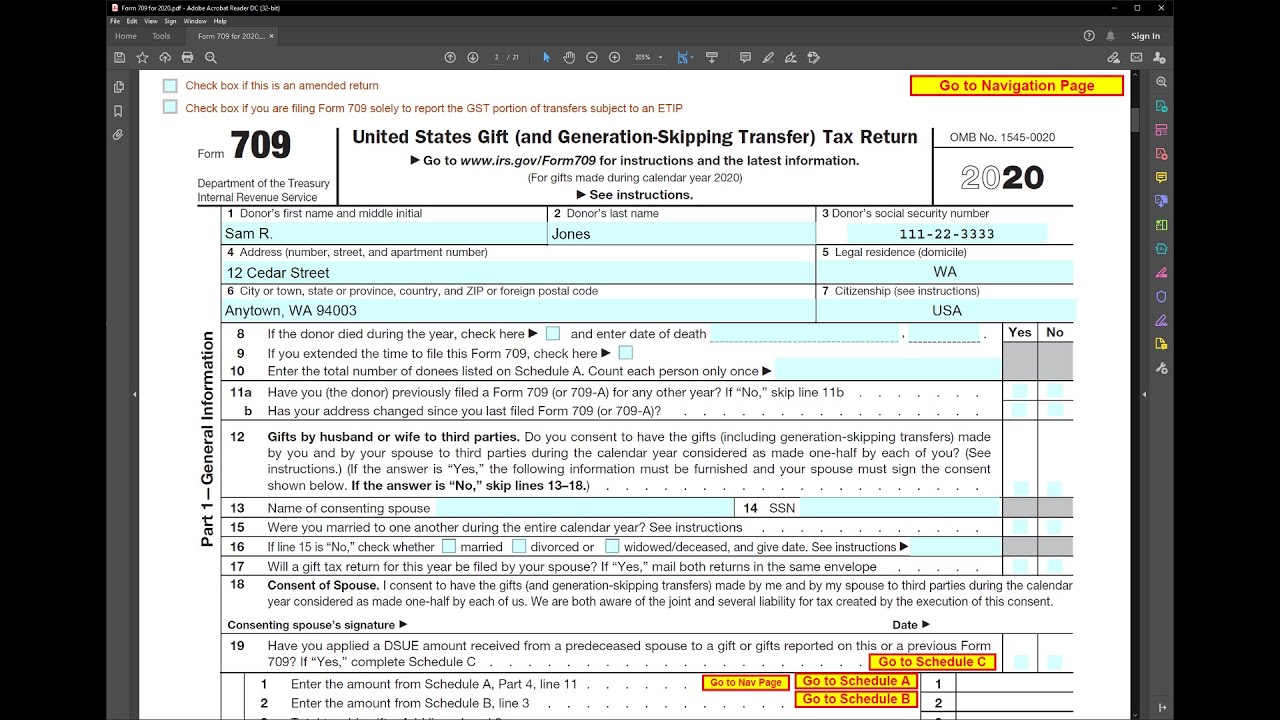

Sample completed Irs Form 709 Fill online, Printable, Fillable Blank

The irs form 709 is filed by u.s. This guide breaks down the steps for reporting gift taxes. Use form 709 to report the following. Individuals to report taxable gifts made during the tax year. Why does a gift tax return need to be completed correctly?

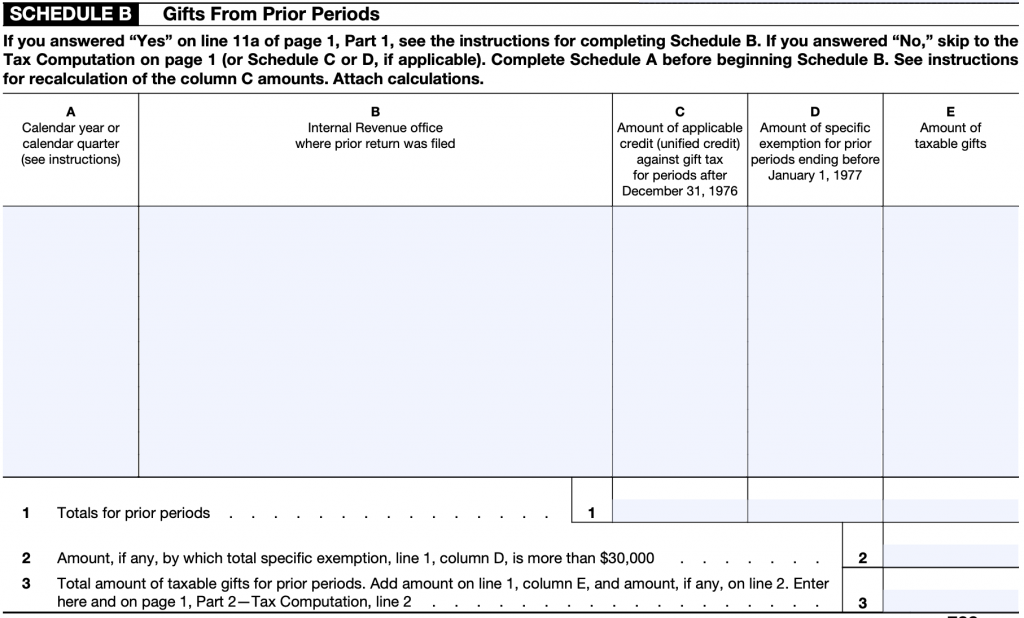

Form 709 Schedule a Continuation Sheet Scotti Flaul1963

This guide breaks down the steps for reporting gift taxes. In this example, we look at a taxpayer. Use form 709 to report the following. Why does a gift tax return need to be completed correctly? The irs form 709 is filed by u.s.

Irs Form 709 For 2023 Printable Forms Free Online

The irs form 709 is filed by u.s. Use form 709 to report the following. Why does a gift tax return need to be completed correctly? If you made substantial gifts this year, you may need to fill out form 709. Individuals to report taxable gifts made during the tax year.

Form 709 Guide to US Gift Taxes for Expats

Individuals to report taxable gifts made during the tax year. This guide breaks down the steps for reporting gift taxes. • a gift tax return needs to be completed correctly and accurately to start the. In this example, we look at a taxpayer. Why does a gift tax return need to be completed correctly?

How to Fill Out Form 709 Nasdaq

Use form 709 to report the following. This guide breaks down the steps for reporting gift taxes. Why does a gift tax return need to be completed correctly? The irs form 709 is filed by u.s. Individuals to report taxable gifts made during the tax year.

2023 Form 709 Instructions Printable Forms Free Online

The irs form 709 is filed by u.s. • a gift tax return needs to be completed correctly and accurately to start the. If you made substantial gifts this year, you may need to fill out form 709. Why does a gift tax return need to be completed correctly? In this example, we look at a taxpayer.

Completed Sample IRS Form 709 Gift Tax Return for 529 Superfunding

This guide breaks down the steps for reporting gift taxes. Individuals to report taxable gifts made during the tax year. In this example, we look at a taxpayer. • a gift tax return needs to be completed correctly and accurately to start the. The irs form 709 is filed by u.s.

Completed Sample IRS Form 709 Gift Tax Return for 529 Superfunding

Use form 709 to report the following. • a gift tax return needs to be completed correctly and accurately to start the. Why does a gift tax return need to be completed correctly? The irs form 709 is filed by u.s. If you made substantial gifts this year, you may need to fill out form 709.

If You Made Substantial Gifts This Year, You May Need To Fill Out Form 709.

In this example, we look at a taxpayer. The irs form 709 is filed by u.s. This guide breaks down the steps for reporting gift taxes. Use form 709 to report the following.

Why Does A Gift Tax Return Need To Be Completed Correctly?

• a gift tax return needs to be completed correctly and accurately to start the. Individuals to report taxable gifts made during the tax year.