Short Calendar Spread - Learn how to use a short calendar call spread to profit from a volatile market when you are unsure of the direction of price movement. To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there is little or no price change.

Learn how to use a short calendar call spread to profit from a volatile market when you are unsure of the direction of price movement. To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there is little or no price change.

Learn how to use a short calendar call spread to profit from a volatile market when you are unsure of the direction of price movement. To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there is little or no price change.

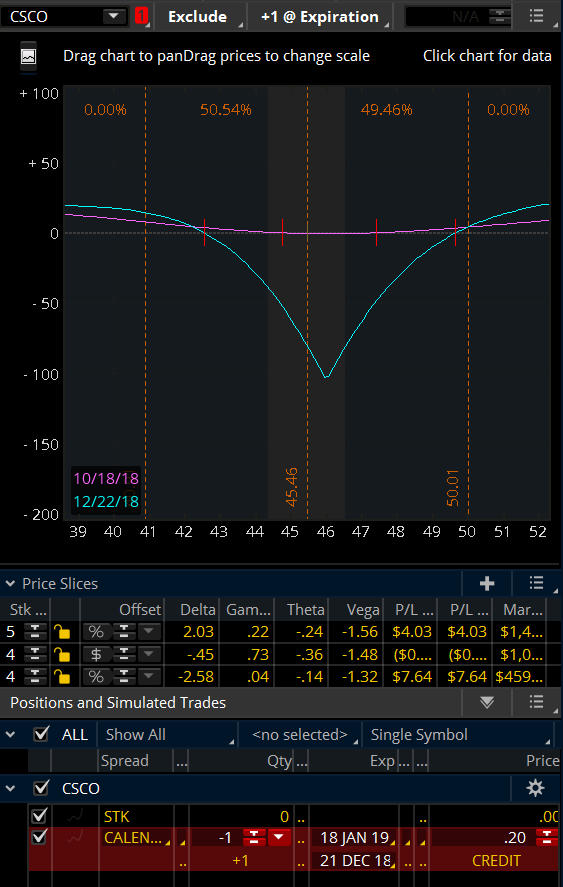

Calendar Spread Options Examples Mavra Sibella

To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there is little or no price change. Learn how to use a short calendar call spread to profit from a volatile market when you are unsure of the direction of price movement.

What is a Calendar Spread? Aeromir

Learn how to use a short calendar call spread to profit from a volatile market when you are unsure of the direction of price movement. To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there is little or no price change.

Short Calendar spread Option Strategy with live in Telugu How to trade

Learn how to use a short calendar call spread to profit from a volatile market when you are unsure of the direction of price movement. To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there is little or no price change.

Calendar Box Spread Sheba Domeniga

To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there is little or no price change. Learn how to use a short calendar call spread to profit from a volatile market when you are unsure of the direction of price movement.

Calendar Call Spread Options Edge

To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there is little or no price change. Learn how to use a short calendar call spread to profit from a volatile market when you are unsure of the direction of price movement.

How to Create a Credit Spread with the Short Calendar Put Spread YouTube

Learn how to use a short calendar call spread to profit from a volatile market when you are unsure of the direction of price movement. To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there is little or no price change.

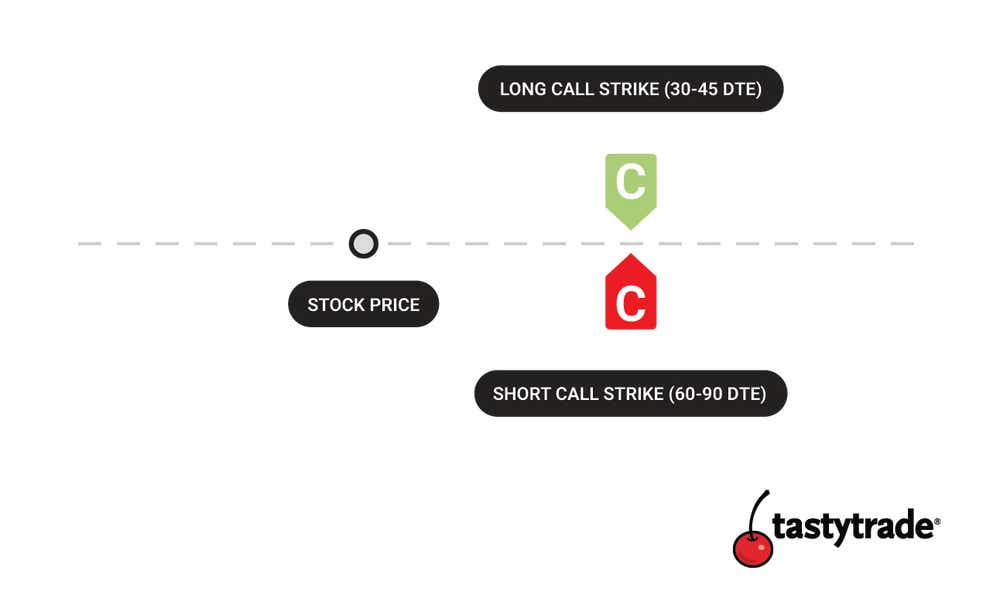

Calendar Spread What is a Calendar Spread Option? tastytrade

To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there is little or no price change. Learn how to use a short calendar call spread to profit from a volatile market when you are unsure of the direction of price movement.

The Poor Man's Covered Call (and other Calendar Spreads) r/ConfusedMoney

To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there is little or no price change. Learn how to use a short calendar call spread to profit from a volatile market when you are unsure of the direction of price movement.

Short Put Calendar Short put calendar Spread Reverse Calendar

To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there is little or no price change. Learn how to use a short calendar call spread to profit from a volatile market when you are unsure of the direction of price movement.

Calendar Spread Option Strategy 2024 Easy to Use Calendar App 2024

To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there is little or no price change. Learn how to use a short calendar call spread to profit from a volatile market when you are unsure of the direction of price movement.

Learn How To Use A Short Calendar Call Spread To Profit From A Volatile Market When You Are Unsure Of The Direction Of Price Movement.

To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there is little or no price change.