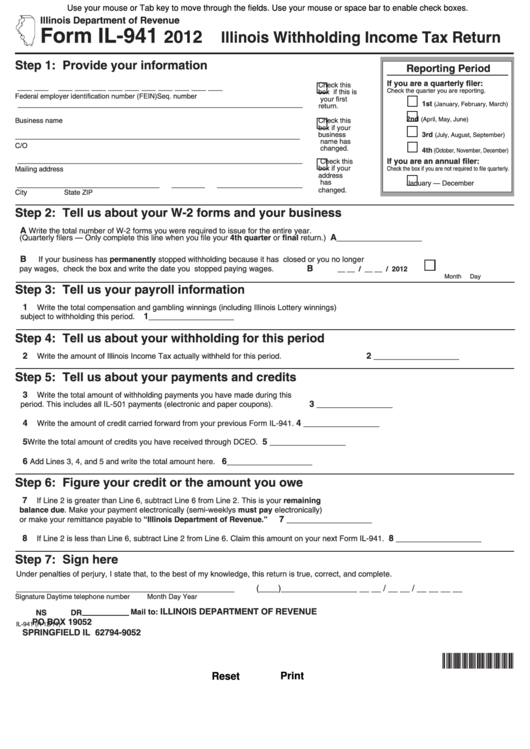

State Tax Withholding Form Illinois - 2012 tax year (for withholding taxes 01/01/2012 through 12/31/2012) 2011 tax years and prior (for withholding taxes prior to. From your pay depends, in part, on the number of allowances you claim on this form. If you are an employee, you must complete this form so your employer can withhold the correct amount of illinois income tax from your pay. Withholding income tax credits information and worksheets. If you are an employee, you must complete this form so your employer can withhold the correct amount of.

Withholding income tax credits information and worksheets. From your pay depends, in part, on the number of allowances you claim on this form. 2012 tax year (for withholding taxes 01/01/2012 through 12/31/2012) 2011 tax years and prior (for withholding taxes prior to. If you are an employee, you must complete this form so your employer can withhold the correct amount of. If you are an employee, you must complete this form so your employer can withhold the correct amount of illinois income tax from your pay.

If you are an employee, you must complete this form so your employer can withhold the correct amount of. From your pay depends, in part, on the number of allowances you claim on this form. If you are an employee, you must complete this form so your employer can withhold the correct amount of illinois income tax from your pay. 2012 tax year (for withholding taxes 01/01/2012 through 12/31/2012) 2011 tax years and prior (for withholding taxes prior to. Withholding income tax credits information and worksheets.

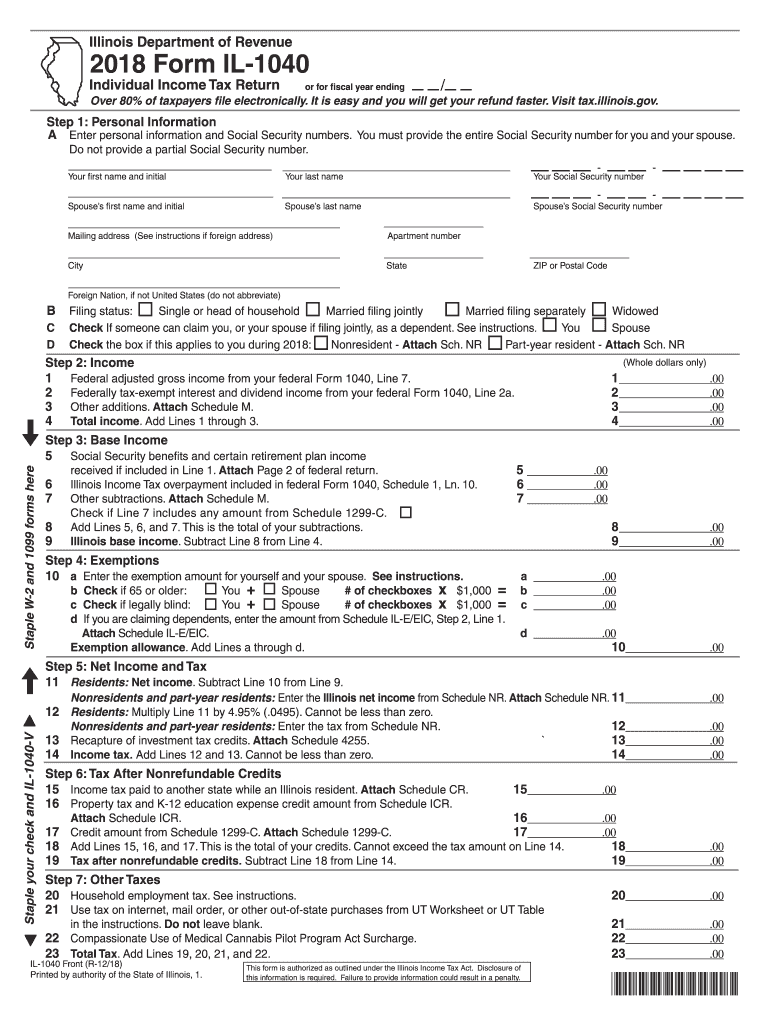

Illinois State Tax Complete with ease airSlate SignNow

If you are an employee, you must complete this form so your employer can withhold the correct amount of. 2012 tax year (for withholding taxes 01/01/2012 through 12/31/2012) 2011 tax years and prior (for withholding taxes prior to. If you are an employee, you must complete this form so your employer can withhold the correct amount of illinois income tax.

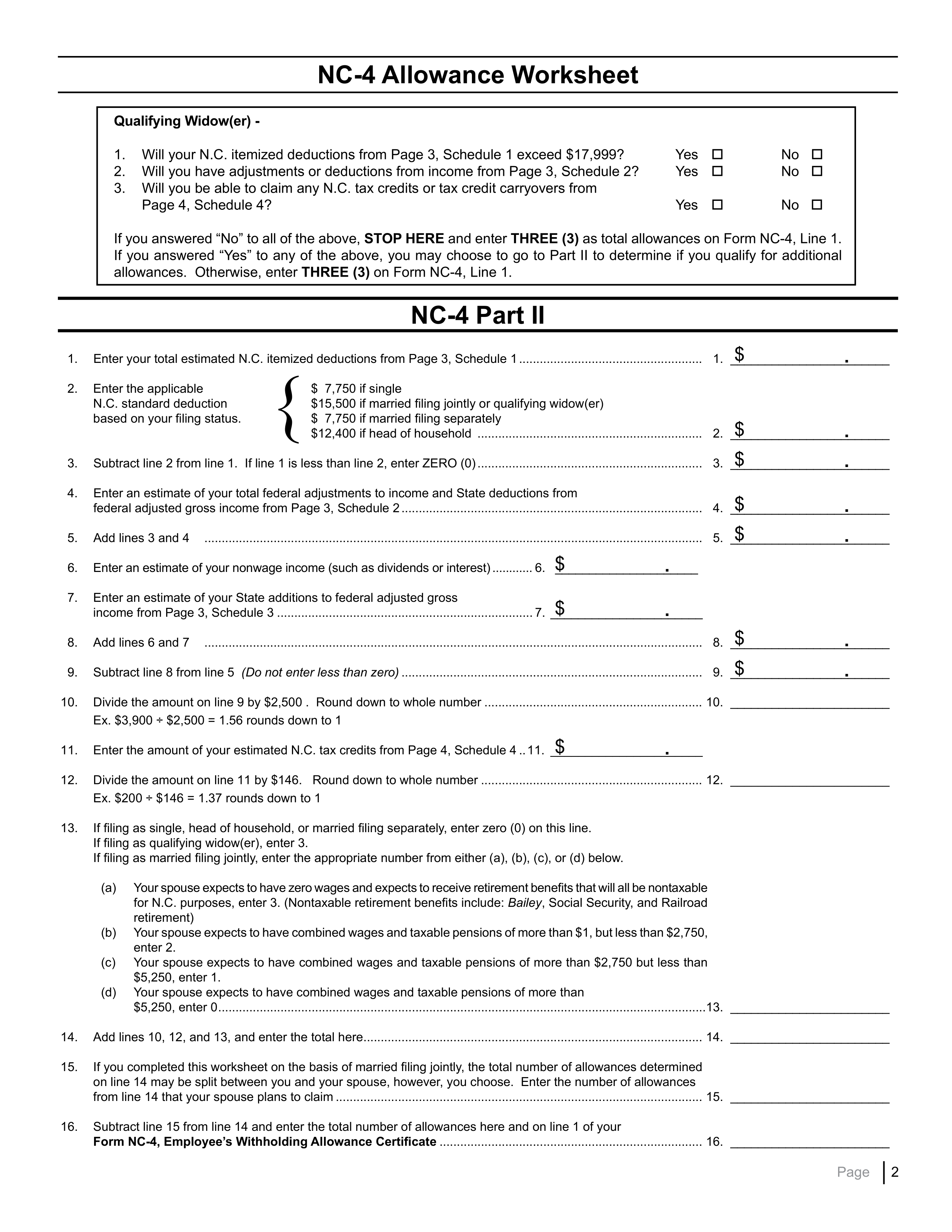

Nc Withholding Tables 2024 Midge Susette

Withholding income tax credits information and worksheets. 2012 tax year (for withholding taxes 01/01/2012 through 12/31/2012) 2011 tax years and prior (for withholding taxes prior to. From your pay depends, in part, on the number of allowances you claim on this form. If you are an employee, you must complete this form so your employer can withhold the correct amount.

North Carolina State Withholding Form Nc4 Ez

If you are an employee, you must complete this form so your employer can withhold the correct amount of. From your pay depends, in part, on the number of allowances you claim on this form. If you are an employee, you must complete this form so your employer can withhold the correct amount of illinois income tax from your pay..

Illinois state tax form Fill out & sign online DocHub

2012 tax year (for withholding taxes 01/01/2012 through 12/31/2012) 2011 tax years and prior (for withholding taxes prior to. If you are an employee, you must complete this form so your employer can withhold the correct amount of illinois income tax from your pay. If you are an employee, you must complete this form so your employer can withhold the.

Indiana State Tax Withholding Form Wh4p

2012 tax year (for withholding taxes 01/01/2012 through 12/31/2012) 2011 tax years and prior (for withholding taxes prior to. If you are an employee, you must complete this form so your employer can withhold the correct amount of illinois income tax from your pay. Withholding income tax credits information and worksheets. From your pay depends, in part, on the number.

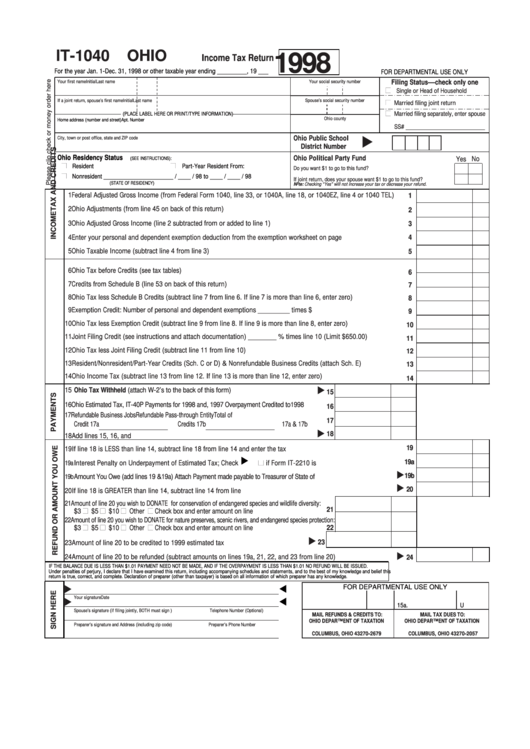

State Tax Withholding Form Ohio

From your pay depends, in part, on the number of allowances you claim on this form. 2012 tax year (for withholding taxes 01/01/2012 through 12/31/2012) 2011 tax years and prior (for withholding taxes prior to. Withholding income tax credits information and worksheets. If you are an employee, you must complete this form so your employer can withhold the correct amount.

New York State Employee Tax Withholding Form

2012 tax year (for withholding taxes 01/01/2012 through 12/31/2012) 2011 tax years and prior (for withholding taxes prior to. Withholding income tax credits information and worksheets. If you are an employee, you must complete this form so your employer can withhold the correct amount of. If you are an employee, you must complete this form so your employer can withhold.

Illinois Tax Withholding Form

From your pay depends, in part, on the number of allowances you claim on this form. 2012 tax year (for withholding taxes 01/01/2012 through 12/31/2012) 2011 tax years and prior (for withholding taxes prior to. If you are an employee, you must complete this form so your employer can withhold the correct amount of. Withholding income tax credits information and.

State Withholding Tax Form 2023 Printable Forms Free Online

If you are an employee, you must complete this form so your employer can withhold the correct amount of illinois income tax from your pay. 2012 tax year (for withholding taxes 01/01/2012 through 12/31/2012) 2011 tax years and prior (for withholding taxes prior to. Withholding income tax credits information and worksheets. From your pay depends, in part, on the number.

Online Ohio State Tax Withholding Form

2012 tax year (for withholding taxes 01/01/2012 through 12/31/2012) 2011 tax years and prior (for withholding taxes prior to. From your pay depends, in part, on the number of allowances you claim on this form. Withholding income tax credits information and worksheets. If you are an employee, you must complete this form so your employer can withhold the correct amount.

From Your Pay Depends, In Part, On The Number Of Allowances You Claim On This Form.

If you are an employee, you must complete this form so your employer can withhold the correct amount of. If you are an employee, you must complete this form so your employer can withhold the correct amount of illinois income tax from your pay. Withholding income tax credits information and worksheets. 2012 tax year (for withholding taxes 01/01/2012 through 12/31/2012) 2011 tax years and prior (for withholding taxes prior to.