Tax Form For Rmd Distribution - If you missed rmds for multiple years, file form 5329 separately for. Use these worksheets to calculate your rmd from your own iras, including sep and simple iras. When you reach age 73 (age 70½ if you attained age 70½ before 2020), you'll be required to withdraw at least a certain amount (called your. The irs provides required minimum distribution worksheets to help calculate the rmd amounts and payout periods. You will report this in the program as follows: You can file this form with your tax return or separately.

The irs provides required minimum distribution worksheets to help calculate the rmd amounts and payout periods. When you reach age 73 (age 70½ if you attained age 70½ before 2020), you'll be required to withdraw at least a certain amount (called your. You will report this in the program as follows: If you missed rmds for multiple years, file form 5329 separately for. You can file this form with your tax return or separately. Use these worksheets to calculate your rmd from your own iras, including sep and simple iras.

You can file this form with your tax return or separately. When you reach age 73 (age 70½ if you attained age 70½ before 2020), you'll be required to withdraw at least a certain amount (called your. Use these worksheets to calculate your rmd from your own iras, including sep and simple iras. You will report this in the program as follows: The irs provides required minimum distribution worksheets to help calculate the rmd amounts and payout periods. If you missed rmds for multiple years, file form 5329 separately for.

Inherited Ira Distribution Table 1

You will report this in the program as follows: You can file this form with your tax return or separately. If you missed rmds for multiple years, file form 5329 separately for. Use these worksheets to calculate your rmd from your own iras, including sep and simple iras. The irs provides required minimum distribution worksheets to help calculate the rmd.

Required Minimum Distribution Planning

When you reach age 73 (age 70½ if you attained age 70½ before 2020), you'll be required to withdraw at least a certain amount (called your. The irs provides required minimum distribution worksheets to help calculate the rmd amounts and payout periods. If you missed rmds for multiple years, file form 5329 separately for. You will report this in the.

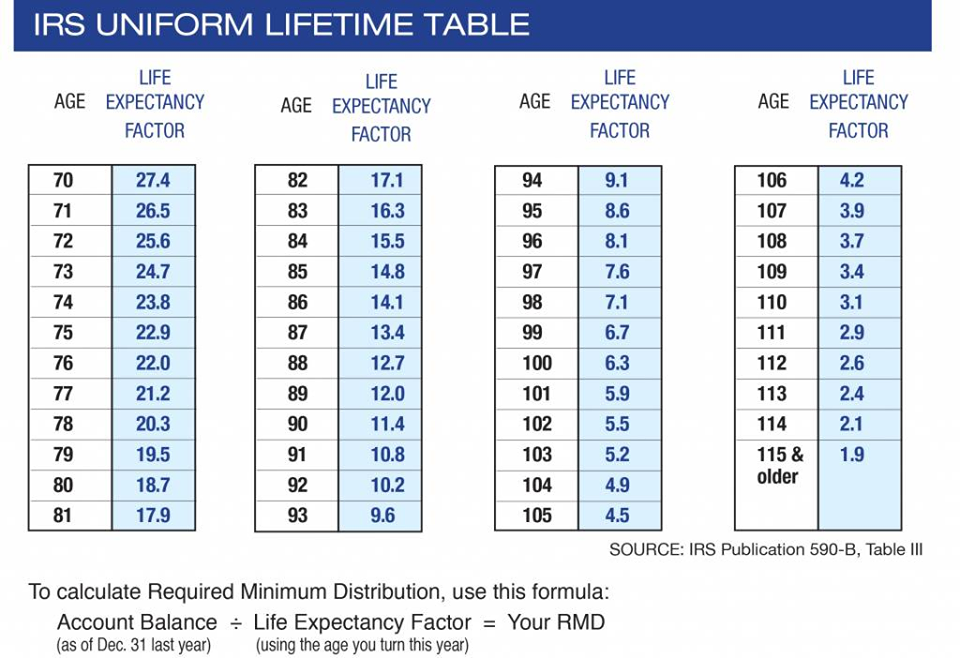

Ira Mandatory Distribution Table

You can file this form with your tax return or separately. Use these worksheets to calculate your rmd from your own iras, including sep and simple iras. You will report this in the program as follows: The irs provides required minimum distribution worksheets to help calculate the rmd amounts and payout periods. If you missed rmds for multiple years, file.

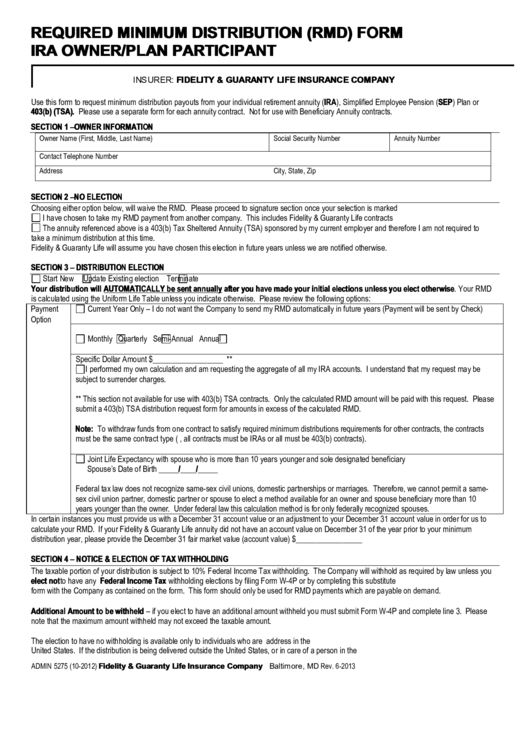

Fillable Online Required Minimum Distribution (RMD) Form Fax Email

If you missed rmds for multiple years, file form 5329 separately for. You can file this form with your tax return or separately. When you reach age 73 (age 70½ if you attained age 70½ before 2020), you'll be required to withdraw at least a certain amount (called your. Use these worksheets to calculate your rmd from your own iras,.

Rmd Distribution Table 2024 Irs Catie Daniela

The irs provides required minimum distribution worksheets to help calculate the rmd amounts and payout periods. When you reach age 73 (age 70½ if you attained age 70½ before 2020), you'll be required to withdraw at least a certain amount (called your. You can file this form with your tax return or separately. You will report this in the program.

How To Fill Out Ira Distribution Form TAX

If you missed rmds for multiple years, file form 5329 separately for. Use these worksheets to calculate your rmd from your own iras, including sep and simple iras. You will report this in the program as follows: When you reach age 73 (age 70½ if you attained age 70½ before 2020), you'll be required to withdraw at least a certain.

New Rmd Rules For 2025 Tax Year Penelope Gibson

When you reach age 73 (age 70½ if you attained age 70½ before 2020), you'll be required to withdraw at least a certain amount (called your. You can file this form with your tax return or separately. If you missed rmds for multiple years, file form 5329 separately for. The irs provides required minimum distribution worksheets to help calculate the.

Rmd Table 10 Years Younger Elcho Table

When you reach age 73 (age 70½ if you attained age 70½ before 2020), you'll be required to withdraw at least a certain amount (called your. You will report this in the program as follows: Use these worksheets to calculate your rmd from your own iras, including sep and simple iras. You can file this form with your tax return.

Irs Rmd Tables 2024 Neely Wenonah

You will report this in the program as follows: You can file this form with your tax return or separately. When you reach age 73 (age 70½ if you attained age 70½ before 2020), you'll be required to withdraw at least a certain amount (called your. The irs provides required minimum distribution worksheets to help calculate the rmd amounts and.

RMDs (Required Minimum Distributions) Top Ten Questions Answered MRB

If you missed rmds for multiple years, file form 5329 separately for. You can file this form with your tax return or separately. You will report this in the program as follows: Use these worksheets to calculate your rmd from your own iras, including sep and simple iras. The irs provides required minimum distribution worksheets to help calculate the rmd.

The Irs Provides Required Minimum Distribution Worksheets To Help Calculate The Rmd Amounts And Payout Periods.

Use these worksheets to calculate your rmd from your own iras, including sep and simple iras. You can file this form with your tax return or separately. You will report this in the program as follows: If you missed rmds for multiple years, file form 5329 separately for.

/https://blogs-images.forbes.com/baldwin/files/2014/03/rmd_own_larger.png?resize=618%2C635&ssl=1)