Tax Resident Malaysia - An individual is regarded as tax resident if he meets any of the following conditions, i.e. Tax residence status of individuals. The malaysian tax system generally determines tax residency based on the physical presence of an individual in malaysia for 182. It determines how much tax you need to pay and. Understanding your tax residency status is crucial when it comes to taxation in malaysia.

Tax residence status of individuals. Understanding your tax residency status is crucial when it comes to taxation in malaysia. The malaysian tax system generally determines tax residency based on the physical presence of an individual in malaysia for 182. An individual is regarded as tax resident if he meets any of the following conditions, i.e. It determines how much tax you need to pay and.

Understanding your tax residency status is crucial when it comes to taxation in malaysia. The malaysian tax system generally determines tax residency based on the physical presence of an individual in malaysia for 182. It determines how much tax you need to pay and. Tax residence status of individuals. An individual is regarded as tax resident if he meets any of the following conditions, i.e.

Tutorial 1 Introduction and Resident status Tutorial 1 Introduction

The malaysian tax system generally determines tax residency based on the physical presence of an individual in malaysia for 182. An individual is regarded as tax resident if he meets any of the following conditions, i.e. Understanding your tax residency status is crucial when it comes to taxation in malaysia. Tax residence status of individuals. It determines how much tax.

7 Tips to File Malaysian Tax For Beginners Swingvy Malaysia

Tax residence status of individuals. The malaysian tax system generally determines tax residency based on the physical presence of an individual in malaysia for 182. Understanding your tax residency status is crucial when it comes to taxation in malaysia. It determines how much tax you need to pay and. An individual is regarded as tax resident if he meets any.

Tax Resident status in Malaysia Read On

An individual is regarded as tax resident if he meets any of the following conditions, i.e. Understanding your tax residency status is crucial when it comes to taxation in malaysia. It determines how much tax you need to pay and. Tax residence status of individuals. The malaysian tax system generally determines tax residency based on the physical presence of an.

How to be a Tax Resident in Malaysia ANC Group

The malaysian tax system generally determines tax residency based on the physical presence of an individual in malaysia for 182. An individual is regarded as tax resident if he meets any of the following conditions, i.e. Tax residence status of individuals. Understanding your tax residency status is crucial when it comes to taxation in malaysia. It determines how much tax.

How to be a Tax Resident in Malaysia ANC Group

Tax residence status of individuals. Understanding your tax residency status is crucial when it comes to taxation in malaysia. The malaysian tax system generally determines tax residency based on the physical presence of an individual in malaysia for 182. It determines how much tax you need to pay and. An individual is regarded as tax resident if he meets any.

Tax 2022 Table Malaysia Latest News Update

The malaysian tax system generally determines tax residency based on the physical presence of an individual in malaysia for 182. Tax residence status of individuals. It determines how much tax you need to pay and. Understanding your tax residency status is crucial when it comes to taxation in malaysia. An individual is regarded as tax resident if he meets any.

Tax Planning Strategies Dignity Consultant

It determines how much tax you need to pay and. Understanding your tax residency status is crucial when it comes to taxation in malaysia. Tax residence status of individuals. The malaysian tax system generally determines tax residency based on the physical presence of an individual in malaysia for 182. An individual is regarded as tax resident if he meets any.

Malaysia Personal Tax Guide 2017

An individual is regarded as tax resident if he meets any of the following conditions, i.e. Understanding your tax residency status is crucial when it comes to taxation in malaysia. Tax residence status of individuals. The malaysian tax system generally determines tax residency based on the physical presence of an individual in malaysia for 182. It determines how much tax.

What are the criteria for an individual to a tax resident in

It determines how much tax you need to pay and. Tax residence status of individuals. Understanding your tax residency status is crucial when it comes to taxation in malaysia. An individual is regarded as tax resident if he meets any of the following conditions, i.e. The malaysian tax system generally determines tax residency based on the physical presence of an.

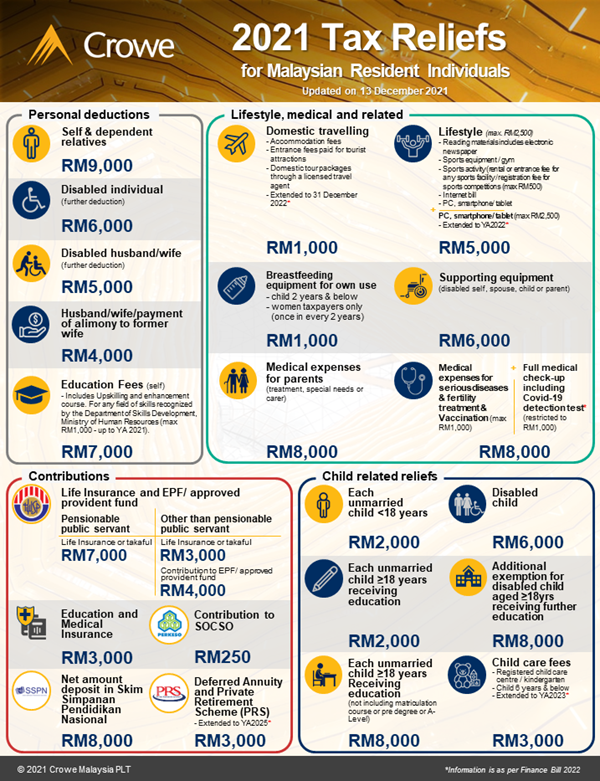

Infographic of 2021 Tax Reliefs for Malaysian Resident Individuals

The malaysian tax system generally determines tax residency based on the physical presence of an individual in malaysia for 182. Understanding your tax residency status is crucial when it comes to taxation in malaysia. An individual is regarded as tax resident if he meets any of the following conditions, i.e. Tax residence status of individuals. It determines how much tax.

Understanding Your Tax Residency Status Is Crucial When It Comes To Taxation In Malaysia.

Tax residence status of individuals. An individual is regarded as tax resident if he meets any of the following conditions, i.e. The malaysian tax system generally determines tax residency based on the physical presence of an individual in malaysia for 182. It determines how much tax you need to pay and.