Taxation In Italy Wikipedia - Italy has a complex tax structure that funds its public services and maintains the italian economy. Taxation in italy is levied by the central and regional governments and is collected by the. Corporate tax, individual income tax, and sales tax, including vat and gst and capital. Taxation in italy is levied by the central and regional governments and is collected by the italian agency of revenue (agenzia delle. This guide will break down. Personal income taxation in italy is progressive. 232 rows the list focuses on the main types of taxes:

232 rows the list focuses on the main types of taxes: Italy has a complex tax structure that funds its public services and maintains the italian economy. Corporate tax, individual income tax, and sales tax, including vat and gst and capital. Personal income taxation in italy is progressive. This guide will break down. Taxation in italy is levied by the central and regional governments and is collected by the. Taxation in italy is levied by the central and regional governments and is collected by the italian agency of revenue (agenzia delle.

Corporate tax, individual income tax, and sales tax, including vat and gst and capital. Personal income taxation in italy is progressive. 232 rows the list focuses on the main types of taxes: This guide will break down. Taxation in italy is levied by the central and regional governments and is collected by the italian agency of revenue (agenzia delle. Taxation in italy is levied by the central and regional governments and is collected by the. Italy has a complex tax structure that funds its public services and maintains the italian economy.

Crypto taxation alternatives to Italy to pay less tax

This guide will break down. Taxation in italy is levied by the central and regional governments and is collected by the. Personal income taxation in italy is progressive. Taxation in italy is levied by the central and regional governments and is collected by the italian agency of revenue (agenzia delle. Italy has a complex tax structure that funds its public.

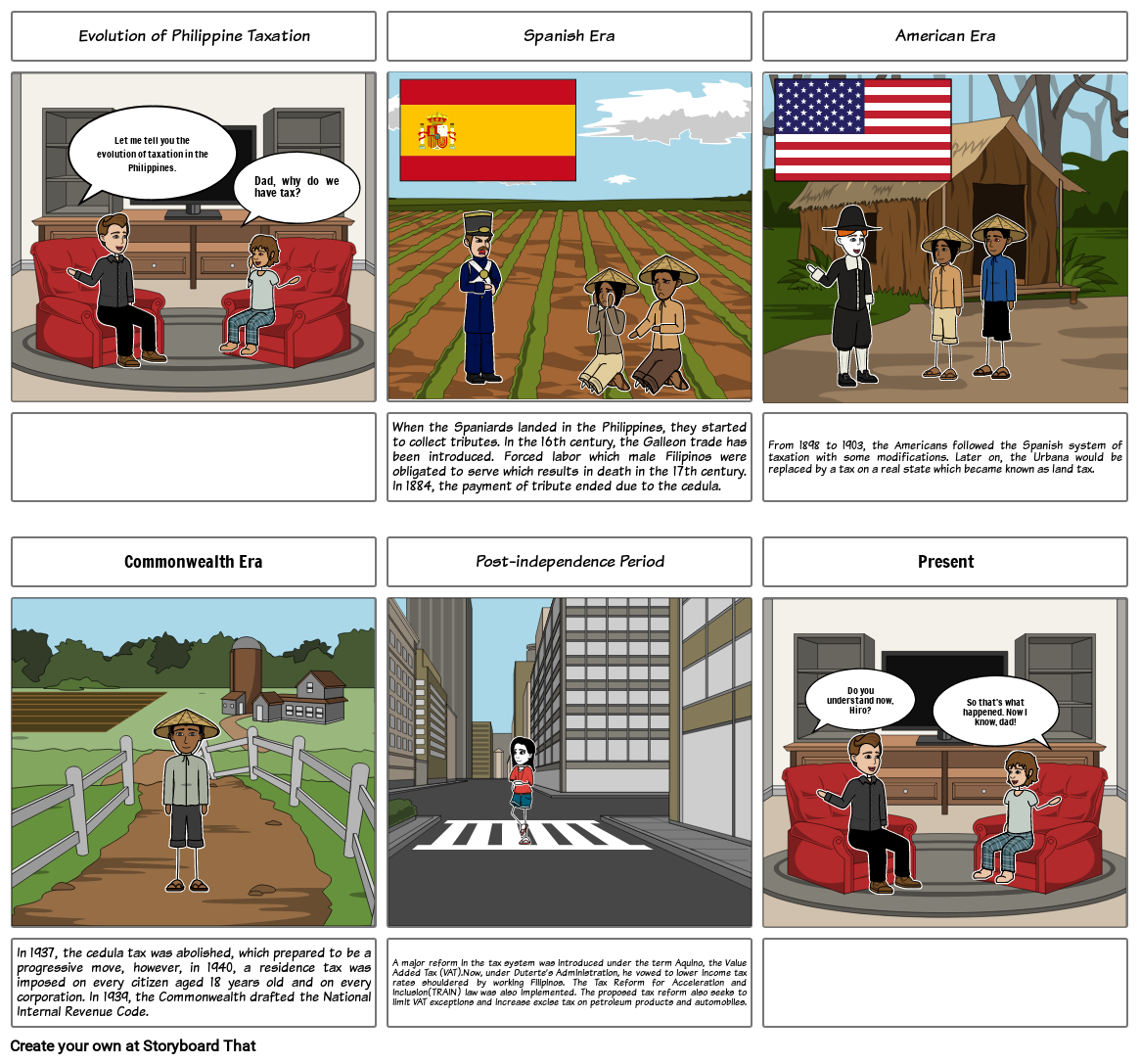

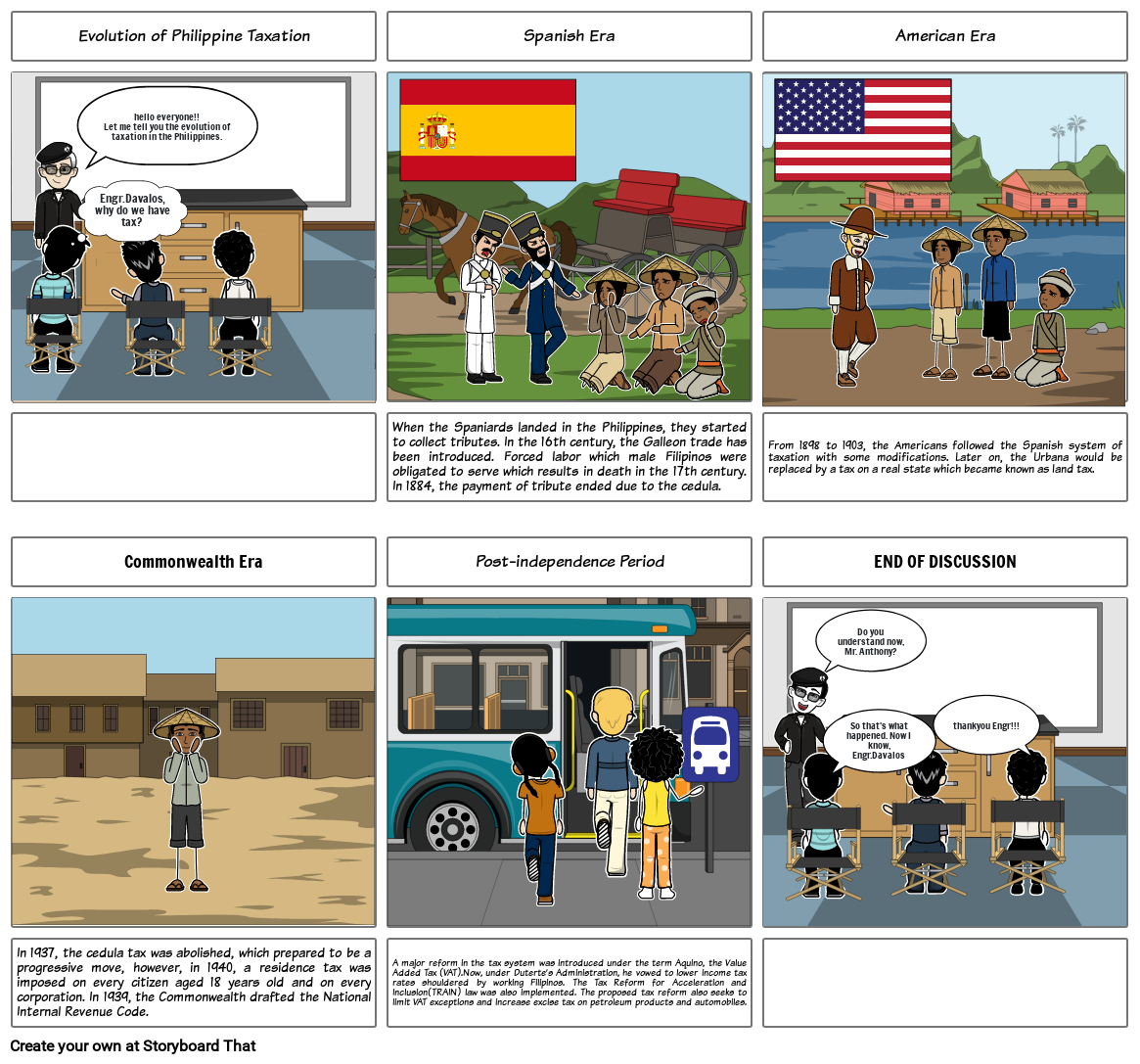

EVOLUTION OF PHILIPPINE TAXATION Storyboard by 0cee0e49

Taxation in italy is levied by the central and regional governments and is collected by the italian agency of revenue (agenzia delle. This guide will break down. Corporate tax, individual income tax, and sales tax, including vat and gst and capital. Taxation in italy is levied by the central and regional governments and is collected by the. Personal income taxation.

Evolution of Philippine Taxation Storyboard by 5890319d

This guide will break down. Corporate tax, individual income tax, and sales tax, including vat and gst and capital. Italy has a complex tax structure that funds its public services and maintains the italian economy. Taxation in italy is levied by the central and regional governments and is collected by the italian agency of revenue (agenzia delle. Taxation in italy.

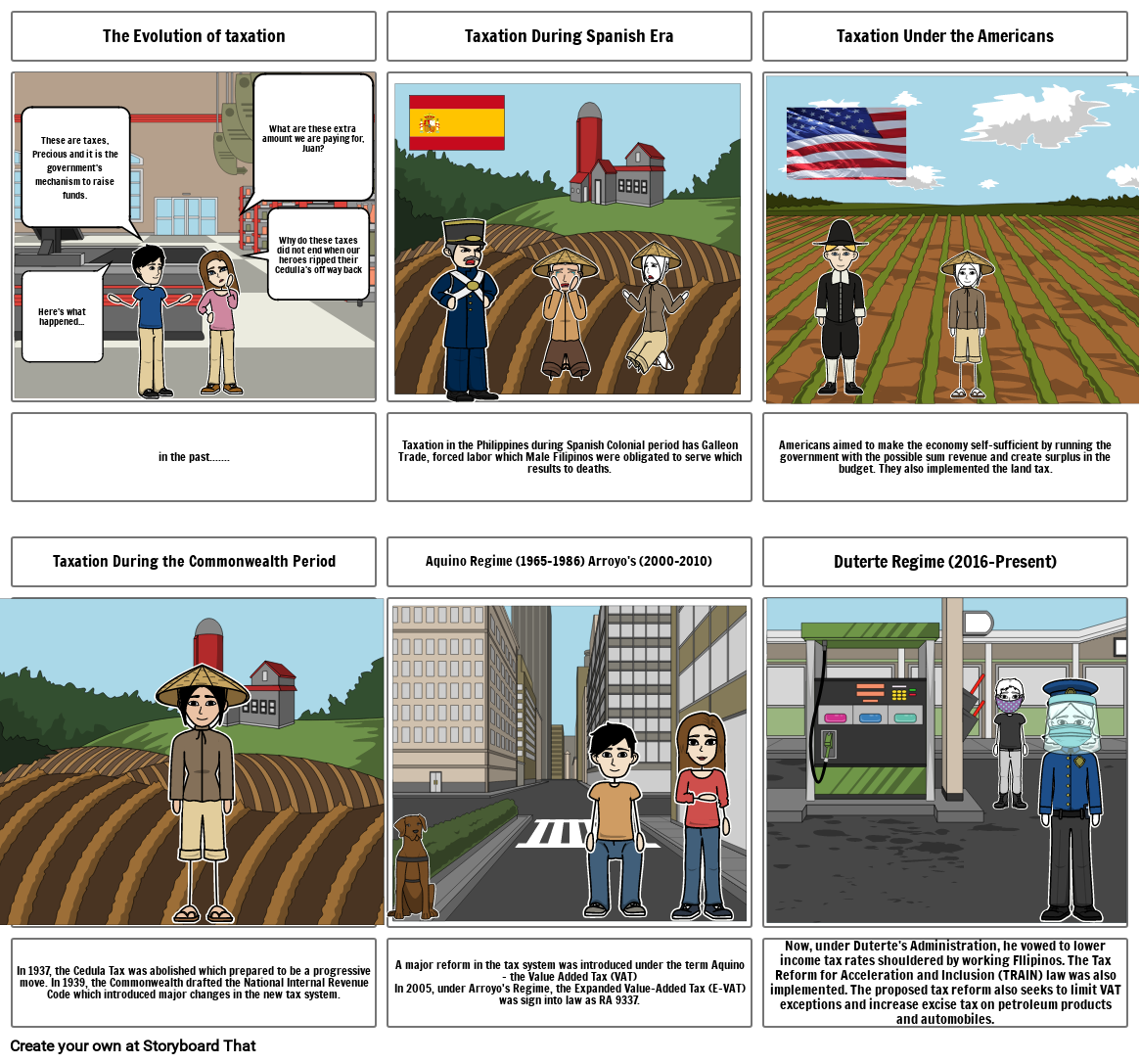

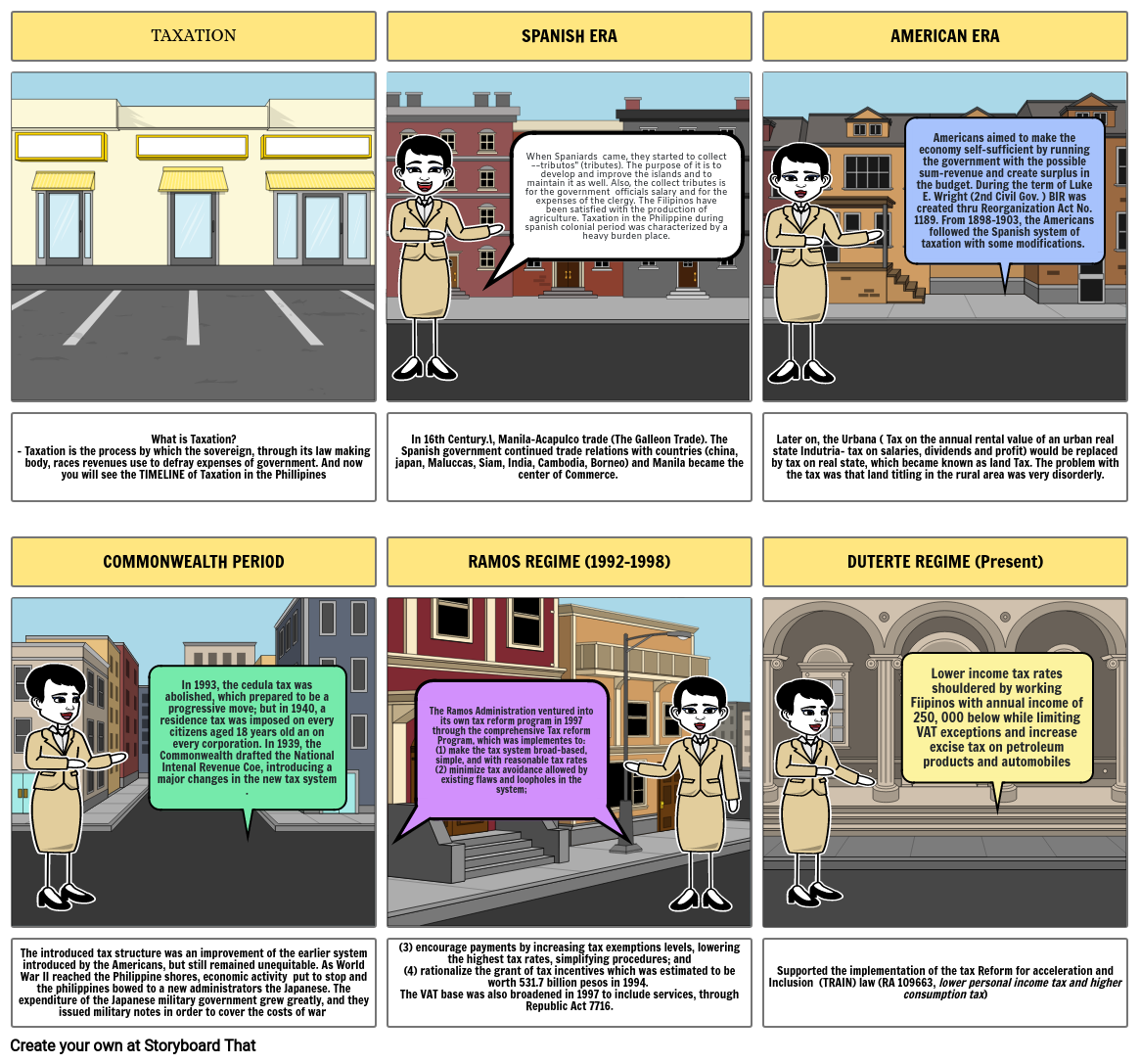

history of taxation Storyboard by 87c03591

Italy has a complex tax structure that funds its public services and maintains the italian economy. Taxation in italy is levied by the central and regional governments and is collected by the italian agency of revenue (agenzia delle. Corporate tax, individual income tax, and sales tax, including vat and gst and capital. Personal income taxation in italy is progressive. Taxation.

Taxation in Italy YouTube

Taxation in italy is levied by the central and regional governments and is collected by the italian agency of revenue (agenzia delle. This guide will break down. 232 rows the list focuses on the main types of taxes: Personal income taxation in italy is progressive. Corporate tax, individual income tax, and sales tax, including vat and gst and capital.

Morning view of Li Cossi beach, summer scene of Costa Paradiso

Personal income taxation in italy is progressive. Italy has a complex tax structure that funds its public services and maintains the italian economy. Taxation in italy is levied by the central and regional governments and is collected by the italian agency of revenue (agenzia delle. Corporate tax, individual income tax, and sales tax, including vat and gst and capital. This.

evolution of taxation storyboard by abreil Storyboard

This guide will break down. 232 rows the list focuses on the main types of taxes: Personal income taxation in italy is progressive. Italy has a complex tax structure that funds its public services and maintains the italian economy. Taxation in italy is levied by the central and regional governments and is collected by the.

SIMPLE TAX GUIDE FOR FOREIGNERS IN ITALY Migrants Digest

232 rows the list focuses on the main types of taxes: This guide will break down. Italy has a complex tax structure that funds its public services and maintains the italian economy. Taxation in italy is levied by the central and regional governments and is collected by the italian agency of revenue (agenzia delle. Taxation in italy is levied by.

HOW TO MANAGE YOUR ITALIAN TAXES FOR THE FIRST TIME CHOOSE YOUR

Personal income taxation in italy is progressive. 232 rows the list focuses on the main types of taxes: Taxation in italy is levied by the central and regional governments and is collected by the. Taxation in italy is levied by the central and regional governments and is collected by the italian agency of revenue (agenzia delle. This guide will break.

Reform of international taxation in Italy Taxand

Personal income taxation in italy is progressive. 232 rows the list focuses on the main types of taxes: Corporate tax, individual income tax, and sales tax, including vat and gst and capital. Italy has a complex tax structure that funds its public services and maintains the italian economy. Taxation in italy is levied by the central and regional governments and.

Taxation In Italy Is Levied By The Central And Regional Governments And Is Collected By The Italian Agency Of Revenue (Agenzia Delle.

232 rows the list focuses on the main types of taxes: Personal income taxation in italy is progressive. Italy has a complex tax structure that funds its public services and maintains the italian economy. Taxation in italy is levied by the central and regional governments and is collected by the.

Corporate Tax, Individual Income Tax, And Sales Tax, Including Vat And Gst And Capital.

This guide will break down.